Name

多指标技术面量化交易策略Multi-indicator-Quant-Trading-Strategy

Author

ChaoZhang

Strategy Description

该策略综合运用多种技术指标,包括抛物线转向系统、缠论出口、零滞后简单移动平均线、指数移动平均线、顺势均线等,识别图表上的潜在买入和卖出点。

- 抛物线转向系统:用于确定止损点和潜在进入点

- 缠论出口策略:用于确定趋势方向

- 零滞后简单移动平均线:提供低滞后移动平均线

- 指数移动平均线:跟踪价格趋势和波动

- 平滑均线:生成更平滑的均线

- 当抛物线转向系统显示上升趋势并且价格超过第99条指数移动平均线时,做多;当显示下降趋势并且价格低于第99条指数移动平均时,做空

- 结合缠论出口策略的信号,进一步确认趋势方向

- 平滑均线配合抛物线信号,避免假突破

- 设定止损和止盈

- 考虑重置购买条件,灵活调整仓位

该策略最大的优势在于指标组合全面,能够有效识别趋势方向。抛物线系统确定潜在反转点;缠论出口策略判断主要趋势;移动平均线过滤假信号。多种指标相互验证,大大提高信号准确性。

另外,策略加入了止损和止盈机制来控制风险。平滑均线也用来避免短期噪声的干扰。这些都使得该策略稳定性很强。

由于依赖较多指标判断,当这些指标发出冲突信号时,该策略会面临一定困难。此外,参数设置不当也会对交易产生不利影响。

此外,技术面交易本身存在一定风险,无法完全避免亏损。需要谨慎操作,切忌盲目跟随。

- 对指标参数进行测试和优化,找到最佳组合

- 加入机器学习算法,利用大数据训练模型,进一步提升信号准确性

- 结合情绪指标、消息面信息等判断市场状况,动态调整仓位和止损线

- 优化重置购买条件逻辑,使信号检测更加灵活连贯

该策略整合多种技术指标,通过指标组合识别交易信号。优势是信号准确性高、稳定性强。同时,风险控制措施到位。整体而言,是一套值得考虑的交易方案。后续通过参数优化、模型训练、情绪指标引入等手段可进一步完善。

||

This strategy integrates various technical indicators, including Parabolic SAR, Chandelier Exit, Zero Lag SMA, EMA, and Heikin Ashi, to identify potential buy and sell signals on the chart.

- Parabolic SAR: Used to determine stop loss points and potential entry points

- Chandelier Exit Strategy: Used to determine trend direction

- Zero Lag SMA: Provides low-lag moving average

- EMA: Tracks trends and price fluctuations

- Smoothed Heikin Ashi: Generates smoothed Heikin Ashi candles

- Long when Parabolic SAR shows uptrend and price is above 99 EMA; Short when downtrend and price is below 99 EMA

- Combine with Chandelier Exit signals to further confirm trend

- Smoothed Heikin Ashi helps avoid false breaks

- Set stop loss and take profit

- Consider reset conditions to flexibly adjust positions

The biggest strength is the comprehensive combination of indicators for effective trend identification. Parabolic SAR detects potential reversals; Chandelier Exit judges the major trend; Moving averages filter false signals. Cross validation improves accuracy.

In addition, stop loss and take profit controls risks. Smoothed lines avoid short-term noise. The strategy is stable.

Conflicting signals can cause difficulties. Improper parameter settings may also negatively impact trading.

There are inherent risks in technical trading that can cause losses. Cautious operation is a must. Blind following should be avoided.

- Test and optimize parameters to find the best combination

- Introduce machine learning models for higher accuracy

- Incorporate sentiment indicators and news to assess market conditions and dynamically manage positions

- Improve logics of reset conditions for more flexible signal detection

This strategy integrates indicators for signal identification. Strengths include high accuracy, stability and sound risk control. Overall a worthwhile trading scheme. Further improvements can be made through parameter tuning, model training and sentiment indicator integration.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 0.02 | start |

| v_input_2 | 0.02 | increment |

| v_input_3 | 0.2 | maximum |

| v_input_int_1 | 10 | Length SHC1 |

| v_input_4 | 10 | len2 |

| v_input_int_2 | 20 | Length SHC2 |

| v_input_5 | 10 | len2Shc2 |

| v_input_int_3 | 32 | Length |

| v_input_int_4 | false | Offset |

| v_input_6_close | 0 | Source: close |

| v_input_int_5 | 10 | Length |

| v_input_source_1_close | 0 | Source: close |

| v_input_int_6 | 34 | Length |

| v_input_source_2_close | 0 | Source: close |

| v_input_int_7 | 99 | Length |

| v_input_source_3_close | 0 | Source: close |

| v_input_int_8 | true | ATR Period |

| v_input_float_1 | 1.1 | ATR Multiplier |

| v_input_bool_1 | true | Show Buy/Sell Labels ? |

| v_input_bool_2 | true | Use Close Price for Extremums ? |

| v_input_bool_3 | true | Highlight State ? |

| v_input_int_9 | 80 | Trend Length: |

| v_input_source_4_close | 0 | Purchase Source (Long and Short):: close |

| v_input_source_5_close | 0 | Exit Source (Long and Short):: close |

| v_input_bool_4 | true | Use Take Profit |

| v_input_bool_5 | true | Use Stop Loss |

| v_input_float_2 | 0.1 | Stoploss Multiplier %: |

| v_input_string_1 | 0 | Reset Purchase Availability After:: Entry |

Source (PineScript)

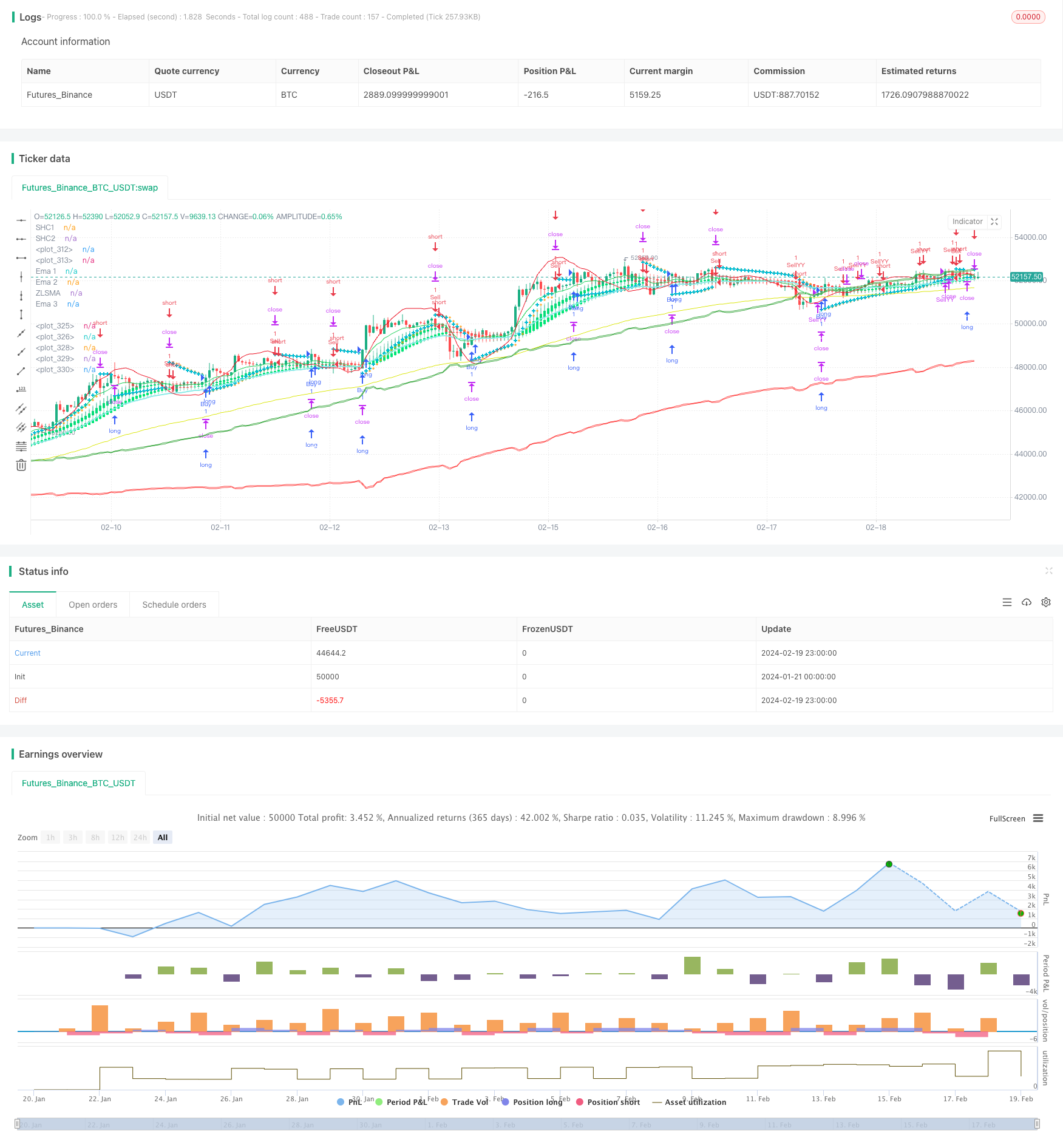

/*backtest

start: 2024-01-21 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("CE-ZLSMA-EMA-SAR-SHC", overlay=true)

// Parabolic SAR Strategy

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

var bool longSar = false

var bool shortSar = false

//input smoothed HAC 1

len=input.int(title="Length SHC1", defval = 10)

o=ta.ema(open,len)

c=ta.ema(close,len)

h=ta.ema(high,len)

l=ta.ema(low,len)

haclose = (o+h+l+c)/4

var haopen = 0.0

if na(haopen[1])

haopen := (o + c) / 2

else

haopen := (haopen[1] + haclose[1]) / 2

hahigh = math.max (h, math.max(haopen,haclose))

halow = math.min (l, math.min(haopen,haclose))

len2=input(10)

o2=ta.ema(haopen, len2)

c2=ta.ema(haclose, len2)

h2=ta.ema(hahigh, len2)

l2=ta.ema(halow, len2)

col=o2>c2 ? color.red : color.lime

bool shc1Green = o2 > c2

bool shc1Lime = o2 < c2

//input smoothed HAC 1

lenSHC2=input.int(title="Length SHC2 ", defval = 20)

oShc2=ta.ema(open,lenSHC2)

cShc2=ta.ema(close,lenSHC2)

hShc2=ta.ema(high,lenSHC2)

lShc2=ta.ema(low,lenSHC2)

hacloseShc2 = (oShc2+hShc2+lShc2+cShc2)/4

var haopenShc2 = 0.0

if na(haopenShc2[1])

haopenShc2 := (oShc2 + cShc2) / 2

else

haopenShc2 := (haopenShc2[1] + hacloseShc2[1]) / 2

hahighShc2 = math.max (hShc2, math.max(haopenShc2,hacloseShc2))

halowShc2 = math.min (lShc2, math.min(haopenShc2,hacloseShc2))

len2Shc2=input(10)

o2Shc2=ta.ema(haopenShc2, len2Shc2)

c2Shc2=ta.ema(hacloseShc2, len2Shc2)

h2Shc2=ta.ema(hahighShc2, len2Shc2)

l2Shc2=ta.ema(halowShc2, len2Shc2)

colShc2=o2Shc2>c2Shc2 ? color.red : color.lime

bool shc2Green = o2Shc2 > c2Shc2

bool shc2Lime = o2Shc2 < c2Shc2

//end smooth

bool shcGree = shc1Green and shc2Green

bool shcLime = shc1Lime and shc2Lime

//zlsma

lengthZlsma = input.int(title="Length", defval=32)

offset = input.int(title="Offset", defval=0)

src = input(close, title="Source")

lsma = ta.linreg(src, lengthZlsma, offset)

lsma2 = ta.linreg(lsma, lengthZlsma, offset)

eq= lsma-lsma2

zlsma = lsma+eq

// ema 10

len4 = input.int(10, minval=1, title="Length")

src4 = input.source(close, title="Source")

out4 = ta.ema(src4, len4)

//End of format

// ema 34

len5 = input.int(34, minval=1, title="Length")

src5 = input.source(close, title="Source")

out5 = ta.ema(src5, len5)

//end ema 34

// ema 99

len6 = input.int(99, minval=1, title="Length")

src6 = input.source(close, title="Source")

out6 = ta.ema(src6, len6)

// end ema 99

//kiem tra dieu kien gia dong cua lon hon ema99 thi moi me lenh long

bool onEma99 = close > out6

bool downEma99 = open < out6

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := math.max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := math.min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := math.min(AF + increment, maximum)

else

if low < EP

EP := low

AF := math.min(AF + increment, maximum)

if uptrend

SAR := math.min(SAR, low[1])

if bar_index > 1

SAR := math.min(SAR, low[2])

else

SAR := math.max(SAR, high[1])

if bar_index > 1

SAR := math.max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

if barstate.isconfirmed

if uptrend

// log.info("true")

strategy.entry("ParSE", strategy.short, stop=nextBarSAR, comment="ParSE")

strategy.cancel("ParLE")

shortSar := false

longSar := true

else

// log.info("false")

strategy.entry("ParLE", strategy.long, stop=nextBarSAR, comment="ParLE")

strategy.cancel("ParSE")

longSar := false

shortSar := true

// Chandelier Exit Strategy

length = input.int(title="ATR Period", defval=1)

mult = input.float(title="ATR Multiplier", step=0.1, defval=1.1)

showLabels = input.bool(title="Show Buy/Sell Labels ?", defval=true)

useClose = input.bool(title="Use Close Price for Extremums ?", defval=true)

highlightState = input.bool(title="Highlight State ?", defval=true)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

var bool longOpened = false

var bool shortOpended = false

// Entry and exit logic

if (dir == 1)

if longSar

if not longOpened

strategy.close("Sell", disable_alert = true)

strategy.order("Buy", strategy.long)

longOpened := true

shortOpended := false

if (dir == -1)

if shortSar

if not shortOpended

strategy.close("Buy", disable_alert = true)

strategy.order("Sell", strategy.short)

shortOpended := true

longOpened := false

//strategy YY

// ~~~~~~~~~~~ INPUTS ~~~~~~~~~~~ //

lenYY = input.int(80, "Trend Length:", tooltip="How far back should we span this indicator?\nThis length effects all lengths of the indicator")

purchaseSrc = input.source(close, "Purchase Source (Long and Short):", tooltip="What source needs to exit the purchase zone for a purchase to happen?")

exitSrc = input.source(close, "Exit Source (Long and Short):", tooltip="What source needs to hit a exit condition to stop the trade (Take profit, Stop Loss or hitting the other sides Purchase Zone)?")

useTakeProfit = input.bool(true, "Use Take Profit", tooltip="Should we take profit IF we cross the basis line and then cross it AGAIN?")

useStopLoss = input.bool(true, "Use Stop Loss", tooltip="Stop loss will ensure you don't lose too much if its a bad call")

stopLossMult = input.float(0.1, "Stoploss Multiplier %:", tooltip="How far from the purchase lines should the stop loss be")

resetCondition = input.string("Entry", "Reset Purchase Availability After:", options=["Entry", "Stop Loss", "None"],

tooltip="If we reset after a condition is hit, this means we can purchase again when the purchase condition is met. \n" +

"Otherwise, we will only purchase after an opposite signal has appeared.\n" +

"Entry: means when the close enters the purchase zone (buy or sell).\n" +

"Stop Loss: means when the close hits the stop loss location (even when were out of a trade)\n" +

"This allows us to get more trades and also if our stop loss initally was hit but it WAS a good time to purchase, we don't lose that chance.")

// ~~~~~~~~~~~ VARIABLES ~~~~~~~~~~~ //

var bool longStart = na

var bool longAvailable = na

var bool longTakeProfitAvailable = na

var bool longStopLoss = na

var bool shortStart = na

var bool shortAvailable = na

var bool shortTakeProfitAvailable = na

var bool shortStopLoss = na

resetAfterStopLoss = resetCondition == "Stop Loss"

resetAfterEntry = resetCondition == "Entry"

// ~~~~~~~~~~~ CALCULATIONS ~~~~~~~~~~~ //

// Mid Line

midHigh = ta.vwma(ta.highest(high, lenYY), lenYY)

midLow = ta.vwma(ta.lowest(low, lenYY), lenYY)

mid = math.avg(midHigh, midLow)

midSmoothed = ta.ema(mid, lenYY)

//Volume Filtered

avgVol = ta.vwma(volume, lenYY)

volDiff = volume / avgVol

midVolSmoothed = ta.vwma(midSmoothed * volDiff, 3)

//RSI Filtered

midDifference = ta.sma(midHigh - midLow, lenYY)

midRSI = ta.rsi(midVolSmoothed, lenYY) * 0.01

midAdd = midRSI * midDifference

//Calculate Zones

purchaseZoneHigh = midSmoothed + midAdd

purchaseZoneLow = midSmoothed - midAdd

purchaseZoneBasis = math.avg(purchaseZoneHigh, purchaseZoneLow)

//Create Stop Loss Locations

stopLossHigh = purchaseZoneHigh * (1 + (stopLossMult * 0.01))

stopLossLow = purchaseZoneLow * (1 - (stopLossMult * 0.01))

// ~~~~~~~~~~~ PURCHASE CALCULATIONS ~~~~~~~~~~~ //

//Long

longEntry = ta.crossunder(purchaseSrc, purchaseZoneLow)

longStart := ta.crossover(purchaseSrc, purchaseZoneLow) and longAvailable

longAvailable := ta.crossunder(purchaseSrc, purchaseZoneHigh) or (resetAfterStopLoss and longStopLoss) or (resetAfterEntry and longEntry) ? true : longStart ? false : longAvailable[1]

longEnd = ta.crossover(exitSrc, purchaseZoneHigh)

longStopLoss := ta.crossunder(exitSrc, stopLossLow)

longTakeProfitAvailable := ta.crossover(exitSrc, purchaseZoneBasis) ? true : longEnd ? false : longTakeProfitAvailable[1]

longTakeProfit = ta.crossunder(exitSrc, purchaseZoneBasis) and longTakeProfitAvailable

//Short

shortEntry = ta.crossover(purchaseSrc, purchaseZoneHigh)

shortStart := ta.crossunder(purchaseSrc, purchaseZoneHigh) and shortAvailable

shortAvailable := ta.crossover(purchaseSrc, purchaseZoneLow) or (resetAfterStopLoss and shortStopLoss) or (resetAfterEntry and shortEntry)? true : shortStart ? false : shortAvailable[1]

shortEnd = ta.crossunder(exitSrc, purchaseZoneLow)

shortStopLoss := ta.crossover(exitSrc, stopLossHigh)

shortTakeProfitAvailable := ta.crossunder(exitSrc, purchaseZoneBasis) ? true : shortEnd ? false : shortTakeProfitAvailable[1]

shortTakeProfit = ta.crossover(exitSrc, purchaseZoneBasis) and shortTakeProfitAvailable

// ~~~~~~~~~~~ STRATEGY ~~~~~~~~~~~ //

var bool openLongYY = false

var bool openShortYY = false

if (longStart)

strategy.order("BuyYY", strategy.long)

strategy.close("SellYY", disable_alert = true)

openLongYY := true

openShortYY := false

else if (longEnd or (useStopLoss and longStopLoss) or (useTakeProfit and longTakeProfit))

strategy.close("BuyYY", disable_alert = true)

if (shortStart)

strategy.close("BuyYY", disable_alert = true)

strategy.order("SellYY", strategy.short)

openShortYY := true

openLongYY := false

else if (shortEnd or (useStopLoss and shortStopLoss) or (useTakeProfit and shortTakeProfit))

strategy.close("SellYY", disable_alert = true)

// ~~~~~~~~~~~ ALERTS ~~~~~~~~~~~ //

// if longStart or (longEnd or (useStopLoss and longStopLoss) or (useTakeProfit and longTakeProfit)) or shortStart or (shortEnd or (useStopLoss and shortStopLoss) or (useTakeProfit and shortTakeProfit))

// alert("{{strategy.order.action}} | {{ticker}} | {{close}}", alert.freq_once_per_bar)

// Plotting

plot(SAR, style=plot.style_cross, linewidth=1, color=color.orange)

plot(nextBarSAR, style=plot.style_cross, linewidth=3, color=color.aqua)

plot(zlsma, color=color.rgb(235, 15, 33), linewidth=1, title = "ZLSMA")

plot(out4, color=color.rgb(24, 209, 85), title="Ema 1")

plot(out5, color=color.rgb(139, 234, 231), linewidth = 2, title="Ema 2")

plot(out6, color=color.rgb(219, 230, 18), title="Ema 3")

plotcandle(o2, h2, l2, c2, title="SHC1", color=col)

plotcandle(o2Shc2, hShc2, l2Shc2, c2Shc2, title="SHC2", color=col)

// ~~~~~~~~~~~ PLOTS YY ~~~~~~~~~~~ //

shortLine = plot(purchaseZoneHigh, color=color.green)

shortStopLossLine = plot(stopLossHigh, color=color.green) //color=color.rgb(0, 97, 3)

fill(shortLine, shortStopLossLine, color = color.new(color.green, 90))

plot(purchaseZoneBasis, color=color.white)

longLine = plot(purchaseZoneLow, color=color.red)

longStopLossLine = plot(stopLossLow, color=color.red) //color=color.rgb(105, 0, 0)

fill(longLine, longStopLossLine, color=color.new(color.red, 90))

Detail

https://www.fmz.com/strategy/442348

Last Modified

2024-02-21 11:53:30