Name

并联移动平均线与无限脉冲响应均线策略Combined-Moving-Average-and-Infinite-Impulse-Response-Line-Strategy

Author

ChaoZhang

Strategy Description

这是一个结合使用移动平均线、无限脉冲响应均线(IIR)和自适应线性移动平均线(ALMA)的量化策略。该策略具有多种指标组合,可以为交易者提供丰富的交易信号。

该策略主要包含以下几个部分:

-

并联使用简单移动平均线(SMA)、ALMA和IIR,检测它们之间的交叉信号作为交易入场时机。

-

使用3条不同周期的IIR,通过计算它们之间的距离,判断价格是否处于挤压状态。挤压状态代表着波动性减小,常常预示着价格即将产生较大幅度的变动。

-

对IIR的斜率进行判断,当斜率上升时,为绿色,下降时为蓝色。可以直观判断IIR的走势。

-

计算SMA之间的距离是否在扩大,如果是,则进行特殊标记,代表“扇形”扩张,通常意味着价格进入趋势状态。

-

结合相对强弱指标(RSI)的超买超卖信号,补充交易信号。

通过组合运用以上几个部分,该策略能够提供比较全面和丰富的交易入场、判断和退出信号。

该策略最大的优势在于指标组合全面和丰富,既考虑了趋势判断,也考虑了波动率和超买超卖状态,为交易决策提供了多维度的参考。

另一个优势是参数和指标容易调整和优化,用户可以根据自己的需要选择来启用相关指标和参数。

从风险管理的角度来说,该策略同时关注快速均线和慢速均线,能够降低因价格震荡产生的错误信号的概率。

该策略的主要风险在于:

-

过于复杂,容易造成指标冲突,选择在某些参数组合下可能会导致过拟合。

-

采用多组均线系统,在市场剧烈变动时(如重大经济事件),还是可能出现较大的亏损。

-

深度回测不足,实战中可能存在一定的survivalship bias 风险。

在应用过程中,我们需要注意风险管理,适当调整仓位规模。并且在更长的时间跨度和更大的数据集上进行多次回测,确保策略的实战效果。

考虑到该策略指标组合比较复杂,参数较多,后续可以从以下几个方面进行优化:

-

简化指标选择,去除相关性不强或者冲突的指标。

-

对IIR均线的选取进行优化,选取更匹配市场特征的长度。

-

优化快慢均线的组合,提高交叉信号的稳定性。

-

增加机器学习模型辅助判断,提升策略的自适应能力。

-

优化与全局指数的相关性,提高趋势判断的成功率。

通过指标的灵活组合和优化,该策略能够比较全面地反映市场状态,为交易决策提供多维支持。但也存在一定的实战和数据过拟合风险。我们仍需要在实践中不断优化调整策略,以适应市场的变化。

||

This is a quantitative strategy that combines the use of moving averages, infinite impulse response lines (IIR) and adaptive linear moving averages (ALMA). The strategy has a combination of multiple indicators to provide traders with rich trading signals.

The main components of the strategy include:

-

Use a combination of simple moving averages (SMA), ALMA and IIR to detect cross signals between them as timing for trade entry.

-

Use 3 IIRs with different periods and calculate the distance between them to determine if the price is in a squeeze state. The squeeze state represents decreasing volatility and often presages significant price changes.

-

Judging the slope of the IIR, when the slope rises it is green, and when it falls it is blue. It can visually determine the trend of IIR.

-

Calculate if the distance between SMAs is widening, if so, make a special mark, representing the "fan" expansion, usually meaning the price is entering a trend state.

-

Combine the overbought and oversold signals of the relative strength index (RSI) to supplement the trading signals.

By combining the use of the above sections, the strategy can provide relatively comprehensive and rich trading entry, judgment and exit signals.

The biggest advantage of this strategy is that the combination of indicators is comprehensive and rich, taking into account both trend judgments and volatility ratios and overbought/oversold states, providing multidimensional references for trading decisions.

Another advantage is that the parameters and indicators are easy to adjust and optimize so users can enable relevant indicators and parameters according to their needs.

From the perspective of risk management, this strategy pays attention to both fast and slow moving averages, which reduces the probability of incorrect signals caused by price fluctuations.

The main risks of this strategy are:

-

Too complex to easily cause conflicts between indicators and improper parameter combinations can lead to overfitting.

-

Adopting multiple moving average systems still carries large losses in the event of severe market turmoil (such as major economic events).

-

Insufficient in-depth backtesting may pose some survival bias risk in real trading.

In practice, we need to pay attention to risk management and appropriately adjust the position size. We also need to conduct multiple backtests over longer time frames and larger datasets to ensure practical effectiveness of the strategy.

Considering the complex combination of indicators and large number of parameters in this strategy, future optimizations can be made in the following aspects:

-

Simplify indicator selections, remove indicators with low correlations or conflicts.

-

Optimize the selection of IIR moving averages to better match market characteristics.

-

Optimize combinations of fast and slow moving averages to increase stability of crossover signals.

-

Increase machine learning models to assist in judgments and improve the adaptability of strategies.

-

Optimize correlation with global indexes to improve success rate of trend judgments.

Through flexible combinations and optimizations of indicators, this strategy can reflect market status relatively comprehensively and provide multi-dimensional support for trading decisions. But there are still risks of real trading and data overfitting. We still need to constantly optimize and adjust the strategy in practice to adapt to market changes.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | false | ═══════════════ Show Fibby MAs ═══════════════ |

| v_input_2 | 960 | MA-Cross Resolution |

| v_input_3 | 8 | MA#1 Length |

| v_input_4 | 13 | MA#2 Length |

| v_input_5 | 34 | MA#3 Length |

| v_input_6 | 1.1 | SMA LooseSqueeze Percent |

| v_input_7 | false | ═══════════════════ Show IIRs ═══════════════════ |

| v_input_8 | 60 | IIR Resolution |

| v_input_9 | 0.8 | IIR Squeeze PercentClose |

| v_input_10 | 34 | IIR Length 1 |

| v_input_11 | 144 | IIR Length 2 |

| v_input_12 | 720 | IIR Length 3 |

| v_input_13 | true | Show IIR1 |

| v_input_14 | true | Show IIR2 |

| v_input_15 | true | Show IIR3 |

| v_input_16 | true | ═════════════ Show Parabolic MA Counts ════════════ |

| v_input_17 | true | ══════════════ Show Buy/Sell Signals ══════════════ |

| v_input_18 | true | ══════════════ Show Background Colors ══════════════ |

| v_input_19 | false | ══════════════ Show Debug ══════════════ |

| v_input_20 | 5 | ══ Bar Lookback Period ══ |

| v_input_21 | true | ══ Percentage Lookback Period ══ |

| v_input_22 | true | ══════════ Show misc MA Cross Strategy ══════════ |

| v_input_23 | 555 | IIRx Length: |

| v_input_24 | 30 | IIRx Period/TF: |

| v_input_25 | 13 | IIRx2 Length: |

| v_input_26 | 5 | IIRx2 Period/TF: |

| v_input_27 | 15 | Alma of IIR1 Period: |

| v_input_28 | 0.7 | Alma Alpha Value: |

| v_input_29 | 500 | Alma Sigma Value: |

| v_input_30 | true | ═══════════════════ Show RSI Arrows ═══════════════════ |

| v_input_31_close | 0 | RSI Source: close |

| v_input_32 | 14 | RSI Length |

| v_input_33 | 80 | RSI Overbought Level |

| v_input_34 | 20 | RSI Oversold Level |

Source (PineScript)

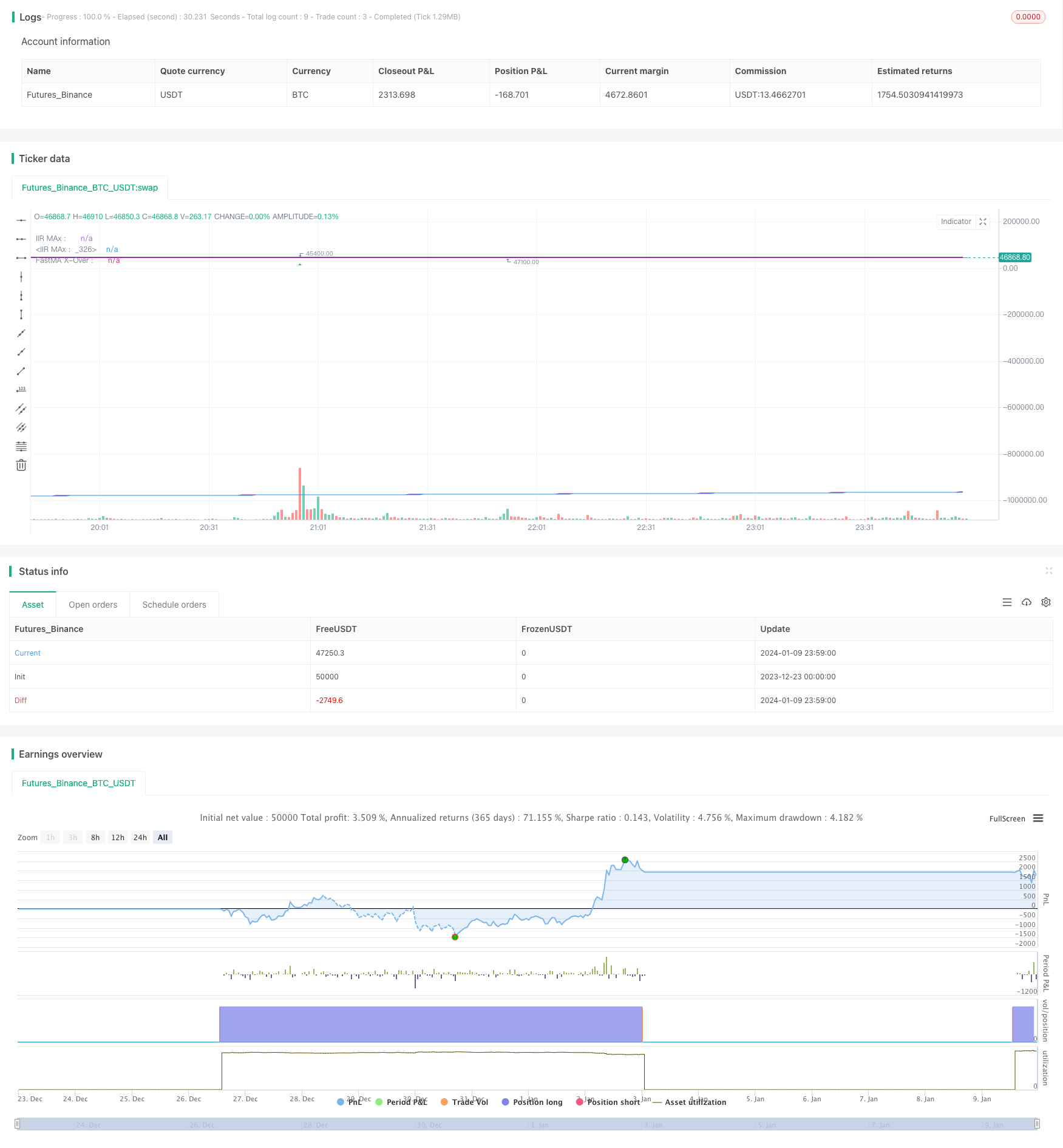

/*backtest

start: 2023-12-23 00:00:00

end: 2024-01-10 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//The plotchar UP/DOWN Arrows is the crossover of the fastest MA and fastest IIR MAs

//

//The dots at the bottom are the two simple averages crossing over

//

//The count over/under the candles is the count of bars that the SMAs on their

//respective resolution are fanning out.

//

//The colored background indicates a squeeze, lime=kinda tight : green=very tight squeeze. based on the 3 IIRs

//

//To answer my own question in a forum, looking at the code, i couldn't figure out how to get it from another timeframe

//and run the same calculations with the same results. My answer in the end was to scale the chosen MA length

//in the corresponding CurrentPeriod/ChosenMAPeriod proportion. This results in the same line in the same place when browsing through the

//different time resolutions. Somebody might find this invaluable

//

//The counts are for MA's fanning out, or going parabolic. Theres IIRs, Almas, one done of the other. A lot.

//The arrows above and below bars are from standard RSI numbers for OB/OS

//

//The IIRs changes color depending on their slope, which can be referenced easily with a variable.

//

//The backgrond on a bar-by-bar basis is colored when 2 sets of moving averages are in a squeeze, aka

//when price is consolidating.

//

//This aims to help the trader combine conditions and entry criteria of the trade and explore these options visually.

//They detail things from all time-frames on the current one. I prefer it because of the fractal nature of price-action, both large and small,

//either yesterday or last year. For best results, go long in short-term trades when the long-term trend is also up.

//and other profitable insights. This is also a great example of an automation algorith.

//

//The pretty ribbon is my script called 'Trading With Colors'. Use them together for fanciest results. 55/233 is my Fib Cross (golden/death) Compare it to the classic 50/200 if

//you get bored. I believe it simply works better, at least for Crypto.

//

//Evidently, I am a day-trader. But this yields higher profits on larger time-frames anyways, so do play around with it. Find what works for you.

//Thanks and credit for code snippets goes to:

//matryskowal

//ChrisMoody, probably twice

//Alex Orekhov (everget)

//author=LucF and midtownsk8rguy, for PineCoders

//If you use code from this, real quick search for perhaps the original and give them a shoutout too. I may have missed something

//Author: Sean Duffy

//@version=4

strategy(title = "Combination Parabolic MA/IIR/ALMA Strategy",

shorttitle = "MA-QuickE",

overlay = true )

// calc_on_order_fills = true,

// calc_on_every_tick = true,

// Input Variables

showFIBMAs = input(false, type=input.bool, title="═══════════════ Show Fibby MAs ═══════════════")

maRes = input(960, type=input.integer, title="MA-Cross Resolution")

mal1 = input(8, type=input.integer, title="MA#1 Length")

mal2 = input(13, type=input.integer, title="MA#2 Length")

mal3 = input(34, type=input.integer, title="MA#3 Length")

loosePercentClose = input(1.1, type=input.float, title="SMA LooseSqueeze Percent")

showIIRs = input(false, type=input.bool, title="═══════════════════ Show IIRs ═══════════════════")

iirRes = input(60, type=input.integer, title="IIR Resolution")

percentClose = input(title="IIR Squeeze PercentClose", type=input.float, defval=.8)

iirlength1 = input(title="IIR Length 1", type=input.integer, defval=34)

iirlength2 = input(title="IIR Length 2", type=input.integer, defval=144)//input(title="ATR Period", type=input.integer, defval=1)

iirlength3 = input(title="IIR Length 3", type=input.integer, defval=720)//input(title="ATR Period", type=input.integer, defval=1)

showIIR1 = input(true, type=input.bool, title="Show IIR1")

showIIR2 = input(true, type=input.bool, title="Show IIR2")

showIIR3 = input(true, type=input.bool, title="Show IIR3")

showCounts = input(true, type=input.bool, title="═════════════ Show Parabolic MA Counts ════════════")

showSignals = input(true, type=input.bool, title="══════════════ Show Buy/Sell Signals ══════════════")

showBackground = input(true, type=input.bool, title="══════════════ Show Background Colors ══════════════")

//runStrategy = input(true, type=input.bool, title="══════════════ Run Strategy ══════════════")

debug = input(false, type=input.bool, title="══════════════ Show Debug ══════════════")

barLookbackPeriod = input(title="══ Bar Lookback Period ══", type=input.integer, defval=5)

percentageLookbackPeriod = input(title="══ Percentage Lookback Period ══", type=input.integer, defval=1)

bullcolor = color.green

bearcolor = color.red

color bgcolor = na

var bool slope1Green = na

var bool slope2Green = na

var bool slope3Green = na

var bool buySignal = na

var bool sellSignal = na

var bool bigbuySignal = na

var bool bigsellSignal = na

bool smbuySignal = false

bool smsellSignal = false

var bool insqueeze = na

var bool intightsqueeze = na

var bool infastsqueeze = na

var bool awaitingEntryIn = false

// My counting variables

var int count1 = 0

var float madist1 = 0

var int count2 = 0

var float madist2 = 0

var int sinceSmSignal = 0

var entryPrice = 0.0

var entryBarIndex = 0

var stopLossPrice = 0.0

// var updatedEntryPrice = 0.0

// var alertOpenPosition = false

// var alertClosePosition = false

// var label stopLossPriceLabel = na

// var line stopLossPriceLine = na

positionType = "LONG" // Strategy type, and the only current option

hasOpenPosition = strategy.opentrades != 0

hasNoOpenPosition = strategy.opentrades == 0

strategyClose() =>

if (hasOpenPosition)

if positionType == "LONG"

strategy.close("LONG", when=true)

else

strategy.close("SHORT", when=true)

strategyOpen() =>

if (hasNoOpenPosition)

if positionType == "LONG"

strategy.entry("LONG", strategy.long, when=true)

else

strategy.entry("SHORT", strategy.short, when=true)

checkEntry() =>

buysignal = false

if (hasNoOpenPosition)

strategyOpen()

buysignal := true

// if (slope1Green and (trend1Green or trend2Green) and awaitingEntryIn and hasNoOpenPosition)

// strategyOpen()

// buysignal := true

buysignal

checkExit() =>

sellsignal = false

// if (trend1Green == false and trend2Green == false) // to later have quicker exit strategy

// sellsignal := true

// strategyClose()

if (hasOpenPosition)

sellsignal := true

strategyClose()

sellsignal

multiplier(_adjRes, _adjLength) => // returns adjusted length

multiplier = _adjRes/timeframe.multiplier

round(_adjLength*multiplier)

//reset the var variables before new calculations

buySignal := false

sellSignal := false

smbuySignal := false

smsellSignal := false

bigbuySignal := false

bigsellSignal := false

ma1 = sma(close, multiplier(maRes, mal1))

ma2 = sma(close, multiplier(maRes, mal2))

ma3 = sma(close, multiplier(maRes, mal3))

madist1 := abs(ma1 - ma2)

madist2 := abs(ma1 - ma3) // check if MA's are fanning/going parabolic

if (ma1 >= ma2 and ma2 >= ma3 and madist1[0] > madist1[1]) //and abs(dataB - dataC >= madist2) // dataA must be higher than b, and distance between gaining, same with C

count1 := count1 + 1

else

count1 := 0

if (ma1 <= ma2 and ma2 <= ma3 and madist1[0] > madist1[1]) //<= madist2 and dataB <= dataC) //and abs(dataB - dataC >= madist2) // dataA must be higher than b, and distance between gaining, same with C

count2 := count2 + 1

else

count2 := 0

crossoverAB = crossover(ma1, ma2)

crossunderAB = crossunder(ma1, ma2)

plot(showFIBMAs ? ma1 : na, linewidth=3)

plot(showFIBMAs ? ma2 : na)

plot(showFIBMAs ? ma3 : na)

// Fast Squeese Check WORK IN PROGRESS

//

float singlePercent = close / 100

if max(madist1, madist2) <= singlePercent*loosePercentClose

bgcolor := color.yellow

infastsqueeze := true

else

infastsqueeze := false

// IIR MOVING AVERAGE

f(a) => a[0] // fixes mutable error

iirma(iirlength, iirsrc) =>

cf = 2*tan(2*3.14159*(1/iirlength)/2)

a0 = 8 + 8*cf + 4*pow(cf,2) + pow(cf,3)

a1 = -24 - 8*cf + 4*pow(cf,2) + 3*pow(cf,3)

a2 = 24 - 8*cf - 4*pow(cf,2) + 3*pow(cf,3)

a3 = -8 + 8*cf - 4*pow(cf,2) + pow(cf,3)

//----

c = pow(cf,3)/a0

d0 = -a1/a0

d1 = -a2/a0

d2 = -a3/a0

//----

out = 0.

out := nz(c*(iirsrc + iirsrc[3]) + 3*c*(iirsrc[1] + iirsrc[2]) + d0*out[1] + d1*out[2] + d2*out[3],iirsrc)

f(out)

iirma1 = iirma(multiplier(iirRes, iirlength1), close)

iirma2 = iirma(multiplier(iirRes, iirlength2), close)

iirma3 = iirma(multiplier(iirRes, iirlength3), close)

// adjusts length for current resolution now, length is lengthened/shortened accordingly, upholding exact placement of lines

// iirmaD1 = security(syminfo.tickerid, tostring(iirRes), iirma1, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaD2 = security(syminfo.tickerid, tostring(iirRes), iirma2, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaD3 = security(syminfo.tickerid, tostring(iirRes), iirma3, barmerge.gaps_on, barmerge.lookahead_on)

slope1color = slope1Green ? color.lime : color.blue

slope2color = slope2Green ? color.lime : color.blue

slope3color = slope3Green ? color.lime : color.blue

plot(showIIR1 and showIIRs ? iirma1 : na, title="IIR1", color=slope1color, linewidth=2, transp=30)

plot(showIIR2 and showIIRs ? iirma2 : na, title="IIR2", color=slope2color, linewidth=3, transp=30)

plot(showIIR3 and showIIRs ? iirma3 : na, title="IIR3", color=slope3color, linewidth=4, transp=30)

// checks slope of IIRs to create a boolean variable and and color it differently

if (iirma1[0] >= iirma1[1])

slope1Green := true

else

slope1Green := false

if (iirma2[0] >= iirma2[1])

slope2Green := true

else

slope2Green := false

if (iirma3[0] >= iirma3[1])

slope3Green := true

else

slope3Green := false

// calculate space between IIRs and then if the price jumps above both

//float singlePercent = close / 100 // = a single percent

var float distIIR1 = na

var float distIIR2 = na

distIIR1 := abs(iirma1 - iirma2)

distIIR2 := abs(iirma1 - iirma3)

if (distIIR1[0] < percentClose*singlePercent and close[0] >= iirma1[0])

if close[0] >= iirma2[0] and close[0] >= iirma3[0]

bgcolor := color.green

insqueeze := true

intightsqueeze := true

else

bgcolor := color.lime

insqueeze := true

intightsqueeze := false

else

insqueeze := false

intightsqueeze := false

// if (true)//sinceSmSignal > 0) // cutting down on fastest MAs noise

// sinceSmSignal := sinceSmSignal + 1

// if (crossoverAB)

// //checkEntry()

// //smbuySignal := true

// sinceSmSignal := 0

// if (crossunderAB) // and all NOT greennot (slope1Green and slope2Green and slope3Green)

// //checkExit()

// //smsellSignal := true

// sinceSmSignal := 0

// else

// sinceSmSignal := sinceSmSignal + 1

f_draw_infopanel(_x, _y, _line, _text, _color)=>

_rep_text = ""

for _l = 0 to _line

_rep_text := _rep_text + "\n"

_rep_text := _rep_text + _text

var label _la = na

label.delete(_la)

_la := label.new(

x=_x, y=_y,

text=_rep_text, xloc=xloc.bar_time, yloc=yloc.price,

color=color.black, style=label.style_labelup, textcolor=_color, size=size.normal)

posx = timenow + round(change(time)*60)

posy = highest(50)

// CONSTRUCTION ZONE

// TODO: program way to eliminate noise and false signals

// MAYBEDO: program it to differentiate between a moving average bump and a cross

// I think the best way would be to calculate the tangent line... OR

// Take the slope of both going back a couple bars and if it's close enough, its a bounce off

// and an excellent entry signal

// program in quickest exit, 2 bars next to eachother both closing under, as to avoid a single wick from

// prompting to close the trade

// Some other time, have it move SMA up or down depending on whether trending up or down. Then use those MA crosses

//THIS CHECKS THE SLOPE FROM CURRENT PRICE TO BACK 10 BARS

checkSlope(_series) => (_series[0]/_series[10])*100 // it now returns it as a percentage

doNewX = input(true, type=input.bool, title="══════════ Show misc MA Cross Strategy ══════════")

iirX = input(555, title="IIRx Length: ", type=input.integer)

iirXperiod = input(30, title="IIRx Period/TF: ", type=input.integer)

iirX2 = input(13, title="IIRx2 Length: ", type=input.integer)

iirX2period = input(5, title="IIRx2 Period/TF: ", type=input.integer) //15

almaXperiod = input(defval=15, title="Alma of IIR1 Period: ", type=input.integer)

almaXalpha = input(title="Alma Alpha Value: ", defval=.7, maxval=.95, type=input.float) // dont forget to try .99

almaXsigma = input(title="Alma Sigma Value: ", defval=500, type=input.float)

iirmaOTF = iirma(multiplier(iirXperiod, iirX), close)

iirma2OTF = iirma(multiplier(iirX2period, iirX2), close)

smaOTF = alma(iirmaOTF, almaXperiod, almaXalpha, almaXsigma) // maybe dont touch, its precise // I took the ALMA of the IIRMA, and i hope thats not cheating ;)

// I could have removed this. the multiplier function adjusts the length to fit the current timeframe while displaying the same

// smaXOTF = security(syminfo.tickerid, smaXperiod, smaOTF, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaXOTF = security(syminfo.tickerid, iirXperiod, iirmaOTF, barmerge.gaps_on, barmerge.lookahead_on)

// iirmaX2OTF = security(syminfo.tickerid, iirX2period, iirma2OTF, barmerge.gaps_on, barmerge.lookahead_on)

plot(doNewX ? smaOTF : na, title="FastMA X-Over : ", color=color.blue, linewidth=1, transp=40)

plot(doNewX ? iirmaOTF : na, title="IIR MAx : ", color=color.purple, linewidth=1, transp=30)

plot(doNewX ? iirma2OTF : na, title="IIR MAx : ", color=color.purple, linewidth=2, transp=20)

iirma2Up = checkSlope(iirma2OTF) > 0 // just another slope up/down variable.

//calculate spaces between averages

distiiralma = abs(iirmaOTF - smaOTF)

crossoverFast = crossover(iirmaOTF, smaOTF) // and (iirmaOTF[1] <= smaOTF[1])

crossunderFast = crossunder(iirmaOTF, smaOTF) // and (iirmaOTF[1] >= smaOTF[1])

if (crossoverFast and iirma2Up == true and infastsqueeze == false and intightsqueeze == false) // and (count1 != 0))// or close[0] < (lowest(barLookbackPeriod) + singlePercent*3))) // must be at most a few percent up from a recent low. Avoid buying highs :P

buySignal := true

strategyOpen()

// if (slope1Green and slope2Green and slope3Green and infastsqueeze == false)

// checkEntry()

if (crossunderFast)

sellSignal := true

checkExit()

// I feel like I didn't cite the OG author for this panel correctly. I hope I did, but there are extentions of his/her work in multiple places.

// I could have gotten it confused.

if (debug)

f_draw_infopanel(posx, posy, 18, "distiiralma from IIR: " + tostring(distiiralma), color.lime)

//f_draw_infopanel(posx, posy, 16, "distiirs: " + tostring(distiirX1), color.lime)

f_draw_infopanel(posx, posy, 14, "Value of iirmaOTF: " + tostring(iirmaOTF), color.lime)

f_draw_infopanel(posx, posy, 6, "slope X: " + tostring(abs(100 - checkSlope(iirmaOTF))), color.lime)

f_draw_infopanel(posx, posy, 12, "value of smaOTF: " + tostring(smaOTF), color.lime)

f_draw_infopanel(posx, posy, 6, "slopeAlma: " + tostring(abs(100 - checkSlope(smaOTF))), color.lime)

f_draw_infopanel(posx, posy, 2, "slopeIIR2 " + tostring(abs(100 - checkSlope(iirma2OTF))), color.lime)

f_draw_infopanel(posx, posy, 2, "slopeIIR2 " + tostring(abs(100 - checkSlope(iirma2OTF))), color.lime)

// I kept this separate because it discludes the calculations. Its hard to hold a train of thought while fishing for the right section

bgcolor(showBackground ? bgcolor : na)

plotshape(showSignals ? buySignal : na, location=location.bottom, style=shape.circle, text="", size=size.tiny, color=color.blue, transp=60)

plotshape(showSignals ? sellSignal : na, location=location.bottom, style=shape.circle, text="", size=size.tiny, color=color.red, transp=60)

plotchar(showSignals and smbuySignal, title="smBuy", location=location.belowbar, char='↑', size=size.tiny, color=color.green, transp=0)

plotchar(showSignals and smsellSignal, title="smSell", location=location.abovebar, char='↓', size=size.tiny, color=color.orange, transp=0)

// can not display a variable. Can only match the count to a corresponding plotchar

// to display a non-constant variable, use the debug box, which was so kindly offered up by our community.

plotchar(showCounts and count1==1, title='', char='1', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==2, title='', char='2', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==3, title='', char='3', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==4, title='', char='4', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==5, title='', char='5', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==6, title='', char='6', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==7, title='', char='7', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==8, title='', char='8', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1==9, title='', char='9', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count1>=10, title='', char='$', location=location.belowbar, color=#2c9e2c, transp=0)

plotchar(showCounts and count2==1, title='', char='1', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==2, title='', char='2', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==3, title='', char='3', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==4, title='', char='4', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==5, title='', char='5', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==6, title='', char='6', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==7, title='', char='7', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==8, title='', char='8', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2==9, title='', char='9', location=location.abovebar, color=#e91e63, transp=0)

plotchar(showCounts and count2>=10, title='', char='$', location=location.abovebar, color=#e91e63, transp=0)

showRSIind = input(true, type=input.bool, title="═══════════════════ Show RSI Arrows ═══════════════════")

// Get user input

rsiSource = input(title="RSI Source", type=input.source, defval=close)

rsiLength = input(title="RSI Length", type=input.integer, defval=14)

rsiOverbought = input(title="RSI Overbought Level", type=input.integer, defval=80)

rsiOversold = input(title="RSI Oversold Level", type=input.integer, defval=20)

// Get RSI value

rsiValue = rsi(rsiSource, rsiLength)

isRsiOB = rsiValue >= rsiOverbought

isRsiOS = rsiValue <= rsiOversold

// Plot signals to chart

plotshape(isRsiOB, title="Overbought", location=location.abovebar, color=color.red, transp=0, style=shape.triangledown)

plotshape(isRsiOS, title="Oversold", location=location.belowbar, color=color.green, transp=0, style=shape.triangleup)

//reset the var variables before new calculations

buySignal := false

sellSignal := false

smbuySignal := false

smsellSignal := false

bigbuySignal := false

bigsellSignal := false

Detail

https://www.fmz.com/strategy/439763

Last Modified

2024-01-23 15:46:48