Name

基于SMA均线和RSI指标的白银价格短期交易策略Short-Term-Silver-Trading-Strategy-Based-on-SMA-and-RSI-Indicators

Author

ChaoZhang

Strategy Description

本策略基于10日简单移动平均线(SMA)、30日SMA和相对强弱指数(RSI)指标,结合平均真实波幅(ATR)指标设定止损和止盈水平,实现白银价格的短期交易。该策略适用于1小时线上操作。

当10日SMA从下向上突破30日SMA时,表示价格短期上涨趋势形成,在RSI高于50时看涨入市。当10日SMA从上向下跌破30日SMA时,表示价格短期下跌趋势形成,在RSI低于50时看跌入市。

止损水平设置为最近低点减去3倍ATR。止盈水平设置为最近高点加上3倍ATR。这样可以利用ATR指标的特性,在行情波动加大时止损幅度较大,波动减小时止损幅度较小,从而实现风险控制。

该策略结合多种指标判断短期趋势和资金的流入流出情况,可以有效过滤虚假信号。同时,ATR止损机制使得止损水平能够动态调整,从而控制风险。

相比长期交易策略,短线操作具有资金周转快、频繁开仓等优势。该策略利用1小时均线系统判断短期趋势变化,配合RSI指标确定买卖时机,可以捕捉价格短期涨跌。

该策略主要面临止损被击穿、多头行情中频繁停损等风险。针对这些风险,可以调整ATR倍数或设置价格过滤来规避止损被击穿。同时建议采用锁仓或加仓方式来减少多头行情中频繁停损的情况。

另外,短线操作对交易者的心理素质要求较高,需要警惕过度交易和情绪化操作的风险。建议交易者适当控制仓位规模并制定严格的风险管理规则。

该策略还可以通过以下方式进一步优化:

- 增加其他指标过滤,如KDJ指标判断过买过卖情况

- 测试不同参数组合,如SMA周期、ATR倍数、RSI阈值等

- 增加机器学习算法,实现参数的动态优化

- 结合股票池技术,扩展至类似模式的其他品种

- 增加自动止损模块,实现止损水平的动态跟踪

本策略整合多个指标判断短期趋势和资金流向,利用ATR指标优化止损机制。该策略具有资金周转快、频繁开仓等优势,适合白银等品种的短线操作。我们还需要防范过度交易和情绪化操作的风险,并继续优化策略以提高稳定性及胜率。

||

This strategy is based on the 10-day simple moving average (SMA), 30-day SMA and relative strength index (RSI) indicator, combined with the average true range (ATR) indicator to set stop loss and take profit levels for short-term silver trading. It is suitable for 1-hour timeframe operations.

When the 10-day SMA crosses above the 30-day SMA, it signals an uptrend in price in the short term. A long position is taken when RSI is above 50. When the 10-day SMA crosses below the 30-day SMA, it signals a downtrend in price in the short term. A short position is taken when RSI is below 50.

The stop loss level is set at the recent low minus 3 times ATR. The take profit level is set at the recent high plus 3 times ATR. This utilizes the characteristics of the ATR indicator to have wider stops when volatility increases and narrower stops when volatility decreases, thereby controlling risk.

This strategy combines multiple indicators to determine short-term trend and capital inflows/outflows, which can effectively filter false signals. At the same time, the ATR stop loss mechanism allows stop levels to be dynamically adjusted to control risk.

Compared to long-term trading strategies, short-term operations have advantages like fast capital turnover and frequent position opening. This strategy uses the 1-hour moving average system to determine short-term trend changes and the RSI indicator to determine entry and exit timing, which can capture short-term price rises and falls.

The main risks this strategy faces are stop loss being hit, frequent stop outs in uptrends etc. To mitigate these risks, the ATR multiplier can be adjusted or price filters can be added to avoid stops being hit. At the same time, locking or adding to positions is recommended to reduce frequent stop outs in uptrends.

In addition, short-term trading requires high psychological endurance from traders, so risks like overtrading and emotional decisions should be avoided. It is recommended that traders control position sizing appropriately and establish strict risk management rules.

This strategy can be further optimized in the following ways:

- Add other indicators for filtration, like the KDJ indicator to determine overbought and oversold conditions

- Test different parameter combinations, like SMA periods, ATR multiplier, RSI threshold etc.

- Incorporate machine learning algorithms to dynamically optimize the parameters

- Expand this pattern to other assets using basket trading techniques

- Add automatic stop loss module to dynamically trail the stop levels

This strategy integrates multiple indicators to determine short-term trends and capital flows, and optimizes the stop loss mechanism using the ATR indicator. It has advantages like fast capital turnover and frequent position opening, making it suitable for short-term trading of assets like silver. We still need to guard against risks like overtrading and emotional decisions, and continue optimizing the strategy to improve robustness and win rate.

[/trans]

Source (PineScript)

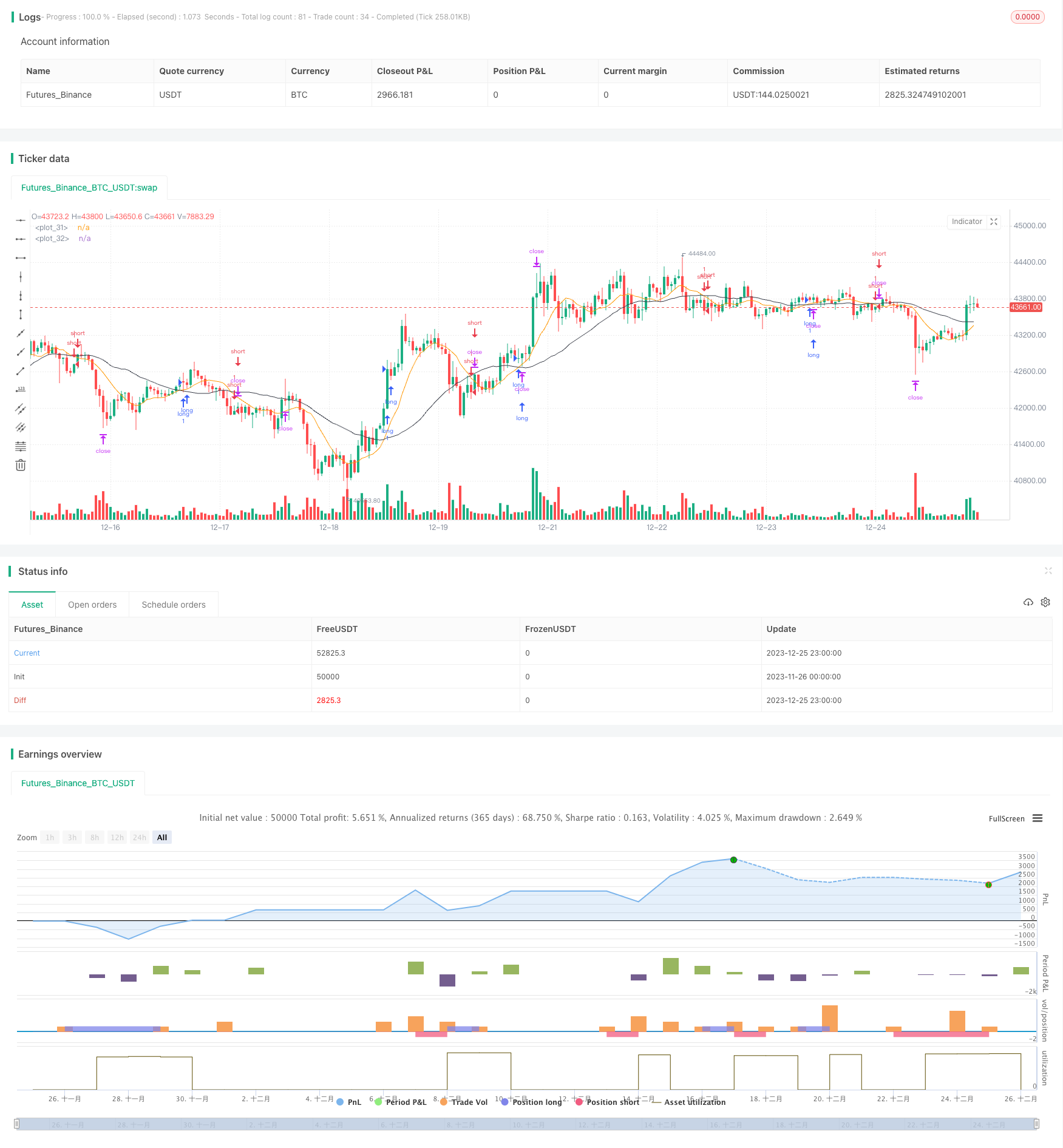

/*backtest

start: 2023-11-26 00:00:00

end: 2023-12-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kapshamam

//@version=5

strategy("SMA 10 30 ATR RSI", overlay=true)

// Create Indicator's

shortSMA = ta.sma(close, 10)

longSMA = ta.sma(close, 30)

rsi = ta.rsi(close, 14)

atr = ta.atr(14)

// Specify crossover conditions

longCondition = ta.crossover(shortSMA, longSMA)

shortCondition = ta.crossunder(shortSMA, longSMA)

// Execute trade if condition is True

if (longCondition)

stopLoss = low - atr * 3

takeProfit = high + atr * 3

strategy.entry("long", strategy.long, 1, when = rsi > 50)

strategy.exit("exit", "long", stop=stopLoss, limit=takeProfit)

if (shortCondition)

stopLoss = high + atr * 2

takeProfit = low - atr * 2

strategy.entry("short", strategy.short, 1, when = rsi < 50)

strategy.exit("exit", "short", stop=stopLoss, limit=takeProfit)

// Plot Moving Average's to chart

plot(shortSMA)

plot(longSMA, color=color.black)

Detail

https://www.fmz.com/strategy/436783

Last Modified

2023-12-27 16:42:05