Name

基于QQE和MA的趋势跟踪策略Trend-Following-Strategy-Based-on-QQE-and-MA

Author

ChaoZhang

Strategy Description

该策略是一个基于QQE(Qualitative Quantitative Estimation,定性量化估计)指标和移动平均线的趋势跟踪策略。它通过快速QQE指标的交叉以及移动平均线的方向过滤来判断趋势方向,产生买入和卖出信号。

该策略可以选择三种QQE指标的交叉来判断信号:(1) 平滑RSI指标与0轴交叉;(2) 平滑RSI指标与快速QQE线交叉;(3) 平滑RSI指标退出RSI阈值通道。默认的是使用第三种交叉来开仓,第二种交叉来平仓。

买入和卖出信号可以选择是否要通过移动平均线来进行额外过滤:收盘价要高于(低于)快速移动平均线,并且快速移动平均线要高于(低于)慢速移动平均线时,才产生信号。

该策略适合作为自动化程序交易的信号对信号模式使用。

该策略的核心指标是QQE,它的计算公式如下:

Wilders_Period = RSILen * 2 - 1

Rsi = rsi(close,RSILen)

RSIndex = ema(Rsi, SF)

AtrRsi = abs(RSIndex - RSIndex[1])

MaAtrRsi = ema(AtrRsi, Wilders_Period)

DeltaFastAtrRsi = ema(MaAtrRsi,Wilders_Period) * QQEfactor

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

其中RSILen是RSI的长度周期,SF是RSI的平滑因子。QQE本质上是一个平滑处理过的RSI。它通过一个快速ATR来计算上下通道,当价格超过通道时,判断为买入或卖出机会。

该策略使用三种QQE的交叉来识别交易信号:

- 平滑RSI指标与0轴交叉 (XZ)

QQEzlong = RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort = RSIndex < 50 ? QQEzshort + 1 : 0

- 平滑RSI指标与快速QQE指标交叉 (XQ),类似于一个提前的摆动信号

QQExlong = FastAtrRsiTL < RSIndex ? QQExlong + 1 : 0

QQExshort = FastAtrRsiTL > RSIndex ? QQExshort + 1 : 0

- 平滑RSI指标退出阈值通道 (XC),类似于一个确认的摆动信号

threshhold = 10

QQEclong = RSIndex > (50 + threshhold) ? QQEclong + 1 : 0

QQEcshort = RSIndex < (50 - threshhold) ? QQEcshort + 1 : 0

可以选择用上面三种交叉中的一种或多种来识别买入/卖出信号以及平仓信号。

买入和卖出信号可以选择是否要通过移动平均线来进行额外过滤:

// 过滤条件

QQEflong = close > ma_medium 和

ma_medium > ma_slow 和

ma_fast > ma_medium

QQEfshort = close < ma_medium 和

ma_medium < ma_slow 和

ma_fast < ma_medium

这样可以避免在震荡行情中产生错误信号。

该策略适合作自动化交易,通过不同QQE交叉来打开和平仓:

开仓信号 = XC 或 XQ 或 XZ

平仓信号 = XQ 或 XZ

该策略具有以下优势:

-

使用QQE指标判断趋势和交叉信号,QQE本身具有平滑去噪的特性,可以减少错误信号。

-

结合移动平均线进行过滤,可以进一步避免震荡市场的错误信号,提高信号质量。

-

可以选择不同的QQE交叉来开仓和平仓,实现自动化交易。

-

平滑RSI指标由于滞后性,所以买入卖出信号不会发生重画。

-

可以在不同时间周期进行优化,寻找最佳参数组合。

该策略也存在一定的风险:

-

在趋势反转时,会产生错误信号,需要设置止损来控制风险。

-

参数设置不当也会影响策略表现,需要多次测试优化来找到最佳参数。

-

不同品种和时间周期参数需要分别测试优化。

-

机械化交易存在回撤和连续亏损的风险,需要资金管理。

对应解决方法如下:

-

设置止损,当亏损达到一定额度时止损出场。

-

详细测试不同参数组合,寻找最佳参数。

-

根据品种和周期特点调整参数。

-

做好资金管理,分批建仓,控制单笔仓位。

该策略可以从以下几个方向进行优化:

-

优化QQE参数,包括RSI长度、RSI平滑长度、快速ATR长度等,找到参数最优组合。

-

优化移动平均线参数,调整周期、类型等参数,与QQE指标形成最佳匹配。

-

测试不同的QQE交叉来开仓和平仓,寻找最稳定的组合方式。

-

根据不同品种和交易周期进行参数细化。日内交易可以缩短周期,提高getParameter。

-

添加止损机制。当亏损达到一定比例时止损。

-

适当缩减仓位规模,测试不同的仓位管理方式。

该策略整合了QQE指标判断趋势和交叉信号,以及移动平均线进行滤波从而产生交易信号。实盘中可以通过调整参数,优化信号的质量;并配合严格的资金管理来控制风险。该策略适合用作自动化交易的信号对信号模式,也可以在 discretionary trading中辅助判断。通过参数优化和规则优化,可以适应更多市场环境。

||

This is a trend following strategy based on the QQE (Qualitative Quantitative Estimation) indicator and moving averages. It determines the trend direction and generates trading signals based on fast QQE crosses filtered by the direction of moving averages.

The strategy can use three kinds of QQE crosses to determine the trading signal: (1) Smooth RSI crossing 0 line; (2) Smooth RSI crossing fast QQE line; (3) Smooth RSI exiting the RSI threshold channel. By default it uses the third cross to open position and the second cross to close position.

The buy and sell signals can choose to add an additional filter by moving averages: the close price should be above (below) the fast MA line, and the fast MA line should be above (below) the slow MA line, to generate a trading signal.

This strategy is suitable to be used in automated trading with signal-to-signal mode.

The core indicator of this strategy is QQE. Its calculation formula is as below:

Wilders_Period = RSILen * 2 - 1

Rsi = rsi(close,RSILen)

RSIndex = ema(Rsi, SF)

AtrRsi = abs(RSIndex - RSIndex[1])

MaAtrRsi = ema(AtrRsi, Wilders_Period)

DeltaFastAtrRsi = ema(MaAtrRsi,Wilders_Period) * QQEfactor

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

Where RSILen is the length period of RSI, and SF is the RSI smoothing factor. QQE is essentially a smoothed RSI. It calculates an upper and lower channel based on a fast ATR, and the crossing of price over the channel indicates buy or sell signals.

The strategy uses three kinds of QQE crosses to identify trading signals:

- Smooth RSI crossing 0 line (XZ)

QQEzlong = RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort = RSIndex < 50 ? QQEzshort + 1 : 0

- Smooth RSI crossing fast QQE line (XQ), like an early swing signal

QQExlong = FastAtrRsiTL < RSIndex ? QQExlong + 1 : 0

QQExshort = FastAtrRsiTL > RSIndex ? QQExshort + 1 : 0

- Smooth RSI exiting threshold channel (XC), like a confirmed swing signal

threshhold = 10

QQEclong = RSIndex > (50 + threshhold) ? QQEclong + 1 : 0

QQEcshort = RSIndex < (50 - threshhold) ? QQEcshort + 1 : 0

One or multiple of the above three crosses can be selected to identify entry and exit signals.

The buy and sell signals can choose to add an additional filter by moving averages:

// Filter condition

QQEflong = close > ma_medium AND

ma_medium > ma_slow AND

ma_fast > ma_medium

QQEfshort = close < ma_medium AND

ma_medium < ma_slow AND

ma_fast < ma_medium

This helps avoid false signals in sideways markets.

The strategy is suitable for automated trading by using different QQE crosses for entries and exits:

Entry signal = XC OR XQ OR XZ

Exit signal = XQ OR XZ

The advantages of this strategy include:

-

Using the QQE indicator to determine trend and cross signals. QQE itself has the characteristic of smoothing and noise reduction, which can decrease false signals.

-

Adding filter by moving averages can further avoid false signals in sideways markets and improve signal quality.

-

Choosing different QQE crosses for entry and exit enables automated trading.

-

The smooth RSI signal has lagging effect, so the buy/sell signals will not repaint.

-

The parameters can be optimized on different timeframes to find the best combination.

There are also some risks of this strategy:

-

Wrong signals may occur during trend reversal. Stop loss should be set to control risks.

-

Inappropriate parameter settings can affect strategy performance. Multiple tests and optimizations are needed to find the best parameters.

-

Different symbols and timeframes need separate test and parameter tuning.

-

Mechanical trading has risks of drawdown and consecutive losses. Position sizing and risk management are necessary.

The corresponding solutions are:

-

Set stop loss to exit positions when loss reaches a certain amount.

-

Test different parameter combinations thoroughly to find the optimal parameters.

-

Adjust parameters according to symbol and timeframe characteristics.

-

Use proper capital management, scale-in positions, and control per trade position size.

There are several directions that this strategy can be optimized:

-

Optimize QQE parameters including RSI length, RSI smoothing length, fast ATR length etc, to find the optimal parameter combination.

-

Optimize moving average parameters, adjust period, type etc to match best with QQE indicator.

-

Test different QQE crosses for entry and exit to find the most stable combination.

-

Fine tune parameters according to different symbols and timeframes. Use shorter periods for lower timeframes and intraday trading.

-

Add stop loss mechanism to stop out when loss reaches certain percentage.

-

Appropriately reduce position sizing and test different position management methods.

This strategy integrates using the QQE indicator for judging trend and crosses, and the moving average for filter, to generate trading signals. During live trading it can be optimized by adjusting parameters to improve signal quality, and by strict money management to control risks. The strategy suits automated trading with signal-to-signal mode, and can also aid discretionary trading. Further optimizations on logics and parameters can make it adaptable to more market conditions.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 4 | Relative TimeFrame Multiplier for Second MA Ribbon (0=none, max=100) |

| v_input_2 | true | Show Moving Average Lines |

| v_input_3 | 0 | Fast MA Type: : EMA |

| v_input_4 | 16 | Fast - Length |

| v_input_5 | 0 | Medium MA Type: : EMA |

| v_input_6 | 21 | Medium - Length |

| v_input_7 | 0 | Slow MA Type: : EMA |

| v_input_8 | 26 | Slow Length |

| v_input_9 | 14 | RSI Length |

| v_input_10 | 8 | RSI Smoothing Factor |

| v_input_11 | 5 | Fast QQE Factor |

| v_input_12 | 10 | RSI Threshhold |

| v_input_13 | true | Show QQE Signal crosses |

| v_input_14 | false | Show QQE Zero crosses |

| v_input_15 | true | Show QQE Thresh Hold Channel Exits |

| v_input_16 | 0 | Select which QQE signal to Buy/Sell: XC |

| v_input_17 | 0 | Select which QQE signal to Close Order: XQ |

| v_input_18 | true | Filter XQ Buy/Sell Orders by Threshold |

| v_input_19 | false | Use Moving Average Filter |

| v_input_20 | true | Use Trend Directional Filter |

| v_input_21 | false | Only Alert First Buy/Sell in a new Trend |

| v_input_22_close | 0 | Source: close |

| v_input_23 | 2018 | Backtest Start Year |

| v_input_24 | 6 | Backtest Start Month |

| v_input_25 | 12 | Backtest Start Day |

Source (PineScript)

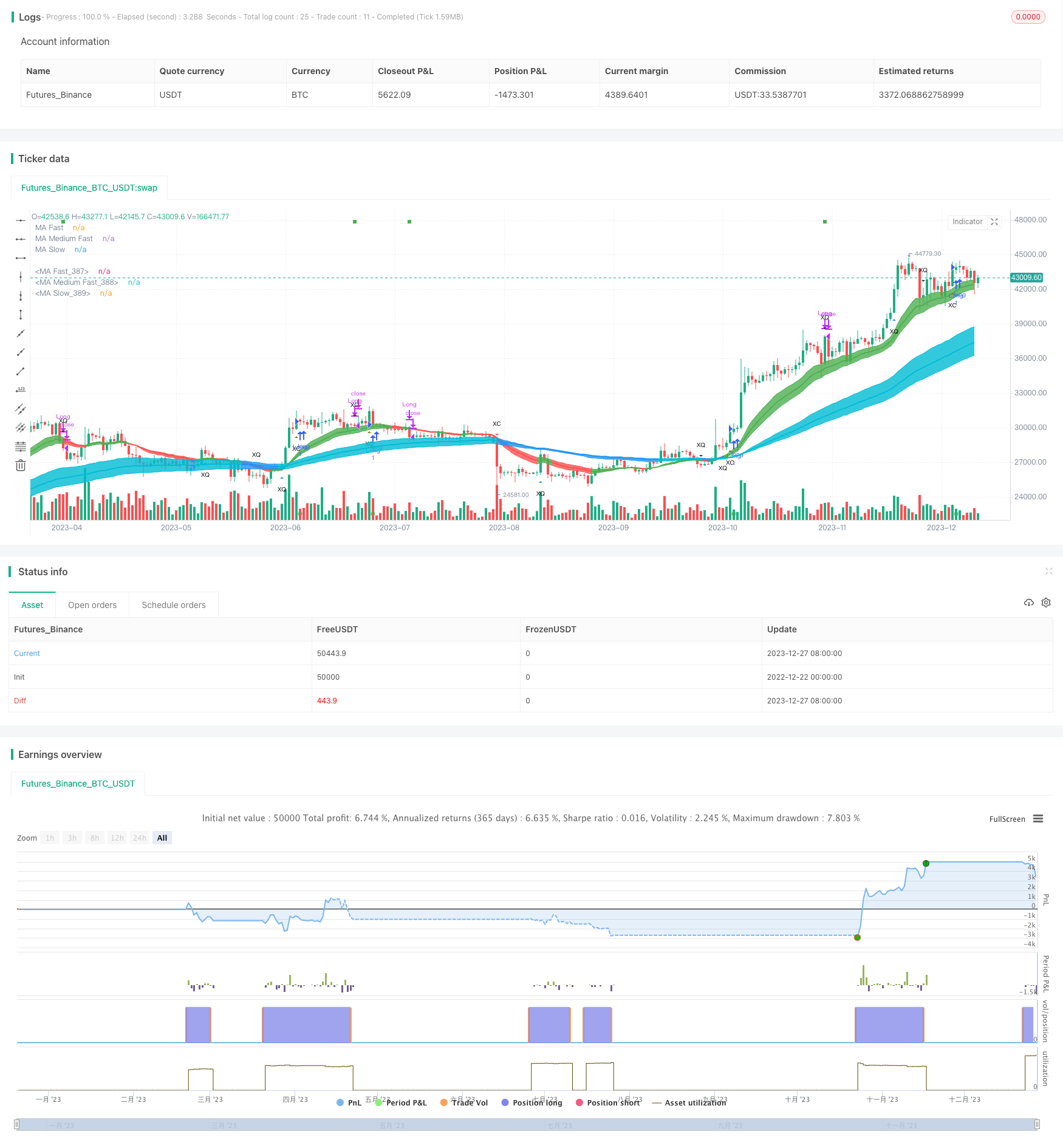

/*backtest

start: 2022-12-22 00:00:00

end: 2023-12-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//

//*** START of COMMENT OUT [Alerts]

strategy(title="[Backtest]QQE Cross v6.0 by JustUncleL", shorttitle="[BT]QQEX v6.0", overlay=true)

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [BackTest]

//study(title="[Alerts]QQE Cross v6.0 by JustUncleL", shorttitle="[AL]QQEX v6.0", overlay=true,max_bars_back=2000)

//*** END of COMMENT OUT [BackTest]

//

// Author: JustUncleL

// Date: 10-July-2016

// Version: v6, Major Release Nov-2018

//

// Description:

// A following indicator is Trend following that uses fast QQE crosses with Moving Averages

// for trend direction filtering. QQE or Qualitative Quantitative Estimation is based

// on the relative strength index (RSI), but uses a smoothing technique as an additional

// transformation. Three crosses can be selected (all selected by default):

// - Smooth RSI signal crossing ZERO (XZ)

// - Smooth RSI signal crossing Fast QQE line (XQ), this is like an early warning swing signal.

// - Smooth RSI signal exiting the RSI Threshhold Channel (XC), this is like a confirmed swing signal.

// An optimumal Smooth RSI threshold level is between 5% and 10% (default=10), it helps reduce

// the false swings.

// These signals can be selected to Open Short/Long and/or Close a trade, default is XC open

// trade and XQ (or opposite open) to Close trade.

//

// The (LONG/SHORT) alerts can be optionally filtered by the Moving Average Ribbons:

// - For LONG alert the Close must be above the fast MA Ribbon and

// fast MA Ribbon must be above the slow MA Ribbon.

// - For SHORT alert the Close must be below the fast MA Ribbon and

// fast MA Ribbon must be below the slow MA Ribbon.

// and/or directional filter:

// - For LONG alert the Close must be above the medium MA and the

// directional of both MA ribbons must be Bullish.

// - For SELL alert the Close must be below the medium MA and the

// directional of both MA ribbons must be Bearish.

//

// This indicator is designed to be used as a Signal to Signal trading BOT

// in automatic or semi-automatic way (start and stop when conditions are suitable).

// - For LONG and SHORT alerts I recommend you use "Once per Bar" alarm option

// - For CLOSE alerts I recommend you use "Once per Bar Close" alarm option

// (* The script has been designed so that long/short signals come at start of candles *)

// (* and close signals come at the end of candles *)

//

// Mofidifications:

// 6.0 - Major Release Version

// - Added second MA ribbon to help filter signals to the trend direction.

// - Modified Alert filtering to include second MA Ribbon

// - Change default settings to reflect Signal to Signal BOT parameters.

// - Removed older redunant alerts.

//

// 5.0 - Development series

//

// 4.1 - Fix bug with painting Buy/Sell arrows when non-repaint shunt mode selected.

// - Added option to alert just the first Buy/Sell alert after a trend swing

// - Added Long and Short Alarms. When combined with the "first Buy/Sell" in trend option,

// It is now possible to use this indicator to interface with AutoView

// or ProfitView. I suggest using the "QQEX XZ Alert" alarm to exit Long or Short

// trade. Use only "Once per bar Close" option for Alarms. This is not a full

// fledged trading BOT though with TP/SL settings.

//

// - Changed QQE defaults to be a bit smoother (8, 5, 3) instead of (6, 3, 2.618).

//

// 4.0 - Added implied GPL copyright notice.

// - Changed defaults to use HullMAs instead of EMAs.

// 3.0 - No repaint on BUY/SELL alert, however, now trades should be taken when the BUY/SELL

// Alert is displayed. The alarm is still generated on the previous candle so you can

// still get a pre-warning, this enables you time to analyse the pending alert.

// - Added option to test success of alerted trades, highlight successful and failed trade bars

// and show simple stats: success rate and number of trades (out of 5000), this will help

// tune the settings for timeframe and currency PAIR.

// 2.0 - Added code to use the medium moving average (EMA20) rising/falling for additional

// trend direction filter.

// - Remove Moving Average cross over signals and other options not used in this indicator.

// - Added code to distinguish between the crosses, now only show Thresh Hold crosses as BUY/SELL

// alerts.

// - Modidied default settings to more well known MA's and slightly different QQE settings, these

// work well at lower timeframes.

// - Added circle plots at bottom of chart to show when actual BUY/SELL alerts occur.

// 1.0 - original

//

// References:

// Some Code borrowed from:

// - "Scalp Jockey - MTF MA Cross Visual Strategizer by JayRogers"

// - "QQE MT4 by glaz"

// Inspiration from:

// - http://www.forexstrategiesresources.com/binary-options-strategies-ii/189-aurora-binary-trading/

// - http://www.forexstrategiesresources.com/metatrader-4-trading-systems-v/652-qqe-smoothed-trading/

// - http://dewinforex.com/forex-indicators/qqe-indicator-not-quite-grail-but-accurately-defines-trend-and-flat.html

// - "Binary option trading by two previous bars" by radixvinni

//

//

// -----------------------------------------------------------------------------

// Copyright 2015 Glaz,JayRogers

//

// Copyright 2016,2017,2018 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

// Use Alternate Anchor TF for MAs

anchor = input(4,minval=0,maxval=100,title="Relative TimeFrame Multiplier for Second MA Ribbon (0=none, max=100)")

//

// - INPUTS START

// Fast MA - type, source, length

showAvgs = input(true,title="Show Moving Average Lines")

type1 = input(defval="EMA", title="Fast MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len1 = input(defval=16, title="Fast - Length", minval=1)

gamma1 = 0.33

// Medium Fast MA - type, source, length

type2 = input(defval="EMA", title="Medium MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len2 = input(defval=21, title="Medium - Length", minval=1)

gamma2 = 0.55

// Slow MA - type, source, length

type3 = input(defval="EMA", title="Slow MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len3 = input(defval=26, title="Slow Length", minval=1)

gamma3 = 0.77

//

// QQE rsi Length, Smoothing, fast ATR factor, source

RSILen = input(14,title='RSI Length')

SF = input(8,title='RSI Smoothing Factor')

QQEfactor = input(5.0,type=float,title='Fast QQE Factor')

threshhold = input(10, title="RSI Threshhold")

//

sQQEx = input(true,title="Show QQE Signal crosses")

sQQEz = input(false,title="Show QQE Zero crosses")

sQQEc = input(true,title="Show QQE Thresh Hold Channel Exits")

//

tradeSignal = input("XC", title="Select which QQE signal to Buy/Sell", options=["XC","XQ","XZ"])

closeSignal = input("XQ", title="Select which QQE signal to Close Order", options=["XC","XQ","XZ"])

//

xfilter = input(true, title="Filter XQ Buy/Sell Orders by Threshold" )

filter = input(false,title="Use Moving Average Filter")

dfilter = input(true, title="Use Trend Directional Filter" )

ufirst = input(false, title="Only Alert First Buy/Sell in a new Trend")

RSIsrc = input(close,title="Source")

src = RSIsrc // MA source

srcclose= RSIsrc

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made by JustUncleL*//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [Alerts]

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(6, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(12, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod = time >= testPeriodStart and time <= testPeriodStop ? true : false

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

// - INPUTS END

gold = #FFD700

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

// - FUNCTIONS

// - variant(type, src, len, gamma)

// Returns MA input selection variant, default to SMA if blank or typo.

// SuperSmoother filter

// © 2013 John F. Ehlers

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier, base on time in mins

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := not isintraday? 1 : mult // Only available Daily or less

// Anchor is a relative multiplier based on current TF.

mult = anchor>0 ? anchor : 1

// - FUNCTIONS END

// - Fast ATR QQE

//

Wilders_Period = RSILen * 2 - 1

//

Rsi = rsi(RSIsrc,RSILen)

RSIndex = ema(Rsi, SF)

AtrRsi = abs(RSIndex[1] - RSIndex)

MaAtrRsi = ema(AtrRsi, Wilders_Period)

DeltaFastAtrRsi = ema(MaAtrRsi,Wilders_Period) * QQEfactor

//

newshortband= RSIndex + DeltaFastAtrRsi

newlongband= RSIndex - DeltaFastAtrRsi

longband = 0.0

shortband=0.0

trend = 0

longband:=RSIndex[1] > longband[1] and RSIndex > longband[1] ? max(longband[1],newlongband) : newlongband

shortband:=RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? min(shortband[1],newshortband) : newshortband

trend:=cross(RSIndex, shortband[1])? 1 : cross(longband[1], RSIndex) ? -1 : nz(trend[1],1)

FastAtrRsiTL = trend==1 ? longband : shortband

// - SERIES VARIABLES

// MA's

ma_fast = variant(type1, srcclose, len1, gamma1)

ma_medium = variant(type2, srcclose, len2, gamma2)

ma_slow = variant(type3, srcclose, len3, gamma3)

// MA's

ma_fast_alt = variant(type1, srcclose, len1*mult, gamma1)

ma_medium_alt = variant(type2, srcclose, len2*mult, gamma2)

ma_slow_alt = variant(type3, srcclose, len3*mult, gamma3)

// Get Direction From Medium Moving Average

direction = rising(ma_medium,3) ? 1 : falling(ma_medium,3) ? -1 : 0

altDirection = rising(ma_medium_alt,3) ? 1 : falling(ma_medium_alt,3) ? -1 : 0

//

// Find all the QQE Crosses

QQExlong = 0, QQExlong := nz(QQExlong[1])

QQExshort = 0, QQExshort := nz(QQExshort[1])

QQExlong := FastAtrRsiTL< RSIndex ? QQExlong+1 : 0

QQExshort := FastAtrRsiTL> RSIndex ? QQExshort+1 : 0

// Zero cross

QQEzlong = 0, QQEzlong := nz(QQEzlong[1])

QQEzshort = 0, QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex>=50 ? QQEzlong+1 : 0

QQEzshort := RSIndex<50 ? QQEzshort+1 : 0

//

// Thresh Hold channel Crosses give the BUY/SELL alerts.

QQEclong = 0, QQEclong := nz(QQEclong[1])

QQEcshort = 0, QQEcshort := nz(QQEcshort[1])

QQEclong := RSIndex>(50+threshhold) ? QQEclong+1 : 0

QQEcshort := RSIndex<(50-threshhold) ? QQEcshort+1 : 0

//

// Check Filtering.

QQEflong = mult == 1 ? (not filter or (srcclose>ma_medium and ma_medium>ma_slow and ma_fast>ma_medium)) and (not dfilter or (direction>0 )) :

(not filter or (ma_medium>ma_medium_alt and srcclose>ma_fast and ma_fast>ma_medium)) and (not dfilter or (direction>0 and altDirection>0 and srcclose>ma_medium))

QQEfshort = mult == 1 ? (not filter or (srcclose<ma_medium and ma_medium<ma_slow and ma_fast<ma_medium)) and (not dfilter or (direction<0 )) :

(not filter or (ma_medium<ma_medium_alt and srcclose<ma_fast and ma_fast<ma_medium)) and (not dfilter or (direction<0 and altDirection<0 and srcclose<ma_medium))

QQExfilter = (not xfilter or RSIndex>(50+threshhold) or RSIndex<(50-threshhold))

//

// Get final BUY / SELL alert determination

buy_ = 0, buy_ := nz(buy_[1])

sell_ = 0, sell_ := nz(sell_[1])

// Make sure Buy/Sell are non-repaint and occur after close signal.

buy_ := tradeSignal=="XC"? (QQEclong[1]==1 and QQEflong[1] ? buy_+1 : 0) :

tradeSignal=="XQ"? (QQExlong[1]==1 and QQEflong[1] and QQExfilter[1]? buy_+1 : 0) :

tradeSignal=="XZ"? (QQEzlong[1]==1 and QQEflong[1] ? buy_+1 : 0) : 0

sell_ := tradeSignal=="XC"? (QQEcshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) :

tradeSignal=="XQ"? (QQExshort[1]==1 and QQEfshort[1] and QQExfilter[1]? sell_+1 : 0) :

tradeSignal=="XZ"? (QQEzshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) : 0

//

// Find the first Buy/Sell in trend swing.

Buy = 0, Buy := nz(Buy[1])

Sell = 0, Sell := nz(Sell[1])

Buy := sell_>0 ? 0 : buy_==1 or Buy>0 ? Buy+1 : Buy

Sell := buy_>0 ? 0 : sell_==1 or Sell>0 ? Sell+1 : Sell

// Select First or all buy/sell alerts.

buy = ufirst ? Buy : buy_

sell = ufirst ? Sell : sell_

closeLong = 0, closeLong := nz(closeLong[1])

closeShort = 0, closeShort := nz(closeShort[1])

closeLong := closeSignal=="XC" ? (QQEcshort==1 ? closeLong+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExshort==1 ? closeLong+1 : 0) : ((QQExshort==1 or QQEzshort or QQEcshort) ? closeLong+1 : 0) :

closeSignal=="XZ" ? (QQEzshort==1 ? closeLong+1 : 0) : 0

closeShort := closeSignal=="XC" ? (QQEclong==1 ? closeShort+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExlong==1 ? closeShort+1 : 0) : ((QQExlong==1 or QQEzlong or QQEclong==1) ? closeShort+1 : 0) :

closeSignal=="XZ" ? (QQEzlong==1 ? closeShort+1 : 0) : 0

tradestate = 0, tradestate := nz(tradestate[1])

tradestate := tradestate==0 ? (buy==1 ? 1 : sell==1 ? 2 : 0) : (tradestate==1 and closeLong==1) or (tradestate==2 and closeShort==1)? 0 : tradestate

isLong = change(tradestate) and tradestate==1

isShort = change(tradestate) and tradestate==2

isCloseLong = change(tradestate) and tradestate==0 and nz(tradestate[1])==1

isCloseShort = change(tradestate) and tradestate==0 and nz(tradestate[1])==2

// - SERIES VARIABLES END

// - PLOTTING

// Ma's

tcolor = direction<0?red:green

ma1=plot(showAvgs?ma_fast:na, title="MA Fast", color=tcolor, linewidth=1, transp=0)

ma2=plot(showAvgs?ma_medium:na, title="MA Medium Fast", color=tcolor, linewidth=2, transp=0)

ma3=plot(showAvgs?ma_slow:na, title="MA Slow", color=tcolor, linewidth=1, transp=0)

fill(ma1,ma3,color=tcolor,transp=90)

// Ma's

altTcolor=altDirection<0?blue:aqua

ma4=plot(showAvgs and mult>1?ma_fast_alt:na, title="MA Fast", color=altTcolor, linewidth=1, transp=0)

ma5=plot(showAvgs and mult>1?ma_medium_alt:na, title="MA Medium Fast", color=altTcolor, linewidth=2, transp=0)

ma6=plot(showAvgs and mult>1?ma_slow_alt:na, title="MA Slow", color=altTcolor, linewidth=1, transp=0)

fill(ma4,ma6,color=altTcolor,transp=90)

// QQE exit from Thresh Hold Channel

plotshape(sQQEc and QQEclong==1 and not isLong, title="QQE X Over Channel", style=shape.triangleup, location=location.belowbar, text="XC", color=olive, transp=20, size=size.tiny)

plotshape(sQQEc and QQEcshort==1 and not isShort, title="QQE X Under Channel", style=shape.triangledown, location=location.abovebar, text="XC", color=red, transp=20, size=size.tiny)

// QQE crosses

plotshape(sQQEx and QQExlong==1 and QQEclong!=1 and not isLong, title="QQE Cross Over", style=shape.triangleup, location=location.belowbar, text="XQ", color=blue, transp=20, size=size.tiny)

plotshape(sQQEx and QQExshort==1 and QQEcshort!=1 and not isShort, title="QQE Cross Under", style=shape.triangledown, location=location.abovebar, text="XQ", color=black, transp=20, size=size.tiny)

// Signal crosses zero line

plotshape(sQQEz and QQEzlong==1 and QQEclong!=1 and not isLong and QQExlong!=1, title="QQE Zero Cross Over", style=shape.triangleup, location=location.belowbar, text="XZ", color=aqua, transp=20, size=size.tiny)

plotshape(sQQEz and QQEzshort==1 and QQEcshort!=1 and not isShort and QQExshort!=1, title="QQE Zero Cross Under", style=shape.triangledown, location=location.abovebar, text="XZ", color=fuchsia, transp=20, size=size.tiny)

//

//*** START of COMMENT OUT [BackTest]

//plotshape(isLong, title="QQEX Long", style=shape.arrowup, location=location.belowbar, text="Open\nLONG", color=lime, textcolor=green, transp=0, size=size.small)

//plotshape(isShort, title="QQEX Short", style=shape.arrowdown, location=location.abovebar, text="Open\nSHORT", color=red, textcolor=maroon, transp=0, size=size.small)

//plotshape(isCloseLong, title="QQEX Close Long", style=shape.arrowdown, location=location.abovebar, text="Close\nLONG", color=gray, textcolor=gray, transp=0, size=size.small)

//plotshape(isCloseShort, title="QQEX Close Short", style=shape.arrowup, location=location.belowbar, text="Close\nSHORT", color=gray, textcolor=gray, transp=0, size=size.small)

//*** END of COMMENT OUT [BackTest]

// - PLOTTING END

// - ALERTING

//*** START of COMMENT OUT [Alerts]

if testPeriod

strategy.entry("Long", 1, when=isLong)

strategy.close("Long", when=isCloseLong )

strategy.entry("Short", 0, when=isShort)

strategy.close("Short", when=isCloseShort )

//end if

//*** END of COMMENT OUT [Alerts]

//*** START of COMMENT OUT [BackTest]

//

// Signal to Signal BOT Alerts.

//

//alertcondition(isLong, title="QQEX Long", message="QQEX LONG") // use "Once per Bar" option

//alertcondition(isShort, title="QQEX Short", message="QQEX SHORT") // use "Once per Bar" option

//alertcondition(isCloseLong, title="QQEX Close Long", message="QQEX CLOSE LONG") // use "Once per Bar Close" option

//alertcondition(isCloseShort, title="QQEX Close Short", message="QQEX CLOSE SHORT") // use "Once per Bar Close" option

//

//*** END of COMMENT OUT [BackTest]

// show only when alert condition is met and bar closed.

plotshape(isLong or isShort,title= "Cross Alert Completed", location=location.bottom, color=isShort?red:green, transp=0, style=shape.circle,size=size.auto,offset=0)

plotshape(isCloseShort[1] or isCloseLong[1],title= "Close Order", location=location.top, color=isCloseShort[1]?red:green, transp=0, style=shape.square,size=size.auto,offset=-1)

// - ALERTING END

//EOF

Detail

https://www.fmz.com/strategy/437034

Last Modified

2023-12-29 16:36:47