Name

多时间周期动量反转策略Momentum-Reversal-Strategy-Based-on-Multiple-Timeframes

Author

ChaoZhang

Strategy Description

该策略基于价格的动量通过计算K线实体和影线比例,结合RSI指标判断市场超买超卖状态,寻找反转机会进行交易。主要用于短线交易,追踪中短线的价格势能反转点,以获得较高胜率。

该策略的核心逻辑基于以下几点:

-

计算K线的实体比例和影线比例:通过计算每根K线的open,close,high,low价格,得出实体和影线所占的百分比。当影线比例小于20%时,认为是强势的K线。

-

计算K线强度变化比例:计算每根K线内部价格变动幅度,判断K线的强弱。当变化幅度比较大时,表明动能较强,判断为强势K线。

-

结合RSI指标判断超买超卖:设置RSI的超买线和超卖线,RSI高于超买线时为超买,RSI低于超卖线时为超卖。超买超卖状态下的强势K线有较高概率发生反转。

-

判断反转信号:当影线比例小于20%且K线强度大于平均值的2倍时,且上一根K线的收盘价高于当前K线,表明满足反转的条件,做空;相反当收盘价低于当前K线则做多。

-

设置止损止盈:针对做多做空信号分别设置固定比例的止损位和止盈位。

该策略具有以下优势:

-

利用K线实体和影线的比例判断趋势和反转的能力较强。能有效判断价格的势能和反转点。

-

结合K线强度变化和RSI指标,判断反转信号的准确率较高。RSI的参数可调节,优化空间大。

-

止损止盈设置合理,有利于把握短线机会,降低单次交易的风险。

-

策略参数调整灵活,可针对不同品种、周期进行优化,实用性强。

该策略可能存在以下风险:

-

强势突破时,可能产生假信号,导致交易失败。可通过优化K线比较周期和RSI参数来减少。

-

反转失败的概率也存在,跟多在下跌行情和跟空在上涨行情都会被套。应适当调整止损位,减少损失。

-

效果与交易品种和时间周期相关。对于波动性不稳定的品种应谨慎使用该策略。

该策略可从以下几个方面进行优化:

-

优化K线比较的根数,寻找最佳判断超买超卖的周期参数组合。

-

优化RSI的超买超卖线,针对不同品种确定较好的参数。

-

测试不同的止损止盈比例设置,确定最佳止损止盈策略。

-

对交易品种按波动率分组优化,使策略参数针对性更强。

-

增加其他指标判断和过滤条件,提高策略稳定性。

本策略总体来说非常实用,通过对K线信息的应用判断价格势能反转点,是一种典型的短线交易策略。优化空间较大,可针对不同品种和交易环境进行调整,在跟踪中短线价格趋势方面效果较好。但需要注意防范止损和风险控制。

||

This strategy identifies trading opportunities by calculating candlestick body/wick ratios and combining RSI indicators to detect overbought/oversold market conditions. It aims to capture potential reversals in the price momentum over short-to-medium term timeframes.

The core logic of this strategy is based on the following:

-

Calculate body/wick percentage of candlesticks: By computing open, close, high and low prices, derive the percentage occupied by candle body and wicks. Wick percentage below 20% indicates a strong candle.

-

Compute candle strength change percentage: Calculate the internal price movement magnitude of each candle to determine candle strength. Larger fluctuations imply stronger momentum and hence indicate stronger candles.

-

Combine with RSI to identify overbought/oversold conditions: Set overbought and oversold threshold lines for RSI. RSI above overbought line signifies overbought state and vice versa for oversold. Strong candles in such states have high probability of reversal.

-

Determine reversal signals: When wick percentage < 20% and candle strength > 2 x average strength, along with previous candle close higher than current candle close, it signals short condition. The opposite indicates long condition.

-

Define stop loss and take profit: Set fixed percentage-based stop loss and take profit levels separately for long and short trades.

The advantages of this strategy include:

-

Effective identification of trend and reversals using candle body/wick proportions. Detects price momentum and turning points well.

-

Higher accuracy of reversal signals by combining candle strength change and RSI. RSI is adjustable providing greater optimization capability.

-

Reasonable stop loss/take profit configuration to capitalize on short-term opportunities while lowering trade risk exposure.

-

Flexible tunability of parameters for optimizing across different products and timeframes. High practical utility.

Some risks present in the strategy:

-

Potential false signals during strong trend breakouts. Can be reduced via optimization of candle comparison periods and RSI parameters.

-

Probability of failed reversals can't be eliminated fully. Being long in downtrend and vice versa induces losses. Stop losses should be adjusted accordingly to minimize damage.

-

Performance depends on product and timeframe. Caution warranted when applying to highly volatile products.

The strategy can be optimized in the following ways:

-

Fine tune periods considered in identifying overbought/oversold to determine optimal parameter combinations.

-

Optimize overbought/oversold RSI thresholds based on product specifics.

-

Test stop loss/take profit ratios for deriving ideal risk management plan.

-

Categorize products as per volatility for more targeted parameter tuning.

-

Additional filters based on other indicators may improve robustness.

The strategy is highly practical overall for detecting reversals by understanding candlestick information. As a typical short-term trading system, it has sizable optimization capability across products and environments for tracking medium-term trends. However adequate risk control through stop losses is imperative.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 14 | Periodo RSI |

| v_input_int_2 | 75 | Sobre Compra |

| v_input_int_3 | 25 | Sobre Venta |

Source (PineScript)

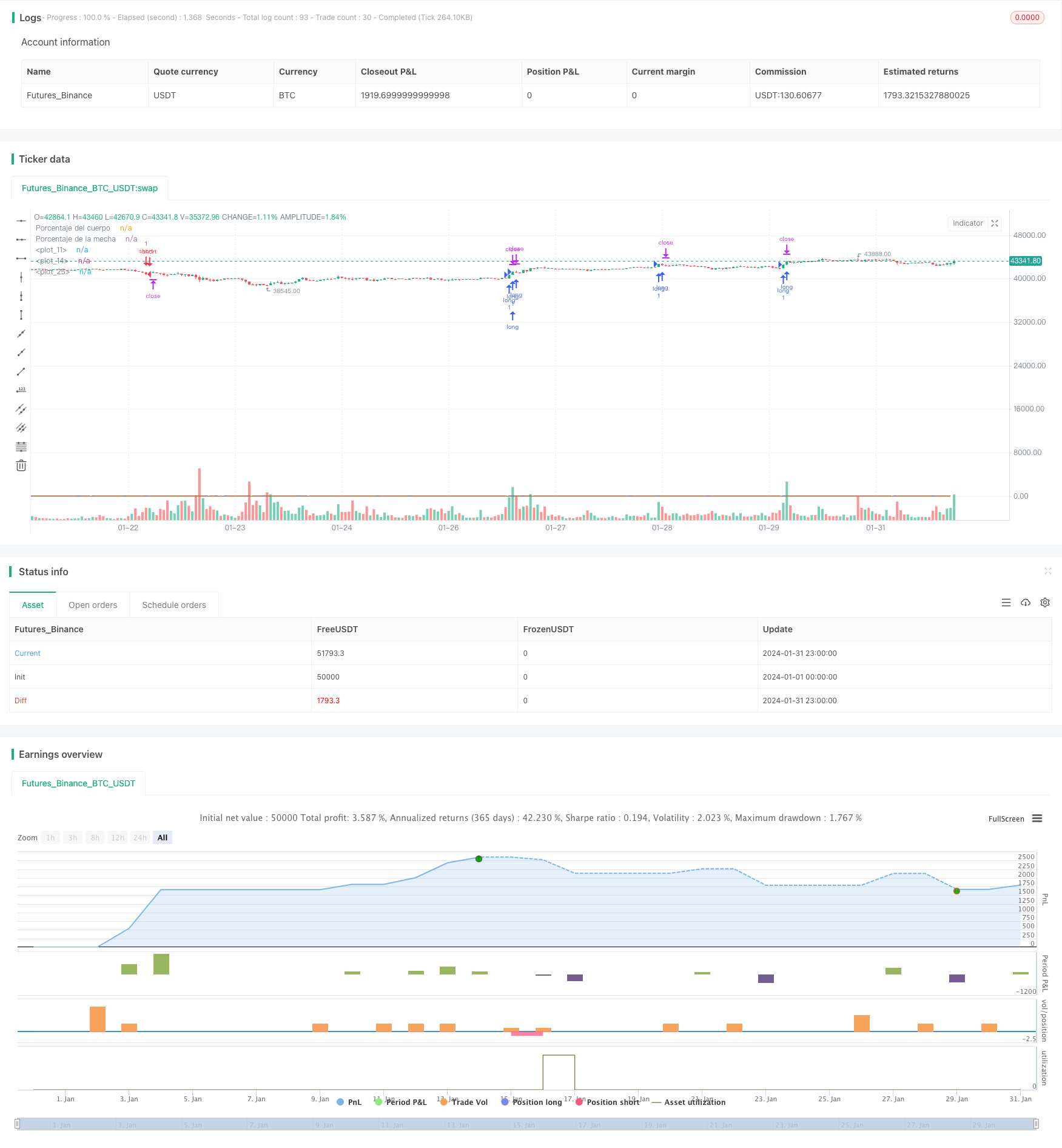

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("mecha larga study",overlay = true, max_bars_back = 600)

//Porcentaje Mecha cuerpo

bodyPercent = math.abs(open - close) / (high - low) * 100

wickPercent = 100 - bodyPercent

plot(bodyPercent, "Porcentaje del cuerpo", color.rgb(163, 76, 175))

plot(wickPercent, "Porcentaje de la mecha", color.red)

VelaDeFuerza = math.abs(((high[0] - low[0])*100)/high)//PORCENTAJE DE VARIACION DE UNA VELA

plot(VelaDeFuerza, color = color.purple)

Promedio = ((VelaDeFuerza[0] + VelaDeFuerza[1] + VelaDeFuerza[2] + VelaDeFuerza[3] + VelaDeFuerza[4] + VelaDeFuerza[5] + VelaDeFuerza[6] + VelaDeFuerza[7] + VelaDeFuerza[8] + VelaDeFuerza[9] + VelaDeFuerza[10] + VelaDeFuerza[11] + VelaDeFuerza[12] + VelaDeFuerza[13] + VelaDeFuerza[14] ) / 15)

plot(Promedio, color = color.yellow)

// rsi

per_Rsi = input.int(14, "Periodo RSI",minval= 11, maxval=20) //inicializo el rsi en 14 periodos pero doy la posibilidad al usuario de cambiarlo

rsi_Sc = input.int(75,"Sobre Compra",minval=68,maxval=80) //ENTRADA DE SOBRE COMPRA DE RSI

rsi_Sv = input.int(25,"Sobre Venta",minval=20,maxval=33) //ENTRADA DE SOBRE VENTA DE RSI

rsi= ta.rsi(close,per_Rsi)//guardo el rsi con los paramentros anteriores en una variable

//logica

MayorPromedio = Promedio + 0.800

plot(MayorPromedio, color = color.green)

Venta = bodyPercent > 80 and VelaDeFuerza > Promedio * 2 and close < close[1]

Compra = bodyPercent > 80 and VelaDeFuerza > Promedio * 2 and close > close[1]

precioVenta = Venta? close : na

precioCompra = Compra? close : na

tp1 = 0.00

sl = 0.00

tp1 := 0.003

sl := 0.010

TP1short = precioVenta - (precioVenta * tp1)

Slshort = precioVenta + (precioVenta * sl)

TP1long = precioCompra + (precioCompra * tp1)

SLlong = precioCompra - (precioCompra * sl)

name1 = "tp1"

name2 = "tp2"

name3= "SL"

if ( precioVenta )

strategy.entry("short", strategy.short , comment = "Sell SL: " + str.tostring(Slshort, "0.000") + " TP1: " + str.tostring(TP1short,"0.000") )

strategy.exit("exit" , "short", stop = Slshort , limit = TP1short ,qty_percent = 100 )

if ( precioCompra )

strategy.entry("long", strategy.long , comment = "Buy SL: " + str.tostring(SLlong, "0.000") + " TP1: " + str.tostring(TP1long,"0.000") )

strategy.exit("exit" , "long", stop = SLlong , limit = TP1long ,qty_percent = 100 )

Detail

https://www.fmz.com/strategy/442927

Last Modified

2024-02-27 14:27:49