Name

基于RSI的简单密码货币交易策略Simple-Cryptocurrency-Trading-Strategy-Based-on-RSI

Author

ChaoZhang

Strategy Description

这是一个基于相对强弱指数(RSI)的简单密码货币交易策略。它通过计算RSI值来判断市场是否处于超买或超卖状态,从而产生交易信号。该策略适用于中短期交易。

该策略首先计算长度为14天的RSI值。然后它判断RSI值是否低于30这个超卖线。如果低于,则产生买入信号;如果高于70这个超买线,则产生卖出信号。

当RSI值上穿超卖线时,关闭买入头寸;当RSI值下穿超买线时,关闭卖出头寸。

- 策略逻辑简单清晰,容易理解和实现

- 利用RSI这一成熟指标判断市场状况

- 可自定义参数,适应不同市场环境

- 回撤风险较小

- 市场突发事件可能导致暂时失效

- 固定参数可能引起过度交易

- 仅基于单一指标,容易产生假信号

可以通过动态调整参数、结合多个指标、设置止损来缓解上述风险。

该策略可以从以下几个方面进行优化:

-

利用移动平均线等其他指标进行组合,形成多重确认;

-

添加趋势判断规则,避免音调市;

-

设置交易量或止损规则控制风险;

-

优化RSI参数,使其更符合加密货币高频交易的特点。

本策略overall是一个非常基础的RSI策略,通过一个成熟指标判断超买超卖形成交易信号。优点是简单易用,实践风险也较小。但仅凭单一指标,也容易产生假信号。我们可以通过多种方式对其进行扩展与优化,使其更稳定、适应性更强。

||

This is a simple cryptocurrency trading strategy based on the Relative Strength Index (RSI). It generates trading signals by calculating RSI values to determine if the market is overbought or oversold. The strategy is suitable for medium-term trading.

The strategy first calculates the 14-day RSI value. It then judges if the RSI value is below 30, the oversold line. If so, a buy signal is generated. If the RSI surpasses 70, the overbought line, a sell signal is generated.

When the RSI value crosses above the oversold line, long positions are closed. When it crosses below the overbought line, short positions are closed.

- The strategy logic is simple and clear, easy to understand and implement

- Utilizes mature RSI indicator to judge market conditions

- Customizable parameters suit different market environments

- Relatively small drawdown risk

- Market events may cause temporary failure

- Fixed parameters may cause overtrading

- Reliance on a single indicator makes false signals likely

The risks above can be mitigated by dynamically adjusting parameters, incorporating multiple indicators, and setting stop loss.

The strategy can be optimized from the following aspects:

-

Combine with moving averages and other indicators to form multiple confirmations;

-

Add trend judgement rules to avoid choppy markets;

-

Set trade size or stop loss rules to control risks;

-

Optimize RSI parameters to suit the high-frequency nature of crypto trading.

Overall this is a very basic RSI strategy, generating trading signals by identifying overbought/oversold levels using a mature indicator. The pros are simplicity and relatively small practical risks. But reliance on a single indicator also makes false signals likely. We can extend and optimize it in many ways to make it more robust and adaptive.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | Length |

| v_input_2 | 70 | Overbought Level |

| v_input_3 | 30 | Oversold Level |

Source (PineScript)

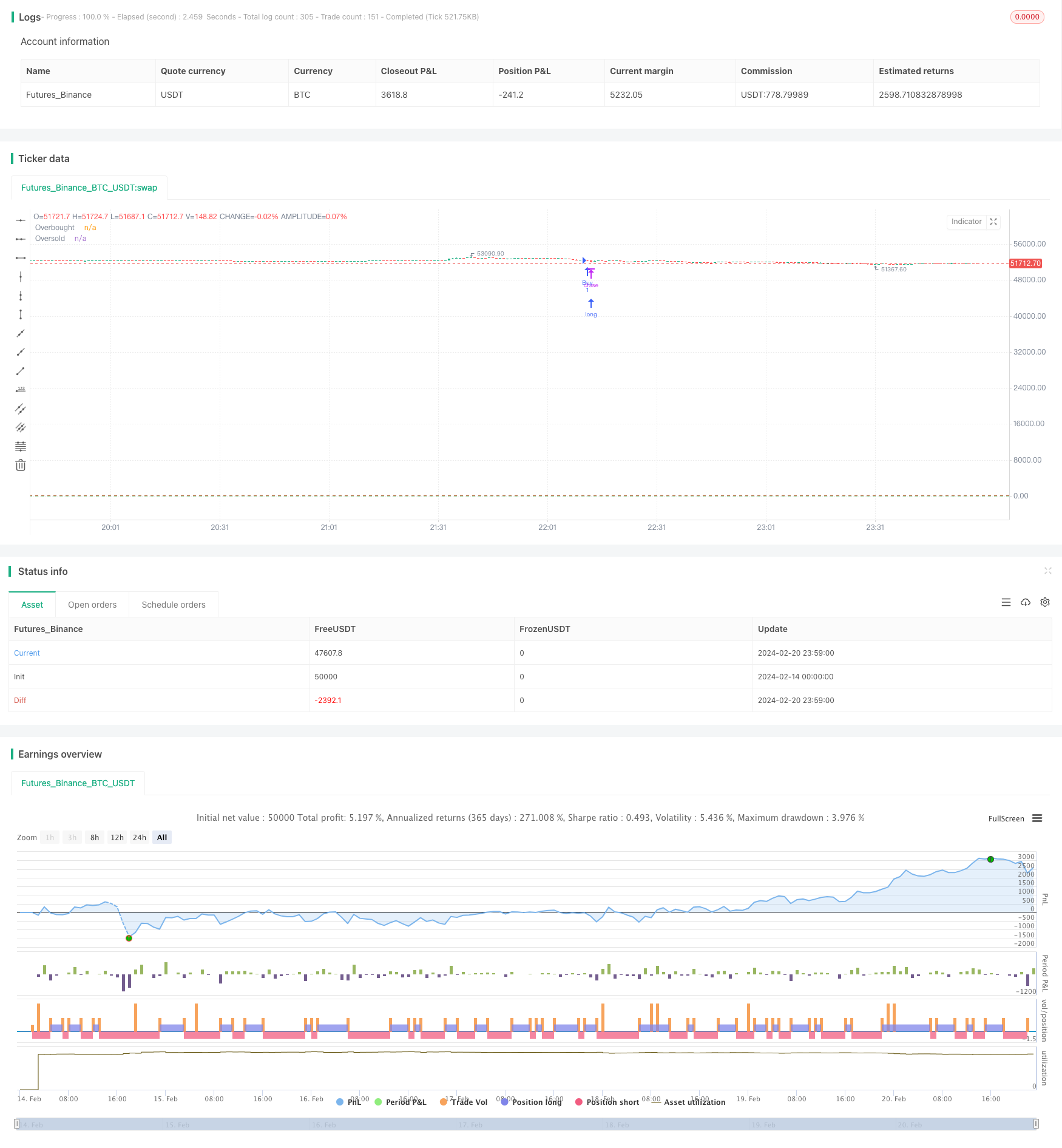

/*backtest

start: 2024-02-14 00:00:00

end: 2024-02-21 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Larry Williams Simple Crypto Strategy", overlay=true)

// Параметры стратегии

length = input(14, title="Length")

overboughtLevel = input(70, title="Overbought Level")

oversoldLevel = input(30, title="Oversold Level")

// Вычисление RSI

rsiValue = rsi(close, length)

// Определение условий для входа в позицию

enterLong = rsiValue < oversoldLevel

enterShort = rsiValue > overboughtLevel

// Открытие позиции

if enterLong

strategy.entry("Buy", strategy.long)

if enterShort

strategy.entry("Sell", strategy.short)

// Закрытие позиции

if enterLong and rsiValue > oversoldLevel

strategy.close("Buy")

if enterShort and rsiValue < overboughtLevel

strategy.close("Sell")

// Отрисовка уровней

hline(overboughtLevel, "Overbought", color=color.red)

hline(oversoldLevel, "Oversold", color=color.green)

Detail

https://www.fmz.com/strategy/442561

Last Modified

2024-02-22 17:44:13