Name

基于Vix修复线性回归的低点捕捉策略Vix-Fix-Linear-Regression-Bottom-Fishing-Strategy

Author

ChaoZhang

Strategy Description

该策略的核心思想是结合Vix修复指标和其线性回归,精确捕捉市场的低点。策略名为“修复线性回归低点策略”。

- 计算Vix修复指标,它能较好地判断市场低点

- 对Vix修复指标应用线性回归。当线性回归 histogram颜色转绿时,表明Vix修复线性回归开始上升,可以发出买入信号

- 结合Vix修复指标绿色柱子,可以进一步确认买入时机

- 当线性回归histogram颜色转红时,表明Vix修复线性回归开始下降,发出卖出信号

以上流程,利用线性回归提高Vix修复指标信号的准确性和及时性,过滤掉部分假信号,从而精确捕捉低点。

- 策略利用线性回归过滤Vix修复指标的部分假信号,使买入/卖出信号更加准确可靠

- 线性回归提高了信号的灵敏度和及时性,能够快速捕捉市场转折点

- 策略逻辑简单清晰,容易理解实现,适合量化交易

- 可配置参数较多,可以灵活调整,适应市场的变化

- 该策略主要用于判断市场整体低点,不适合个股

- 线性回归并不能完全过滤假信号,结合Vix修复指标可以降低风险

- 需要适当调整参数,适应行情的变化,避免失效

- 建议与其他指标结合使用,进一步确认信号

- 可以考虑与波动率指标或者量能指标结合,进一步过滤信号

- 可以研究参数自适应优化方法,使策略更加智能化

- 可以探索机器学习方法,用更复杂的模型预测Vix修复走势

- 可以尝试在个股上运用类似方法,研究如何过滤假信号

该策略利用Vix修复指标判断低点的同时,引入线性回归提高信号质量,从而实现对市场低点的有效捕捉。策略简单实用,结果较为理想,主要风险在假信号未能完全过滤。我们仍需优化参数设置,并考虑引入其他手段进一步确认信号,使策略更加完善。总体来说,该策略为判断市场低点提供了新的有效途径,值得进一步研究。

||

The core idea of this strategy is to combine Vix Fix indicator and its linear regression to accurately capture market bottoms. The strategy is named "Fix Regression Bottom Fishing Strategy".

- Calculate the Vix Fix indicator, which is good at judging market bottoms

- Apply linear regression on Vix Fix. When the linear regression histogram color turns green, it means the Vix Fix linear regression starts to rise, a buy signal can be triggered

- Combine with the green columns of the Vix Fix indicator to further confirm the timing of entries

- When the linear regression histogram color turns red, it means the Vix Fix linear regression starts to decline, a sell signal is triggered

The above process utilizes linear regression to improve the accuracy and timeliness of Vix Fix signals, filtering out some false signals, and thus accurately capturing bottoms.

- The strategy uses linear regression to filter out some false signals of the Vix Fix indicator, making buy/sell signals more accurate and reliable

- Linear regression improves the sensitivity and timeliness of signals, and can quickly capture market turning points

- The strategy logic is simple and clear, easy to understand and implement, suitable for quantitative trading

- There are many configurable parameters that can be flexibly adjusted to adapt to market changes

- This strategy is mainly used to determine the overall market bottom, not suitable for individual stocks

- Linear regression cannot completely filter out false signals. Combining with the Vix Fix indicator can reduce risks

- Need to properly adjust parameters to adapt to market changes and avoid failure

- It is recommended to combine with other indicators to further confirm signals

- Consider combining with volatility indicators or on-balance volume indicators to further filter out signals

- Study parameter adaptive optimization methods to make the strategy more intelligent

- Explore machine learning methods to predict Vix Fix trends with more complex models

- Try to apply similar methods to individual stocks to study how to filter false signals

This strategy utilizes the Vix Fix indicator to judge bottoms while introducing linear regression to improve signal quality, thereby effectively capturing market bottoms. The strategy is simple, practical and yields decent results. The main risk lies in the false signals that fail to be completely filtered out. We still need to optimize parameter settings and consider introducing other means to further confirm signals to make the strategy more robust. Overall, this strategy provides a new effective way to determine market bottoms, and is worth further research.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 22 | LookBack Period Standard Deviation High |

| v_input_2 | 20 | Bolinger Band Length |

| v_input_3 | 2 | Bollinger Band Standard Devaition Up |

| v_input_4 | 50 | Look Back Period Percentile High |

| v_input_5 | 0.85 | Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99% |

| v_input_6 | 1.01 | Lowest Percentile - 1.10=90%, 1.05=95%, 1.01=99% |

| v_input_7 | false | Show High Range - Based on Percentile and LookBack Period? |

| v_input_8 | false | Show Standard Deviation Line? |

| v_input_9 | timestamp(01 Jan 2010 00:00 +0000) | Start Time |

| v_input_10 | timestamp(01 Jan 2099 00:00 +0000) | End Time |

| v_input_11 | false | considerVIXFixClose |

| v_input_12 | 20 | KC Length |

| v_input_13 | 1.5 | KC MultFactor |

| v_input_14 | 22 | atrLen |

| v_input_15 | 5 | atrMult |

| v_input_16 | 5 | initialStopBar |

| v_input_17 | true | waitForCloseBeforeStop |

Source (PineScript)

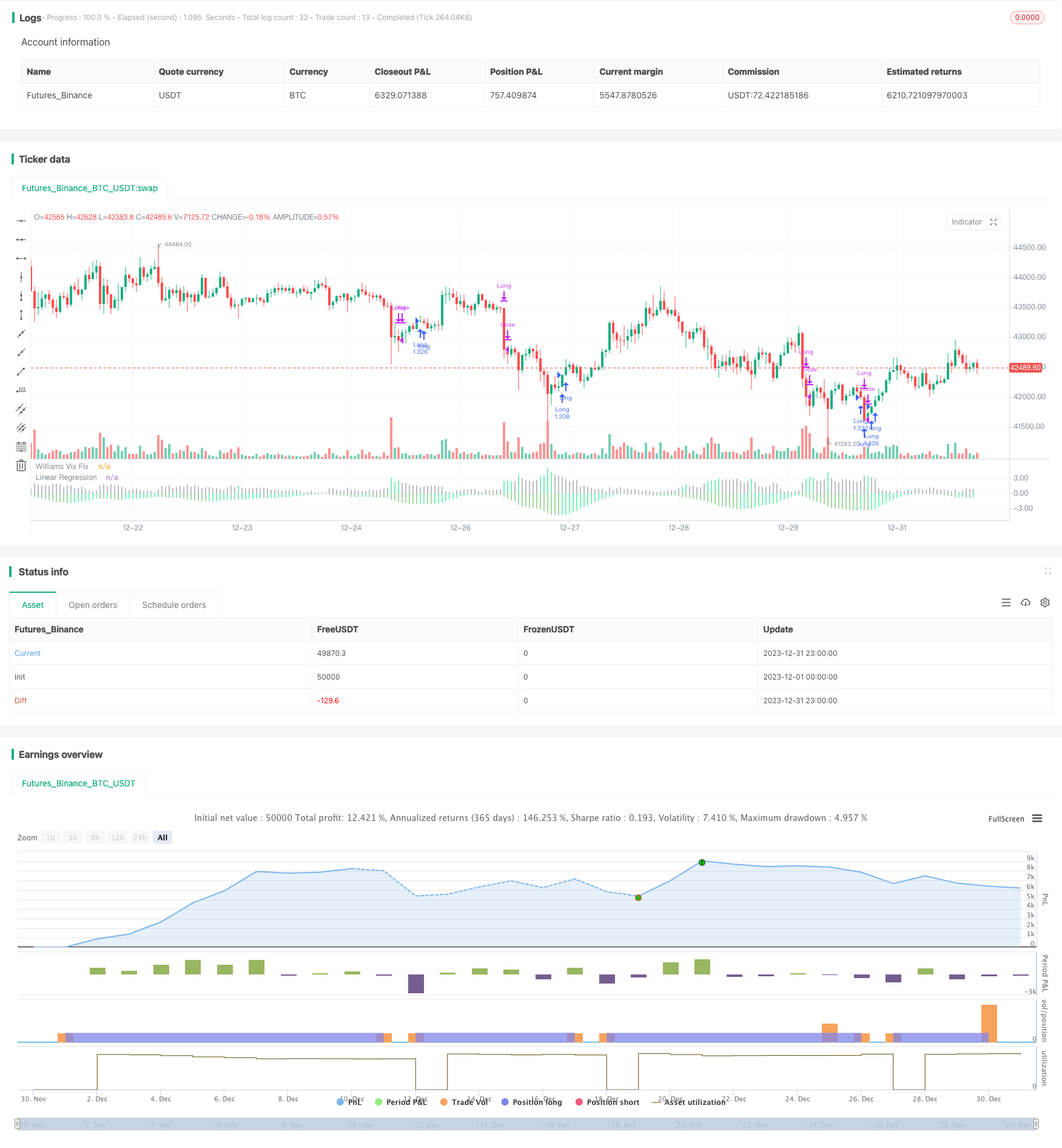

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HeWhoMustNotBeNamed

//@version=4

strategy("VixFixLinReg-Strategy", shorttitle="VixFixLinReg - Strategy",

overlay=false, initial_capital = 100000,

default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type = strategy.commission.percent, pyramiding = 1,

commission_value = 0.01)

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

pl = input(1.01, title="Lowest Percentile - 1.10=90%, 1.05=95%, 1.01=99%")

hp = input(false, title="Show High Range - Based on Percentile and LookBack Period?")

sd = input(false, title="Show Standard Deviation Line?")

i_startTime = input(defval = timestamp("01 Jan 2010 00:00 +0000"), title = "Start Time", type = input.time)

i_endTime = input(defval = timestamp("01 Jan 2099 00:00 +0000"), title = "End Time", type = input.time)

inDateRange = true

considerVIXFixClose = input(false)

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

atrLen = input(22)

atrMult = input(5)

initialStopBar = input(5)

waitForCloseBeforeStop = input(true)

f_getStop(atrLen, atrMult)=>

stop = strategy.position_size > 0 ? close - (atrMult * atr(atrLen)) : lowest(initialStopBar)

stop := strategy.position_size > 0 ? max(stop,nz(stop[1], stop)) : lowest(initialStopBar)

stop

wvf = ((highest(close, pd)-low)/(highest(close, pd)))*100

sDev = mult * stdev(wvf, bbl)

midLine = sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (highest(wvf, lb)) * ph

rangeLow = (lowest(wvf, lb)) * pl

col = wvf >= upperBand or wvf >= rangeHigh ? color.lime : color.gray

val = linreg(wvf, pd, 0)

absVal = abs(val)

linRegColor = val>val[1]? (val > 0 ? color.green : color.orange): (val > 0 ? color.lime : color.red)

plot(hp and rangeHigh ? rangeHigh : na, title="Range High Percentile", style=plot.style_line, linewidth=4, color=color.orange)

plot(hp and rangeLow ? rangeLow : na, title="Range High Percentile", style=plot.style_line, linewidth=4, color=color.orange)

plot(wvf, title="Williams Vix Fix", style=plot.style_histogram, linewidth = 4, color=col)

plot(sd and upperBand ? upperBand : na, title="Upper Band", style=plot.style_line, linewidth = 3, color=color.aqua)

plot(-absVal, title="Linear Regression", style=plot.style_histogram, linewidth=4, color=linRegColor)

vixFixState = (col == color.lime) ? 1: 0

vixFixState := strategy.position_size == 0? max(vixFixState, nz(vixFixState[1],0)) : vixFixState

longCondition = (vixFixState == 1 and linRegColor == color.lime) and inDateRange

exitLongCondition = (linRegColor == color.orange or linRegColor == color.red) and considerVIXFixClose

stop = f_getStop(atrLen, atrMult)

label_x = time+(60*60*24*1000*20)

myLabel = label.new(x=label_x, y=0, text="Stop : "+tostring(stop), xloc=xloc.bar_time, style=label.style_none, textcolor=color.black, size=size.normal)

label.delete(myLabel[1])

strategy.entry("Long", strategy.long, when=longCondition, oca_name="oca_buy")

strategy.close("Long", when=exitLongCondition or (close < stop and waitForCloseBeforeStop and linRegColor == color.green))

strategy.exit("ExitLong", "Long", stop = stop, when=not waitForCloseBeforeStop and linRegColor == color.green)

Detail

https://www.fmz.com/strategy/440454

Last Modified

2024-01-30 16:56:39