Name

基于RSI和SuperTrend的双向交易策略RSI-and-SuperTrend-Based-Dual-Direction-Trading-Strategy

Author

ChaoZhang

Strategy Description

[trans]

这是一个综合运用RSI指标和SuperTrend指标的双向交易策略。该策略旨在识别市场的强弱势,并在趋势方向发生转变时及时进行换仓,以获取更高的收益。

该策略主要基于以下原理:

-

使用RSI指标判断当前市场的强弱势。RSI高于50时为强势市场,低于50时为弱势市场。

-

利用SuperTrend指标作为趋势过滤器。只有当价格突破SuperTrend时,才会发出交易信号。

-

在RSI指标发出强势信号时,如果价格突破上轨,则做多;如果价格跌破下轨,则平仓。

-

在RSI指标发出弱势信号时,如果价格突破下轨,则做空;如果价格突破上轨,则平仓。

-

通过RSI指标的多空转换来捕捉趋势变化点,及时进行换仓操作。

-

计算RSI指标值,长度为14,以50作为界限判断强弱势。

-

计算SuperTrend指标,长度为10,乘数为2。

-

当RSI高于50而价格突破SuperTrend上轨时,做多。当RSI低于50而价格跌破SuperTrend下轨时,做空。

-

当已做多时,如果RSI转弱且价格跌破SuperTrend上轨,则平仓。当已做空时,如果RSI转强且价格突破SuperTrend下轨,则平仓。

-

可配置只做多或只做空。

这种策略结合了趋势跟踪和超买超卖判断,有以下优势:

-

可以及时捕捉趋势变化,减少无谓开仓。

-

RSI指标可以有效判断超买超卖区域,避免在市场转头前追高杀低。

-

SuperTrend较好地滤除了市场中的噪音,跟踪中长线趋势。

-

结合RSI和SuperTrend两个指标,可以提高策略的稳定性。

-

该策略参数优化空间大,可以根据不同品种和周期进行调整。

-

支持只做多或只做空模式,可以灵活应对不同行情类型。

这种策略也存在一些风险:

-

RSI指标容易产生虚假信号,需要结合价格实体验证。

-

SuperTrend指标参数设置不当可能导致漏点或追高杀低。

-

双指标组合存在发散风险,需调整参数达到最佳匹配。

-

行情剧烈变动时,止损可能被秒出,需要合理设置止损位置。

-

需避免在重要支持阻力区域附近进行反向开仓。

这种策略还可以从以下方面进行优化:

-

调整RSI参数,寻找最佳长度以过滤虚假信号。

-

优化SuperTrend参数,提高对趋势的跟踪效果。

-

测试不同品种不同周期的参数组合,寻找最优参数。

-

增加其他指标过滤,如MACD、KDJ等,提高信号准确率。

-

增加重要支撑阻力位、布林线、运动平均线等判断,定性策略信号。

-

优化止损策略,在保证止损有效性的前提下,尽量减小止损被秒出概率。

该策略整合RSI和SuperTrend两个指标的优势,能够有效识别市场中期趋势的变化,并进行熊市牛市之间的切换操作。通过参数优化,可以适应更广泛的市场情况。但也需要注意一些常见问题,如虚假信号、ParameterSet,等等。总体来说,该策略思路清晰,易于实现,有很强的实用性。

||

This is a dual direction trading strategy that comprehensively utilizes the RSI indicator and the SuperTrend indicator. The strategy aims to identify the strength and weakness in the market and make timely position switching when the trend direction changes, in order to obtain higher returns.

The strategy is mainly based on the following principles:

-

Use the RSI indicator to determine the current market strength and weakness. Above 50 RSI indicates a strong market, and below 50 a weak one.

-

Use the SuperTrend indicator as a trend filter. Trading signals are triggered only when the price breaks through the SuperTrend lines.

-

When RSI gives a strong signal, go long if the price breaks above the upper band, and close position if it breaks below the lower band.

-

When RSI gives a weak signal, go short if the price breaks below the lower band, and close position if it breaks above the upper band.

-

Capture turning points by monitoring the transitions of RSI between long and short, and make timely position switching.

-

Calculate RSI values with length of 14, using 50 as the threshold for strength/weakness.

-

Calculate SuperTrend with length of 10 and multiplier of 2.

-

Go long when RSI goes above 50 and price breaks above SuperTrend upper band. Go short when RSI falls below 50 and price breaks below lower band.

-

When already long, if RSI turns weak and price breaks below upper band, close long position. Vice versa when short.

-

Configurable for long-only or short-only modes.

This strategy combines trend following and overbought/oversold analysis, and has the following advantages:

-

Can capture trend changes in a timely manner and avoid unnecessary entries.

-

RSI effectively identifies overbought/oversold zones to avoid chasing tops and bottoms.

-

SuperTrend filters out market noise well and tracks mid-long term trends.

-

Combining RSI and SuperTrend improves stability.

-

The strategy has large parameter tuning space for different products and timeframes.

-

Supports long-only/short-only modes to handle different market conditions flexibly.

There are also some risks with this strategy:

-

RSI can generate false signals easily, requiring price confirmation.

-

Bad SuperTrend parameters may cause missed trades or chasing.

-

Divergence risk exists when combining two indicators. Parameters need to be adjusted for best match.

-

Stop loss may be taken out instantly in extreme volatility. Reasonable stop loss placement is necessary.

-

Avoid taking reversal positions near major support/resistance levels.

The strategy can be further optimized in the following aspects:

-

Adjust RSI parameters to find the optimal length for filtering out false signals.

-

Optimize SuperTrend parameters for better trend tracking capability.

-

Test different parameter combinations on different products and timeframes to find the optimum.

-

Add other indicators like MACD, KDJ to improve signal accuracy.

-

Add analysis of key support/resistance, Bollinger Bands, moving averages etc. to qualify strategy signals.

-

Optimize stop loss strategy to reduce being stopped out while maintaining effectiveness.

This strategy integrates the strengths of RSI and SuperTrend to effectively identify mid-term trend changes between bull and bear markets. The strategy is easy to implement with clear logic and has strong practical value. With parameter tuning it can adapt to more market conditions. Common issues like false signals and bad parameters need to be watched out for. Overall this is a solid trend following strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_string_1 | 0 | (?Base Settings ---------------------------------------)Allow Repainting ?: Non-Repainting |

| v_input_string_2 | 0 | Trade Direction: Both |

| v_input_bool_1 | true | Show Entries |

| v_input_bool_2 | true | Show Exits |

| v_input_bool_3 | true | (?Display Settings ------------------------------------)Apply Bar Colors |

| v_input_color_1 | #089981 | Candle Colors |

| v_input_color_2 | #f23645 | cbearColor |

| v_input_color_3 | #089981 | Long/Short Labels |

| v_input_color_4 | #f23645 | lbearColor |

| v_input_bool_4 | true | Show Supertrend |

| v_input_color_5 | #089981 | st_bullColor |

| v_input_color_6 | #f23645 | st_bearColor |

| v_input_bool_5 | true | (? Trend & Signal Settings---------------------)Entry |

| v_input_bool_6 | false | Exit |

| v_input_bool_7 | false | Entry |

| v_input_bool_8 | false | Exit |

| v_input_bool_9 | false | Filter |

| v_input_bool_10 | false | Exit |

| v_input_bool_11 | false | Filter |

| v_input_bool_12 | true | Filter |

| v_input_bool_13 | true | Exit |

| v_input_bool_14 | true | Filter |

| v_input_string_3 | 0 | (?RSI Settings ----------------------------------)TF: Auto Multiplied TF |

| v_input_int_1 | 4 | setHTF1a |

| v_input_timeframe_1 | D | setHTF1b |

| v_input_int_2 | 14 | RSI Length |

| v_input_int_3 | 50 | Bullish Level |

| v_input_int_4 | 50 | Bearish Level |

| v_input_int_5 | 21 | MA Length |

| v_input_bool_15 | true | Show MA |

| v_input_color_7 | #089981 | ma_bullColor |

| v_input_color_8 | #f23645 | ma_bearColor |

| v_input_string_4 | 0 | (?Supertrend Settings ----------------------------------)TF: Auto Multiplied TF |

| v_input_int_6 | 4 | setHTF2a |

| v_input_timeframe_2 | D | setHTF2b |

| v_input_int_7 | 10 | Supertrend Length |

| v_input_int_8 | 2 | Mult |

| v_input_bool_16 | true | Highlights |

| v_input_1 | timestamp(UTC 01 Jan 2020 00:00) | (?Step 5 - ? Time Filter ?-------------)Start Timeㅤㅤ |

| v_input_2 | timestamp(UTC 31 Dec 2025 23:45) | End Time ㅤ ㅤ |

| v_input_bool_17 | true | (?Step 6 - Risk Management-------------)TP Price % |

| v_input_float_1 | true | tppercent |

| v_input_int_9 | 5 | Quantity % |

| v_input_bool_18 | false | SL Price % |

| v_input_float_2 | 5 | stoppercent |

| v_input_string_5 | 0 | Order Size: EQUITY |

| v_input_bool_19 | true | Use Net Profit |

| v_input_int_10 | 30 | ?????? % |

| v_input_int_11 | 10000 | ???? |

| v_input_int_12 | true | ????????? |

| v_input_string_6 | 0 | (?Step 7 - Alerts & Bot Trading Settings-------------)Broker: Binance |

| v_input_5 | Bot ID | Bot ID |

| v_input_6 | Bot Email Token | Bot Email Token |

| v_input_3 | FTMM/USDT | (?Cloud Function Server)Ticker |

| v_input_4 | Passphrase | Passphrase |

Source (PineScript)

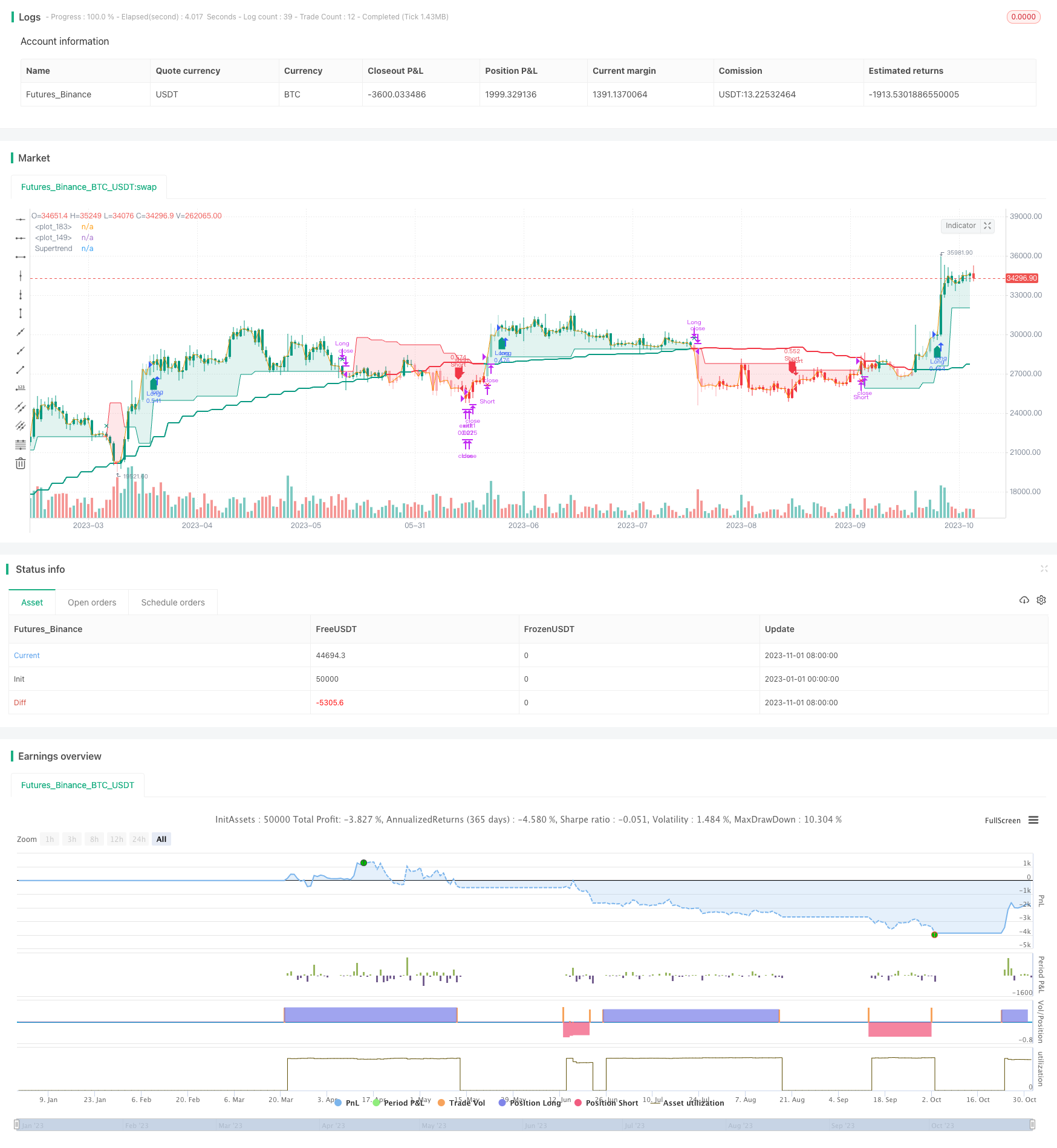

/*backtest

start: 2023-01-01 00:00:00

end: 2023-11-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//Created by @CITIAlgo

// —————————————————————————————————————————————————————————————————————————————————————————————————————————

strategy('CITI Trends A with RSI Candles', shorttitle = "CITI Trends A" , overlay = true ,

initial_capital = 10000,

commission_value = 0.025,

default_qty_value = 25,

slippage = 1,

pyramiding = 0,

max_lines_count = 500,

max_labels_count = 500,

currency = currency.USD,

default_qty_type = strategy.percent_of_equity)

bullColor1 = #089981

bearColor1 = #f23645

bullColor2 = #3873e3

bearColor2 = #630ef5

neutralColor1 = #d5d5d5

//Base Settings

groupBase = "Base Settings ---------------------------------------"

Repaint_type = input.string('Non-Repainting', "Allow Repainting ?", options = ['Non-Repainting', 'Repainting'], inline ='repaint' , group = groupBase , tooltip = 'The default value is Non-Repainting. To learn more visit https://www.tradingview.com/pine-script-docs/en/v5/concepts/Repainting.html')

//Configure trade direction

tradeDirection = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"] , group=groupBase , inline = 'Type' )

longOK = tradeDirection == "Long" or tradeDirection == "Both"

shortOK = tradeDirection == "Short" or tradeDirection == "Both"

var bool PlotEntries = input.bool (true, "Show Entries" ,group=groupBase , inline = 'Signals' )

var bool PlotExits = input.bool (true, "Show Exits" , group=groupBase, inline = 'Signals' )

//Display Settings

groupDisplay = "Display Settings ------------------------------------"

MomBars = input.bool( true , title="Apply Bar Colors", inline = 'candles' , group=groupDisplay)

cbullColor = input.color( bullColor1 , 'Candle Colors' , inline = 'candles1a',group=groupDisplay)

cbearColor = input.color( bearColor1 , '' , inline = 'candles1a',group=groupDisplay)

//Candle & label Colors

Bullish_Bars = color.new( cbullColor , 0)

WBullish_Bars = color.new( cbullColor , 60)

Bearish_Bars = color.new( cbearColor , 0)

WBearish_Bars = color.new( cbearColor , 60)

lbullColor = input.color( bullColor1 , 'Long/Short Labels' , group=groupDisplay, inline = 'Signals1' )

lbearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'Signals1' )

st_status = input.bool( true , title="Show Supertrend", inline = 'st' , group=groupDisplay)

st_bullColor = input.color( bullColor1 , '' , group=groupDisplay, inline = 'st' )

st_bearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'st' )

//Build Your Signals Settings

groupEntry = " Trend & Signal Settings---------------------"

Entry1a = input.bool(true, title= "Entry", inline='entry1a', group=groupEntry)

Exit1a = input.bool(false, title= "Exit | Strong/Weak Momentum", inline='entry1a', group=groupEntry)

Entry1b = input.bool(false, title= 'Entry' , inline='entry1b', group=groupEntry)

Exit1b = input.bool(false, title= 'Exit | Bull/Bear Momentum' , inline='entry1b', group=groupEntry)

Entry3a = input.bool(false, title= "Filter", inline='entry3a', group=groupEntry)

Exit3a = input.bool(false, title= "Exit | MA ", inline='entry3a', group=groupEntry)

Entry4a = input.bool(false, title= "Filter | Disable RSI Ranges ", inline='entry4a', group=groupEntry)

Entry4b = input.bool(true, title= "Filter", inline='entry4b', group=groupEntry)

Exit4b = input.bool(true, title= "Exit | Supertrend ", inline='entry4b', group=groupEntry)

Entry4c = input.bool(true, title= "Filter | Disable Supertrend Ranges ", inline='entry4c', group=groupEntry)

// —————————————————————————————————————MTF FUNCTIONS

// —————————— PineCoders MTF Selection Framework functions

// ————— Converts current "timeframe.multiplier" plus the TF into minutes of type float.

f_resInMinutes() =>

_resInMinutes = timeframe.multiplier * (timeframe.isseconds ? 1. / 60. : timeframe.isminutes ? 1. : timeframe.isdaily ? 1440. : timeframe.isweekly ? 10080. : timeframe.ismonthly ? 43800. : na)

_resInMinutes

// Get current resolution in float minutes.

var ResInMinutes = f_resInMinutes()

// ————— Returns resolution of _resolution period in minutes.

f_tfResInMinutes(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

request.security(syminfo.tickerid, _res, f_resInMinutes())

// ————— Returns a multiple of current resolution as a string in "timeframe.period" format usable with "security()".

f_multipleOfRes(_res, _mult) =>

// _res: current resolution in minutes, in the fractional format supplied by f_resInMinutes() companion function.

// _mult: Multiple of current TF to be calculated.

// Convert current float TF in minutes to target string TF in "timeframe.period" format.

_targetResInMin = _res * math.max(_mult, 1)

// Find best string to express the resolution.

_targetResInMin <= 0.083 ? '5S' : _targetResInMin <= 0.251 ? '15S' : _targetResInMin <= 0.501 ? '30S' : _targetResInMin <= 1440 ? str.tostring(math.round(_targetResInMin)) : _targetResInMin <= 43800 ? str.tostring(math.round(math.min(_targetResInMin / 1440, 365))) + 'D' : str.tostring(math.round(math.min(_targetResInMin / 43800, 12))) + 'M'

// ————— Converts current resolution

f_resInString(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

_res == "1" ? "1m" :

_res == "3" ? "3m" :

_res == "5" ? "5m" :

_res == "15" ? "15m" :

_res == "30" ? "30m" :

_res == "45" ? "45m" :

_res == "60" ? "1h" :

_res == "120" ? "2h" :

_res == "180" ? "3h" :

_res == "240" ? "4h" :

_res == "1D" ? "D" :

_res == "1W" ? "W" :

_res == "1M" ? "M" : _res

//Set repaint security function

repaint_sw = Repaint_type == 'Non-Repainting' ? false : true

f_security(_symbol, _res, _src, _repaint) => request.security(_symbol, _res, _src[_repaint ? 0 : barstate.isrealtime ? 1 : 0] , barmerge.gaps_off, barmerge.lookahead_on)[_repaint ? 0 : barstate.isrealtime ? 0 : 1]

f_source(_res , source) => f_security(syminfo.tickerid , _res , source , repaint_sw )

Type1 = 'Auto Multiplied TF'

Type2 = 'Fixed TF'

//---------------------------------------------------------------------------

//RSI Settings // INPUTS

groupRange = "RSI Settings ----------------------------------"

TF1type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf1' , group=groupRange)

setHTF1a = input.int( 4 , '' , inline ='tf1', group=groupRange)

setHTF1b = input.timeframe( 'D' , '' , inline ='tf1', group=groupRange)

// Get HTF from user-defined mode.

var TF1 = TF1type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF1a) : setHTF1b

mLength = input.int( 14 , "RSI Length" ,inline='lines', group=groupRange)

BullLevel = input.int( 50 , "Bullish Level | Above 50 ",inline='lines1a', group=groupRange)

BearLevel = input.int( 50 , "Bearish Level | Below 50 ",inline='lines1b', group=groupRange)

ma_length = input.int( 21 , "MA Length" ,inline='ma', group=groupRange)

ma_status = input.bool( true , "Show MA" ,inline='ma1', group=groupRange)

ma_bullColor = input.color( bullColor1 , '' , inline='ma1', group=groupRange)

ma_bearColor = input.color( bearColor1 , '' , inline='ma1', group=groupRange)

//--------------------------------------------------------------------------

//Momentum Calculations

f_momTF( _tf ) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

rsi_ = _isShow ? f_security(syminfo.tickerid , _tf, ta.rsi( close_, mLength) , repaint_sw) : na

ma = _isShow ? f_security(syminfo.tickerid , _tf, ta.vwma( hlc3 , ma_length ) , repaint_sw) : na

[rsi_ , ma]

[ rsi , ma ] = f_momTF(TF1)

ma_color = close > ma ? ma_bullColor : ma_bearColor

plot( ma_status ? ma : na , color = ma_color , linewidth = 2 , style = plot.style_line)

//---------------------------------------------------------------------------

//Supertrend Settings // INPUTS

groupST = "Supertrend Settings ----------------------------------"

TF2type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf2' , group=groupST)

setHTF2a = input.int( 4 , '' , inline ='tf2', group=groupST)

setHTF2b = input.timeframe( 'D' , '' , inline ='tf2', group=groupST)

// Get HTF from user-defined mode.

var TF2 = TF2type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF2a) : setHTF2b

stLength = input.int( 10 , "Supertrend Length" ,inline='lines', group=groupST)

stmult = input.int( 2 , "Mult" ,inline='lines', group=groupST)

stHighlights = input.bool( true , "Highlights",inline='lines1a', group=groupST)

f_st( _tf) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

atr= f_security(syminfo.tickerid , _tf, ta.atr(stLength) , repaint_sw)

Up=close_ -(stmult*atr)

Dn=close_ +(stmult*atr)

TrendUp = 0.0

TrendUp := close_[1]>TrendUp[1] ? math.max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := close_[1]<TrendDown[1]? math.min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := close_ > TrendDown[1] ? 1: close_< TrendUp[1]? -1: nz(Trend[1],1)

stLine = Trend==1? TrendUp: TrendDown

[Trend, stLine]

[Trend, stLine] = f_st( TF2 )

stTrend = close > stLine ? 1:-1

stplot = plot( st_status? stLine : na , color= stTrend ==1 ? st_bullColor : st_bearColor , linewidth=1 ,title ="Supertrend")

priceLineP = plot( close , color= na , linewidth=1 , display = display.none)

fill(priceLineP , stplot , color = stHighlights ? stTrend ==1 ? color.new(st_bullColor , 85) : color.new( st_bearColor , 85 ) : na )

//---------------------------------------------------------------------------

//Momentum BarColors

mom2a = rsi > BullLevel ? Bullish_Bars : WBullish_Bars

mom2b = rsi < BearLevel ? Bearish_Bars : WBearish_Bars

mom2_color = close > ma ? mom2a : mom2b

mom_color = MomBars ? mom2_color : na

barcolor(mom_color)

//-------------------------------------------------

//Momentum Strength & Values

momVal2a = rsi > BullLevel ? 2 : 1

momVal2b = rsi < BearLevel ? -2 : -1

momVal2 = close > ma ? momVal2a : momVal2b

momVal = momVal2

///==============================================================================================================

//Long Trend Conditions

Entry1aL = Entry1a ? momVal == 2 : true

Entry1bL = Entry1b ? momVal == 1 or momVal == 2 : true

Entry3aL = Entry3a ? close > ma : true

Entry4aL = Entry4a ? rsi > BullLevel : true

Entry4bL = Entry4b ? close > stLine : true

Entry4cL = Entry4c ? stLine > stLine[1] : true

//------

noEntry = Entry1a == false and Entry1b == false and Entry3a == false and Entry4a == false and Entry4b == false and Entry4c == false ? false : true

noExit = Exit1a == false and Exit1b == false and Exit3a == false and Exit4b == false ? false : true

//------

EntryL = noEntry and Entry1aL and Entry1bL and Entry3aL and Entry4aL and Entry4bL and Entry4cL

Exit1aL = Exit1a ? momVal == 1 and momVal[1] == 2 : true

Exit1bL = Exit1b ? momVal == -1 or momVal == -2 : true

Exit3aL = Exit3a ? close < ma : true

Exit4bL = Exit4b ? close < stLine : true

ExitL = noExit and Exit1aL and Exit3aL and Exit1bL and Exit4bL

//Short Trend Conditions

Entry1aS = Entry1a ? momVal == -2 : true

Entry1bS = Entry1b ? momVal == -1 or momVal == -2 : true

Entry3aS = Entry3a ? close < ma : true

Entry4aS = Entry4a ? rsi < BearLevel : true

Entry4bS = Entry4b ? close < stLine : true

Entry4cS = Entry4c ? stLine < stLine[1] : true

EntryS = noEntry and Entry1aS and Entry1bS and Entry3aS and Entry4aS and Entry4bS and Entry4cS

Exit1aS = Exit1a ? momVal == -1 and momVal[1] == -2 : true

Exit1bS = Exit1b ? momVal == 1 or momVal == 2 : true

Exit3aS = Exit3a ? close > ma : true

Exit4bS = Exit4b ? close > stLine : true

ExitS = noExit and Exit1aS and Exit3aS and Exit1bS and Exit4bS

///==============================================================================================================

//Entry & exit conditions

isLong = false

isLong := nz(isLong[1], false)

isShort = false

isShort := nz(isShort[1], false)

goLong = not isLong and EntryL and not ExitL and longOK and barstate.isconfirmed

goShort = not isShort and EntryS and not ExitS and shortOK and barstate.isconfirmed

longExit = isLong and ExitL and barstate.isconfirmed

shortExit = isShort and ExitS and barstate.isconfirmed

if (goLong)

isLong := true

isShort := false

if (goShort)

isLong := false

isShort := true

if (longExit)

isLong := false

if (shortExit)

isShort := false

//------------------------------------------------------------------------------

// ——Backtester

grouptime = 'Step 5 - ? Time Filter ?-------------'

startTime = input (group=grouptime, title="Start Timeㅤㅤ", defval=timestamp('UTC 01 Jan 2020 00:00'), inline="Start")

endTime = input (group=grouptime, title="End Time ㅤ ㅤ", defval=timestamp('UTC 31 Dec 2025 23:45'), inline="End")

dateRange = true

//------------------------------------------------------------------------------

// Risk Managment

grouprisk = 'Step 6 - Risk Management-------------'

takeprofit = input.bool(true,title = "TP Price %",group=grouprisk, inline="profit")

tppercent = input.float(1, '', group=grouprisk, inline="profit") / 100

q1 = input.int (5 , "Quantity %",group=grouprisk , inline="profit")

stoploss = input.bool(false,title = "SL Price %",group=grouprisk, inline="loss")

stoppercent = input.float(5, '', group=grouprisk, inline="loss") / 100

// Determine where you've entered and in what direction

longtp = strategy.position_avg_price * (1 + tppercent)

longStop = strategy.position_avg_price * (1 - stoppercent)

shorttp = strategy.position_avg_price * (1 - tppercent)

shortStop = strategy.position_avg_price * (1 + stoppercent)

QTYMethod = input.string ('EQUITY', 'Order Size', group=grouprisk, inline=' ', options=['NONE', 'EQUITY', 'SIZE', 'CONTRACTS'])

useNetProfit = input.bool (true, 'Use Net Profit', group=grouprisk, inline=' ', tooltip='Use Net Profit- On/Off the use of profit in the following trades. *Only works if the type is EQUITY')

riskPerc = input.int (30, '?????? %', group=grouprisk, inline='.', minval=1, maxval=100)

riskSize = input.int (10000, '????', group=grouprisk, inline='.', minval=1)

riskCntr = input.int (1, '?????????', group=grouprisk, inline='.', minval=1, tooltip='Order Size: \nNone- Use the default position size settings in Tab "Properties". \nEquity% - per trade from the initial capital. \nSize- Fixed size amount of trade. \nContracts- The fixed amount of the deal in contracts. \n')

// —————— Order Size

eqty = switch QTYMethod

'NONE' => na

'EQUITY' => riskPerc / close

'SIZE' => riskSize / close

'CONTRACTS' => riskCntr

//-----------------------------------------------------------------------------

// —————— Trade variables

entry = strategy.position_avg_price

sizePos = strategy.position_size

inLong = sizePos > 0

inShort = sizePos < 0

inTrade = inLong or inShort

inPos = (inLong and not inShort[1]) or (inShort and not inLong[1])

var ID = 'TradeID'

var tpPrice = float(na)

var slPrice = float(na)

///==============================================================================================================

// ALERTS

groupalerts = 'Step 7 - Alerts & Bot Trading Settings-------------'

broker = input.string('Binance', "Broker", options=['Binance', 'Alpaca', 'Kucoin', '3Commas'], group=groupalerts, tooltip = 'Choose which type you are using to send the correct Json Alert message for entry and exit alerts.')

my_sym = input("FTMM/USDT", "Ticker", group = 'Cloud Function Server', tooltip = 'Only used with Alerts to fix ticker ID in json message. Some exchanges use the forward slash and some do not.')

my_pass = input('Passphrase', "Passphrase" , group = 'Cloud Function Server', tooltip = 'Only enter your Passphrase and nothing else goes here. Only needed when using a Cloud Function Server.')

i_alert_3CID_txt = input('Bot ID', "Bot ID", group =groupalerts, tooltip = 'Only enter your 3Commas Bot ID and nothing else goes here.')

i_alert_3CET_txt = input('Bot Email Token', title = 'Bot Email Token', group =groupalerts , tooltip = 'Only enter your 3Commas Bot Email Token and nothing else goes here.')

Alert='{"passphrase": "'+str.tostring(my_pass)+'","symbol": "'+ str.tostring(my_sym) +'","type":"market", "side":"{{strategy.order.action}}","amount":"{{strategy.order.contracts}}","price": "' + str.tostring(close) + '"}'

//---------------------------------------------------------------------------------

// JSON alert message used for 3Commas Bots

C3_EntryAlert ='{"message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0 }'

C3_ExitAlert ='{"action": "close_at_market_price_all", "message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0}'

//---------------------------------------------------------------------------------

// JSON alert message used for setting up a Google Cloud Function Server works when using Alpaca Exchange

Alert_Alpaca = '{"symbol": "{{ticker}}", "quantity": "{{strategy.order.contracts}}", "side": "{{strategy.order.action}}", "order_type": "market", "time_in_force": "gtc", "passphrase": "' + str.tostring(my_pass) + '"}'

entryAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_EntryAlert

exitAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_ExitAlert

strategy.initial_capital = 50000

// —————— Entry's

goLongEntry = goLong and dateRange and barstate.isconfirmed

goShortEntry = goShort and dateRange and barstate.isconfirmed

eqty(qty) => QTYMethod=='EQUITY' ? qty / 100 * (strategy.initial_capital + (useNetProfit ? strategy.netprofit : 0)) : QTYMethod=='SIZE' ? qty / syminfo.pointvalue : qty

if goLongEntry

ID := 'Long'

strategy.entry(ID, strategy.long, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

if goShortEntry

ID := 'Short'

strategy.entry(ID, strategy.short, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

// —————— Exit's

qty(perc) => math.abs(sizePos*perc/100)

if longExit

strategy.close("Long",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Long", limit=takeprofit ? longtp : na, stop=stoploss ? longStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Long", stop=stoploss ? longStop : na, comment_loss='SL')

if shortExit

strategy.close("Short",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Short", limit=takeprofit ? shorttp : na, stop=stoploss ? shortStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Short", stop=stoploss ? shortStop : na, comment_loss='SL')

///==============================================================================================================

//Style- Plots on Chart

posH = high + 2 * stLine

posL = low - 2 * stLine

plotshape( goLong and PlotEntries ? posL : na ,'Long Entry Signals' , text= '' , location=location.belowbar, style=shape.labelup , size=size.small , color=lbullColor , textcolor = color.white )

plotshape( longExit and PlotExits ? posH : na ,'Long Exit' , location=location.abovebar, style= shape.xcross , size=size.small, color=lbullColor )

plotshape( goShort and PlotEntries ? posH : na ,'Short Entry Signals' , text= '' , location=location.abovebar, style=shape.labeldown , size=size.small , color=lbearColor , textcolor = color.white )

plotshape( shortExit and PlotExits ? posL : na ,'Short Exit' , location=location.belowbar, style=shape.xcross , size=size.small , color=lbearColor )

///==============================================================================================================

// Alerts

alertcondition( goLong , 'Long Entry Alerts', 'Long Alerts')

alertcondition( goShort , 'Short Entry Alerts', 'Short Alerts')

Detail

https://www.fmz.com/strategy/430974

Last Modified

2023-11-03 14:22:50