Name

基于PIVOT高低点的加密货币趋势反转策略CRYPTO-TREND-REVERSAL-STRATEGY-BASED-ON-PIVOT-SWING-HIGH-AND-LOW-POINTS

Author

ChaoZhang

Strategy Description

该策略基于PIVOT高低点和突破来判断加密货币的趋势反转,属于突破反转类策略。策略首先计算标的物最近一段时间的最高价和最低价PIVOT点,然后判断价格是否突破这些关键点位后发生反转,以捕捉大的趋势变化。

-

计算PIVOT高低点

使用ta.pivothigh()和ta.pivotlow()函数计算最近一定bar数的最高价点和最低价点作为关键PIVOT点。

-

判断突破

如果价格突破PIVOT低点向上,或者突破PIVOT高点向下,则判断趋势发生反转。

-

设置过滤条件

需要价格较PIVOT点有一定幅度突破,并且突破150bar的收盘价,避免被套。

-

入场和出场

触发买入条件后做多入场,触发卖出条件后平掉多单。类似判断空单入场和出场。

- 使用PIVOT点判断,对大的趋势变化比较敏感

- 有效过滤加入震荡趋势中,确保趋势反转后入场

- 由于判断高低PIVOT点突破,能及时捕捉反转机会

- 大周期震荡容易使策略被套

- 需要调整PIVOT点长度和过滤条件来适应不同标的物

- 需要确保交易所手续费接近于零,否则盈亏受影响较大

- 可以测试不同的PIVOT参数组合

- 可以添加移动止损来控制单笔损失

- 可以结合其他指标判断过滤信号

该策略整体较为稳健,适合捕捉大幅反转。但需要注意控制风险,调整参数适应不同币种。相信在参数优化和风控的基础上,该策略可以取得较好的效果。

||

This strategy identifies trend reversals in crypto assets based on PIVOT swing high/low points and breakout signals. It belongs to the breakout reversal strategy category. The strategy first calculates the recent highest and lowest price points as PIVOT levels, then detects if price breaks out these key levels, signaling major trend changes.

-

Calculate PIVOT High/Low Points

Uses ta.pivothigh() and ta.pivotlow() to find highest high and lowest low prices over a custom bar lookback period to plot PIVOT points.

-

Identify Breakout Signals

If price breaks above PIVOT low point, or breaks below PIVOT high point, the strategy considers it as trend reversal signal.

-

Set Filter Conditions

Requires price to breakout PIVOT levels by meaningful distance, and closing price crosses 150 bar closing prices to avoid whipsaws.

-

Entries and Exits

Trigger buy signal on long condition, close long position on exit condition. Similarly for short setup rules.

- PIVOT points are sensitive to major trend shifts

- Avoids whipsaws in consolidation trends with filters

- Captures reversals early with swing high/low breakouts

- Larger cycles can cause strategy to get whipsawed

- PIVOT points and filters need tuning for each asset

- Exchange fees impact results, need near-zero fee structure

- Test different PIVOT lookback periods

- Add moving stop loss to control loss per trade

- Combine with other indicators for filter

The strategy is robust overall to capture large reversals, but needs customized parameters per asset and risk controls. With further optimization and guardrails, it can perform well across crypto markets.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_timeframe_1 | Timeframe | |

| v_input_int_1 | 10 | (?LENGTH LEFT / RIGHT)Pivot High |

| v_input_int_2 | 10 | / |

| v_input_1 | red | colorH |

| v_input_int_3 | 10 | Pivot Low |

| v_input_int_4 | 10 | / |

| v_input_2 | blue | colorL |

Source (PineScript)

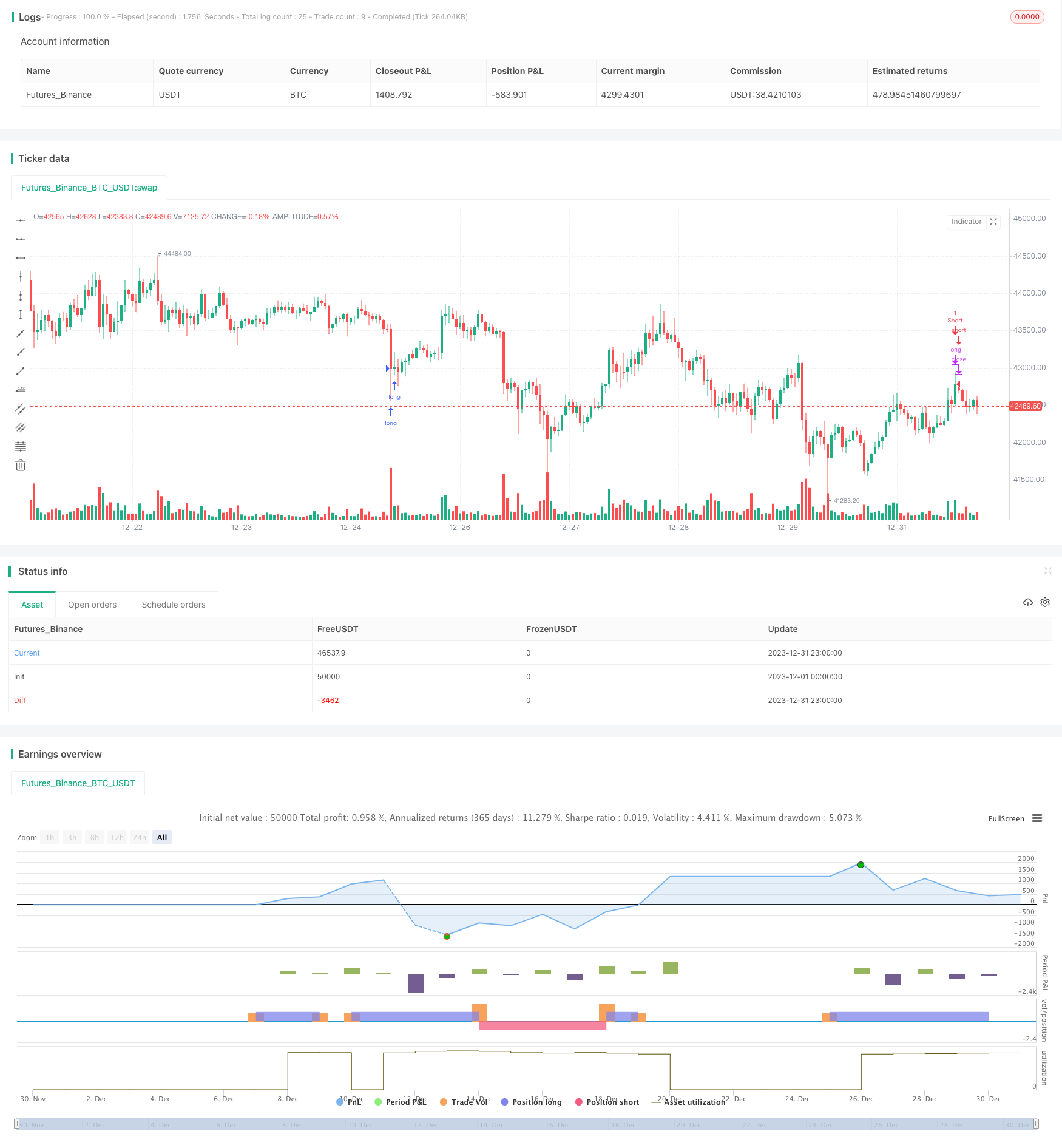

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nkrastins95

//@version=5

strategy("Swing Hi Lo", overlay=true, margin_long=100, margin_short=100)

//-----------------------------------------------------------------------------------------------------------------------//

tf = input.timeframe(title="Timeframe", defval="")

gr="LENGTH LEFT / RIGHT"

leftLenH = input.int(title="Pivot High", defval=10, minval=1, inline="Pivot High",group=gr)

rightLenH = input.int(title="/", defval=10, minval=1, inline="Pivot High",group=gr)

colorH = input(title="", defval=color.red, inline="Pivot High",group=gr)

leftLenL = input.int(title="Pivot Low", defval=10, minval=1, inline="Pivot Low", group=gr)

rightLenL = input.int(title="/", defval=10, minval=1, inline="Pivot Low",group=gr)

colorL = input(title="", defval=color.blue, inline="Pivot Low",group=gr)

//-----------------------------------------------------------------------------------------------------------------------//

pivotHigh(ll, rl) =>

maxLen = 1000

float ph = ta.pivothigh(ll, rl)

int offset = 0

while offset < maxLen

if not na(ph[offset])

break

offset := offset + 1

ph[offset]

pivotLow(ll, rl) =>

maxLen = 1000

float pl = ta.pivotlow(ll, rl)

int offset = 0

while offset < maxLen

if not na(pl[offset])

break

offset := offset + 1

pl[offset]

//-----------------------------------------------------------------------------------------------------------------------//

ph = request.security(syminfo.tickerid, tf, pivotHigh(leftLenH, rightLenH), barmerge.gaps_off, barmerge.lookahead_on)

pl = request.security(syminfo.tickerid, tf, pivotLow(leftLenL, rightLenL), barmerge.gaps_off, barmerge.lookahead_on)

drawLabel(_offset, _pivot, _style, _color) =>

if not na(_pivot)

label.new(bar_index[_offset], _pivot, str.tostring(_pivot, format.mintick), style=_style, color=_color, textcolor=#131722)

//-----------------------------------------------------------------------------------------------------------------------//

VWAP = ta.vwap(ohlc4)

longcondition = ta.crossunder(close,pl) and close > close[150]

exitcondition = close > ph

shortcondition = ta.crossover(close,ph) and close < close[150]

covercondition = close < pl

strategy.entry("long", strategy.long, when = longcondition)

strategy.close("long", when = exitcondition)

strategy.entry("Short", strategy.short, when = shortcondition)

strategy.close("Short", when = covercondition)

Detail

https://www.fmz.com/strategy/438489

Last Modified

2024-01-12 14:13:36