Name

多重MA带动量交易策略Multi-Timeframe-Moving-Average-Momentum-Trading-Strategy

Author

ChaoZhang

Strategy Description

[trans]

这个交易策略采用多重移动平均线和动量指标相结合的方式,识别趋势的方向和力度,在趋势开始阶段建立仓位,随后利用移动止损、移动止盈等方式进行利润优化和风险控制,目标是在中长线趋势中捕捉大幅度的价格走势。

-

使用两组不同参数设置的移动平均线组合构建快线和慢线:

- 快线由5周期指数移动平均线和25周期加权移动平均线构成,代表短期趋势

- 慢线由28周期指数移动平均线和72周期加权移动平均线组成,代表中长期趋势

-

当快线上穿慢线时,表示短期趋势开始强于中长期趋势,为入场信号。

-

结合动量指标RSI,仅在RSI低位(买入信号)或RSI高位(卖出信号)时才入场,以过滤假突破。

-

一旦入场后,采用移动止损来压缩亏损,采用移动止盈来锁定利润。

-

当快线下穿慢线时,提示趋势反转,此时止损或止盈退出。

- 双重移动平均线组合过滤噪音,识别趋势中段的运行方向和力度。

- 仅在趋势开始阶段建立仓位,避免假突破造成不必要的损失。

- 动量指标结合过滤 Entries,提高 entries 质量。

- 移动止损压缩单笔亏损,减少个别点亏带来的损失。

- 移动止盈让利润可观,在行情好的时候追加利润。

- 双重移动平均线在趋势转折点会有滞后,可能错过反转机会。

- 可以适当缩短移动平均线周期,使其更敏感。

- 假突破造成不必要入场。

- 可以加入更多过滤指标。

- 止损或止盈距离未优化,可能过于宽松或过于紧凑。

- 可以通过回测优化参数,找到最佳止损止盈距离。

- 方向性策略,只适合趋势市。

- 可以根据大盘情况选择是否使用该策略。

- 优化移动平均线参数,找到representations of trend的最佳参数组合。

- 增加趋势过滤指标,例如ATR动态止损,能量潮指标等。

- 优化止损止盈参数,找到最佳参数组合。

- 增加对大行情的判断,选择是否启用该策略。

- 增加对多时间周期的综合判断,使用更大级别的趋势方向指引短周期策略方向。

本策略整合移动平均线和动量指标, aim to 识别establish early entries during emerging 趋势s, 通过及时止损和止盈来进行风险和利润管理。虽然仍需要进行参数和规则优化以适应更广泛的市场情况,但已具备捕捉中长线趋势的基本框架和方向。通过不断优化,本策略有望成长为一个稳定、高效的趋势跟踪策略。

||

This trading strategy combines multiple moving averages and momentum indicators to identify the direction and strength of trends, establishing positions early in emerging trends, and then optimizing profit and risk management through the use of trailing stops and take profits. It aims to capture significant price swings during sustained trends.

-

Two sets of moving averages with different parameters are constructed to create fast and slow lines:

- Fast line consists of 5-period EMA and 25-period WMA, representing short-term trend

- Slow line consists of 28-period EMA and 72-period WMA, representing mid- to long-term trend

-

When fast line crosses above slow line, it signals short-term trend is gaining strength over mid-term trend, and presents entry signal.

-

RSI filter incorporated, only taking entries at RSI lows (for long) and RSI highs (for short) to avoid false breakouts.

-

Once entered, trailing stop used to minimize losses, while take profit locks in gains.

-

When fast line crosses below slow line, it signals trend reversal, prompting exit via stop loss or take profit.

- Dual moving average combinations filter noise and identify trend direction & strength during trend progression.

- Entries established early in emerging trends avoids unnecessary losses from false breakouts.

- RSI filter improves quality of entries.

- Trailing stop compresses losses from individual losing trades.

- Take profit allows sizable profit capture during favorable moves.

- Dual moving averages can lag at turning points, missing reversal opportunities.

- Shorten moving average periods for greater sensitivity.

- False breakouts lead to unnecessary entries.

- Incorporate more filters before entry.

- Stop loss / take profit distances not optimized, may be too wide or too narrow.

- Optimize via backtest to find optimal levels.

- Directional strategy only works for trending markets.

- Only employ strategy based on market conditions.

- Optimize moving average parameters to find best representations of trend.

- Add trend filters like dynamic ATR stop, momentum oscillators etc.

- Optimize stop loss / take profit parameters.

- Incorporate regime filters based on market conditions.

- Add cross-timeframe analysis using higher timeframes to guide shorter-term strategy direction.

This strategy integrates moving averages and momentum indicators to identify and establish early entries during emerging trends, while managing risk and reward via timely stops and take profits. Although further parameter and logic optimization is needed to adapt to wider market conditions, it already has a basic framework and directionality for capturing mid- to long-term trends. With continual improvements, this strategy can potentially grow into a robust, efficient trend-following system.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | IS This a RENKO Chart |

| v_input_2 | false | Alternate TimeFrame Multiplier (0=none) |

| v_input_3 | false | Show Coloured MA Ribbons |

| v_input_4 | false | Show Ribbon Median MA Lines |

| v_input_5 | 0 | FAST MA Ribbon Type: : EMA |

| v_input_6 | 5 | FAST Ribbon Lower MA Length |

| v_input_7 | 25 | FAST Ribbon Upper Length |

| v_input_8 | 0 | SLOW MA Ribbon Type: : EMA |

| v_input_9 | 28 | SLOW Ribbon Lower MA Length |

| v_input_10 | 72 | SLOW Ribbon Upper Length |

| v_input_11 | 2018 | Backtest Start Year |

| v_input_12 | true | Backtest Start Month |

| v_input_13 | true | Backtest Start Day |

| v_input_14 | 0.02 | start |

| v_input_15 | 0.02 | increment |

| v_input_16 | 0.2 | maximum |

| v_input_17 | false | Use Opposite Trade as a Close Signal |

| v_input_18 | true | Colour Candles to Trade Order state |

| v_input_19 | 0 | What type of Orders: Longs+Shorts |

| v_input_20 | true | Trailing Stop |

| v_input_21 | 3 | Trailing Stop (%) |

| v_input_22 | true | Take Profit |

| v_input_23 | 3 | Take Profit (%) |

| v_input_24 | true | Trailing Profit (%) |

| v_input_25 | false | Stop Loss |

| v_input_26 | 3 | Stop Loss (%) |

Source (PineScript)

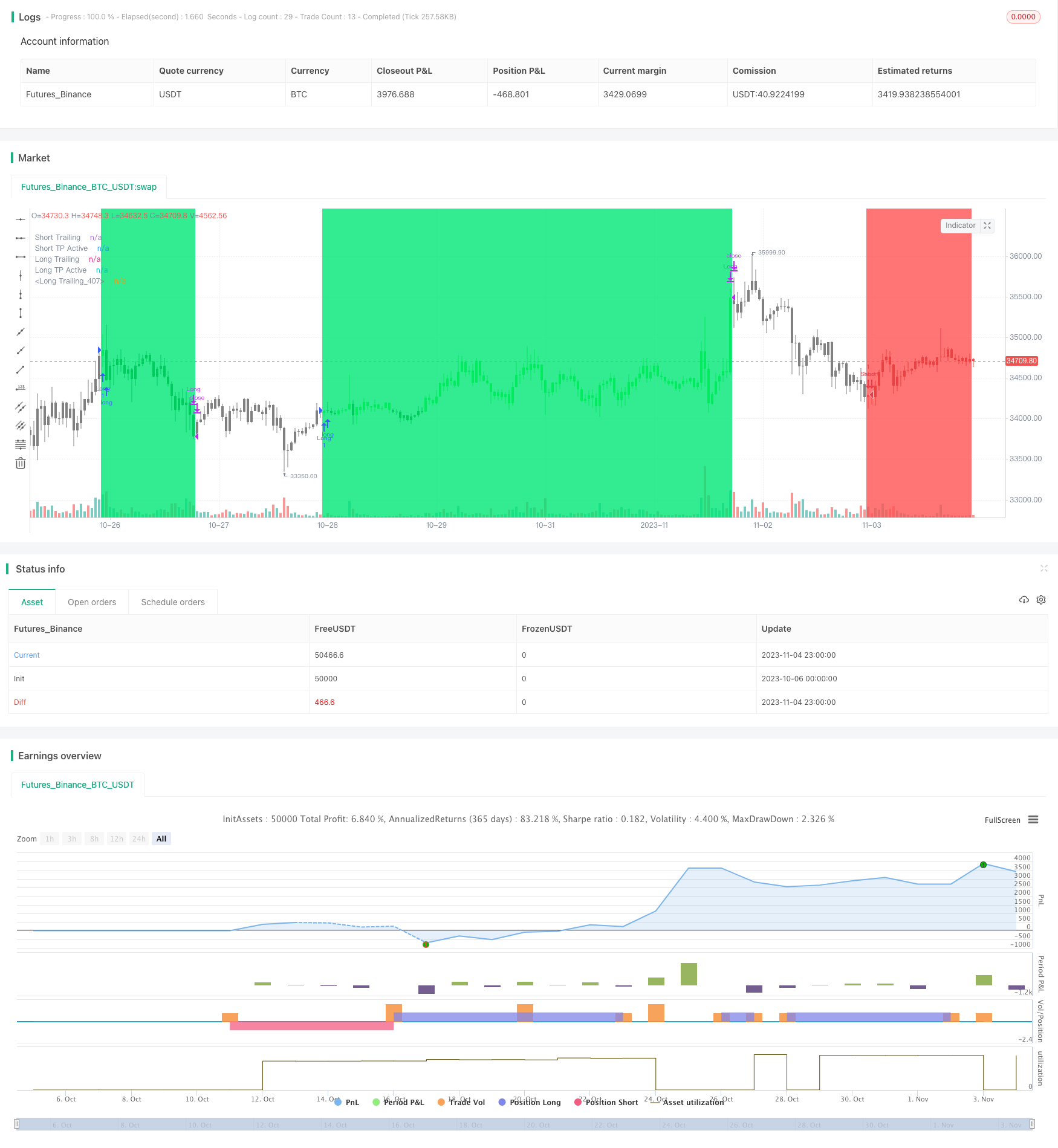

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="[WAI GUA]", shorttitle="[EOS] 1.0", overlay=true)

//study(title="[WAI GUA]", shorttitle="[EOS] 1.0", overlay=true)

//

// Use Alternate Anchor TF for MAs

uRenko = input(true, title="IS This a RENKO Chart")

//

anchor = input(0,minval=0,maxval=1440,title="Alternate TimeFrame Multiplier (0=none)")

//

src = close //input(close, title="EMA Source")

showRibbons = input(false,title="Show Coloured MA Ribbons")

showAvgs = input(false,title="Show Ribbon Median MA Lines")

//

// Fast Ribbon MAs

// Lower MA - type, length

typeF1 = input(defval="EMA", title="FAST MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF1 = input(defval=5, title="FAST Ribbon Lower MA Length", minval=1)

gammaF1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeF11 = typeF1 //input(defval="WMA", title="FAST Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF11 = input(defval=25, title="FAST Ribbon Upper Length", minval=2)

gammaF11 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// Slow Ribbon MAs

// Lower MA - type, length

typeS1 = input(defval="EMA", title="SLOW MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS1 = input(defval=28, title="SLOW Ribbon Lower MA Length", minval=1)

gammaS1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeS16 = typeS1 //input(defval="WMA", title="SLOW Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS16 = input(defval=72, title="SLOW Ribbon Upper Length", minval=2)

gammaS16 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// - Constants

gold = #FFD700

// - FUNCTIONS

// - variant(type, src, len, gamma)

// 返回MA输入选择变量,默认为SMA,如果空白或键入。

// SuperSmoother filter

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier.

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := isdwm? 1 : mult // Only available Daily or less

mult = anchor>0 ? anchor : 1

//

high_ = uRenko? max(close,open) : high

low_ = uRenko? min(close,open) : low

//用锚乘器调整MA长度

//Fast MA Ribbon

emaF1 = variant(typeF1, src, lenF1*mult, gammaF1)

emaF11 = variant(typeF11, src, lenF11*mult,gammaF11)

emafast = (emaF1+emaF11)/2 // Average of Upper and Lower MAs

//

//Slow MA Ribbon

emaS1 = variant(typeS1,src, lenS1*mult,gammaS1)

emaS16 = variant(typeS16, src, lenS16*mult, gammaS16)

emaslow = (emaS1+emaS16)/2 // Average of Upper and Lower MAs

//

// Count crossover candles

xup = 0

xdn = 0

fup = 0

fdn = 0

sup = 0

sdn = 0

//

xup := (emafast-emaslow)>0 and (emafast-emaslow)>(emafast[1]-emaslow[1]) ? nz(xup[1])+1 : 0

xdn := (emafast-emaslow)<0 and (emafast-emaslow)<(emafast[1]-emaslow[1]) ? nz(xdn[1])+1 : 0

fup := (emaF1-emaF11)>0 and (emaF1-emaF11)>(emaF1[1]-emaF11[1]) ? nz(fup[1])+1 : 0

fdn := (emaF1-emaF11)<0 and (emaF1-emaF11)<(emaF1[1]-emaF11[1]) ? nz(fdn[1])+1 : 0

sup := (emaS1-emaS16)>0 and (emaS1-emaS16)>(emaS1[1]-emaS16[1]) ? nz(sup[1])+1 : 0

sdn := (emaS1-emaS16)<0 and (emaS1-emaS16)<(emaS1[1]-emaS16[1]) ? nz(sdn[1])+1 : 0

//Fast EMA Final Color Rules

colFinal = fup>=2 ? aqua : fdn>=2 ? blue : gray

//Slow EMA Final Color Rules

colFinal2 = sup>=2 ? lime : sdn>=2 ? red : gray

//Fast EMA Plots

p1=plot(showRibbons?emaF1:na, title="Fast Ribbon Lower MA", style=line, linewidth=1, color=colFinal,transp=10)

p2=plot(showRibbons?emaF11:na, title="Fast Ribbon Upper MA", style=line, linewidth=1, color=colFinal,transp=10)

plot(showAvgs?emafast:na, title="Fast Ribbon Avg MA", style=circles,join=true, linewidth=1, color=gold,transp=10)

//

//fill(p1,p2,color=colFinal, transp=90)

//Slow EMA Plots

p3=plot(showRibbons?emaS1:na, title="Slow Ribbon Lower MA", style=line, linewidth=1, color=colFinal2,transp=10)

p4=plot(showRibbons?emaS16:na, title="Slow Ribbon Upper MA", style=line, linewidth=1, color=colFinal2,transp=10)

plot(showAvgs?emaslow:na, title="Slow Ribbon Avg MA", style=circles,join=true, linewidth=1, color=fuchsia,transp=10)

//

//fill(p3,p4, color=colFinal2, transp=90)

// Generate Buy Sell signals,

buy = 0

sell=0

//

buy := xup>=2 and sup>=2 and fup>=2 ? nz(buy[1])>0?buy[1]+1 :1 : 0

sell := xdn>=2 and sdn>=2 and fdn>=2 ? nz(sell[1])>0?sell[1]+1 :1 : 0

////////////////////////

//* 反测试周期选择器 *//

////////////////////////

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

///////////////

//* RSI策略 *//

///////////////

//指示器 1

lowerpc = lowest(low, 21)

upperpc = highest(high, 21)

midpc = avg(upperpc, lowerpc)

//指示器 2

ma = sma(close, 50)

petd = ema(close,13)

rangema = ema(tr, 50)

upperkc = ma + rangema * 0.25

lowerkc = ma - rangema * 0.25

//指示器 3

up = rma(max(change(close), 0), 5)

down = rma(-min(change(close), 0), 5)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// PET-D

petdcolor = close > petd ? green : red

barcolor (petdcolor)

//Slope

SlopeL = midpc > midpc[5]

SlopeS = midpc < midpc[5]

//条件

CL = SlopeL == 1 and close > lowerkc and close < midpc and rsi < 35

CS = SlopeS == 1 and close < upperkc and close > midpc and rsi > 65

//Setup

RsiSL = CL == 1 and CL[1] != 1

RsiSS = CS == 1 and CS[1] != 1

/////////////////////

//* RSA抛物线指标 *//

/////////////////////

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

psar = sar(start, increment, maximum)

RSALE = false

RSASE = false

if (psar > high)

RSALE = true

else

RSALE = false

if (psar < low)

RSASE = true

else

RSASE = false

////////////////

//* 策略组件 *//

////////////////

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

//

fastExit = input(false,title="Use Opposite Trade as a Close Signal")

clrBars = input(true,title="Colour Candles to Trade Order state")

orderType = input("Longs+Shorts",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly","Flip"])

//

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

//////////////////////////

//* 贸易状态引擎 *//

//////////////////////////

// 追踪当前贸易状态

longClose = false, longClose := nz(longClose[1],false)

shortClose = false, shortClose := nz(shortClose[1],false)

tradeState = 0, tradeState := nz(tradeState[1])

tradeState := tradeState==0 ? buy==1 and (barstate.isconfirmed or barstate.ishistory) and isLong and not longClose and not shortClose? 1 :

sell==1 and (barstate.isconfirmed or barstate.ishistory) and isShort and not longClose and not shortClose? -1 :

tradeState : tradeState

////////////////////////////////////

//* 在这里设置入口和特殊出口条件 *//

////////////////////////////////////

//进入状态,当状态改变方向时。

longCondition = false

shortCondition = false

//longCondition := longCondition != true ? change(tradeState) and tradeState==1 : true

//shortCondition := shortCondition != true ? change(tradeState) and tradeState==-1 : true

longCondition := change(tradeState) and tradeState==1

shortCondition := change(tradeState) and tradeState==-1

if orderType=="Flip"

temp = longCondition

longCondition := shortCondition

shortCondition := temp

//end if

// 卖出信号退出

longExitC = (emafast[1]<emaslow[1] and open<emaslow[1]) ? 1 : 0

shortExitC = (emafast[1]>emaslow[1] and open>emaslow[1]) ? 1 : 0

// change退出条件。

longExit = change(longExitC) and longExitC==1 and tradeState==1

shortExit = change(shortExitC) and shortExitC==1 and tradeState==-1

// -- debugs

//plotchar(tradeState,"tradeState at Event",location=location.bottom, color=#FF0000FF)

//plotchar(longCondition, title="longCondition",color=#FF0000FF)

//plotchar(shortCondition, title="shortCondition",color=#FF0000FF)

//plotchar(tradeState, title="tradeState",color=#006400FF)

// -- /debugs

////////////////////////////////

//======[ 交易入门价格 ]======//

////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

////////////////////////////

//======[ 位置状态 ]======//

////////////////////////////

in_longCondition = tradeState == 1

in_shortCondition = tradeState == -1

////////////////////////

//======[ 尾停 ]======//

////////////////////////

isTS = input(true, "Trailing Stop")

ts = input(3.0, "Trailing Stop (%)", minval=0,step=0.1, type=float) /100

last_high = na

last_low = na

last_high_short = na

last_low_long = na

last_high := not in_longCondition ? na : in_longCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_high_short := not in_shortCondition ? na : in_shortCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_low := not in_shortCondition ? na : in_shortCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

last_low_long := not in_longCondition ? na : in_longCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

long_ts = isTS and in_longCondition and not na(last_high) and (low_ <= last_high - last_high * ts) //and (last_high >= last_open_longCondition + last_open_longCondition * tsi)

short_ts = isTS and in_shortCondition and not na(last_low) and (high_ >= last_low + last_low * ts) //and (last_low <= last_open_shortCondition - last_open_shortCondition * tsi)

////////////////////////

//======[ 获利 ]======//

////////////////////////

isTP = input(true, "Take Profit")

tp = input(3.0, "Take Profit (%)",minval=0,step=0.1,type=float) / 100

ttp = input(1.0, "Trailing Profit (%)",minval=0,step=0.1,type=float) / 100

ttp := ttp>tp ? tp : ttp

long_tp = isTP and in_longCondition and (last_high >= last_open_longCondition + last_open_longCondition * tp) and (low_ <= last_high - last_high * ttp)

short_tp = isTP and in_shortCondition and (last_low <= last_open_shortCondition - last_open_shortCondition * tp) and (high_ >= last_low + last_low * ttp)

////////////////////////////

//======[ 停止损耗 ]======//

////////////////////////////

isSL = input(false, "Stop Loss")

sl = input(3.0, "Stop Loss (%)", minval=0,step=0.1, type=float) / 100

long_sl = isSL and in_longCondition and (low_ <= last_open_longCondition - last_open_longCondition * sl)

short_sl = isSL and in_shortCondition and (high_ >= last_open_shortCondition + last_open_shortCondition * sl)

////////////////////////

//======[ 对峙 ]======//

////////////////////////

//注:短出口信号不重漆,无需用力,如果锥体继续进行。

long_sos = (fastExit or (not isTS and not isSL)) and longExit and in_longCondition

short_sos = (fastExit or (not isTS and not isSL)) and shortExit and in_shortCondition

////////////////////////////

//======[ 关闭信号 ]======//

////////////////////////////

// 为所有不同的关闭条件创建一个单独的关闭,这里的所有条件都不重漆。

longClose := isLong and (long_tp or long_sl or long_ts or long_sos) and not longCondition

shortClose := isShort and (short_tp or short_sl or short_ts or short_sos) and not shortCondition

////////////////////////////

//======[ 情节色彩 ]======//

////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? green : long_sl ? maroon : long_ts ? purple : long_sos ? orange :longCloseCol[1]

shortCloseCol := short_tp ? green : short_sl ? maroon : short_ts ? purple : short_sos ? orange : shortCloseCol[1]

//

tpColor = isTP and in_longCondition ? lime : isTP and in_shortCondition ? lime : na

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : na

//////////////////////////////////

//======[ 策略图 ]======//

//////////////////////////////////

plot(isTS and in_longCondition?

last_high - last_high * ts : na, "Long Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_longCondition and last_high < last_open_longCondition + last_open_longCondition * tp ?

last_open_longCondition + last_open_longCondition * tp : na, "Long TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_longCondition and last_high >= last_open_longCondition + last_open_longCondition * tp ?

last_high - last_high * ttp : na, "Long Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_longCondition and last_low_long > last_open_longCondition - last_open_longCondition * sl ?

last_open_longCondition - last_open_longCondition * sl : na, "Long SL", slColor, style=3,join=false, linewidth=2,offset=1)

plot(isTS and in_shortCondition?

last_low + last_low * ts : na, "Short Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_shortCondition and last_low > last_open_shortCondition - last_open_shortCondition * tp ?

last_open_shortCondition - last_open_shortCondition * tp : na, "Short TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_shortCondition and last_low <= last_open_shortCondition - last_open_shortCondition * tp ?

last_low + last_low * ttp : na, "Short Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_shortCondition and last_high_short < last_open_shortCondition + last_open_shortCondition * sl ?

last_open_shortCondition + last_open_shortCondition * sl : na, "Short SL", slColor, style=3,join=false, linewidth=2,offset=1)

bclr = not clrBars ? na : tradeState==0 ? GRAY :

in_longCondition ? close<last_open_longCondition? DARKGREEN : LIME :

in_shortCondition ? close>last_open_shortCondition? DARKRED : RED : GRAY

barcolor(bclr,title="Trade State Bar Colouring")

//////////////////////////////////

//======[ 战略进入与退出 ]======//

//////////////////////////////////

if testPeriod() and isLong

strategy.entry("Long", 1, when=longCondition)

strategy.close("Long", when=longClose )

if testPeriod() and isShort

strategy.entry("Short", 0, when=shortCondition)

strategy.close("Short", when=shortClose )

// --- Debugs

//plotchar(longExit,title="longExit",location=location.bottom,color=na)

//plotchar(longCondition,title="longCondition",location=location.bottom,color=na)

//plotchar(in_longCondition,title="in_longCondition",location=location.bottom,color=na)

//plotchar(longClose,title="longClose",location=location.bottom,color=na,color=na)

//plotchar(buy,title="buy",location=location.bottom,color=na)

// --- /Debugs

//开单时改变背景

bgcolor( in_longCondition ? lime : na, transp=90)

bgcolor( in_shortCondition ? red : na, transp=90)

////////////////////////////

//======[ 重置变量 ]======//

////////////////////////////

if longClose or not in_longCondition

last_high := na

last_high_short := na

if shortClose or not in_shortCondition

last_low := na

last_low_long := na

if longClose or shortClose

tradeState := 0

in_longCondition := false

in_shortCondition := false

//plotchar(tradeState,"tradeState at EOF",location=location.bottom, color=na)

// EOF

Detail

https://www.fmz.com/strategy/431272

Last Modified

2023-11-06 16:04:46