Name

玫瑰十字星双重指标波动策略Rose-Cross-Star-Dual-Indicator-Volatility-Strategy

Author

ChaoZhang

Strategy Description

[trans]

该策略通过运用布林带和修改版相对强弱指标的组合指标,识别价格突破进行交易。测试结果显示,该策略整体盈利良好,胜率较高。它能在趋势行情中捕捉突破信号,适合短线和中线交易。

该策略使用标准差乘数为2的布林带及周期设置为14的RSI指标。布林带能识别价格突破,RSI则用于判断超买超卖状态。指标参数设置基于经验和反复测试结果。

-

当价格突破布林带下轨且RSI低于30(超卖区)时,做多入场。

-

当价格突破布林带上轨且RSI高于70(超买区)时,做空入场。

-

多单止损或价格跌破布林带上轨时平仓。

-

空单止损或价格涨破布林带下轨时平仓。

-

双指标组合,提高策略精确性。

-

指标参数经优化,具有较强适应性。

-

突破操作清晰易行,不容易错过信号。

-

回撤和亏损控制良好。

-

可视化信号提示,操作方便。

-

布林带缩量可能导致假突破。可以适当延长布林带周期。

-

震荡行情中可能出现频繁交易。可以调整RSI参数降低敏感度。

-

需关注交易成本控制。适当放宽止损幅度。

-

可以测试EMA等指标代替SMA生成布林带。

-

可以加入交易量或均量指标过滤假突破。

-

可以基于ATR设定布林带和止损距离。

-

可以加入趋势判断指标,避免震荡行情过度交易。

该策略整合布林带和RSI双重指标优势,在趋势和突破两方面具有出色表现。它操作简单,容易实施,非常适合中短线突破交易。通过指标和参数优化,可以进一步扩展该策略的适用性。

||

This strategy identifies trading opportunities through combining Bollinger Bands and a modified Relative Strength Index (RSI). Backtest results demonstrate its overall profitability and high winning rate. It captures breakout signals in trending markets and suits short-term to medium-term trading.

The strategy utilizes Bollinger Bands with a standard deviation multiplier of 2 and RSI with a period of 14. Bollinger Bands detect breakouts and RSI determines overbought/oversold levels. Indicator parameters are set based on experience and iterative testing.

-

Go long when price breaks above the lower Bollinger Band and RSI is below 30 (oversold zone).

-

Go short when price breaks below the upper Bollinger Band and RSI is above 70 (overbought zone).

-

Close long positions on a stop loss or when price breaks below the upper Bollinger Band.

-

Close short positions on a stop loss or when price breaks above the lower Bollinger Band.

-

Dual indicator combination improves strategy precision.

-

Optimized indicator parameters provide robust adaptability.

-

Breakout signals are clear and easy to implement.

-

Effective drawdown and loss control.

-

Visual signals simplify trade execution.

-

Band squeeze may cause false breakouts. Consider longer Bollinger periods.

-

Frequent trading possible in range-bound markets. Lower RSI sensitivity.

-

Manage transaction costs. Widen stop distances.

-

Test EMA and other indicators to generate bands.

-

Add volume or MA filters to avoid false breaks.

-

Set band and stop distances based on ATR.

-

Add trend filter to reduce whipsaws.

This strategy combines the strengths of Bollinger Bands and RSI for trend and breakout trading. Simple to implement, it is well-suited for short to medium-term breakouts. Extensions through indicator and parameter optimization can further expand its robustness.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 20 | Longitud |

| v_input_2 | 2 | mult |

Source (PineScript)

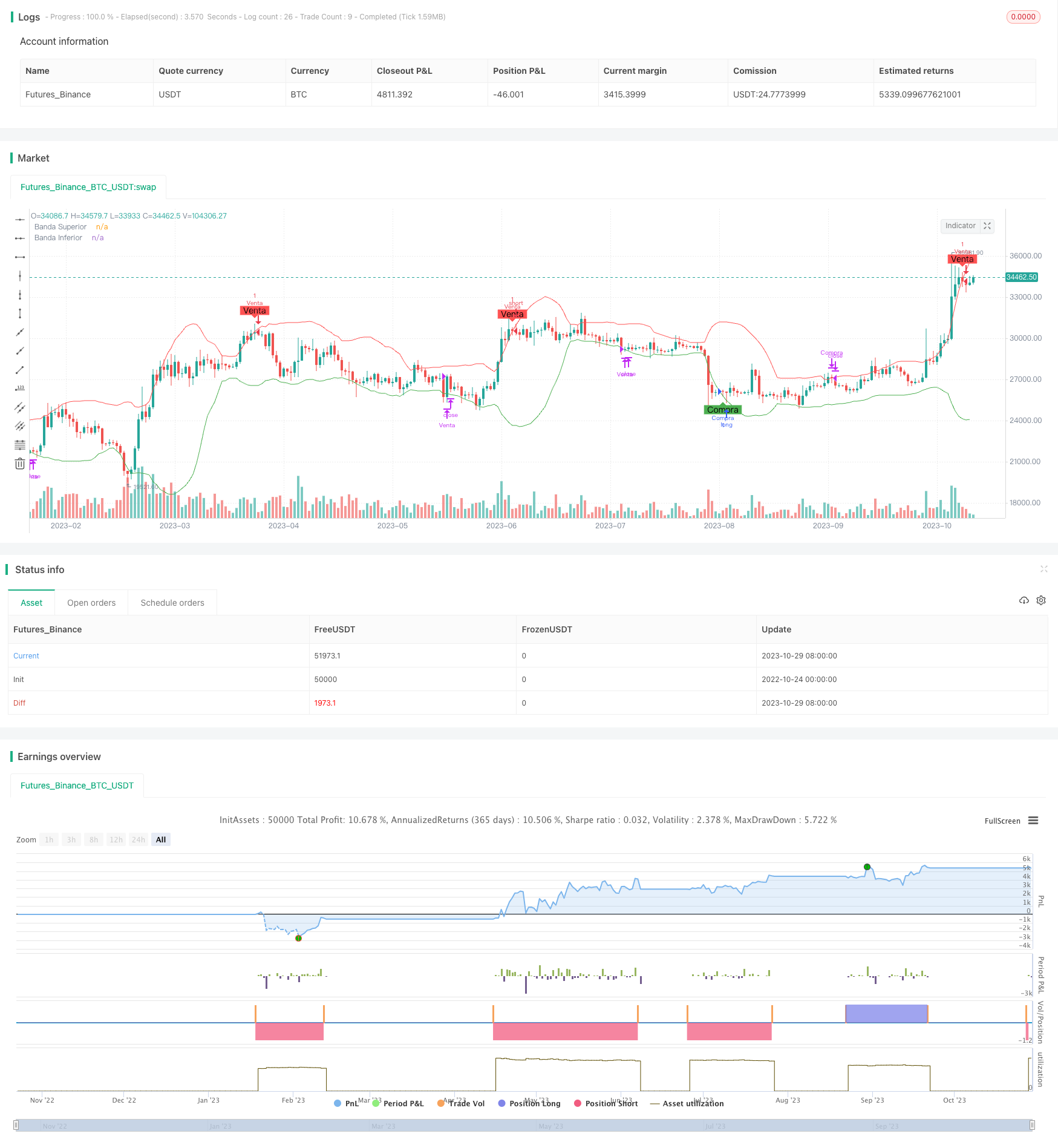

/*backtest

start: 2022-10-24 00:00:00

end: 2023-10-30 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Estrategia de Ruptura con Bollinger y RSI Modificada", shorttitle="BB RSI Mod", overlay=true)

// Parámetros de Bollinger Bands

src = close

length = input(20, title="Longitud", minval=1)

mult = input(2.0)

basis = sma(src, length)

upper = basis + mult * stdev(src, length)

lower = basis - mult * stdev(src, length)

// Parámetros del RSI

rsiSource = rsi(close, 14)

overbought = 70

oversold = 30

longCondition = crossover(src, lower) and rsiSource < oversold

shortCondition = crossunder(src, upper) and rsiSource > overbought

longExit = crossunder(src, upper)

shortExit = crossover(src, lower)

if (longCondition)

strategy.entry("Compra", strategy.long, stop=low)

if (shortCondition)

strategy.entry("Venta", strategy.short, stop=high)

if (longExit)

strategy.close("Compra")

if (shortExit)

strategy.close("Venta")

// Visualización

plotshape(series=longCondition, title="Compra", location=location.belowbar, color=color.green, style=shape.labelup, text="Compra")

plotshape(series=shortCondition, title="Venta", location=location.abovebar, color=color.red, style=shape.labeldown, text="Venta")

plot(upper, "Banda Superior", color=color.red)

plot(lower, "Banda Inferior", color=color.green)

Detail

https://www.fmz.com/strategy/430692

Last Modified

2023-10-31 17:33:10