Name

基于RSI和AI自定义条件进行交易的高级策略Improved-RSI-Scalping-Strategy-based-on-Relative-Strength-Index

Author

ChaoZhang

Strategy Description

这个策略的核心思想是结合RSI指标以及自定义的AI条件来发现交易机会。它会在满足多重条件时建立多头或空头仓位,并使用固定的止盈止损水平。

该策略通过以下几个步骤实现:

- 计算14周期的RSI值

- 定义两个自定义AI条件(多头和空头)

- 将AI条件与RSI超买超卖区结合,形成入场信号

- 根据风险百分比和止损点数计算仓位大小

- 计算止盈和止损价格

- 在满足入场信号时开仓

- 在满足止盈或止损条件时平仓

同时,该策略还会在形成交易信号时发出警报,并在图表上画出RSI曲线。

该策略有以下几个优势:

- 结合RSI和AI条件,可以更准确地发现交易机会

- 采用多个条件的组合,可以有效过滤假信号

- 根据风险管理原则计算仓位大小,可以控制每笔交易的风险

- 采用固定止盈止损方式,每笔交易的风险和回报明确

- 可以通过参数调整自由定制策略

该策略也存在一些风险:

- RSI参数设置不当可能导致交易信号不准确

- 自定义AI条件设计不当也可能产生错误信号

- 止损点数设置太小可能导致止损频繁被触发

- 市场剧烈波动时,固定止盈止损方式可能会损失更多利润或增加损失

可以通过调整RSI参数、优化AI条件、适当放宽止损距离等方式来降低这些风险。

该策略还可以通过以下几个方面进行优化:

- 增加更多自定义AI条件,组合更多因素判断趋势

- 对RSI参数进行优化,找到最佳参数组合

- 测试不同的止盈止损机制,如追踪止损、移动止盈

- 添加附加过滤条件,如交易量突增等,以发现高质量交易机会

- 结合机器学习算法自动生成最优参数

总的来说,这是一个基于RSI指标和AI自定义条件进行交易的可定制和优化空间大的高级策略。它通过组合多个信号源判断趋势方向,采用风险管理和止盈止损机制进行交易。该策略可以为用户提供较好的交易效果,也具有很强的扩展性和优化空间。

||

The core idea of this strategy is to combine the RSI indicator and custom AI conditions to discover trading opportunities. It will establish long or short positions when multiple conditions are met, and use fixed take profit and stop loss levels.

The strategy is implemented through the following steps:

- Calculate 14-period RSI values

- Define two custom AI conditions (long and short)

- Combine AI conditions with RSI overbought/oversold zones to generate entry signals

- Calculate position size based on risk percentage and stop loss pips

- Compute take profit and stop loss price

- Enter positions when entry signals are triggered

- Exit positions when take profit or stop loss is hit

Additionally, the strategy will generate alerts on signal creation and plot RSI values on the chart.

The strategy has several key advantages:

- Combining RSI and AI conditions lead to more accurate trade signals

- Using multiple condition combinations effectively filters out false signals

- Position sizing based on risk management principles controls per trade risk

- Fixed take profit/stop loss provides clarity on risk and reward

- Highly customizable through parameter tuning

There are also some risks to consider:

- Incorrect RSI parameters may lead to inaccurate signals

- Poorly designed custom AI logic can generate false signals

- A stop loss level too tight may result in excessive stopping out

- Fixed take profit/stop loss may lose more profits or create more losses in volatile markets

These can be mitigated by tuning RSI parameters, optimizing AI logic, relaxing stop loss distances, etc.

Some ways the strategy can be further improved:

- Incorporate more custom AI conditions to determine trend based on multiple factors

- Optimize RSI parameters to find best combinations

- Test different take profit/stop loss mechanisms like trailing stops or moving take profit

- Add additional filters like volume spikes to detect quality trading opportunities

- Employ machine learning to automatically generate optimal parameters

In summary, this is a highly configurable and optimizable advanced strategy for trading based on RSI and custom AI logic. It determines trend direction through a combination of multiple signal sources, executes trades with risk management and take profit/stop loss procedures. The strategy can provide good trading performance for users, with abundant expansion and optimization capabilities.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 14 | RSI Length |

| v_input_int_2 | 70 | RSI Overbought Threshold |

| v_input_int_3 | 30 | RSI Oversold Threshold |

| v_input_int_4 | 10 | Take Profit (Pips) |

| v_input_int_5 | 5 | Stop Loss (Pips) |

| v_input_float_1 | true | Risk Percentage |

Source (PineScript)

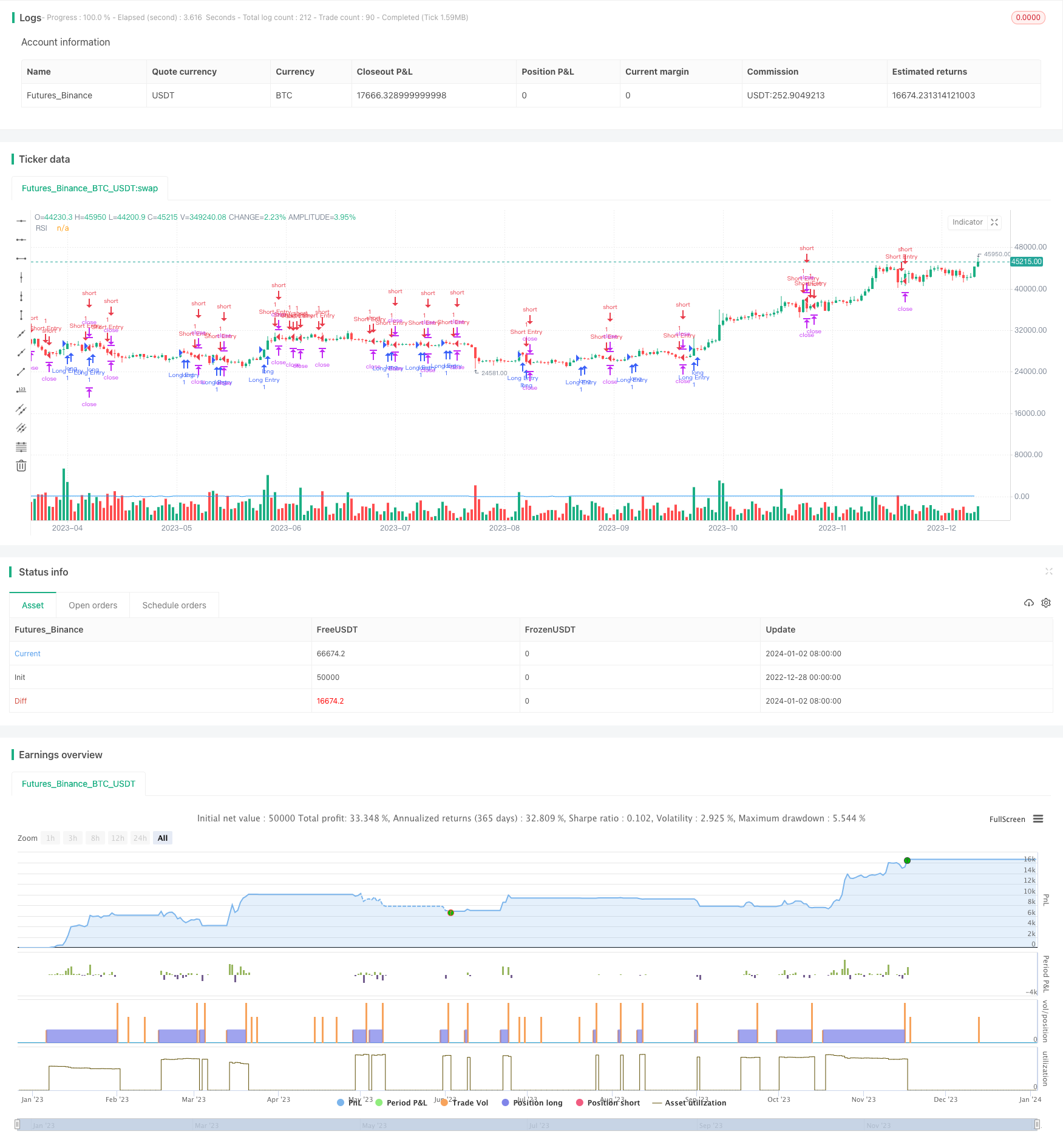

/*backtest

start: 2022-12-28 00:00:00

end: 2024-01-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved RSI Scalping Strategy", overlay=true)

// Parameters

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Threshold")

rsiOversold = input.int(30, title="RSI Oversold Threshold")

takeProfitPips = input.int(10, title="Take Profit (Pips)")

stopLossPips = input.int(5, title="Stop Loss (Pips)")

riskPercentage = input.float(1, title="Risk Percentage", minval=0, maxval=100, step=0.1)

// Calculate RSI

rsiValue = ta.rsi(close, rsiLength)

// Custom AI Conditions

aiCondition1Long = ta.crossover(rsiValue, 50)

aiCondition1Short = ta.crossunder(rsiValue, 50)

// Add more AI conditions here

var aiCondition2Long = ta.crossover(rsiValue, 30)

var aiCondition2Short = ta.crossunder(rsiValue, 70)

// Combine AI conditions with RSI

longCondition = aiCondition1Long or aiCondition2Long or ta.crossover(rsiValue, rsiOversold)

shortCondition = aiCondition1Short or aiCondition2Short or ta.crossunder(rsiValue, rsiOverbought)

// Calculate position size based on risk percentage

equity = strategy.equity

riskAmount = (equity * riskPercentage) / 100

positionSize = riskAmount / (stopLossPips * syminfo.mintick)

// Calculate Take Profit and Stop Loss levels

takeProfitLevel = close + takeProfitPips * syminfo.mintick

stopLossLevel = close - stopLossPips * syminfo.mintick

// Long entry

strategy.entry("Long Entry", strategy.long, when=longCondition[1] and not longCondition, qty=1)

strategy.exit("Take Profit/Stop Loss", from_entry="Long Entry", limit=takeProfitLevel, stop=stopLossLevel)

// Short entry

strategy.entry("Short Entry", strategy.short, when=shortCondition[1] and not shortCondition, qty=1)

strategy.exit("Take Profit/Stop Loss", from_entry="Short Entry", limit=takeProfitLevel, stop=stopLossLevel)

// Alerts

alertcondition(longCondition, title="Long Entry Signal", message="Long Entry Signal")

alertcondition(shortCondition, title="Short Entry Signal", message="Short Entry Signal")

// Plot RSI on the chart

plot(rsiValue, title="RSI", color=color.blue)

Detail

https://www.fmz.com/strategy/437674

Last Modified

2024-01-04 17:20:57