Name

移动平均线的趋势跟踪策略trend-following-strategy-based-on-moving-averages

Author

ChaoZhang

Strategy Description

双均线交叉策略是一种基于移动平均线的趋势跟踪策略。该策略通过计算不同周期的均线,判断市场趋势方向,以发出买入和卖出信号。本策略采用快速均线和慢速均线交叉形成交易信号。当快线上穿慢线时,采取看涨立场买入;当快线下穿慢线时,采取看跌立场卖出。

本策略主要依靠均线交叉形成交易信号。具体来说,策略包含以下几个步骤:

-

计算快速均线和慢速均线。快速均线周期为10,慢速均线周期为50。

-

判断均线关系。当快速均线上穿慢速均线时,产生买入信号;当快速均线下穿慢速均线时,产生卖出信号。

-

发出买入卖出信号。产生买入信号时,进入多头仓位;产生卖出信号时,进入空头仓位。

-

设置止损止盈。交易入场后,根据输入的止损百分比设置止损位和止盈位,实现风险控制。

该策略通过比较不同时间周期价格趋势的变化,来判断市场目前处于上升趋势还是下降趋势,属于典型的趋势跟踪策略。由于均线能过滤市场噪音,使得交易信号更加可靠。

- 利用均线的趋势跟踪特性,能够有效捕捉中长线趋势。

- 均线交叉信号简单清晰,容易执行。

- 可自定义快线和慢线的周期,优化参数组合。

- 采用止损止盈方式,可以限制个别订单的损失。

- 当市场处于震荡态势时,容易产生频繁的交易信号,造成过度交易。

- 均线具有滞后性,可能错过短线机会。

- 未考虑突发事件的影响,如重大利空消息。

- 没有设置资金管理机制,容易造成超出风险承受能力的损失。

风险控制措施:

- 优化均线周期,减少震荡市场下的虚假信号。

- 结合其他指标作为过滤条件,避免均线滞后问题。

- 增加消息面分析作为辅助。

- 设置止损与持仓规模控制,控制单笔损失。

-

可考虑将均线系统与其他分析工具组合使用,如通道、形态等,提高交易信号质量。

-

优化快线和慢线的参数,寻找最佳组合。一般快线周期在10到30天之间,慢线周期在20到120天之间会较好。

-

增加仓位管理机制。如采用固定比例递增法,能够在趋势中获得较优利润。

-

增加对突发事件的判断。重大利空消息发布时可考虑暂停交易,避免异常大亏损。

-

进行回测与模拟交易,评估策略表现,不断改进策略系统。

双均线交叉策略通过比较快速均线和慢速均线的交叉情况,判断市场目前的趋势方向,属于简单实用的趋势跟踪策略。该策略优点是交易信号清晰、易于实现,但也存在一些局限性。我们可以通过参数优化、增加过滤条件、组合其他工具等方法来改进该策略,在控制风险的前提下获得更好的回报。

||

The dual moving average crossover strategy is a trend-following strategy based on moving averages. It generates trading signals by calculating moving averages of different periods and identifying crossovers. This strategy uses a fast moving average and a slow moving average to form signals. When the fast MA crosses above the slow MA, it takes a bullish stance and buys. When the fast MA crosses below the slow MA, it takes a bearish stance and sells.

This strategy mainly relies on MA crossovers to generate trading signals. Specifically, it involves the following steps:

-

Calculate the fast MA and slow MA. The fast MA period is 10, and the slow MA period is 50.

-

Identify MA relationships. A buy signal is generated when the fast MA crosses above the slow MA. A sell signal is generated when the fast MA crosses below the slow MA.

-

Issue buy and sell signals. Go long when a buy signal occurs. Go short when a sell signal occurs.

-

Set stop loss and take profit. After entering a trade, set the stop loss based on the input percentage and take profit to manage risks.

By comparing price trend changes across different timeframes, this strategy determines whether the market is currently in an uptrend or downtrend. It is a typical trend-following strategy. MAs filter out market noise and generate more reliable trading signals.

-

Effectively captures mid to long-term trends using the inherent trend-following nature of MAs.

-

Simple and clear crossover signals that are easy to implement.

-

Customizable fast and slow periods for parameter optimization.

-

Limits losses on individual trades through stop loss.

-

Prone to whipsaws and overtrading in range-bound markets.

-

MAs have lag and may miss short-term opportunities.

-

Does not account for sudden events like significant bearish news.

-

Lacks risk management mechanisms and could lead to losses beyond risk tolerance.

Risk Management:

-

Optimize MA periods to reduce false signals during consolidations.

-

Add other indicators as filters to address MA lag.

-

Supplement with news analytics.

-

Implement stop loss and position sizing to limit losses.

-

Combine with other analytical tools like channels and patterns to improve signal quality.

-

Optimize fast and slow MA parameters to find best combinations. 10-30 days for fast MA and 20-120 days for slow MA often work well.

-

Add position sizing rules. Fixed fractional position sizing can improve profits in trends.

-

Incorporate logic to handle sudden events like halting trading after major bearish news.

-

Backtest and paper trade to evaluate performance and continuously improve the system.

The dual moving average crossover strategy identifies trend direction by comparing fast and slow MA crossovers. It is a simple and practical trend-following approach. While effective, it has some limitations that can be addressed through optimizations like parameter tuning, adding filters, and incorporating other tools. With appropriate risk control, this strategy can provide good returns.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 10 | Fast MA Length |

| v_input_2 | 50 | Slow MA Length |

| v_input_3 | true | Stop Loss Percentage |

Source (PineScript)

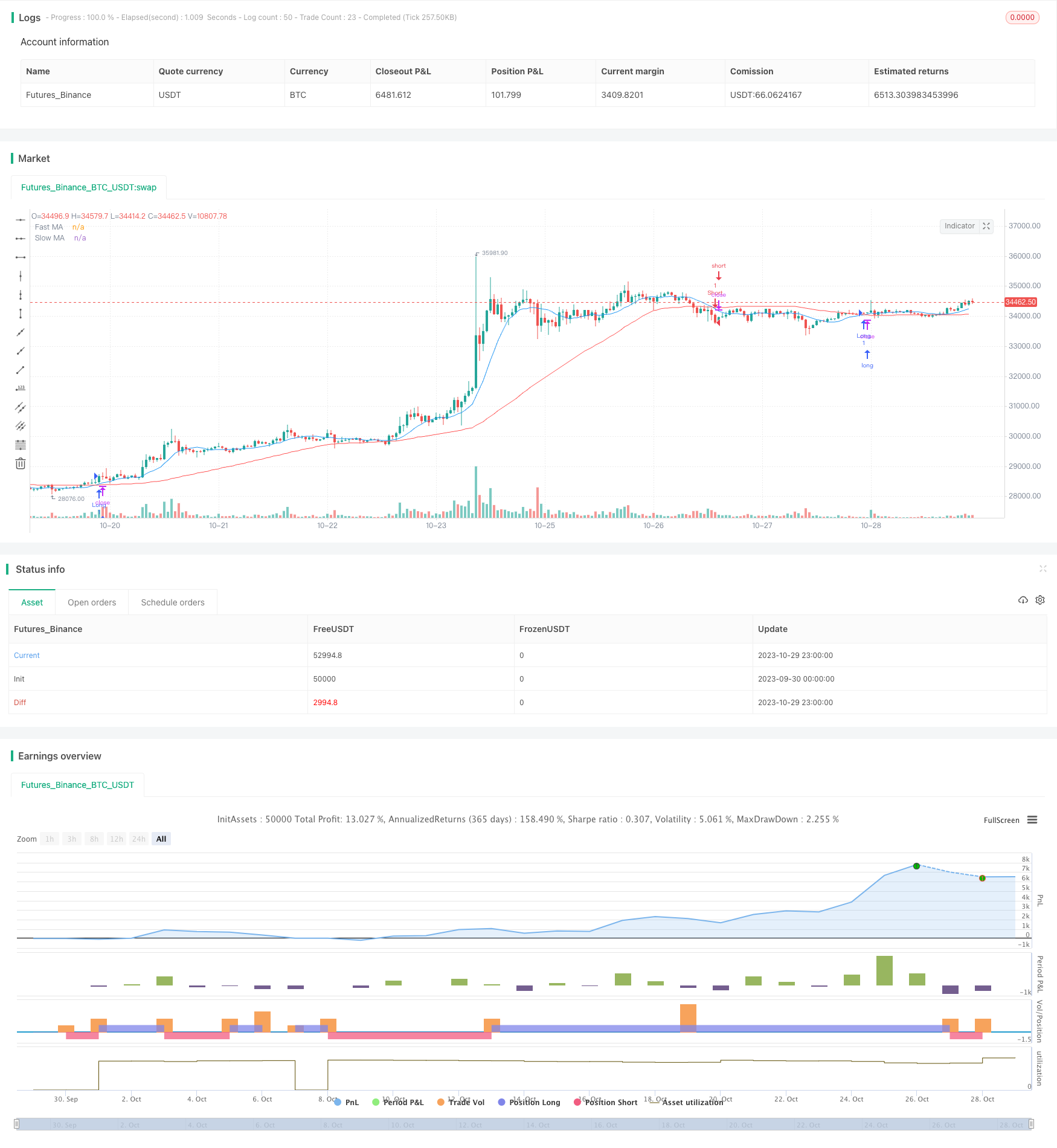

/*backtest

start: 2023-09-30 00:00:00

end: 2023-10-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Simple Moving Average Crossover", overlay=true)

// Input parameters

fast_length = input(10, title="Fast MA Length")

slow_length = input(50, title="Slow MA Length")

stop_loss_pct = input(1, title="Stop Loss Percentage", minval=0, maxval=5) / 100

// Calculate moving averages

fast_ma = sma(close, fast_length)

slow_ma = sma(close, slow_length)

// Plot moving averages

plot(fast_ma, color=color.blue, title="Fast MA")

plot(slow_ma, color=color.red, title="Slow MA")

// Strategy logic

long_condition = crossover(fast_ma, slow_ma)

short_condition = crossunder(fast_ma, slow_ma)

// Execute trades

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

// Set stop loss

long_stop_price = close * (1 - stop_loss_pct)

short_stop_price = close * (1 + stop_loss_pct)

strategy.exit("Stop Loss/Profit", from_entry="Long", stop=long_stop_price)

strategy.exit("Stop Loss/Profit", from_entry="Short", stop=short_stop_price)

Detail

https://www.fmz.com/strategy/430658

Last Modified

2023-10-31 14:00:47