Name

移动平均线交叉策略Simple-Moving-Average-Crossover-Strategy

Author

ChaoZhang

Strategy Description

移动平均线交叉策略是一种基于两个移动平均线(快速移动平均线和慢速移动平均线)交叉的交易策略。当快速移动平均线向上突破慢速移动平均线时,采取长仓(买入)的操作。反之,当快速移动平均线向下跌破慢速移动平均线时,平掉之前的多头仓位。

该策略使用两个移动平均线。一个是短期的快速移动平均线,一个是长期的慢速移动平均线。快速移动平均线能更快地响应价格变化,慢速移动平均线过滤掉短期波动,更能反映长期趋势。当快速移动平均线上穿慢速移动平均线时,表示短期价格开始向上,属于金叉信号,做多;当快速移动平均线下穿慢速移动平均线时,表示短期价格开始向下,属于死叉信号,平仓。

- 实现简单,容易理解,参数较少,不易过拟合;

- 移动平均线指标平滑价格,有一定的预测能力,避免被噪声误导;

- 策略回撤较小,最大回撤不会太大;

- 适用于大部分行情,特别是趋势性行情;

- 在盘整行情中容易产生错误信号;

- 移动平均线指标具有滞后性,可能错过趋势的最佳入场和出场点;

- 无止损设置,可能造成较大亏损;

- 参数设置不当可能导致策略效果不佳;

可以设置止损来控制风险。选择合适的参数可以提高策略效果。

- 测试不同长度的移动平均线组合,找到最优参数;

- 加入其他技术指标进行过滤,提高信号质量;

- 设置动态止损来控制风险;

- 结合波动率指标优化入场和出场;

- 优化资金管理,设置头寸规模;

移动平均线交叉策略总的来说是一种简单实用的趋势跟踪策略。它利用移动平均线的指示作用识别价格趋势的变化。优点是实现简单,容易理解,回撤较小。缺点是可能产生错误信号,具有滞后性。通过参数优化、止损设置以及与其他指标组合使用,可以获得更好的策略效果。

||

The Simple Moving Average Crossover strategy is based on the crossover of two moving averages, a faster moving average (fast MA) and a slower moving average (slow MA). It goes long (buys) when the fast MA crosses above the slow MA, and closes the long position when the fast MA crosses below the slow MA.

The strategy uses two moving averages. One is a short-term fast MA that responds quickly to price changes. The other is a long-term slow MA that filters out short-term fluctuations and reflects long-term trends better. When the fast MA crosses above the slow MA, it signals an upward trend in the short-term and is considered a golden cross buy signal. When the fast MA crosses below the slow MA, it signals a short-term downward trend and is considered a death cross sell signal.

- Simple to implement and easy to understand with few parameters and less prone to overfitting.

- Moving averages smooth price fluctuations and have some predictive abilities to avoid being misled by noise.

- Relatively small drawdowns, maximum drawdown won't be too large.

- Works well across most market conditions, especially trending markets.

- Prone to generating false signals during range-bound markets.

- Moving averages have lag and may miss the optimal entry and exit points of trends.

- No stop loss setting may lead to large losses.

- Improper parameter tuning affects strategy performance.

Risks can be controlled by setting stop loss. Choosing proper parameters can improve strategy performance.

- Test different MA length combinations to find optimal parameters.

- Add other technical indicators for filtration and signal quality improvement.

- Set dynamic stop loss to control risks.

- Incorporate volatility metrics to optimize entries and exits.

- Optimize position sizing and money management.

In summary, the Simple Moving Average Crossover is a simple and practical trend following strategy. It identifies trend changes using the indicator properties of moving averages. The main advantages are easy implementation, understandability, and relatively small drawdowns. The main disadvantages are potential false signals, lagging nature. The strategy can be improved further through parameter optimization, stop loss setting, and combining with other indicators.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 10 | Fast MA Length |

| v_input_2 | 30 | Slow MA Length |

| v_input_3 | true | Stop Loss Percentage |

Source (PineScript)

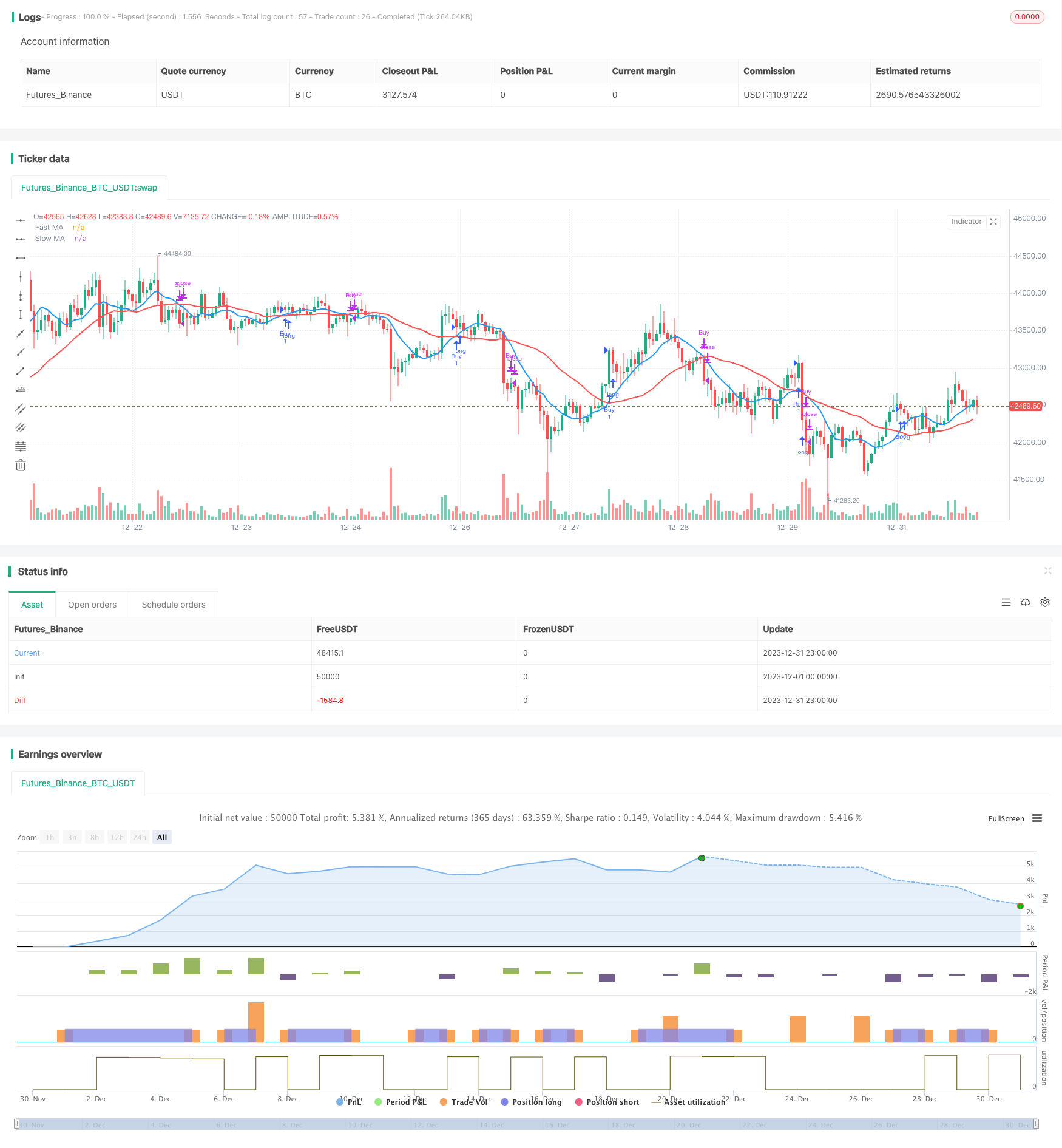

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Simple Moving Average Crossover", overlay=true)

// Input parameters

fastLength = input(10, title="Fast MA Length")

slowLength = input(30, title="Slow MA Length")

stopLossPercent = input(1, title="Stop Loss Percentage")

// Calculate moving averages

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Buy condition: Fast MA crosses above Slow MA

buyCondition = ta.crossover(fastMA, slowMA)

// Sell condition: Fast MA crosses below Slow MA

sellCondition = ta.crossunder(fastMA, slowMA)

// Plot moving averages as lines

plot(fastMA, color=color.blue, title="Fast MA", linewidth=2)

plot(slowMA, color=color.red, title="Slow MA", linewidth=2)

// Execute trades based on conditions

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.close("Buy")

// Set stop loss level

stopLossLevel = close * (1 - stopLossPercent / 100)

strategy.exit("Sell", from_entry="Buy", loss=stopLossLevel)

Detail

https://www.fmz.com/strategy/440436

Last Modified

2024-01-30 15:39:39