Name

基于MACD和RSI的5分钟动量交易策略MACD-and-RSI-Based-5-Minute-Momentum-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略是一个结合MACD和RSI指标的XRP/USDT 5分钟短期动量交易策略。该策略通过识别MACD指标金叉做多信号和死叉做空信号,以捕捉XRP/USDT交易对短期价格动量。同时,RSI指标的超买超卖信号用于确认交易信号。本策略适合短期追踪市场动量的积极交易者。

-

使用RSI指标判断超买超卖区域。RSI低于30为超卖区,高于70为超买区。

-

使用MACD指标判断买卖信号。MACD线上穿信号线为金叉做多信号。MACD线下穿信号线为死叉做空信号。

-

当RSI指标显示超卖信号,且MACD出现金叉时,做多XRP/USDT。

-

当RSI指标显示超买信号,或MACD出现死叉时,做空XRP/USDT。

-

设置止损和止盈价格。

-

结合RSI和MACD两个指标过滤信号,避免假突破。

-

追踪短期价格趋势,捕捉动量较大的行情。

-

适合短线操作的积极交易者。

-

策略参数可自定义,适应性强。

-

短期行情震荡较大,存在止损风险。

-

MACD指标容易发出错误信号,需要结合其它指标确认。

-

超短线操作,对交易者情绪控制要求较高。

-

交易成本和手续费对盈利有一定影响。

-

优化RSI参数,寻找最佳参数组合。

-

测试不同持仓时间下的盈亏情况。

-

加入其它指标结合MACD指标确认信号。

-

设置移动止损来锁定利润,减少风险。

本策略是一个短期追踪XRP/USDT交易对动量的5分钟MACD和RSI指标组合交易策略。策略优势是捕捉行情热点,通过指标组合过滤误信号。但短线操作的风险和成本也较高,需要交易者控制好资金管理和止损策略。通过参数优化和加入其它指标可以进一步完善该策略。

||

This strategy combines the MACD and RSI indicators for short-term momentum trading on the XRP/USDT 5-minute chart. It identifies buying and selling signals by detecting MACD crossovers to capture price swings on XRP/USDT. Meanwhile, RSI overbought and oversold signals are used to confirm the trading signals. The strategy suits aggressive traders who aim to capitalize on short-term market momentum.

-

Use RSI indicator to identify overbought and oversold levels. Below 30 is oversold while above 70 is overbought.

-

Use MACD indicator to generate buy and sell signals. MACD line crossing above signal line gives buy signal while crossing below gives sell signal.

-

Go long XRP/USDT when RSI shows oversold plus MACD bullish crossover.

-

Go short XRP/USDT on RSI overbought or MACD bearish crossover signals.

-

Set stop loss and take profit price levels.

-

Combining RSI and MACD filters false signals.

-

Captures high momentum price swings.

-

Suits aggressive short-term traders.

-

Customizable parameters for adaptability.

-

High volatility risks stop loss being hit.

-

MACD prone to false signals without confirmation.

-

Challenging emotional control on ultra short-term trades.

-

Trading costs and fees erode profits.

-

Optimize RSI parameters for best settings.

-

Test profitability across different holding periods.

-

Add other indicators to confirm MACD signals.

-

Implement trailing stop loss to lock in profits and reduce risk.

This is a 5-minute MACD and RSI strategy for trading short-term XRP/USDT momentum. It capitalizes on catching trend reversals but risks and costs are higher for such short-term trading. Controlling position sizing and stops while optimizing parameters can enhance performance. Overall it suits aggressive traders aiming to profit from market swings.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | RSI Length |

| v_input_2 | 70 | RSI Overbought Threshold |

| v_input_3 | 30 | RSI Oversold Threshold |

| v_input_4 | 12 | MACD Short Length |

| v_input_5 | 26 | MACD Long Length |

| v_input_6 | 9 | MACD Signal Length |

| v_input_7 | true | Stop Loss Percentage |

| v_input_8 | 2 | Take Profit Percentage |

Source (PineScript)

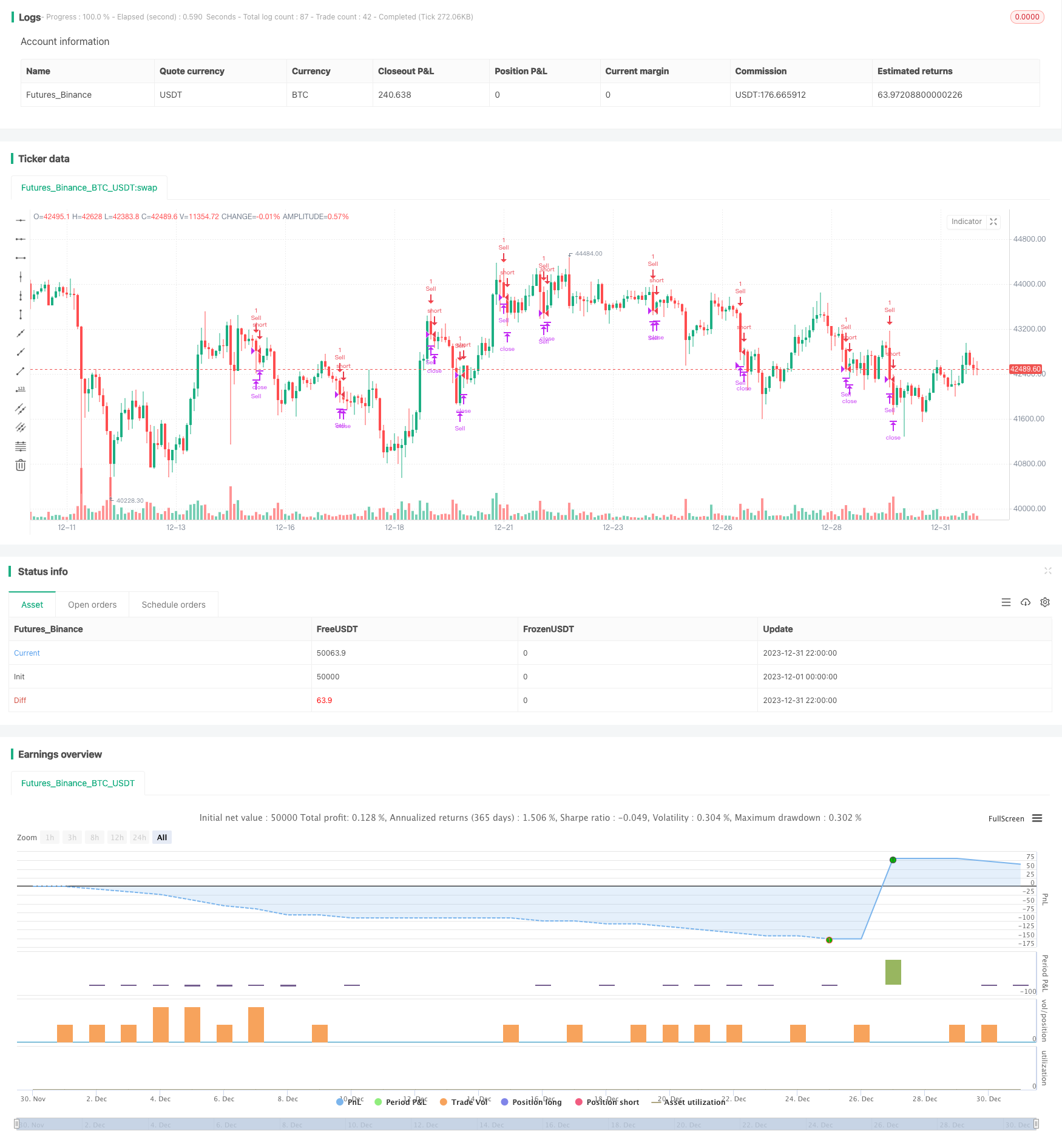

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XRP/USDT 5-Minute Momentum Strategy", shorttitle="XRP Momentum", overlay=true)

// Input parameters

rsi_length = input(14, title="RSI Length")

rsi_overbought = input(70, title="RSI Overbought Threshold")

rsi_oversold = input(30, title="RSI Oversold Threshold")

macd_short_length = input(12, title="MACD Short Length")

macd_long_length = input(26, title="MACD Long Length")

macd_signal_length = input(9, title="MACD Signal Length")

stop_loss_pct = input(1, title="Stop Loss Percentage")

take_profit_pct = input(2, title="Take Profit Percentage")

// Calculate RSI

rsi = ta.rsi(close, rsi_length)

// Calculate MACD

[macd_line, signal_line, _] = ta.macd(close, macd_short_length, macd_long_length, macd_signal_length)

// Define buy and sell conditions

buy_condition = ta.crossover(rsi, rsi_oversold) and ta.crossover(macd_line, signal_line)

sell_condition = ta.crossunder(rsi, rsi_overbought) or ta.crossunder(macd_line, signal_line)

// Calculate stop loss and take profit levels

stop_loss = close * (1 - stop_loss_pct / 100)

take_profit = close * (1 + take_profit_pct / 100)

// Plot shapes on the chart to visualize buy/sell signals

plotshape(buy_condition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(sell_condition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Use the `strategy.close` function to manage positions

strategy.entry("Buy", strategy.long, when=buy_condition)

strategy.entry("Sell", strategy.short, when=sell_condition)

strategy.close("Buy", when=close > take_profit or close < stop_loss)

strategy.close("Sell", when=close < take_profit or close > stop_loss)

Detail

https://www.fmz.com/strategy/440441

Last Modified

2024-01-30 15:59:06