Name

基于RSI指标的短线反转交易策略RSI-Mean-Reversion-Trading-Strategy

Author

ChaoZhang

Strategy Description

[trans]

本策略采用RSI指标识别趋势和超买超卖情况,结合EMA均线判断当前趋势方向,在趋势方向与RSI信号一致时,进行反向开仓,实现短线反转交易。

-

使用EMA指标判断当前趋势方向。当价格高于EMA均线时,定义为上升趋势;当价格低于EMA均线时,定义为下降趋势。

-

使用RSI指标判断超买超卖情况。RSI高于60为超买区,低于40为超卖区。

-

当上升趋势且RSI低于40时,发出买入信号;当下降趋势且RSI高于60时,发出卖出信号。

-

在发出买入和卖出信号时,分别设置止盈和止损价格。止盈价格按照开仓价格的一定比例计算;止损价格按照开仓价格的一定比例计算。

-

当仓位大于0时,设置止盈单;当仓位小于0时,设置止损单。

-

策略合理运用EMA和RSI指标,识别趋势和超买超卖情况,避免逆势交易。

-

策略采用短线反转交易方式,能够抓住短线轮动获利机会。

-

策略设置止盈止损点,有助于锁定利润,控制风险。

-

策略交易逻辑清晰简洁,容易理解实现,适合新手学习。

-

策略可通过调整EMA周期、RSI参数等进行优化,适应不同品种和交易环境。

-

反转失败风险。短线反转可能失败,从而造成亏损。

-

趋势不明显风险。在震荡行情下,EMA难以判断明确趋势方向,可能产生错误信号。

-

止损被触发风险。止损设置过于接近,可能会被意外触发。

-

过优化风险。针对历史数据过度优化,可能无法适应实盘环境。

-

交易频率过高风险。短线交易频率过高,会产生大量交易费用。

-

优化EMA和RSI参数,寻找最佳参数组合。可以通过遍历回测获得最优参数。

-

增加过滤条件,避免在震荡行情中产生错误信号。例如增加成交量条件。

-

优化止盈止损比例,寻找最佳比例以锁定利润。止损比例不宜过大,可适当放宽。

-

增加仓位管理策略,例如固定仓位、马丁格尔等,控制单笔亏损。

-

结合其他指标,例如MACD、KD等,提高信号准确率。或优化为多因子模型。

-

针对实盘数据进行回测,不断优化参数,使策略适应最新行情。

本策略基于EMA和RSI指标设计了一套短线反转交易策略,采用趋势判断和超买超卖识别的交易逻辑,在短线获利的同时设置止盈止损控制风险。该策略优势在于简单易用,逻辑清晰,通过参数优化可以获得较好回测结果。但实盘中仍需注意反转失败、震荡市等风险,需进行风险管理。整体来说,该策略为新手提供了一个简单实用的短线交易思路,值得学习借鉴。

||

This strategy uses the RSI indicator to identify trends and overbought/oversold conditions. Combined with EMA to determine current trend direction, it opens reverse positions when the trend direction is consistent with RSI signals to implement mean reversion trading.

-

Use EMA indicator to determine current trend direction. Above EMA defines an uptrend while below EMA defines a downtrend.

-

Use RSI indicator to identify overbought/oversold conditions. RSI above 60 is overbought zone and below 40 is oversold zone.

-

When uptrend and RSI below 40, a buy signal is triggered. When downtrend and RSI above 60, a sell signal is triggered.

-

When buy/sell signals triggered, take profit and stop loss prices are set based on certain percentage of entry price.

-

When position size greater than 0, take profit order is placed. When position size less than 0, stop loss order is placed.

-

The strategy reasonably combines EMA and RSI to identify trends and overbought/oversold conditions, avoiding trading against trends.

-

The mean reversion approach catches short-term rotations for profits.

-

Take profit and stop loss points help lock in profits and control risks.

-

Simple and clear logic, easy to understand and implement, suitable for beginners.

-

Parameters like EMA period and RSI can be optimized for different products and market environments.

-

Failed reversal risk. Short-term reversal may fail, resulting in losses.

-

Unclear trend risk. EMA may fail to identify a clear trend in ranging markets, generating wrong signals.

-

Stop loss triggered risk. Stop loss set too close may be unexpectedly triggered.

-

Overfitting risk. Excessive optimization on historical data may not apply for live trading.

-

High trading frequency risk. Too frequent trading incurs significant transaction costs.

-

Optimize EMA and RSI parameters to find best combination through backtesting.

-

Add filters to avoid wrong signals in ranging market. For example, add volume condition.

-

Optimize take profit/stop loss ratio to lock in profits. Stop loss should not be too wide.

-

Add position sizing rules like fixed fraction to control single trade loss.

-

Combine other indicators like MACD, KD to improve signal accuracy or use multivariate models.

-

Backtest on live data and continuously optimize for latest market conditions.

This strategy implements a short-term mean reversion approach based on EMA and RSI, with clear logic of trend identification and overbought/oversold detection. It sets take profit and stop loss to control risks while profiting from short-term rotations. The simplicity and clarity are its advantages. Further optimizations can yield good backtest results. But risks like failed reversal and ranging market should be noted for live trading. Overall it provides a simple and practical short-term trading idea for beginners to learn from.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Long Entry |

| v_input_2 | true | Short Entry |

| v_input_3 | 100 | EMA Length |

| v_input_float_2 | true | Short Take Profit |

| v_input_float_4 | 1.5 | Short Stop Loss |

| v_input_float_1 | true | (?Take Profit Percentage)Long Take Profit |

| v_input_float_3 | 1.5 | (?Stop Percentage)Long Stop Loss |

Source (PineScript)

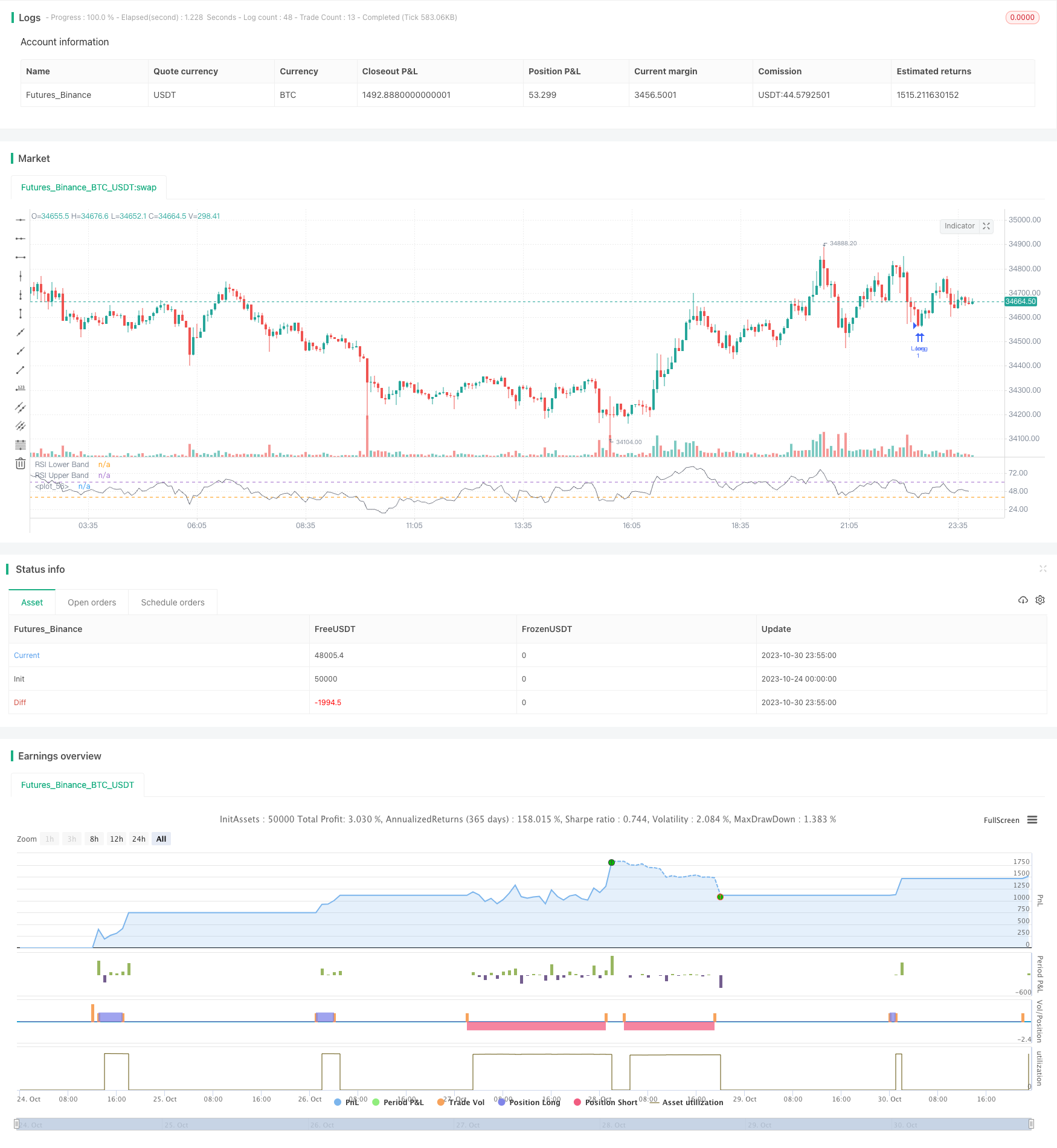

/*backtest

start: 2023-10-24 00:00:00

end: 2023-10-31 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Sarahann999

//@version=5

strategy("RSI Strategy", shorttitle="RSI", overlay= false)

//Inputs

long_entry = input(true, title='Long Entry')

short_entry = input(true, title='Short Entry')

emaSettings = input(100, 'EMA Length')

ema = ta.ema(close,emaSettings)

rsi = ta.rsi(close,14)

//Conditions

uptrend = close > ema

downtrend = close < ema

OB = rsi > 60

OS = rsi < 40

buySignal = uptrend and OS and strategy.position_size == 0

sellSignal = downtrend and OB and strategy.position_size == 0

//Calculate Take Profit Percentage

longProfitPerc = input.float(title="Long Take Profit", group='Take Profit Percentage',

minval=0.0, step=0.1, defval=1) / 100

shortProfitPerc = input.float(title="Short Take Profit",

minval=0.0, step=0.1, defval=1) / 100

// Figure out take profit price 1

longExitPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortExitPrice = strategy.position_avg_price * (1 - shortProfitPerc)

// Make inputs that set the stop % 1

longStopPerc = input.float(title="Long Stop Loss", group='Stop Percentage',

minval=0.0, step=0.1, defval=1.5) / 100

shortStopPerc = input.float(title="Short Stop Loss",

minval=0.0, step=0.1, defval=1.5) / 100

// Figure Out Stop Price

longStopPrice = strategy.position_avg_price * (1 - longStopPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortStopPerc)

// Submit entry orders

if buySignal and long_entry

strategy.entry(id="Long", direction=strategy.long, alert_message="Enter Long")

if sellSignal and short_entry

strategy.entry(id="Short", direction=strategy.short, alert_message="Enter Short")

//Submit exit orders based on take profit price

if (strategy.position_size > 0)

strategy.exit(id="Long TP/SL", limit=longExitPrice, stop=longStopPrice, alert_message="Long Exit 1 at {{close}}")

if (strategy.position_size < 0)

strategy.exit(id="Short TP/SL", limit=shortExitPrice, stop=shortStopPrice, alert_message="Short Exit 1 at {{close}}")

//note: for custom alert messages to read, "{{strategy.order.alert_message}}" must be placed into the alert dialogue box when the alert is set.

plot(rsi, color= color.gray)

hline(40, "RSI Lower Band")

hline(60, "RSI Upper Band")

Detail

https://www.fmz.com/strategy/430760

Last Modified

2023-11-01 16:15:30