Name

平滑移动平均策略组合优化Price-EMA-with-stochastic-optimization-based-on-machine-learning

Author

ChaoZhang

Strategy Description

该策略是基于平滑移动平均线与Stochastic指标的组合,目标是在趋势中捕获更多机会。它主要使用两条不同周期的指数移动平均线形成策略信号,结合Stochastic指标中的K线与D线的交叉作为入场时机选择,以期望在趋势中获得更高的盈利率。

该策略使用12周期与26周期两条平滑移动平均线。当快线从下方上穿慢线时,做多;当快线从上方下穿慢线时,做空。为过滤假信号,它要求快线与慢线同向,快线在慢线之上才可做多,快线在慢线之下才可做空。

Stochastic指标中的K线与D线交叉作为入场时机选择。K线从超买线下方向上交叉D线时,做多;K线从超卖区下方向下交叉D线时,做空。

平滑移动平均线确定趋势方向,Stochastic指标过滤 Noise 并选择入场时机。它们的结合可以在趋势中获得更多获利机会。

- 平滑移动平均策略本身就具有顺势而为特点,容易跟踪趋势

- 利用Stochastic指标过滤 Noise ,提高获利概率

- 快慢均线组合,当快线回调至慢线附近再入场,可获得更优博弈机会

- Stochastic指标中的K线与D线交叉组合使用,可进一步选择更佳入场点位

因此,该策略可顺势而为,有选择性地把握机会,从而获得更高的获利率。

- 短期内离场风险较大。当快线回调至慢线时,可能会被否定信号或被套住

- 因其顺势而为的特性,行情剧烈反转时,无法快速适应,可能导致较大亏损

为降低这些风险,我们可以设置止损,或采用更宽松的移动平均线参数组合。

该策略可从以下几个方面进行进一步优化:

- 测试不同移动平均线参数的组合,找到更佳的参数

- 测试不同Stochastic参数的组合

- 增加止损策略

- 增加基于波动率的动态止损

- 测试不同品种不同周期参数的组合优化

- 测试机器学习算法优化参数

通过测试不同的参数组合,可找到更强的参数;同时设立止损策略可有效降低风险,提高策略稳定性。

该策略整合了平滑移动平均与Stochastic指标的优势,可顺势跟踪趋势,并选择更佳时机入场。它容易操作,风险可控,具有很大的实用价值。通过持续的测试与优化,其表现可得到进一步提升。它可为量化交易者提供一个高效稳定的趋势跟踪策略模型。

||

This strategy combines Smooth Moving Average with the Stochastic indicator to capture more opportunities in trends. It mainly uses two exponential moving averages with different periods to generate trading signals, together with the crossover of K line and D line in Stochastic indicator for entry timing selection, in order to obtain higher profitability in trends.

The strategy uses 12-period and 26-period smooth moving averages. When the fast line crosses above the slow line from the bottom, go long. When the fast line crosses below the slow line from the top, go short. To filter fake signals, it requires the fast and slow lines to be in the same direction, with the fast line above the slow line for long, and the fast line below the slow line for short.

The crossover of K line and D line in Stochastic indicator is used for entry timing selection. When K line crosses above D line from below the overbought line, go long. When K line crosses below D line from above the oversold line, go short.

Smooth moving average determines the trend direction, while Stochastic indicator filters Noise and selects entry timing. Their combination could obtain more profitable opportunities in trends.

- Smooth moving average itself has the characteristic of trend-following, easy to track trends

- Utilize Stochastic to filter Noise and improve profitability

- The combination of fast and slow MAs allows entering when fast MA pulls back to slow MA, obtaining better risk-reward

- The crossover of K line and D line provides further timing optimization

Therefore, this strategy could follow the trend selectively to capture opportunities, obtaining higher profitability.

- High risk of premature exit in the short term. Signals may be denied or trapped when fast MA pulls back to slow MA

- As it follows the trend, it cannot adapt quickly to drastic trend reversal, leading to large loss

To reduce those risks, we could set stop loss, or adopt more moderate MA parameters.

The strategy could be further optimized from the follows aspects:

- Test different combinations of MA parameters to find the optimal

- Test different combinations of Stochastic parameters

- Add stop loss strategy

- Add dynamic stop loss based on volatility

- Test parameter optimization across different products and time frames

- Utilize machine learning algorithms to optimize parameters

By testing different parameter combinations, better parameters could be found. Also, stop loss strategies could effectively reduce risk and enhance stability.

The strategy integrates the strengths of Smooth Moving Average and Stochastic for trend-following, while selecting better entry timing. It is easy to operate, with controllable risk and great practical value. Its performance could be further improved through continuous testing and optimization. It provides quant traders an efficient and stable trend tracking model.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_close | 0 | Source: close |

| v_input_2 | 50 | Length |

| v_input_3_close | 0 | Source: close |

| v_input_4 | 100 | len100 |

| v_input_5_close | 0 | Source: close |

| v_input_6 | true | Length |

| v_input_7_close | 0 | Source: close |

| v_input_8 | 5 | length |

| v_input_9 | 80 | OverBought |

| v_input_10 | 20 | OverSold |

| v_input_11 | 12 | Fast Length |

| v_input_12 | 26 | Slow Length |

| v_input_13_close | 0 | Source: close |

| v_input_14 | 9 | Signal Smoothing |

| v_input_15 | false | Simple MA(Oscillator) |

| v_input_16 | false | Simple MA(Signal Line) |

| v_input_17 | 0.1 | tp |

| v_input_18 | 0.1 | sl |

Source (PineScript)

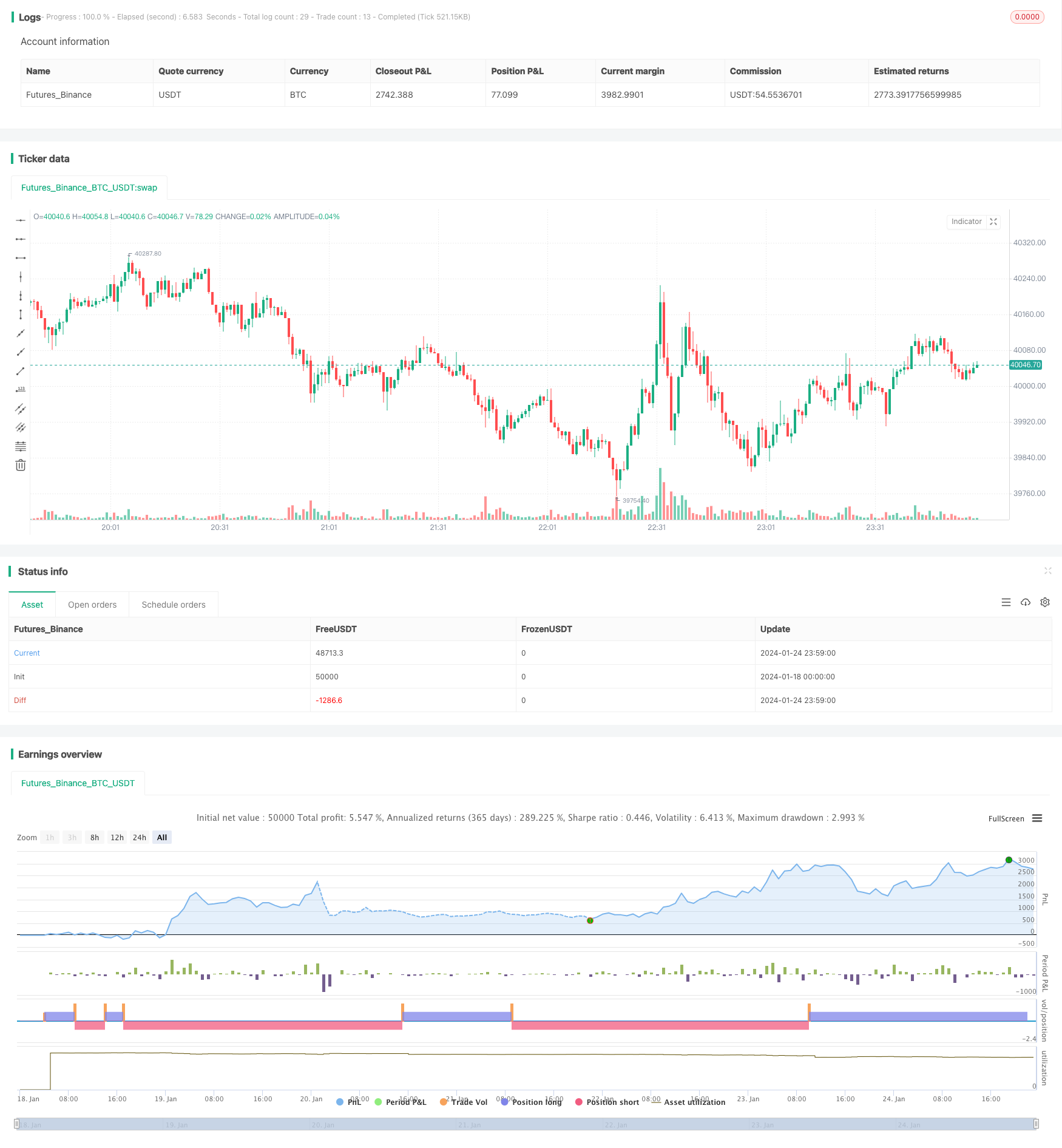

/*backtest

start: 2024-01-18 00:00:00

end: 2024-01-25 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// author SoftKill

strategy(title="Price EMA with stock", shorttitle="EMA STOCH", overlay=true)

src = input(title="Source", type=input.source, defval=close)

src_0 = src[0]

src_1 = src[1]

src_2 = src[2]

src_3 = src[3]

src_4 = src[4]

len50 = input(50, minval=1, title="Length")

src50 = input(close, title="Source")

out50 = ema(src50, len50)

len100 = input(100)

src100 = input(close, title="Source")

out100 = ema(src100, len100)

len1 = input(1, minval=1, title="Length")

src1 = input(close, title="Source")

out1 = sma(src1, len1)

length = input(5, minval=1)

OverBought = input(80)

OverSold = input(20)

smoothK = 3

smoothD = 3

k = sma(stoch(close, high, low, length), smoothK)

d = sma(k, smoothD)

cu = crossover(k,OverSold)

co = crossunder(k,OverBought)

sma_down = crossunder(out1, out50)

sma_up = crossover(out1,out50)

//if (not na(k) and not na(d))

// if (co and k < OverSold)

// strategy.entry("StochLE", strategy.long, comment="StochLE")

//if (cu and k > OverBought)

// strategy.entry("StochSE", strategy.short, comment="StochSE")

crossCandle_4 = crossover(src[4],out50)

crossCandleUnder_4= cross(src[4],out50)

crossCandle_3 = crossover(src[3],out50)

crossCandleUnder_3= crossunder(src[3],out50)

crossCandle_2 = crossover(src[2],out50)

crossCandleUnder_2= crossunder(src[2],out50)

crossCandle_1 = crossover(src[1],out50)

crossCandleUnder_1= crossunder(src[1],out50)

crossCandle_0 = crossover(src[0],out50)

crossCandleUnder_0= crossunder(src[0],out50)

conditionOver = (crossCandle_4 or crossCandle_3 or crossCandle_2 or crossCandle_1 or crossCandle_0)

conditionUnder =(crossCandleUnder_4 or crossCandleUnder_3 or crossCandleUnder_2 or crossCandleUnder_1 or crossCandleUnder_0)

touch4 = (cross(low[4],out50) or cross(high[4],out50))

touch3 = (cross(low[3],out50) or cross(high[3],out50))

touch2 = (cross(low[2],out50) or cross(high[2],out50))

touch1 = (cross(low[1],out50) or cross(high[1],out50))

touch = touch1 or touch2 or touch3 or touch4

//and sma_up

//and sma_down

// Getting inputs

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

src_macd = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=false)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=false)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

// Calculating

fast_ma = sma_source ? sma(src_macd, fast_length) : ema(src_macd, fast_length)

slow_ma = sma_source ? sma(src_macd, slow_length) : ema(src_macd, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

//plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

//plot(macd, title="MACD", color=col_macd, transp=0)

//plot(signal, title="Signal", color=col_signal, transp=0)

// plot((conditionOver or conditionUnder or touch) and src[0] >= out50 and close >= out50 and (cu) and out50 > out100 and hist>=0 , title="Buy", style=plot.style_columns, color=color.lime)

// plot((conditionOver or conditionUnder or touch) and src[0] <= out50 and close <= out50 and (co) and out50< out100 and hist<=0 , title="sell", style=plot.style_columns, color=color.red)

long_cond = ((conditionOver or conditionUnder or touch) and src[0] >= out50 and close > out50 and (cu) and out50 > out100 and hist>=0)

short_cond = ((conditionOver or conditionUnder or touch) and src[0] <= out50 and close < out50 and (co) and out50< out100 and hist<=0)

tp=input(0.1)

sl=input(0.1)

strategy.entry("long",strategy.long, when=long_cond)

strategy.entry("short",strategy.short, when=short_cond)

strategy.exit("X_long", "long", profit=close * tp / syminfo.mintick, loss=close * sl / syminfo.mintick, when=touch )

strategy.exit("x_short", "short",profit=close * tp / syminfo.mintick,loss=close * sl / syminfo.mintick,when = touch )

// //tp = input(0.0003, title="tp")

// tp = 0.0003

// //sl = input(1.0 , title="sl")

// sl = 1.0

// strategy.exit("closelong", "long" , profit = close * tp / syminfo.mintick, loss = close * sl / syminfo.mintick, alert_message = "closelong")

// strategy.exit("closeshort", "short" , profit = close * tp / syminfo.mintick, loss = close * sl / syminfo.mintick, alert_message = "closeshort")

Detail

https://www.fmz.com/strategy/440083

Last Modified

2024-01-26 14:57:08