Name

基于RSI和平均线的多时间框架交易策略Multi-timeframe-RSI-and-Moving-Average-Trading-Strategy

Author

ChaoZhang

Strategy Description

这个策略结合了随机指标RSI、移动平均线SMA和加权移动平均线WMA来寻找买入卖出信号。它同时在5分钟和1小时时间框架判断趋势方向。在企稳的趋势中,当快线RSI上穿或下穿慢线时产生交易信号。

该策略首先在1小时和5分钟两个时间框架分别计算144周期加权移动平均线WMA和5周期简单移动平均线SMA。只有当5分钟SMA在WMA之上时,才认为是多头市场。然后策略计算RSI的多空指标,以及对应的K线和D线。当K线从超买区域下穿D线时,产生卖出信号;当K线从超卖区域上穿D线时,产生买入信号。

这是一个非常有效的趋势跟踪策略。它同时结合了两个时间框架判断趋势,非常有效地减少了错误信号。另外,它结合多种指标进行过滤,包括RSI、SMA和WMA,使信号更加可靠。通过让RSI驱动KDJ,它也修改了普通KDJ策略中容易产生的假信号问题。此外,该策略还有止损和止盈设置来锁定利润,可以有效控制风险。

该策略最大的风险在于趋势判断错误。在行情转折点时,短期和长期平均线可能同时上翻或下翻,从而产生错误信号。此外,在震荡行情时,RSI也可能产生较多纠缠不清的交易信号。不过这些风险可以通过适当调整SMA和WMA周期以及RSI参数来减轻。

该策略可以从以下几个方面进行优化: 1)测试不同长度的SMA、WMA和RSI,找到最佳参数组合 2)增加其他指标判断,如MACD、布林线等来验证信号可靠性 3)优化止损止盈策略,测试固定比例止损、余额滑点止损、跟踪止损等方法 4)加入资金管理模块,控制单笔投资规模和整体风险敞口 5)增加机器学习算法,通过大量回测找到有最好绩效的参数

该策略充分利用了移动平均线和随机指标的优势,建立了一个较为可靠的趋势跟踪体系。通过多个时间框架和指标的验证,它能顺利捕捉中长线趋势的方向。同时止损止盈设置也让其承受了一定程度的市场震荡。不过仍有一定改进空间,如测试更多指标结合使用,引入机器学习方法寻找最优参数等。总的来说这是一个非常有前景的交易策略。

||

This strategy combines the RSI indicator, simple moving average (SMA) and weighted moving average (WMA) to identify trading signals. It judges the trend direction simultaneously on the 5-min and 1-hour timeframes. Trading signals are generated when the fast RSI line crosses over or under the slow line during a steady trend.

The strategy first calculates the 144-period WMA and 5-period SMA on both the 1-hour and 5-min timeframes. A bullish market is identified only when the 5-min SMA is above the WMA. The strategy then computes the RSI oscillator and the corresponding K and D lines. Sell signals are generated when the K line crosses below the D line from the overbought area. Buy signals are generated when the K line crosses over the D line from the oversold area.

This is a very effective trend-following strategy. By incorporating two timeframes to determine the trend, it significantly reduces false signals. In addition, it combines multiple filters including RSI, SMA and WMA to make the signals more reliable. By driving KDJ with RSI, it also avoids some fake signals inherent in the normal KDJ strategy. Furthermore, proper stop loss and take profit settings help lock in profits and control risks.

The biggest risk of this strategy lies in wrong trend judgement. At turning points, the short-term and long-term moving averages may flip upside or downside together, resulting in wrong signals. Also, RSI may generate more noisy signals during ranging markets. However, these risks can be reduced by properly adjusting the periods of SMA, WMA and RSI parameters.

The strategy can be improved from the following aspects:

- Test different lengths of SMA, WMA and RSI to find the optimal combination

- Incorporate other indicators like MACD, Bollinger Bands to verify signal reliability

- Optimize stop loss and take profit mechanisms by testing fixed ratio stops, trailing stops etc.

- Add capital management modules to control trade sizing and overall risk exposure

- Introduce machine learning models to find the best performing parameters through large-scale backtesting

The strategy fully utilizes the strengths of moving averages and oscillators to establish a relatively solid trend following system. By confirming signals across multiple timeframes and indicators, it can smoothly capture mid to long term trends. The stop loss and take profit settings also make it withstand normal market fluctuations to a certain degree. However, there are still rooms of improvement, such as testing more indicator combinations, leveraging machine learning for parameter optimization. Overall speaking, this is a very promising trading strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Use Swing Lo/Hi Stop Loss & Take Profit |

| v_input_2 | 20 | Swing Lo/Hi Lookback |

| v_input_3 | 10 | SL Expander |

| v_input_4 | 30 | TP Expander |

| v_input_5 | false | Reverse Trades |

| v_input_6 | false | Use Trailing Stop |

| v_input_7_close | 0 | RSI Source: close |

| v_input_8 | 20 | Stochastics Oversold Level |

| v_input_9 | 80 | Stochastics Overbought Level |

| v_input_10 | 3 | smoothK |

| v_input_11 | 3 | smoothD |

| v_input_12 | 14 | lengthRSI |

| v_input_13 | 14 | lengthStoch |

| v_input_14 | 144 | WMA Length |

Source (PineScript)

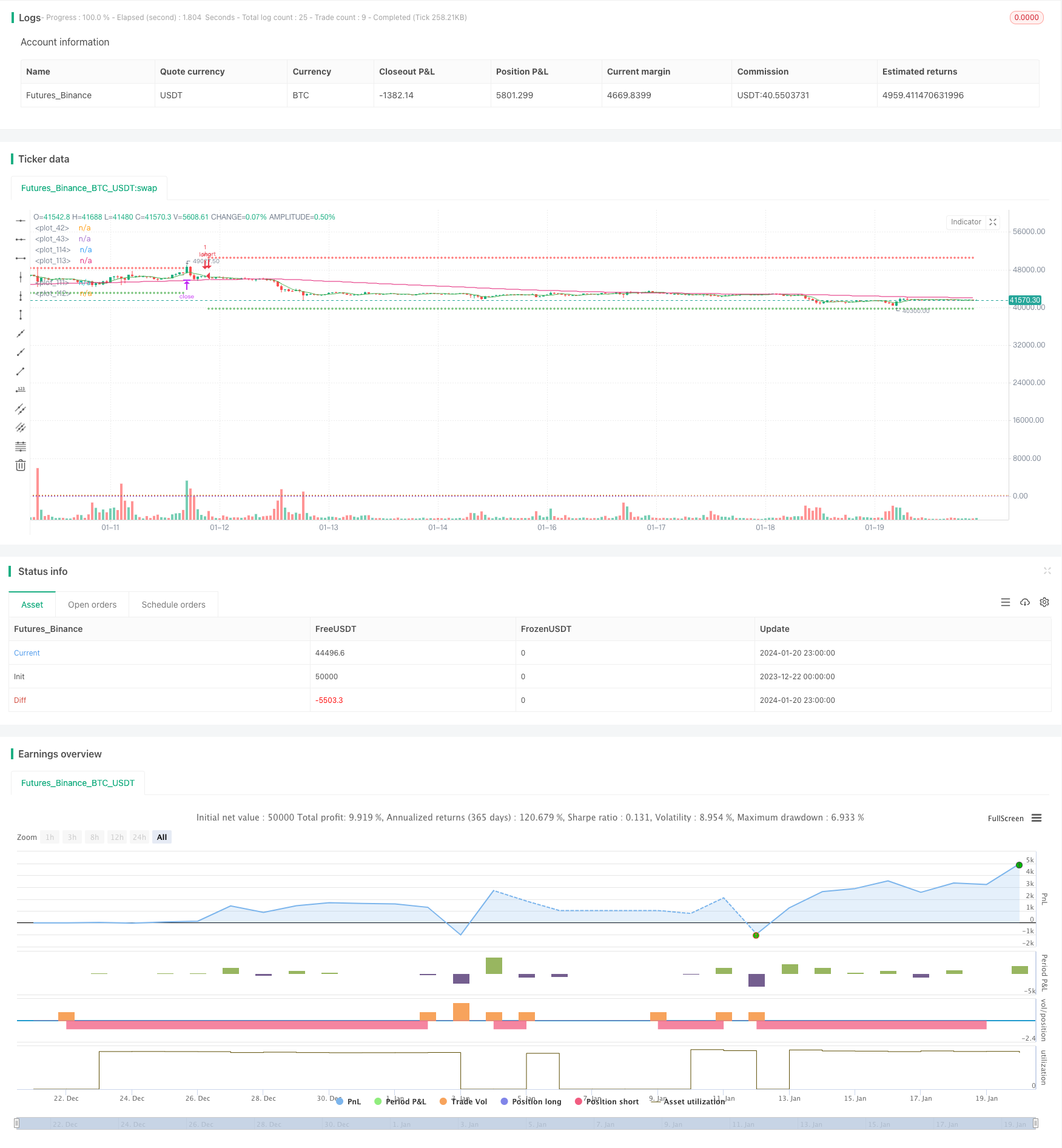

/*backtest

start: 2023-12-22 00:00:00

end: 2024-01-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © bufirolas

// Works well with a wide stop with 20 bars lookback

// for the SL level and a 2:1 reward ratio Take Profit .

// These parameters can be modified in the Inputs section of the strategy panel.

// "an entry signal it's a cross down or up on

// the stochastics. if you're in a downtrend

// on the hourly time frame you

// must also be in a downtrend on the five

// minute so the five period has to be below the 144

// as long as the five period is still trading below

// the 144 period on both the hourly and the five minutes

// we are looking for these short signals crosses down

// in the overbought region of the stochastic. Viceversa for longs"

//@version=4

strategy("Stoch + WMA + SMA strat", overlay=true)

//SL & TP Inputs

i_SL=input(true, title="Use Swing Lo/Hi Stop Loss & Take Profit")

i_SwingLookback=input(20, title="Swing Lo/Hi Lookback")

i_SLExpander=input(defval=10, step=1, title="SL Expander")

i_TPExpander=input(defval=30, step=1, title="TP Expander")

i_reverse=input(false, title="Reverse Trades")

i_TStop =input(false, title="Use Trailing Stop")

//Strategy Inputs

src4 = input(close, title="RSI Source")

stochOS=input(defval=20, step=5, title="Stochastics Oversold Level")

stochOB=input(defval=80, step=5, title="Stochastics Overbought Level")

//Stoch rsi Calculations

smoothK = input(3, minval=1)

smoothD = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStoch = input(14, minval=1)

rsi1 = rsi(src4, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

h0 = hline(80, linestyle=hline.style_dotted)

h1 = hline(20, linestyle=hline.style_dotted)

//MA

wmalen=input(defval=144, title="WMA Length")

WMA = security(syminfo.tickerid, "60", wma(close, wmalen))

SMA = security(syminfo.tickerid, "60", sma(close, 5))

minWMA = wma(close, wmalen)

minSMA = sma(close, 5)

//Entry Logic

stobuy = crossover(k, d) and k < stochOS

stosell = crossunder(k, d) and k > stochOB

mabuy = minSMA > minWMA

daymabuy = SMA > WMA

//SL & TP Calculations

SwingLow=lowest(i_SwingLookback)

SwingHigh=highest(i_SwingLookback)

bought=strategy.position_size != strategy.position_size[1]

LSL=valuewhen(bought, SwingLow, 0)-((valuewhen(bought, atr(14), 0)/5)*i_SLExpander)

SSL=valuewhen(bought, SwingHigh, 0)+((valuewhen(bought, atr(14), 0)/5)*i_SLExpander)

lTP=(strategy.position_avg_price + (strategy.position_avg_price-(valuewhen(bought, SwingLow, 0)))+((valuewhen(bought, atr(14), 0)/5)*i_TPExpander))

sTP=(strategy.position_avg_price - (valuewhen(bought, SwingHigh, 0) - strategy.position_avg_price))-((valuewhen(bought, atr(14), 0)/5)*i_TPExpander)

islong=strategy.position_size > 0

isshort=strategy.position_size < 0

//TrailingStop

dif=(valuewhen(strategy.position_size>0 and strategy.position_size[1]<=0, high,0))

-strategy.position_avg_price

trailOffset = strategy.position_avg_price - LSL

var tstop = float(na)

if strategy.position_size > 0

tstop := high- trailOffset - dif

if tstop<tstop[1]

tstop:=tstop[1]

else

tstop := na

StrailOffset = SSL - strategy.position_avg_price

var Ststop = float(na)

Sdif=strategy.position_avg_price-(valuewhen(strategy.position_size<0

and strategy.position_size[1]>=0, low,0))

if strategy.position_size < 0

Ststop := low+ StrailOffset + Sdif

if Ststop>Ststop[1]

Ststop:=Ststop[1]

else

Ststop := na

//Stop Selector

SL= islong ? LSL : isshort ? SSL : na

if i_TStop

SL:= islong ? tstop : isshort ? Ststop : na

TP= islong ? lTP : isshort ? sTP : na

//Entries

if stobuy and mabuy and daymabuy

strategy.entry("long", long=not i_reverse?true:false)

if stosell and not mabuy and not daymabuy

strategy.entry("short", long=not i_reverse?false:true)

//Exit

if i_SL

strategy.exit("longexit", "long", stop=SL, limit=TP)

strategy.exit("shortexit", "short", stop=SL, limit=TP)

//Plots

plot(i_SL ? SL : na, color=color.red, style=plot.style_cross)

plot(i_SL ? TP : na, color=color.green, style=plot.style_cross)

plot(minWMA)

plot(minSMA, color=color.green)

Detail

https://www.fmz.com/strategy/439611

Last Modified

2024-01-22 11:00:20