Name

欧玛与阿波罗双轨交易策略Oma-and-Apollo-Dual-Rail-Trading-Strategy

Author

ChaoZhang

Strategy Description

该策略结合了欧玛指标和阿波罗指标两个主流技术指标,实现了多空双轨交易。其基本思路是在中长线趋势判断为多头时,寻找短线价格回调入场机会建立多头;在中长线趋势判断为空头时,寻找短线价格反弹入场机会建立空头。

该策略使用50日、200日两条移动平均线来判断中长线趋势,50日线在200日线之上表明处于多头趋势,反之,为空头趋势。

接着,该策略使用欧玛指标来定位短线价格反转机会。欧玛指标包括%K线和%D线,分别是经过简单移动平均线平滑处理的RSI指标的结果。当%K线从超卖区(高于80)下行突破%D线时,表明价格从超买状态转为反弹下跌,是一个空头选择时机;当%K从超卖区(低于20)上行突破%D线时,表明价格从超卖区反弹上扬,是一个多头选择时机。

此外,为了进一步过滤误报机会,该策略还引入了阿波罗指标。阿波罗指标展现了K线%D值的极值点信息。当%K线形成新的低点时,意味着反弹力度较弱;当形成新的高点时,意味着反弹力度较强。结合欧玛指标的讯号,这可以进一步提升入场的准确性。

具体来说,在多头趋势中,该策略会在欧玛指标显示超卖区下穿形成多头机会时,同时检查新的高点信息,以确认反弹的力度;在空头趋势中,该策略会在欧玛指标显示超买区上穿形成空头机会时,同时检查新的低点信息,以确认反弹力度的弱化。

通过上述流程,该策略充分利用了中长线趋势判断和短线反转指标的优势,构建了一个稳定的多空双轨交易体系。

-

该策略结合趋势判断和反转指标,兼顾趋势交易和逆势交易的优点,形成稳定的混合交易框架。

-

通过双重指标过滤,可以减少误报比例,提高信号的可靠性。

-

策略参数较为简单,容易理解和优化,适合用于量化交易。

-

策略运行效果稳健,具有较好的胜率和盈亏比特征。

-

采用多空双轨方式,可以持续获得交易机会,不会局限在单一方向。

-

作为反转性质的策略,当趋势发生变化时,可能会产生一系列的连续亏损。

-

该策略对交易者情绪控制要求较高,需要承受一定回撤比例。

-

部分参数如移动平均线周期等存在一定主观性,需要通过回测优化确定合适参数。

-

欧玛指标和阿波罗指标均对异常波动具有一定敏感性,极端行情下可能出现失效。

-

该策略更适合动荡盘整的市场环境,在趋势明显的行情中效果可能会打折扣。

可以通过适当调整移动平均线周期引入趋势过滤,以及加入止损止盈策略来规避风险。当市场进入明显趋势时,可以考虑暂停策略,避开该环境交易。

-

测试不同的参数组合,以得到更佳的参数设置。例如可以尝试采用EWMA平滑移动平均等指标。

-

增加Volume或BV等指标来判断背离,可以进一步验证信号可靠性。

-

加入VIX等恐慌指数作为监控指标,在市场恐慌时降低仓位。

-

优化止损止盈策略,例如可采用ATR止损等动态止损方式。

-

引入机器学习算法来动态优化参数设置。

-

加入多因子模型来提升信号质量。

该策略总体来说是一个稳定高效的量化交易策略。它结合趋势判断和反转指标,采用欧玛指标和阿波罗指标的双重验证方式,能够有效发掘短线价格反转机会。相比单一使用趋势系统或反转系统,该策略形式更为稳健,回撤控制也更优异,是一个值得推荐的量化交易策略。当然,用户也需要注意防范其中存在的风险点,通过参数优化、止损止盈、环境识别等方式来控制风险,使策略达到最佳效果。

||

This strategy combines two mainstream technical indicators: the Oma indicator and the Apollo indicator to implement dual-rail trading of long and short positions. Its basic idea is to find short-term pullback opportunities when the medium-long term trend is judged to be bullish in order to establish long positions. When the medium-long term trend is judged to be bearish, it looks for opportunities in short-term rebounds to establish short positions.

This strategy uses 50-day and 200-day moving averages to determine the medium-long term trend. The 50-day line above the 200-day line indicates a bullish trend, and vice versa for a bearish trend.

Next, the strategy uses the Oma indicator to locate short-term price reversal opportunities. The Oma indicator includes %K and %D lines, which are the results of the RSI indicator smoothed by a simple moving average. When %K breaks below %D from the overbought area (above 80), it indicates the price is turning from an overbought state to a pullback down; when %K breaks above %D from the oversold area (below 20), it indicates the price is rebounding up from the oversold area, which presents a long opportunity.

In addition, to further filter false signals, this strategy also incorporates the Apollo indicator. The Apollo indicator displays the extreme points of the %D values of the K line. When %K forms a new low, it means the rebound strength is relatively weak. When it forms a new high, it means the rebound strength is relatively strong. Combined with the signals from the Oma indicator, this can further improve the accuracy of entry.

Specifically, in an uptrend, this strategy will check the new high point information at the same time when the Oma indicator shows an opportunity below the overbought area, to confirm the strength of the bounce. In a downtrend, when the Oma indicator shows a short opportunity crossing up from the oversold area, this strategy will check the new low point information at the same time to confirm the weakening of the rebound strength.

Through the above process, this strategy takes full advantage of the strengths of medium-long term trend judgment and short-term reversal indicators to build a steady dual-rail trading system.

-

The strategy combines trend trading and countertrend trading by using both trend judgment and reversal indicators, forming a stable hybrid trading framework.

-

By double indicator filtering, the false signal ratio can be reduced and the reliability of signals improved.

-

The strategy parameters are relatively simple, easy to understand and optimize, suitable for quantitative trading.

-

The performance of the strategy is robust, with good win rate and risk-reward ratio characteristics.

-

By adopting dual rails for long and short, trading opportunities can be obtained continuously without being limited to a single direction.

-

As a reversal strategy, consecutive losses may occur when the trend changes.

-

The strategy requires relatively high emotional control from the trader, who needs to withstand a certain level of drawdown.

-

Some parameters such as moving average periods involve a certain subjectivity and need to be determined through backtesting and optimization.

-

Both the Oma and Apollo indicators have some sensitivity to abnormal fluctuations, and may fail in extreme market conditions.

-

This strategy is more suitable for range-bound volatile markets, and may underperform in strong trending markets.

Risks can be mitigated by appropriately adjusting the moving average period to introduce trend filtering, and adding stop loss/take profit. When the market becomes strongly trending, consider suspending the strategy to avoid trading in that environment.

-

Test different parameter combinations to obtain better parameter settings, e.g. using EWMA smoothing moving averages.

-

Add Volume or BV indicators to judge divergence which can help verify signal reliability.

-

Add volatility indices like VIX as monitoring indicators, to reduce position size when the market is in panic.

-

Optimize stop loss/take profit strategies, such as adopting dynamic ATR stop loss.

-

Introduce machine learning algorithms to dynamically optimize parameter settings.

-

Add multifactor models to improve signal quality.

Overall, this is a stable and efficient quantitative trading strategy. It combines trend judgment and reversal indicators, and adopts dual verification using the Oma and Apollo indicators, which can effectively uncover short-term price reversal opportunities. Compared to using purely trend or reversal systems, this strategy form is more robust with superior drawdown control, and is a recommended quantitative trading strategy. Of course, users also need to be aware of the risks involved, and use parameter optimization, stop loss/take profit, market regime identification etc. to control risks and achieve the best performance.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 2011 | (?Backtesting window)Start Year |

| v_input_int_1 | true | Start Month |

| v_input_int_2 | true | Start Day |

| v_input_2 | 2050 | Finish Year |

| v_input_int_3 | 12 | Finish Month |

| v_input_int_4 | 31 | Finish Day |

| v_input_int_5 | 50 | (?EMA)EMA Length 1 |

| v_input_int_6 | 200 | EMA Length 2 |

| v_input_int_7 | 3 | (?Stochastic RSI)K |

| v_input_int_8 | 3 | D |

| v_input_int_9 | 14 | RSI Length |

| v_input_int_10 | 14 | Stochastic Length |

| v_input_int_11 | 14 | (?ATR Stoploss Finder)Length |

| v_input_string_1 | 0 | Smoothing: EMA |

| v_input_float_1 | 0.7 | Multiplier |

| v_input_3_high | 0 | Source for upper band: high |

| v_input_4_low | 0 | Source for lower band: low |

| v_input_bool_1 | true | Show ATR Bands |

| v_input_color_1 | purple | Long ATR SL |

| v_input_color_2 | purple | Short ATR SL |

| v_input_float_2 | 2 | (?Profit Target)Reward to Risk ratio (X times SL) |

Source (PineScript)

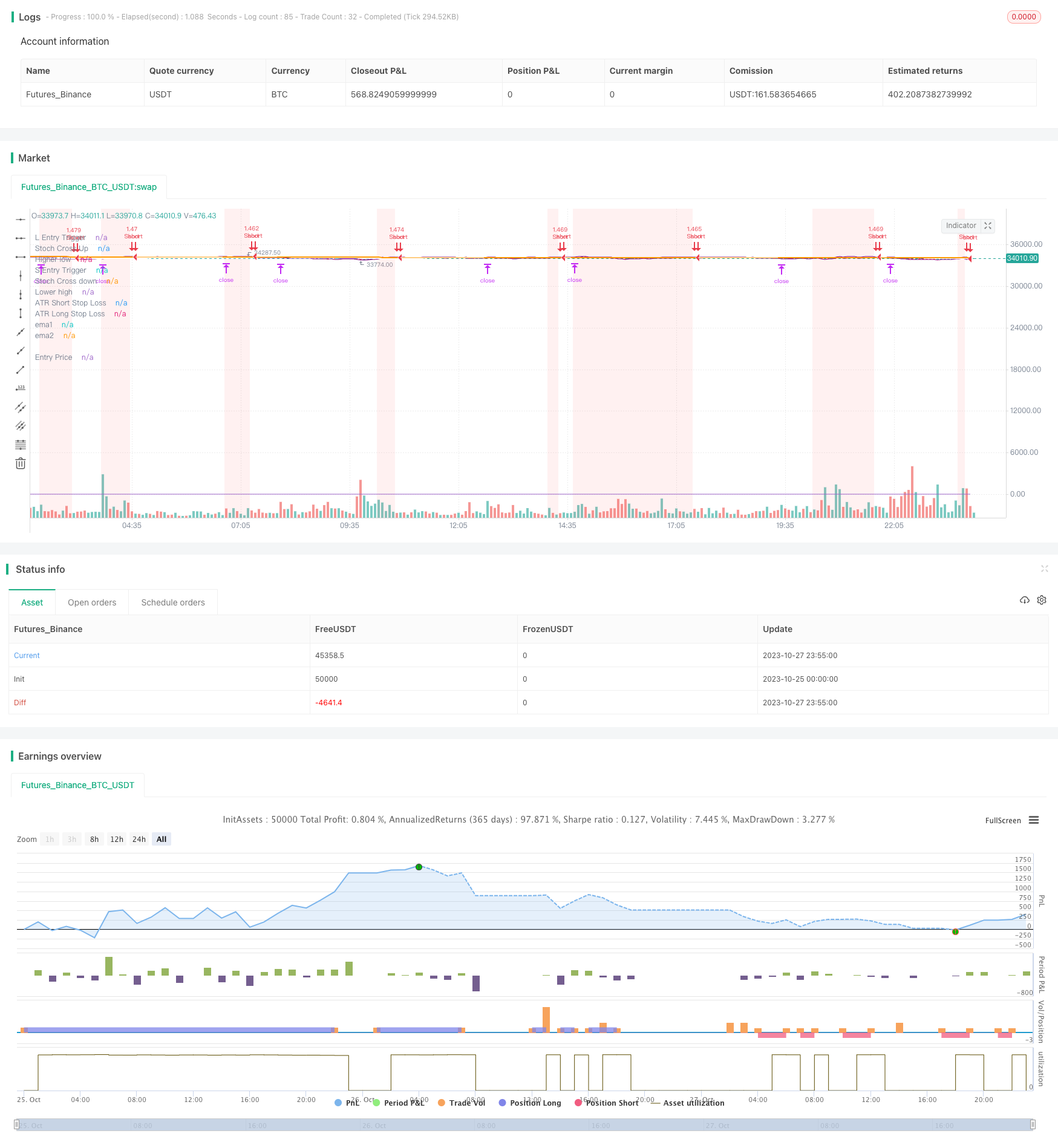

/*backtest

start: 2023-10-25 00:00:00

end: 2023-10-28 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PtGambler

//@version=5

strategy("2 EMA + Stoch RSI + ATR [Pt]", shorttitle = "2EMA+Stoch+ATR", overlay=true, initial_capital = 10000, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills = false, max_bars_back = 500)

// ********************************** Trade Period / Strategy Setting **************************************

startY = input(title='Start Year', defval=2011, group = "Backtesting window")

startM = input.int(title='Start Month', defval=1, minval=1, maxval=12, group = "Backtesting window")

startD = input.int(title='Start Day', defval=1, minval=1, maxval=31, group = "Backtesting window")

finishY = input(title='Finish Year', defval=2050, group = "Backtesting window")

finishM = input.int(title='Finish Month', defval=12, minval=1, maxval=12, group = "Backtesting window")

finishD = input.int(title='Finish Day', defval=31, minval=1, maxval=31, group = "Backtesting window")

timestart = timestamp(startY, startM, startD, 00, 00)

timefinish = timestamp(finishY, finishM, finishD, 23, 59)

// ******************************************************************************************

group_ema = "EMA"

group_stoch = "Stochastic RSI"

group_atr = "ATR Stoploss Finder"

// ----------------------------------------- 2 EMA -------------------------------------

ema1_len = input.int(50, "EMA Length 1", group = group_ema)

ema2_len = input.int(200, "EMA Length 2", group = group_ema)

ema1 = ta.ema(close, ema1_len)

ema2 = ta.ema(close, ema2_len)

plot(ema1, "ema1", color.white, linewidth = 2)

plot(ema2, "ema2", color.orange, linewidth = 2)

ema_bull = ema1 > ema2

ema_bear = ema1 < ema2

// -------------------------------------- Stochastic RSI -----------------------------

smoothK = input.int(3, "K", minval=1, group = group_stoch)

smoothD = input.int(3, "D", minval=1, group = group_stoch)

lengthRSI = input.int(14, "RSI Length", minval=1, group = group_stoch)

lengthStoch = input.int(14, "Stochastic Length", minval=1, group = group_stoch)

src = close

rsi1 = ta.rsi(src, lengthRSI)

k = ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = ta.sma(k, smoothD)

var trigger_stoch_OB = k > 80

var trigger_stoch_OS = k < 20

stoch_crossdown = ta.crossunder(k, d)

stoch_crossup = ta.crossover(k, d)

P_hi = ta.pivothigh(k,1,1)

P_lo = ta.pivotlow(k,1,1)

previous_high = ta.valuewhen(P_hi, k, 1)

previous_low = ta.valuewhen(P_lo, k, 1)

recent_high = ta.valuewhen(P_hi, k, 0)

recent_low = ta.valuewhen(P_lo, k, 0)

// --------------------------------------- ATR stop loss finder ------------------------

length = input.int(title='Length', defval=14, minval=1, group = group_atr)

smoothing = input.string(title='Smoothing', defval='EMA', options=['RMA', 'SMA', 'EMA', 'WMA'], group = group_atr)

m = input.float(0.7, 'Multiplier', step = 0.1, group = group_atr)

src1 = input(high, "Source for upper band", group = group_atr)

src2 = input(low, "Source for lower band", group = group_atr)

showatr = input.bool(true, 'Show ATR Bands', group = group_atr)

collong = input.color(color.purple, 'Long ATR SL', inline='1', group = group_atr)

colshort = input.color(color.purple, 'Short ATR SL', inline='2', group = group_atr)

ma_function(source, length) =>

if smoothing == 'RMA'

ta.rma(source, length)

else

if smoothing == 'SMA'

ta.sma(source, length)

else

if smoothing == 'EMA'

ta.ema(source, length)

else

ta.wma(source, length)

a = ma_function(ta.tr(true), length) * m

up = ma_function(ta.tr(true), length) * m + src1

down = src2 - ma_function(ta.tr(true), length) * m

p1 = plot(showatr ? up : na, title='ATR Short Stop Loss', color=colshort)

p2 = plot(showatr ? down : na, title='ATR Long Stop Loss', color=collong)

// ******************************* Profit Target / Stop Loss *********************************************

RR = input.float(2.0, "Reward to Risk ratio (X times SL)", step = 0.1, group = "Profit Target")

var L_PT = 0.0

var S_PT = 0.0

var L_SL = 0.0

var S_SL = 0.0

BSLE = ta.barssince(strategy.opentrades.entry_bar_index(0) == bar_index)

if strategy.position_size > 0 and BSLE == 1

L_PT := close + (close-down)*RR

L_SL := L_SL[1]

S_PT := close - (up - close)*RR

S_SL := up

else if strategy.position_size < 0 and BSLE == 1

S_PT := close - (up - close)*RR

S_SL := S_SL[1]

L_PT := close + (close-down)*RR

L_SL := down

else if strategy.position_size != 0

L_PT := L_PT[1]

S_PT := S_PT[1]

else

L_PT := close + (close-down)*RR

L_SL := down

S_PT := close - (up - close)*RR

S_SL := up

entry_line = plot(strategy.position_size != 0 ? strategy.opentrades.entry_price(0) : na, "Entry Price", color.white, linewidth = 1, style = plot.style_linebr)

L_PT_line = plot(strategy.position_size > 0 and BSLE > 0 ? L_PT : na, "L PT", color.green, linewidth = 2, style = plot.style_linebr)

S_PT_line = plot(strategy.position_size < 0 and BSLE > 0 ? S_PT : na, "S PT", color.green, linewidth = 2, style = plot.style_linebr)

L_SL_line = plot(strategy.position_size > 0 and BSLE > 0 ? L_SL : na, "L SL", color.red, linewidth = 2, style = plot.style_linebr)

S_SL_line = plot(strategy.position_size < 0 and BSLE > 0 ? S_SL : na, "S SL", color.red, linewidth = 2, style = plot.style_linebr)

fill(L_PT_line, entry_line, color = color.new(color.green,90))

fill(S_PT_line, entry_line, color = color.new(color.green,90))

fill(L_SL_line, entry_line, color = color.new(color.red,90))

fill(S_SL_line, entry_line, color = color.new(color.red,90))

// ---------------------------------- strategy setup ------------------------------------------------------

var L_entry_trigger1 = false

var S_entry_trigger1 = false

L_entry_trigger1 := ema_bull and close < ema1 and k < 20 and strategy.position_size == 0

S_entry_trigger1 := ema_bear and close > ema1 and k > 80 and strategy.position_size == 0

L_entry1 = L_entry_trigger1[1] and stoch_crossup and recent_low > previous_low

S_entry1 = S_entry_trigger1[1] and stoch_crossdown and recent_high < previous_high

//debugging

plot(L_entry_trigger1[1]?1:0, "L Entry Trigger")

plot(stoch_crossup?1:0, "Stoch Cross Up")

plot(recent_low > previous_low?1:0, "Higher low")

plot(S_entry_trigger1[1]?1:0, "S Entry Trigger")

plot(stoch_crossdown?1:0, "Stoch Cross down")

plot(recent_high < previous_high?1:0, "Lower high")

if L_entry1

strategy.entry("Long", strategy.long)

if S_entry1

strategy.entry("Short", strategy.short)

strategy.exit("Exit Long", "Long", limit = L_PT, stop = L_SL, comment_profit = "Exit Long, PT hit", comment_loss = "Exit Long, SL hit")

strategy.exit("Exit Short", "Short", limit = S_PT, stop = S_SL, comment_profit = "Exit Short, PT hit", comment_loss = "Exit Short, SL hit")

//resetting triggers

L_entry_trigger1 := L_entry_trigger1[1] ? L_entry1 or ema_bear or S_entry1 ? false : true : L_entry_trigger1

S_entry_trigger1 := S_entry_trigger1[1] ? S_entry1 or ema_bull or L_entry1 ? false : true : S_entry_trigger1

//Trigger zones

bgcolor(L_entry_trigger1 ? color.new(color.green ,90) : na)

bgcolor(S_entry_trigger1 ? color.new(color.red,90) : na)

Detail

https://www.fmz.com/strategy/430898

Last Modified

2023-11-02 17:09:35