Name

基于Wave-Trend和VWMA的趋势跟踪量化策略Wave-Trend-and-VWMA-Based-Trend-Following-Quant-Strategy

Author

ChaoZhang

Strategy Description

本策略结合了Wave Trend振荡器和VWMA指标,实现了一个趋势跟踪的量化交易策略。该策略可以识别市场趋势,并基于Wave Trend振荡器的信号进行买入或卖出。另外,交易大小根据VWMA指标的信号来确定。

该策略主要基于以下两个指标:

-

Wave Trend振荡器:这是一个由LazyBear移植到TradingView的指标,可以识别价格波动的“波浪”,并产生买入/卖出信号。具体计算方法是:先计算价格的平均值ap,然后计算ap的EMA(称为esa),再计算ap与esa的差值的绝对值的EMA(称为d),最后计算一致性指数ci=(ap-esa)/(0.015*d), ci的EMA即为Wave Trend(wt1), wt1的4周期SMA即为wt2。当wt1上穿wt2时为买入信号,下穿为卖出信号。

-

VWMA指标:这是一个考虑成交量的加权移动平均线。根据价格在VWMABands(VWMA的上下轨)之内或之外,产生+1(多头)、0(中性)或-1(空头)的信号。

根据Wave Trend的信号确定买入和卖出的时机。而根据VWMA指标的多空信号,确定每次交易的具体数量。

- 结合两种指标的信号,可以提高决策的准确性

- 基于成交量的VWMA指标,可以判断市场的力量对比

- 可自定义交易时间段,避免重要新闻事件的剧烈波动

- 交易数量根据VWMA的信号进行调整,可以减少交易风险

- Wave Trend指标可能产生假信号

- 成交量数据不精确可能影响VWMA指标

- 需要较长的历史数据进行指标计算

- 未考虑止损策略

- 测试不同参数组合,找到最佳参数

- 增加止损策略

- 考虑结合其他指标进行信号过滤

- 测试不同的交易时间段设置

- 动态调整交易数量的计算方式

本策略整合了趋势判断和量能指标,实现了一个较为先进的趋势跟踪策略。该策略具有一定的优势,但也存在一些风险需要注意。通过参数和规则的优化,有望进一步提高策略的稳定性和收益率。

||

This strategy combines the Wave Trend oscillator and VWMA indicator to implement a trend following quant trading strategy. It can identify market trends and make buy or sell decisions based on signals from the Wave Trend oscillator. Meanwhile, trade size is determined by signals from the VWMA indicator.

The strategy is mainly based on the following two indicators:

-

Wave Trend Oscillator: This is an oscillator ported to TradingView by LazyBear, which identifies "waves" in price fluctuations and generates buy/sell signals. The specific calculation is: first calculate the average price ap, then calculate the EMA of ap (called esa), then calculate the EMA of the absolute value of the difference between ap and esa (called d), finally calculate the consistency index ci=(ap-esa)/(0.015*d), the EMA of ci is the Wave Trend (wt1), and the 4-period SMA of wt1 is wt2. When wt1 crosses above wt2, it is a buy signal, and when wt1 crosses below wt2, it is a sell signal.

-

VWMA Indicator: This is a volume weighted moving average line. Based on whether the price is inside or outside the VWMA Bands (Upper and lower bands of VWMA), it generates +1 (bullish), 0 (neutral) or -1 (bearish) signals.

The Wave Trend signals determine when to buy and sell. While the bullish/bearish signals from VWMA indicator determine the specific trade size for each trade.

- Combines signals from two indicators to improve decision accuracy

- VWMA considers volume flow to judge market strength

- Customizable trading sessions to avoid volatility from news

- Trade size adjusted based on VWMA signals to reduce risks

- Potential false signals from Wave Trend

- Inaccurate volume data may affect VWMA

- Requires long historical data for indicator calculation

- No stop loss in place

- Test different parameter combinations to find optimum

- Add stop loss strategies

- Consider combining with other indicators for signal filtering

- Test different settings for trading sessions

- Dynamically adjust trade size calculation

This strategy integrates trend judgment and volume capabilities for an advanced trend following approach. It has some edges but also risks to note. Further improvements in parameters and rules may enhance its stability and profitability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Base Quantity |

| v_input_2 | true | Limit Signals to Trading Sessions? |

| v_input_3 | 8 | Session 1: Start Hour |

| v_input_4 | 25 | Session 1: Start Minute |

| v_input_5 | 10 | Session 1: Stop Hour |

| v_input_6 | 25 | Session 1: Stop Minute |

| v_input_7 | 12 | Session 2: Start Hour |

| v_input_8 | 55 | Session 2: Start Minute |

| v_input_9 | 14 | Session 2: Stop Hour |

| v_input_10 | 55 | Session 2: Stop Minute |

| v_input_11 | false | Close All at End of Session 1 |

| v_input_12 | true | Close All at End of Session 2 |

| v_input_13 | true | VWMA: Use Volume (uncheck if equity does not have volume) |

| v_input_14 | 21 | VWMA: Length |

| v_input_15 | 10 | Wave Trend: Channel Length |

| v_input_16 | 21 | Wave Trend: Average Length |

| v_input_17 | 60 | Wave Trend: Over Bought Level 1 |

| v_input_18 | 53 | Wave Trend: Over Bought Level 2 |

| v_input_19 | -60 | Wave Trend: Over Sold Level 1 |

| v_input_20 | -53 | Wave Trend: Over Sold Level 2 |

Source (PineScript)

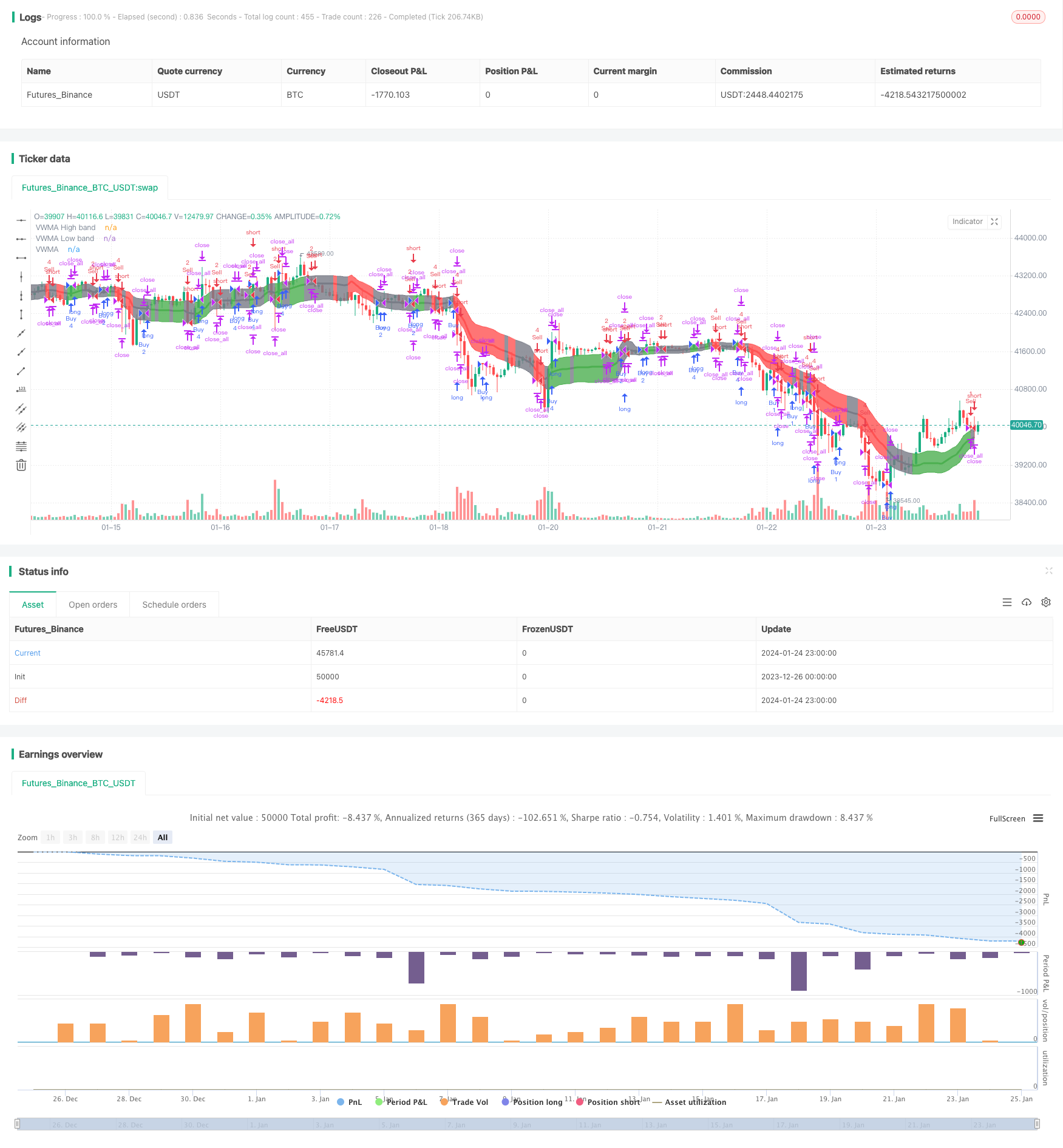

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at

// https://mozilla.org/MPL/2.0/

//

// Created by jadamcraig

//

// This strategy benefits from extracts taken from the following

// studies/authors. Thank you for developing and sharing your ideas in an open

// way!

// * Wave Trend Strategy by thomas.gigure

// * cRSI + Waves Strategy with VWMA overlay by Dr_Roboto

//

//@version=4

//==============================================================================

//==============================================================================

overlay = true // plots VWMA (need to close and re-add)

//overlay = false // plots Wave Trend (need to close and re-add)

strategy("Wave Trend w/ VWMA overlay", overlay=overlay)

baseQty = input(defval=1, title="Base Quantity", type=input.float, minval=1)

useSessions = input(defval=true, title="Limit Signals to Trading Sessions?")

sess1_startHour = input(defval=8, title="Session 1: Start Hour",

type=input.integer, minval=0, maxval=23)

sess1_startMinute = input(defval=25, title="Session 1: Start Minute",

type=input.integer, minval=0, maxval=59)

sess1_stopHour = input(defval=10, title="Session 1: Stop Hour",

type=input.integer, minval=0, maxval=23)

sess1_stopMinute = input(defval=25, title="Session 1: Stop Minute",

type=input.integer, minval=0, maxval=59)

sess2_startHour = input(defval=12, title="Session 2: Start Hour",

type=input.integer, minval=0, maxval=23)

sess2_startMinute = input(defval=55, title="Session 2: Start Minute",

type=input.integer, minval=0, maxval=59)

sess2_stopHour = input(defval=14, title="Session 2: Stop Hour",

type=input.integer, minval=0, maxval=23)

sess2_stopMinute = input(defval=55, title="Session 2: Stop Minute",

type=input.integer, minval=0, maxval=59)

sess1_closeAll = input(defval=false, title="Close All at End of Session 1")

sess2_closeAll = input(defval=true, title="Close All at End of Session 2")

//==============================================================================

//==============================================================================

// Volume Weighted Moving Average (VWMA)

//==============================================================================

//==============================================================================

plotVWMA = overlay

// check if volume is available for this equity

useVolume = input(

title="VWMA: Use Volume (uncheck if equity does not have volume)",

defval=true)

vwmaLen = input(defval=21, title="VWMA: Length", type=input.integer, minval=1,

maxval=200)

vwma = vwma(close, vwmaLen)

vwma_high = vwma(high, vwmaLen)

vwma_low = vwma(low, vwmaLen)

if not(useVolume)

vwma := wma(close, vwmaLen)

vwma_high := wma(high, vwmaLen)

vwma_low := wma(low, vwmaLen)

// +1 when above, -1 when below, 0 when inside

vwmaSignal(priceOpen, priceClose, vwmaHigh, vwmaLow) =>

sig = 0

color = color.gray

if priceClose > vwmaHigh

sig := 1

color := color.green

else if priceClose < vwmaLow

sig := -1

color := color.red

else

sig := 0

color := color.gray

[sig,color]

[vwma_sig, vwma_color] = vwmaSignal(open, close, vwma_high, vwma_low)

priceAboveVWMA = vwma_sig == 1 ? true : false

priceBelowVWMA = vwma_sig == -1 ? true : false

// plot(priceAboveVWMA?2.0:0,color=color.blue)

// plot(priceBelowVWMA?2.0:0,color=color.maroon)

//bandTrans = input(defval=70, title="VWMA Band Transparancy (100 invisible)",

// type=input.integer, minval=0, maxval=100)

//fillTrans = input(defval=70, title="VWMA Fill Transparancy (100 invisible)",

// type=input.integer, minval=0, maxval=100)

bandTrans = 60

fillTrans = 60

// ***** Plot VWMA *****

highband = plot(plotVWMA?fixnan(vwma_high):na, title='VWMA High band',

color = vwma_color, linewidth=1, transp=bandTrans)

lowband = plot(plotVWMA?fixnan(vwma_low):na, title='VWMA Low band',

color = vwma_color, linewidth=1, transp=bandTrans)

fill(lowband, highband, title='VWMA Band fill', color=vwma_color,

transp=fillTrans)

plot(plotVWMA?vwma:na, title='VWMA', color = vwma_color, linewidth=3,

transp=bandTrans)

//==============================================================================

//==============================================================================

// Wave Trend

//==============================================================================

//==============================================================================

plotWaveTrend = not(overlay)

n1 = input(10, "Wave Trend: Channel Length")

n2 = input(21, "Wave Trend: Average Length")

obLevel1 = input(60, "Wave Trend: Over Bought Level 1")

obLevel2 = input(53, "Wave Trend: Over Bought Level 2")

osLevel1 = input(-60, "Wave Trend: Over Sold Level 1")

osLevel2 = input(-53, "Wave Trend: Over Sold Level 2")

ap = hlc3

esa = ema(ap, n1)

d = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

plot(plotWaveTrend?0:na, color=color.gray)

plot(plotWaveTrend?obLevel1:na, color=color.red)

plot(plotWaveTrend?osLevel1:na, color=color.green)

plot(plotWaveTrend?obLevel2:na, color=color.red, style=3)

plot(plotWaveTrend?osLevel2:na, color=color.green, style=3)

plot(plotWaveTrend?wt1:na, color=color.green)

plot(plotWaveTrend?wt2:na, color=color.red, style=3)

plot(plotWaveTrend?wt1-wt2:na, color=color.blue, transp=80)

//==============================================================================

//==============================================================================

// Order Management

//==============================================================================

//==============================================================================

// Define Long and Short Conditions

longCondition = crossover(wt1, wt2)

shortCondition = crossunder(wt1, wt2)

// Define Quantities

orderQty = baseQty * 2

if (longCondition)

if (vwma_sig == 1)

if ( strategy.position_size >= (baseQty * 4 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 4 + abs(strategy.position_size)

else

orderQty := baseQty * 4

else if (vwma_sig == 0)

if ( strategy.position_size >= (baseQty * 2 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 2 + abs(strategy.position_size)

else

orderQty := baseQty * 2

else if (vwma_sig == -1)

if ( strategy.position_size >= (baseQty * 1 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 1 + abs(strategy.position_size)

else

orderQty := baseQty * 1

else if (shortCondition)

if (vwma_sig == -1)

if ( strategy.position_size <= (baseQty * 4) and

strategy.position_size > 0 )

orderQty := baseQty * 4 + strategy.position_size

else

orderQty := baseQty * 4

else if (vwma_sig == 0)

if ( strategy.position_size <= (baseQty * 2) and

strategy.position_size > 2 )

orderQty := baseQty * 2 + strategy.position_size

else

orderQty := baseQty * 2

else if (vwma_sig == 1)

if ( strategy.position_size <= (baseQty * 1) and

strategy.position_size > 0 )

orderQty := baseQty * 1 + strategy.position_size

else

orderQty := baseQty * 1

// Determine if new trades are permitted

newTrades = false

if (useSessions)

if ( hour == sess1_startHour and minute >= sess1_startMinute )

newTrades := true

else if ( hour > sess1_startHour and hour < sess1_stopHour )

newTrades := true

else if ( hour == sess1_stopHour and minute < sess1_stopMinute )

newTrades := true

else if ( hour == sess2_startHour and minute >= sess2_startMinute )

newTrades := true

else if ( hour > sess2_startHour and hour < sess2_stopHour )

newTrades := true

else if ( hour == sess2_stopHour and minute < sess2_stopMinute )

newTrades := true

else

newTrades := false

else

newTrades := true

// Long Signals

if ( longCondition )

strategy.order("Buy", strategy.long, orderQty)

// Short Signals

if ( shortCondition )

strategy.order("Sell", strategy.short, orderQty)

// Close open position at end of Session 1, if enabled

if (sess1_closeAll )

strategy.close_all()

// Close open position at end of Session 2, if enabled

if (sess2_closeAll )

strategy.close_all()

Detail

https://www.fmz.com/strategy/440118

Last Modified

2024-01-26 17:35:29