Name

基于MACD指标的双向交易策略MACD-based-Dual-Trading-Strategy

Author

ChaoZhang

Strategy Description

该策略基于MACD指标实现了一个双向交易策略。它可以在MACD指标上金叉和死叉的时候分别做多和做空,并结合其他指标判断来过滤掉一些信号。

该策略主要利用MACD指标实现双向交易。具体来说,它会计算快速移动平均线、慢速移动平均线和MACD信号线。当快速移动平均线上穿慢速移动平均线时生成金叉信号做多;当快速移动平均线下穿慢速移动平均线时生成死叉信号做空。

为了过滤掉部分无效信号,该策略还设置了一个±30范围作为过滤器,只有在MACD柱状线超出这个范围的时候才会触发交易信号。此外,在平仓的时候也会判断MACD柱状线的方向,只有连续两个柱子的方向发生转变的时候才会平仓。

- 使用MACD指标作为主要交易信号,该指标对双向股票市场行情都比较敏感

- 增加了滤波器,可以过滤掉部分无效信号

- 采用了连续两个柱子方向判断的平仓逻辑,可以一定程度避免假突破

- MACD指标容易产生频繁交易信号,可能带来过高的交易频率

- 单一指标策略,信号稍有延迟就可能导致亏损

- 柱状线方向判断的平仓逻辑不够严谨,可能存在信号漏失的风险

- 可以考虑结合其他指标来确认信号,如KDJ指标、布林带指标等

- 可以研究其他更先进的指标来替代MACD指标,如KD指标

- 可以优化平仓逻辑,设置止损和止盈,以控制单笔亏损

本策略总的来说是一个基本可用的双向交易策略。它利用MACD指标的优势,同时也增加了一定的过滤器来控制信号的质量。但MACD指标本身也存在一些问题,在实盘中仍需要进一步的测试和优化,才能使策略更加可靠。总体而言,本策略为双向交易策略奠定了基础,后续可在此基础上不断优化,使之成为一个强大的量化交易策略。

||

This strategy implements a dual trading strategy based on the MACD indicator. It can go long when there is a golden cross on the MACD and go short when there is a death cross, with additional filters based on other indicators to eliminate some invalid signals.

The core of this strategy is utilizing the MACD indicator to realize dual-directional trading. Specifically, it calculates the fast moving average, slow moving average and MACD signal line. When the fast MA crosses over the slow MA, a golden cross is generated for going long. When the fast MA crosses below the slow MA, a death cross is generated for going short.

To filter out some invalid signals, the strategy also sets a ±30 range as a filter, so that trade signals are only triggered when the MACD histogram exceeds this range. In addition, when closing positions, it also judges the direction of the MACD histogram - positions are closed only when the directions of two successive histogram bars change.

- MACD indicator is used as the main trading signal, which is sensitive to price movements in both directions

- Added filters help eliminate some invalid signals

- The two-bar directional logic for closing positions avoids some false breakouts to some extent

- MACD indicator tends to generate frequent trade signals, leading to high trading frequency

- Relying solely on one indicator makes the strategy vulnerable to signal delays

- The closing logic based on histogram direction is not rigorous enough, risks missing some signals

- Consider combining with other indicators for signal confirmation, like KDJ, Bollinger Bands etc.

- Research more advanced indicators to replace MACD, like KD

- Optimize the closing logic by setting stop loss and take profit to control single trade loss

In summary, this is a basically feasible dual directional trading strategy. It utilizes the advantages of MACD indicator and also adds some filters to control signal quality. However, MACD itself has some issues as well. Further testing and optimization in live trading is still needed to make the strategy more reliable. Overall speaking, this strategy lays the foundation for dual-directional trading strategies, and can be further optimized incrementally to become a powerful quantitative trading strategy.

[/trans]]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Use Current Chart Resolution? |

| v_input_2 | 60 | Use Different Timeframe? Uncheck Box Above |

| v_input_3 | true | Show MacD & Signal Line? Also Turn Off Dots Below |

| v_input_4 | true | Show Dots When MacD Crosses Signal Line? |

| v_input_5 | true | Show Histogram? |

| v_input_6 | true | Change MacD Line Color-Signal Line Cross? |

| v_input_7 | true | MacD Histogram 4 Colors? |

| v_input_8 | 12 | fastLength |

| v_input_9 | 26 | slowLength |

| v_input_10 | 9 | signalLength |

Source (PineScript)

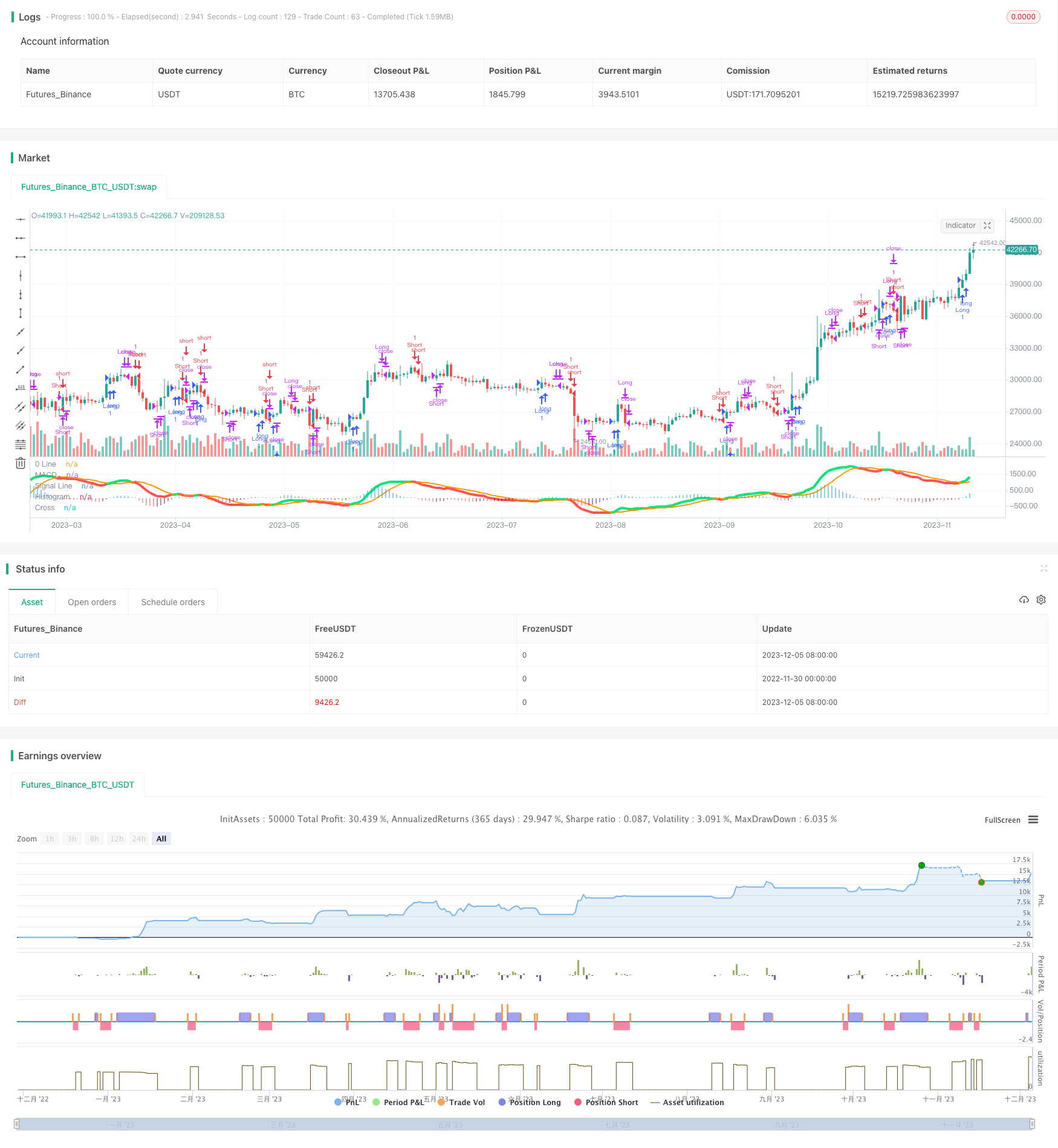

/*backtest

start: 2022-11-30 00:00:00

end: 2023-12-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Created by user ChrisMoody updated 4-10-2014

//Regular MACD Indicator with Histogram that plots 4 Colors Based on Direction Above and Below the Zero Line

//Update allows Check Box Options, Show MacD & Signal Line, Show Change In color of MacD Line based on cross of Signal Line.

//Show Dots at Cross of MacD and Signal Line, Histogram can show 4 colors or 1, Turn on and off Histogram.

//Special Thanks to that incredible person in Tech Support whoem I won't say you r name so you don't get bombarded with emails

//Note the feature Tech Support showed me on how to set the default timeframe of the indicator to the chart Timeframe, but also allow you to choose a different timeframe.

//By the way I fully disclose that I completely STOLE the Dots at the MAcd Cross from "TheLark"

strategy("MACD Strategy", overlay=false)

// study(title="CM_MacD_Ult_MTF", shorttitle="CM_Ult_MacD_MTF")

source = close

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="60")

smd = input(true, title="Show MacD & Signal Line? Also Turn Off Dots Below")

sd = input(true, title="Show Dots When MacD Crosses Signal Line?")

sh = input(true, title="Show Histogram?")

macd_colorChange = input(true,title="Change MacD Line Color-Signal Line Cross?")

hist_colorChange = input(true,title="MacD Histogram 4 Colors?")

res = useCurrentRes ? timeframe.period : resCustom

fastLength = input(12, minval=1), slowLength=input(26,minval=1)

signalLength=input(9,minval=1)

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

signal = sma(macd, signalLength)

hist = macd - signal

outMacD = request.security(syminfo.tickerid, res, macd)

outSignal = request.security(syminfo.tickerid, res, signal)

outHist = request.security(syminfo.tickerid, res, hist)

histA_IsUp = outHist > outHist[1] and outHist > 0

histA_IsDown = outHist < outHist[1] and outHist > 0

histB_IsDown = outHist < outHist[1] and outHist <= 0

histB_IsUp = outHist > outHist[1] and outHist <= 0

//MacD Color Definitions

macd_IsAbove = outMacD >= outSignal

macd_IsBelow = outMacD < outSignal

// strategy.entry("Long", strategy.long, 1, when = shouldPlaceLong)

// strategy.close("Long", shouldExitLong)

// strategy.entry("Short", strategy.short, 1, when = shouldPlaceShort)

// strategy.close("Short", shouldExitShort)

isWithinZeroMacd = outHist < 30 and outHist > -30

delta = hist

// shouldExitShort = false//crossover(delta, 0)

// shouldExitLong = false//crossunder(delta, 0)

// if(crossover(delta, 0))// and not isWithinZeroMacd)

// strategy.entry("Long", strategy.long, comment="Long")

// if (crossunder(delta, 0))// and not isWithinZeroMacd)

// strategy.entry("Short", strategy.short, comment="Short")

shouldPlaceLong = crossover(delta, 0)

strategy.entry("Long", strategy.long, 1, when = shouldPlaceLong)

shouldExitLong = not histA_IsUp and histA_IsDown

shouldExitShort = not histA_IsUp and not histA_IsDown and not histB_IsDown and histB_IsUp

shouldPlaceShort = crossunder(delta, 0)

strategy.entry("Short", strategy.short, 1, when = shouldPlaceShort)

// plot_color = gray

plot_color = if(hist_colorChange)

if(histA_IsUp)

aqua

else

if(histA_IsDown)

//need to sell

// if(not isWithinZeroMacd)

// shouldExitLong = true

// strategy.entry("Short", strategy.short, comment="Short")

blue

else

if(histB_IsDown)

red

else

if(histB_IsUp)

//need to buy

// if(not isWithinZeroMacd)

// shouldExitShort = true

// strategy.entry("Long", strategy.long, comment="Long")

maroon

else

yellow

else

gray

// plot_color = hist_colorChange ? histA_IsUp ? aqua : histA_IsDown ? blue : histB_IsDown ? red : histB_IsUp ? maroon :yellow :gray

macd_color = macd_colorChange ? macd_IsAbove ? lime : red : red

signal_color = macd_colorChange ? macd_IsAbove ? orange : orange : lime

circleYPosition = outSignal

plot(smd and outMacD ? outMacD : na, title="MACD", color=macd_color, linewidth=4)

plot(smd and outSignal ? outSignal : na, title="Signal Line", color=signal_color, style=line ,linewidth=2)

plot(sh and outHist ? outHist : na, title="Histogram", color=plot_color, style=histogram, linewidth=4)

plot(sd and cross(outMacD, outSignal) ? circleYPosition : na, title="Cross", style=circles, linewidth=4, color=macd_color)

// plot( isWithinZeroMacd ? outHist : na, title="CheckSmallHistBars", style=circles, linewidth=4, color=black)

hline(0, '0 Line', linewidth=2, color=white)

strategy.close("Short", shouldExitShort)

strategy.close("Long", shouldExitLong)

// fastLength = input(12)

// slowlength = input(26)

// MACDLength = input(9)

// MACD = ema(close, fastLength) - ema(close, slowlength)

// aMACD = ema(MACD, MACDLength)

// delta = MACD - aMACD

// if (crossover(delta, 0))

// strategy.entry("MacdLE", strategy.long, comment="MacdLE")

//if last two macd bars are higher than current, close long position

// if (crossunder(delta, 0))

// strategy.entry("MacdSE", strategy.short, comment="MacdSE")

//if last two macd bars are higher than current, close long position

// plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

Detail

https://www.fmz.com/strategy/434598

Last Modified

2023-12-07 17:11:52