Name

多时间框架RSI交易策略Multi-Timeframe-RSI-Trading-Strategy

Author

ChaoZhang

Strategy Description

多时间框架RSI交易策略是一种综合性的交易工具,它在15分钟、1小时和4小时三个不同的时间框架上运用相对强弱指数(RSI)。该策略通过比较这三个时间框架上的RSI值,帮助交易者识别动量和趋势的转变。

该策略的核心逻辑是在15分钟(M15)、1小时(H1)和4小时(H4)三个时间框架上计算RSI,并比较这三个时间框架上的RSI读数。具体来说,它遵循以下原理:

-

当M15上的RSI高于H1,且H1高于H4时生成买入信号,前提是H4上的RSI高于30,以避免超卖。

-

当H1上的RSI低于H4,且M15上的RSI低于H1时生成卖出信号,前提是H4上的RSI低于70,以避免超买。

-

当M15上的RSI下穿H1上的RSI时,建议平掉多单。

-

当M15上的RSI上穿H1上的RSI时,建议平掉空单。

相比单一时间框架的RSI,该策略具有以下优势:

-

多时间框架分析提供更可靠的交易信号。通过比较不同周期的RSI,可以过滤掉部分噪音交易信号。

-

直观的可视化效果。该策略用不同颜色描绘各时间框架的RSI曲线,使交易决策更清晰可见。

-

动态的入场与离场机制。策略利用 RSI 的配置变化自动生成买入和卖出信号。

-

可自定义的超买超卖位配置。交易者可以根据自己的交易风格和风险偏好,调整 RSI 周期和阈值水平。

该策略也存在一定的风险,主要体现在:

-

RSI容易产生错误信号。在震荡行情中,RSI可能出现频繁的穿越。

-

多时间框架判断中,短周期的噪音可能被放大。

-

经济新闻和重大事件会增加市场波动,影响技术指标的可靠性。

为了降低风险,建议进行充分的回测,优化参数设置,并辅以其他技术分析工具进行信号过滤。此外,交易者应当关注重大经济事件的日历,以避免在关键时刻打开仓位。

该策略还具有进一步优化的空间:

-

增加更多的时间框架,构建多层次的RSI交易体系。例如加入日线或周线的RSI分析。

-

尝试不同的RSI参数设置。可以测试不同的RSI周期参数,寻找最佳配置。

-

结合其他指标进行信号过滤。例如Volume,MACD等指标可以用来验证RSI信号的可靠性。

-

添加止损策略。设定合理的止损水平,可以有效控制单笔损失。

多时间框架RSI策略通过比较不同周期RSI的配置,实现了更稳定和高效的交易信号生成。相比单一RSI,它具有噪音过滤和直观的可视化等优势。当然,作为一种技术指标策略,它也面临一定的风险,需要进行适当的优化和调整来降低风险。总的来说,该策略为RSI的应用提供了新的思路,值得量化交易者进一步研究和应用。

||

The Multi-Timeframe RSI Trading Strategy is a comprehensive trading tool that utilizes the Relative Strength Index (RSI) across three different timeframes: 15-minute (M15), 1-hour (H1), and 4-hour (H4). This strategy helps traders identify momentum and trend shifts by comparing RSI values across these timeframes.

The core logic of this strategy is to calculate RSI on 15-minute (M15), 1-hour (H1) and 4-hour (H4) timeframes and compare the RSI readings across these three timeframes. Specifically, it follows these principles:

-

A buy signal is generated when the RSI on M15 is greater than H1, and H1 is greater than H4, with the condition that H4 RSI is above 30 to avoid oversold conditions.

-

A sell signal occurs when the RSI on H1 is less than H4, and M15 RSI is less than H1, with the condition that H4 RSI is below 70 to avoid overbought conditions.

-

It suggests closing buy positions when the RSI on M15 crosses below the RSI on H1.

-

It recommends closing sell positions when the RSI on M15 crosses above the RSI on H1.

Compared to single timeframe RSI, this strategy has the following advantages:

-

Multi-timeframe analysis provides more reliable trading signals. Comparing RSI across different periods filters out some noisy signals.

-

Intuitive visualizations. The strategy plots each timeframe's RSI in distinct colors for clearer decision making.

-

Dynamic entry/exit mechanism. The strategy automatically generates buy and sell signals based on RSI configuration changes.

-

Customizable overbought/oversold levels. Traders can adjust RSI periods and threshold levels based on their trading style and risk tolerance.

The strategy also carries some risks, mainly:

-

RSI can generate false signals. It may produce frequent crossovers in ranging markets.

-

Noise from shorter timeframes may be amplified in multi-timeframe judgments.

-

Economic news and major events increase market volatility, affecting indicator reliability.

To mitigate risks, thorough backtesting, parameter optimization, and additional signal filtering tools are recommended. Traders should also be mindful of high-impact economic event calendars to avoid openings during such times.

There is room for further enhancing this strategy:

-

Incorporate more timeframes to construct a multi-layer RSI trading system, e.g. adding daily or weekly RSI analysis.

-

Test different RSI parameter settings to find optimal configurations.

-

Combine with other indicators for signal verification, e.g. Volume, MACD etc.

-

Add stop loss strategies to effectively control single trade loss amount.

The Multi-Timeframe RSI Strategy generates more stable and efficient trading signals by comparing cross-period RSI configurations. Compared to single timeframe RSI, it has advantages like noise filtering and intuitive visualizations. As a technical indicator based strategy, it still carries some inherent risks and would need proper optimization and tuning to minimize those risks. Overall, it provides new ideas for RSI application and is worth further research and usage by quantitative traders.

[/trans]

Source (PineScript)

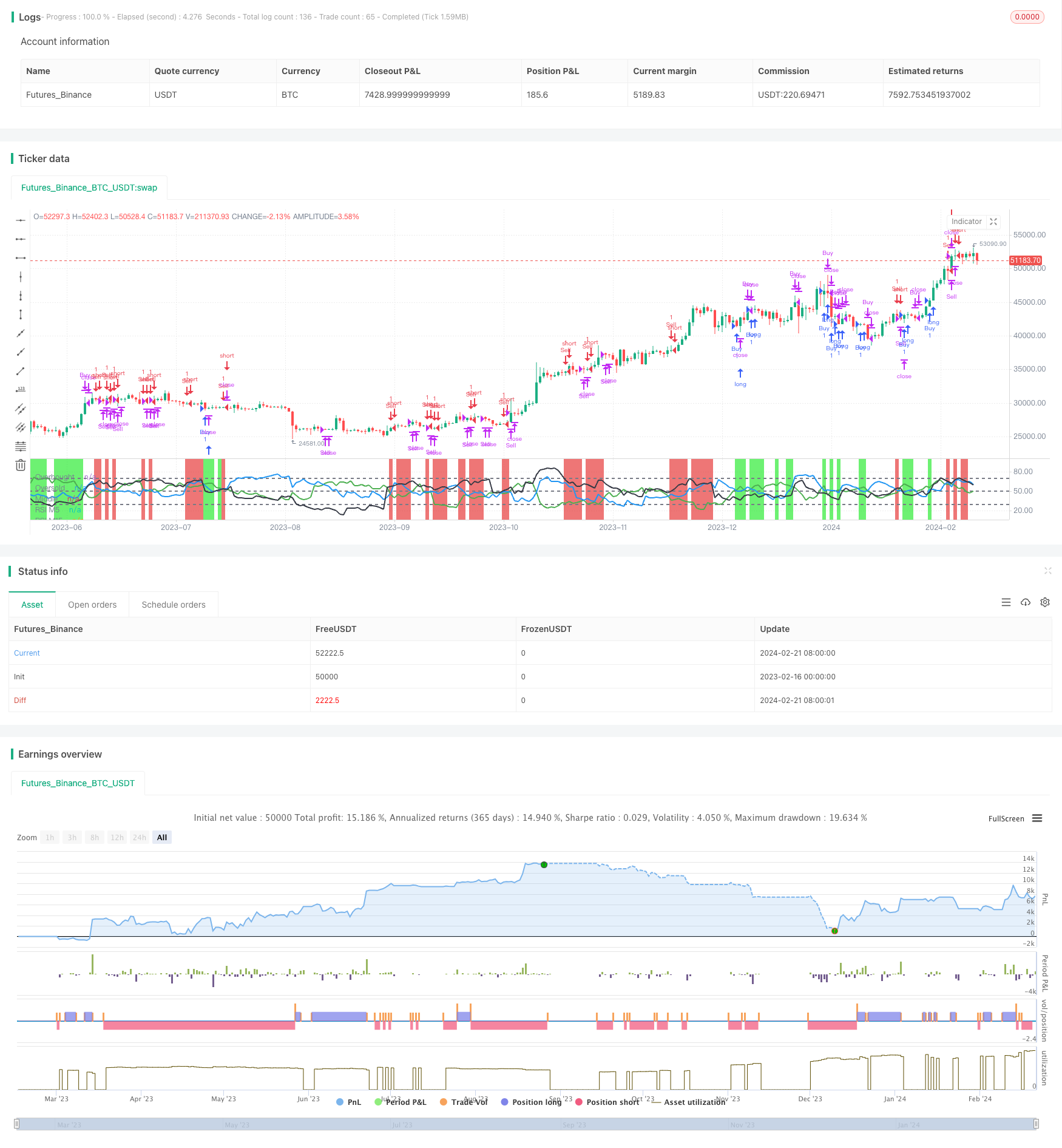

/*backtest

start: 2023-02-16 00:00:00

end: 2024-02-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Multi-Timeframe RSI Strategy", overlay=false)

// Lấy dữ liệu RSI từ các biểu đồ khác nhau

rsiM15 = request.security(syminfo.tickerid, "15", ta.rsi(close, 14))

rsiH1 = request.security(syminfo.tickerid, "60", ta.rsi(close, 14))

rsiH4 = request.security(syminfo.tickerid, "240", ta.rsi(close, 14))

// Vẽ đường RSI

plot(rsiM15, title="RSI M5", color=color.green, linewidth=2)

plot(rsiH1, title="RSI M15", color=color.blue, linewidth=2)

plot(rsiH4, title="RSI H1", color=color.black, linewidth=2)

// Điều kiện mua và bán

buyCondition = rsiM15 > rsiH1 and rsiH1 > rsiH4 and rsiH4 > 30

sellCondition = rsiH1 < rsiH4 and rsiM15 < rsiH1 and rsiH4 <70

// Điều kiện đóng lệnh

closeBuyCondition = rsiM15 < rsiH1

closeSellCondition = rsiM15 > rsiH1

// Vẽ đường Overbought và Oversold

hline(70, "Overbought", color=color.gray, linewidth=2)

hline(30, "Oversold", color=color.gray, linewidth=2)

hline(50, "Middle", color=color.gray, linewidth=2)

// Màu nền cho điều kiện mua và bán

bgcolor(buyCondition ? color.new(#0ce714, 40) : sellCondition ? color.new(#e21b1b, 40) : na)

// Đưa ra các quyết định mua hoặc bán

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

// Điều kiện đóng lệnh

if (closeBuyCondition)

strategy.close("Buy")

if (closeSellCondition)

strategy.close("Sell")

//@version=5

// Tạo các cảnh báo

alertcondition(buyCondition, title="Mua Signal", message="Mua Signal")

alertcondition(sellCondition, title="Bán Signal", message="Bán Signal")

Detail

https://www.fmz.com/strategy/442625

Last Modified

2024-02-23 12:24:41