Name

基于RSI指标的多头趋势追踪策略RSI-Based-Bullish-Trend-Following-Strategy

Author

ChaoZhang

Strategy Description

该策略基于相对强弱指数(RSI)指标设计,针对RSI低点买入,高点止损止盈的多头趋势追踪交易策略。当RSI指标低于超买线时生成买入信号,当RSI指标高于超卖线时生成卖出信号。策略优化追踪趋势的表现,能够有效控制交易风险。

该策略使用RSI指标判断股票价格是否被高估或低估。RSI指标结合超买超卖线,形成买入和卖出信号。具体来说,如果RSI指标上穿20的超卖线,产生买入信号;如果RSI指标下穿80的超买线,产生卖出信号。

进入多头仓位后,策略设置一个初始止损线,以控制下行风险。同时设置两个不同比例的止盈线,分批止盈以锁定利润。具体来说,最先止盈50%的头寸,止盈价为买入价格的3%;然后止盈剩余50%的头寸, 止盈价为买入价格的5%。

该策略简洁有效地利用RSI指标判断入市时机。止盈止损设置合理,可以有效控制风险。

- 利用RSI指标判断多空,避免盲目做多

- RSI指标参数经过优化,指标效果更佳

- 双止盈设计合理,可以实现分批止盈,锁定更多利润

- 初止损和连续止损防止巨额亏损

- 多头策略,无法持续盈利的牛市中效果欠佳

- RSI指标发出错误信号的概率存在,信号判断不当可能增加损失

- 止损点过深造成无法止损的风险

- 缺乏对加仓次数和比例的限制,可能造成亏损放大

- 结合其他指标过滤RSI信号,提高信号准确率

- 加入对加仓次数和比例的限制

- 测试不同RSI参数的效果

- 优化止损止盈点,降低风险

该策略运用RSI指标判断行情,止盈止损设置合理。可有效判断行情趋势,控制交易风险,适合作为多头追踪策略使用。通过信号过滤、参数测试、止损优化等方式可进一步提升策略的稳定性。

||

This strategy is designed based on the Relative Strength Index (RSI) indicator for buying on RSI low points and taking profit and stop loss on RSI high points. It generates buy signals when RSI drops below the oversold line and sell signals when RSI rises above the overbought line. The strategy is optimized to track trends with effective risk control.

The strategy uses the RSI indicator to determine if a stock is overvalued or undervalued. RSI combined with overbought and oversold lines forms buy and sell signals. Specifically, if RSI crosses above the 20 oversold line, a buy signal is generated; if RSI crosses below the 80 overbought line, a sell signal is generated.

After entering a long position, the strategy sets an initial stop loss to control the downside risk. At the same time, two take profit lines with different ratios are set to take profits in batches and lock in profits. Specifically, 50% of the position will take profit first at 3% above the entry price; then the remaining 50% position will take profit at 5% above the entry price.

The strategy effectively utilizes the RSI indicator to determine entry timing. The stop loss and take profit settings are reasonable to effectively control risks.

- Utilize RSI indicator to determine long/short positions and avoid trading blindly

- Optimized RSI parameters for better indicator effect

- Reasonable dual take profit design allows taking profits in batches to lock in more profits

- Initial stop loss and trailing stop loss prevent huge losses

- Poor performance in a bull market that cannot sustain profits

- Probability of incorrect signals from RSI exists and can increase losses from improper signal judgement

- Risk that stops cannot be triggered if stop loss points are set too deep

- Risk of magnified losses without limit on pyramiding times and ratio

- Add other indicators to filter RSI signals and improve accuracy

- Set limits on pyramiding times and ratios

- Test effects of different RSI parameters

- Optimize stop loss and take profit points to lower risks

The strategy utilizes RSI to judge market condition and has reasonable stop loss and take profit configuration. It can effectively determine market trend and control trading risks, suitable as a bullish trend following strategy. Signal filtering, parameter testing, stop loss optimization etc. can further improve the stability of the strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_string_1 | 0 | Strategy Direction: long |

| v_input_1 | 21 | length |

| v_input_2 | 20 | overSold |

| v_input_3 | 80 | overBought |

| v_input_4 | true | Display info panels? |

| v_input_5 | 40 | fibs label offset |

| v_input_string_2 | 0 | fibs label size: size.normal |

| v_input_6 | false | trend |

| v_input_float_1 | 5 | stop loss |

| v_input_int_1 | 50 | qty_percent1 |

| v_input_int_2 | 50 | qty_percent2 |

| v_input_float_2 | 3 | Take profit1 |

| v_input_float_3 | 5 | Take profit2 |

Source (PineScript)

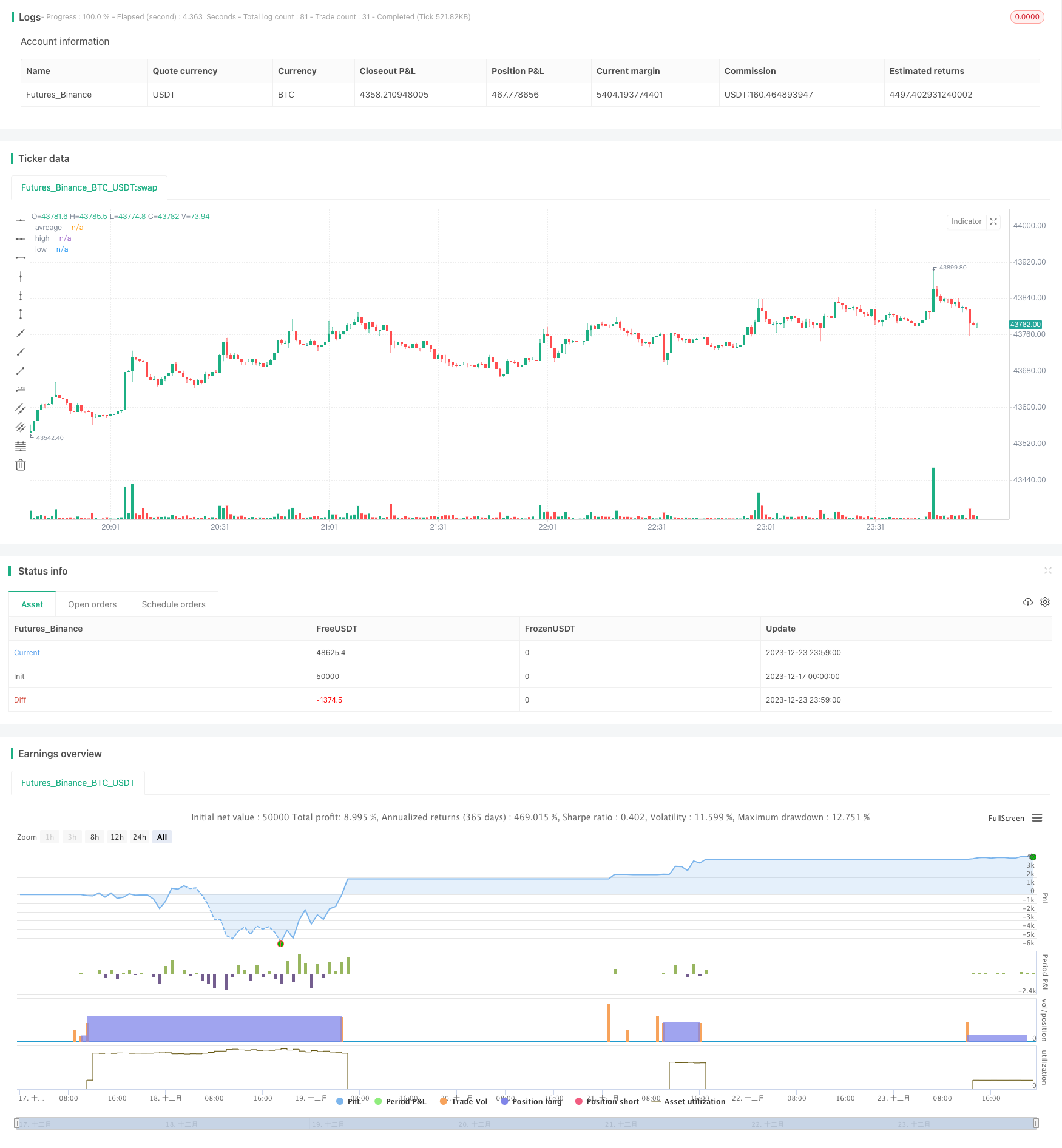

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-24 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

strategy(title='RSI Long Strategy', overlay=true, pyramiding=5, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, calc_on_order_fills=false, slippage=0, commission_type=strategy.commission.percent, commission_value=0.075)

strat_dir_input = input.string(title='Strategy Direction', defval='long', options=['long', 'short', 'all'])

strat_dir_value = strat_dir_input == 'long' ? strategy.direction.long : strat_dir_input == 'short' ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(strat_dir_value)

//INPUTS

length = input(21)

overSold = input(20)

overBought = input(80)

p = close

vrsi = ta.rsi(p, length)

price = close

var bool long = na

var bool short = na

long := ta.crossover(vrsi, overSold)

short := ta.crossunder(vrsi, overBought)

var float last_open_long = na

var float last_open_short = na

last_open_long := long ? close : nz(last_open_long[1])

last_open_short := short ? close : nz(last_open_short[1])

mpoint=(last_open_long+last_open_short)/2

entry_value = last_open_long

entry_value1 = last_open_short

// Rounding levels to min tick

nround(x) =>

n = math.round(x / syminfo.mintick) * syminfo.mintick

n

//

disp_panels = input(true, title='Display info panels?')

fibs_label_off = input(40, title='fibs label offset')

fibs_label_size = input.string(size.normal, options=[size.tiny, size.small, size.normal, size.large, size.huge], title='fibs label size')

r1_x = timenow + math.round(ta.change(time) * fibs_label_off)

r1_y = last_open_short

text1 = 'High : ' + str.tostring(nround(last_open_short))

s1_y = last_open_long

text3 = 'low : ' + str.tostring(nround(last_open_long))

R1_label = disp_panels ? label.new(x=r1_x, y=r1_y, text=text1, xloc=xloc.bar_time, yloc=yloc.price, color=color.orange, style=label.style_label_down, textcolor=color.black, size=fibs_label_size) : na

S1_label = disp_panels ? label.new(x=r1_x, y=s1_y, text=text3, xloc=xloc.bar_time, yloc=yloc.price, color=color.lime, style=label.style_label_up, textcolor=color.black, size=fibs_label_size) : na

label.delete(R1_label[1])

label.delete(S1_label[1])

//

plot(mpoint, title='avreage', color=color.new(color.red, 40), style=plot.style_linebr, linewidth=3, trackprice=true, offset=-9999)

plot(last_open_short, title='high', color=color.new(color.red, 40), style=plot.style_linebr, linewidth=3, trackprice=true, offset=-9999)

plot(last_open_long, title='low', color=color.new(color.blue, 40), style=plot.style_linebr, linewidth=3, trackprice=true, offset=-9999)

//

trend = input(false)

if barstate.islast and trend == true

line z = line.new(bar_index[1], last_open_short[1], bar_index, last_open_short, extend=extend.both, color=color.red, style=line.style_dashed, width=1)

line f = line.new(bar_index[1], mpoint[1], bar_index, mpoint, extend=extend.both, color=color.blue, style=line.style_dashed, width=1)

line w = line.new(bar_index[1], last_open_long[1], bar_index, last_open_long, extend=extend.both, color=color.green, style=line.style_dashed, width=1)

line.delete(z[1])

line.delete(f[1])

line.delete(w[1])

//bu = ta.crossover(close, mpoint)

//sz = ta.crossunder(close, mpoint)

//bu1 = ta.crossover(close, last_open_short)

sz1 = ta.crossunder(close, last_open_short)

bu2 = ta.crossover(close, last_open_long)

//sz2 = ta.crossunder(close, last_open_long)

//plotshape(sz, style=shape.triangledown, location=location.abovebar, color=color.new(color.orange, 0), size=size.tiny)

//plotshape(bu, style=shape.triangleup, location=location.belowbar, color=color.new(color.blue, 0), size=size.tiny)

//plotshape(sz1, style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny)

//plotshape(bu1, style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.tiny)

//plotshape(sz2, style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny)

//plotshape(bu2, style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.tiny)

l = bu2

s = sz1

if l

strategy.entry('buy', strategy.long)

if s

strategy.entry('sell', strategy.short)

per(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

stoploss = input.float(title=' stop loss', defval=5, minval=0.01)

los = per(stoploss)

q1 = input.int(title=' qty_percent1', defval=50, minval=1)

q2 = input.int(title=' qty_percent2', defval=50, minval=1)

tp1 = input.float(title=' Take profit1', defval=3, minval=0.01)

tp2 = input.float(title=' Take profit2', defval=5, minval=0.01)

//tp4 = input.float(title=' Take profit4', defval=5, minval=0.01)

strategy.exit('x1', qty_percent=q1, profit=per(tp1), loss=los)

strategy.exit('x2', qty_percent=q2, profit=per(tp2), loss=los)

Detail

https://www.fmz.com/strategy/436524

Last Modified

2023-12-25 14:32:19