Name

平滑波动率目标带策略Smooth-Volatility-Band-Strategy

Author

ChaoZhang

Strategy Description

本策略基于价格的平滑波动率,生成价格目标带,当价格突破目标带时,产生交易信号。

该策略首先计算价格在一定周期内的平均波动幅度,然后通过指数移动平均线对波动幅度进行平滑处理,生成平滑波动率。平滑波动率乘以一个系数后,得到目标带的范围。当价格突破目标带上轨时,产生买入信号;当价格突破目标带下轨时,产生卖出信号。

具体来说,策略中通过smoothrng函数计算得出平滑波动率smrng,然后根据smrng值计算出目标带的上下轨hband和lband。在此基础上设定长仓条件longCondition和短仓条件shortCondition。当长仓条件满足时,产生买入信号;当短仓条件满足时,产生卖出信号。

该策略具有以下优势:

-

使用价格波动率构建交易信号,可有效跟踪市场变化。

-

通过指数移动平均线平滑波动率,可过滤噪音,产生更可靠的交易信号。

-

目标带范围可通过波动率系数进行调整,使策略更加灵活。

-

结合价格突破判断,可在趋势发生转折时及时捕捉交易机会。

该策略也存在一些风险:

-

市场出现异常波动时,平滑波动率可能无法准确反映真实波动情况,从而导致错误信号。可通过调整参数优化模型。

-

目标带范围如果设置不当,可能导致交易频率过高或信号不足。可测试不同的参数以找到最优范围。

-

突破信号判断存在时间滞后,可能导致入场过早或过晚。可结合其他指标进行确认。

该策略可从以下几个方向进行优化:

-

测试不同的价格数据周期,找到计算波动率最合适的周期参数。

-

尝试不同的移动平均线算法,如线性加权移动平均线等。

-

引入交易量或其他指标来确认突破信号。

-

设置止损位或 trailing stop来控制单笔止损。

-

优化波动率系数mult的值来确定最佳目标带范围。

本策略整体思路清晰,通过价格波动率构建目标带,利用价格突破产生交易信号,可有效跟踪市场变化趋势。但也存在一定改进空间,通过参数优化、引入确认指标等手段可使策略更稳健可靠。

||

This strategy generates price bands based on the smoothed volatility of price, and produces trading signals when price breaks through the bands.

The strategy first calculates the average volatility range of price over a certain period, then smoothes the volatility range using an exponential moving average to generate smoothed volatility. The smoothed volatility multiplied by a coefficient gives the range of the bands. When price breaks above the upper band, a buy signal is generated. When price breaks below the lower band, a sell signal is generated.

Specifically, the smoothed volatility smrng is calculated by the smoothrng function. The upper band hband and lower band lband of the price bands are then calculated based on smrng. The long condition longCondition and short condition shortCondition are set up based on that. When longCondition is met, a buy signal is generated. When shortCondition is met, a sell signal is generated.

The advantages of this strategy are:

-

Using price volatility to construct trading signals can effectively track market changes.

-

Smoothing volatility with exponential moving average can filter noise and generate more reliable trading signals.

-

The range of bands can be adjusted through the volatility coefficient, making the strategy more flexible.

-

Combined with breakout judgment, it can capture trading opportunities timely when trend reversal occurs.

There are also some risks in this strategy:

-

In abnormal market volatility, the smoothed volatility may fail to accurately reflect the actual volatility, leading to wrong signals. Parameters can be optimized to improve the model.

-

Improper band range setting may lead to overtrading or insufficient signals. Different parameters can be tested to find the optimal range.

-

There is time lag in breakout signals, which may cause premature entry or late entry. Other indicators can be introduced for confirmation.

The strategy can be optimized through:

-

Testing different price data cycles to find the most appropriate period for calculating volatility.

-

Trying different moving average algorithms like weighted moving average.

-

Introducing trading volume or other indicators to confirm breakout signals.

-

Setting stop loss or trailing stop to control losses per trade.

-

Optimizing the volatility coefficient mult to determine optimal band range.

The overall logic of this strategy is clear, using price volatility to construct bands and price breakouts to generate trading signals, which can effectively track market trend changes. But there is room for improvement via parameter optimization, signal confirmation etc to make strategy more robust.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_close | 0 | Source: close |

| v_input_2 | 100 | Sampling Period |

| v_input_3 | 3 | Range Multiplier |

Source (PineScript)

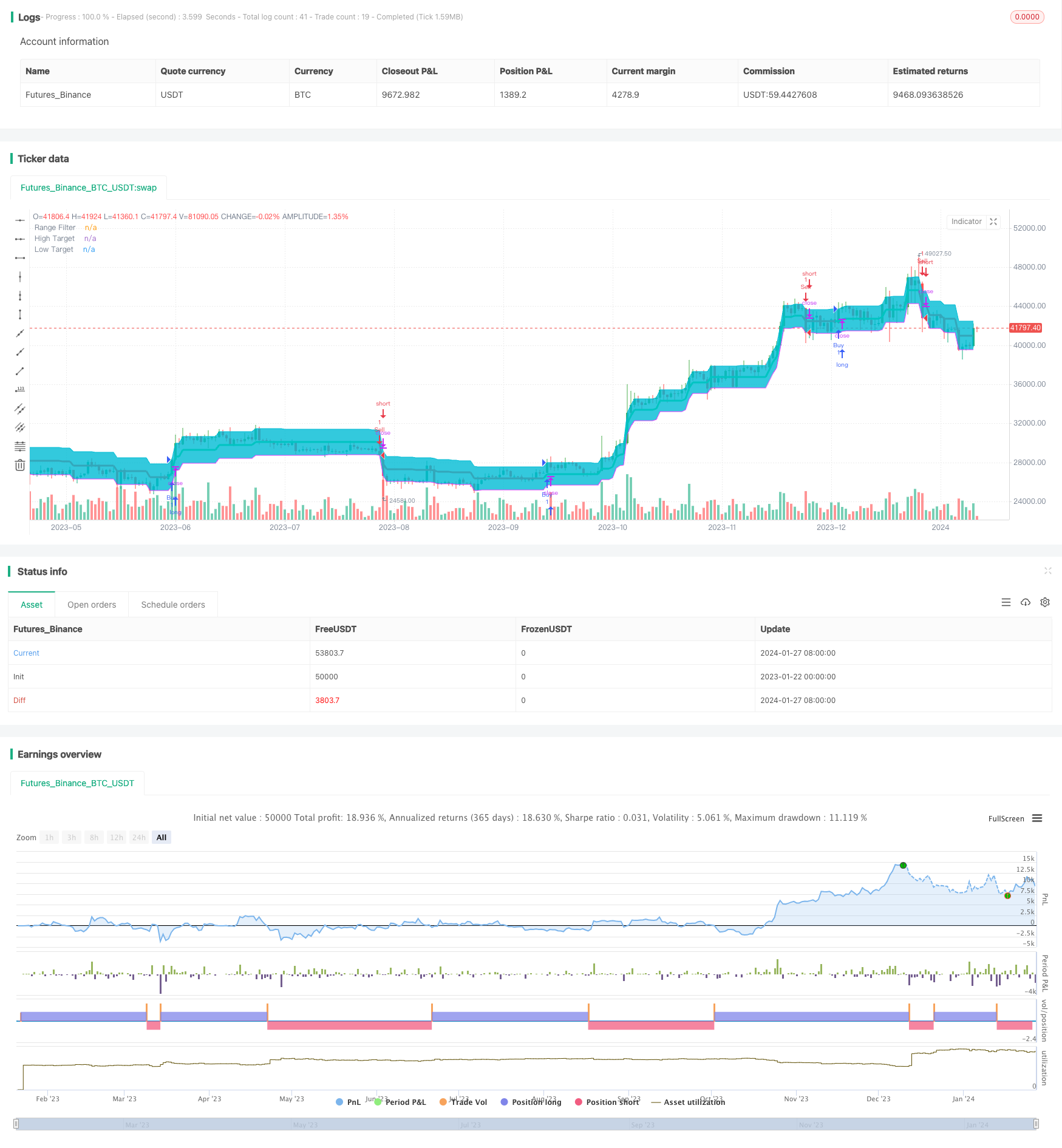

/*backtest

start: 2023-01-22 00:00:00

end: 2024-01-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("1SmSm1 Strategy", shorttitle="1SmSm1", overlay=true)

// Source

src = input(defval=close, title="Source")

// Sampling Period

per = input(defval=100, minval=1, title="Sampling Period")

// Range Multiplier

mult = input(defval=3.0, minval=0.1, title="Range Multiplier")

// Smooth Average Range

smoothrng(x, t, m) =>

wper = (t * 2) - 1

avrng = ema(abs(x - x[1]), t)

smoothrng = ema(avrng, wper) * m

smoothrng

smrng = smoothrng(src, per, mult)

// Range Filter

rngfilt(x, r) =>

rngfilt = x

rngfilt := x > nz(rngfilt[1]) ? ((x - r) < nz(rngfilt[1]) ? nz(rngfilt[1]) : (x - r)) : ((x + r) > nz(rngfilt[1]) ? nz(rngfilt[1]) : (x + r))

rngfilt

filt = rngfilt(src, smrng)

// Filter Direction

upward = 0.0

upward := filt > filt[1] ? nz(upward[1]) + 1 : filt < filt[1] ? 0 : nz(upward[1])

downward = 0.0

downward := filt < filt[1] ? nz(downward[1]) + 1 : filt > filt[1] ? 0 : nz(downward[1])

// Target Bands

hband = filt + smrng

lband = filt - smrng

// Breakouts

longCondition = (src > filt) and (src > src[1]) and (upward > 0)

shortCondition = (src < filt) and (src < src[1]) and (downward > 0)

strategy.entry("Buy", strategy.long, when = longCondition)

strategy.entry("Sell", strategy.short, when = shortCondition)

// Plotting

plot(filt, color=upward > 0 ? color.lime : downward > 0 ? color.red : color.orange, linewidth=3, title="Range Filter")

hbandplot = plot(hband, color=color.aqua, transp=100, title="High Target")

lbandplot = plot(lband, color=color.fuchsia, transp=100, title="Low Target")

// Fills

fill(hbandplot, lbandplot, color=color.aqua, title="Target Range")

// Bar Color

barcolor(longCondition ? color.green : shortCondition ? color.red : na)

// Alerts

alertcondition(longCondition, title="Buy Alert", message="BUY")

alertcondition(shortCondition, title="Sell Alert", message="SELL")

Detail

https://www.fmz.com/strategy/440367

Last Modified

2024-01-29 16:22:14