Name

移动平均envelop通道趋势跟踪策略Moving-Average-Envelop-Channel-Trend-Following-Strategy

Author

ChaoZhang

Strategy Description

[trans]

移动平均envelop通道趋势跟踪策略是一个基于移动平均线和通道指标的趋势跟踪策略。它通过建立多层移动平均线通道,实现对价格趋势的判断和跟踪。该策略同时结合不同时间周期的移动平均线计算,实现了多时间框架的融合,有助于Capture更大的趋势。

该策略的核心原理基于移动平均线的趋势跟踪功能以及Envelop指标的通道判断。策略使用可配置的移动平均线周期、平滑类型、价格源等参数构建基准移动平均线。然后根据参数设定的百分比shift值,建立上下通道。当价格突破下通道时,做多;当价格突破上通道时,做空。同时,策略引入独立的移动平均线作为止损线。

具体来说,该策略具有以下特点:

1.同时支持做多和做空操作,通过上下通道判断趋势方向。

2.最多可开4张单,通过折线分层实现金字塔加仓,追求更大利润。

3.可配置独立的开仓移动平均线和平仓移动平均线,实现精确止损。

4.支持不同时间周期(1分钟到1天)的移动平均线计算,实现多时间框架融合。

5.开仓和平仓移动平均线支持6种不同的平滑模式选择,可针对不同品种和周期进行优化。

6.可输入正负偏移量进行通道调整,追求更加精准的突破。

该策略的具体交易逻辑如下:

-

计算基准开仓移动平均线,根据参数设定百分比,得到4条突破线。

-

当价格突破下通道线时,按顺序开仓做多;当价格突破上通道线时,按顺序开仓做空。

-

计算独立的平仓移动平均线,作为止损线。当价格重新跌破该线时,对多单逐层止损;当价格重新涨破该线时,对空单逐层止损。

-

最多可开4张单,通过折线分层金字塔加仓,追求更大利润。

通过该策略原理可知,该策略融合了移动平均线的趋势跟踪、通道判断的突破信号,以及独立止损线设定等元素,形成了一个相对严谨和完备的趋势系统。

根据策略代码和逻辑剖析,该移动平均envelop通道趋势跟踪策略具有以下优势:

-

多时间框架融合,提高抓取大级别趋势的概率。策略支持从1分钟到1天不同周期的移动平均线计算,可配置开仓和止损移动平均线使用不同周期,融合多时间框架的趋势判断力,更有利于捕捉大级别趋势。

-

金字塔加仓方式,追求更大利润。策略最多可开4张单,通过分层加仓的方式均衡盈亏比,在控制风险的前提下追求更大利润。

-

6种移动平均线模式可选择,适应性强。开仓和止损移动平均线支持SMA/EMA/动态移动平均线等6种模式选择,可针对不同品种和周期进行优化,从而提高适应性。

-

通道线可调,突破判断精准。策略可输入通道移动百分比参数,调整通道宽度,从而针对不同品种或市场环境进行优化,提高突破判断的准确性。

-

独立的止损线,有助于风险控制。策略计算独立的移动平均线作为平仓线,对多单或空单进行止损,可大幅降低交易风险,避免追注射。

-

代码结构清晰,易于二次开发。策略使用Pine Script编写,代码结构清晰,易于理解和二次开发。用户可基于现有框架,继续优化参数或加入其他逻辑。

尽管该策略总体上逻辑严谨、风险控制到位,但仍然存在一定的交易风险需要注意,具体包括:

-

大级别趋势反转风险。策略的核心假设是价格会持续推进,存在一定的趋势性。但是大级别趋势发生反转时,会对策略盈利产生较大冲击。此时则需要及时止损,控制损失。

-

突破失效风险。在盘整或震荡市场中,价格突破通道线后可能会重新跌破。这时就会造成追注射,需要通过优化参数减少这种情况的发生。

-

期望值管理风险。策略为追求更大利润而设置4层加仓,这在盈利时收益显著,但在亏损时期望值下降明显。这需要投资者具备专业的心态管理能力。

-

信号调优风险。策略涉及多个参数的调整优化,如通道宽度、移动平均线周期等,这需要专业量化分析师具备优化经验,以避免过拟合风险。

-

特殊行情风险。极端行情如快速Gap或短线限价日等会大幅破坏策略逻辑,这时则需要关注系统风险指标,及时止损。

总的来说,该策略主要依赖大级别趋势性来获利,只适用于具有长期持续性特征的品种和市场环境。另外,多参数优化和心态控制也都是确保策略稳定盈利的关键。

对该移动平均envelop通道趋势跟踪策略来说,其后续的主要优化方向包括:

-

基于机器学习算法实现通道线和止损线的自适应优化。可使用LSTM、轨迹预测等算法训练通道线和止损线模型,实现更智能的价格预测和风险规避。

-

结合情绪指标、组合持仓比等辅助因子优化加仓逻辑。可加入如绝对波幅、市场情绪等指标判断,控制组合风险,优化金字塔加仓逻辑。

-

引入交易成本和滑点模型,提高回测真实性。当前回测没有考虑交易成本的影响,实盘中这是一个重要的因素,需要建立数学模型纳入其中。

-

扩展同类品种的关联分析,构建统一的风控体系。对现有单一品种的策略扩展至商品、数字货币等多个同类市场,通过关联度分析统一风控,提高策略的稳定性。

-

增加策略 explanability,提高用户易用性。使用SHAP等方法分析各输入变量对策略结果的影响程度,输出importance排行,使策略逻辑对用户更加透明可解释。

通过引入机器学习、多因子模型等算法手段,继续优化策略的稳定性、真实性和易用性,是该策略后续的主要提升方向。

总的来说,该移动平均envelop通道趋势跟踪策略融合了移动平均线的趋势跟踪、通道指标的趋势判断和独立止损线的风险控制三大核心要点。在严格的趋势市场中,strategies策略可以提供稳定且具有一定突破收益的实现。但用户需要注意大级别市场环境的把控,做好参数调优和风险管理工作,使策略可以适应复杂多变的交易市场。总体而言,该策略为用户提供了一个相对完整和严谨的趋势跟踪解决方案,是一个非常适合自建和二次开发的量化策略框架。 ||

The moving average envelop channel trend following strategy is a trend following strategy based on moving average lines and channel indicators. It realizes the judgment and tracking of price trends by establishing multi-level moving average channel. The strategy also combines moving average calculations of different time frames to achieve multi-timeframe fusion, which helps capture larger trends.

The core principle of this strategy is based on the trend tracking functionality of moving average lines and the channel judgment of Envelop indicators. The strategy uses configurable parameters such as moving average period, smooth type, price source, etc. to build a baseline moving average. Then the up and down channels are established according to the percentage shift values set by the parameters. When the price breaks through the lower channel, go long; when the price breaks through the upper channel, go short. At the same time, the strategy introduces an independent moving average as the stop loss line.

Specifically, the strategy has the following characteristics:

-

Support both long and short operations, judge the trend direction through up and down channels.

-

Open up to 4 orders, implement pyramid order opening through polyline layers to pursue greater profits.

-

Configure independent opening moving average and closing moving average to achieve precise stop loss.

-

Support moving average calculation of different time frames (1 minute to 1 day) to achieve multi-timeframe fusion.

-

The opening and closing moving averages support the selection of 6 different smoothing modes, which can be optimized for different varieties and cycles.

-

Positive and negative offsets can be entered to adjust channels and pursue more accurate breakthroughs.

The specific trading logic of the strategy is as follows:

-

Calculate the benchmark opening moving average, and obtain 4 breakthrough lines according to the set percentage of parameters.

-

When the price breaks through the lower channel line, open positions in order to go long; when the price breaks through the upper channel line, open positions in order to go short.

-

Calculate independent closing moving average as stop loss line. When the price falls below the line again, stop loss the long orders in layers; when the price rises above the line again, stop loss the short orders in layers.

-

Up to 4 orders can be opened. Use layered pyramid order opening to pursue greater profits.

Through the principle of this strategy, it can be seen that the strategy integrates elements such as trend tracking of moving average lines, breakthrough signals of channel judgment, and setting of independent stop loss lines to form a relatively rigorous and complete trend system.

According to the code and logical analysis, the moving average envelop channel trend following strategy has the following advantages:

-

Multi-timeframe fusion improves the probability of capturing large-scale trends. The strategy supports the calculation of moving averages of different cycles from 1 minute to 1 day. Configuring opening and stop-loss moving averages with different cycles achieves the fusion of multi-timeframe trend judgment power, which is more conducive to capturing large-scale trends.

-

Pyramid order opening method pursues greater profits. The strategy can open up to 4 orders. By layered order opening, it balances the profit ratio and pursues greater profits while controlling risks.

-

6 types of moving averages are available for selection and adaptability is strong. The opening and stop-loss moving average supports the selection of 6 modes including SMA/EMA/Dynamic Moving Average, which can be optimized for different varieties and cycles to improve adaptability.

-

Adjustable channel lines make breakthrough judgment more precise. Strategy allows input of channel moving percentage parameters to adjust channel width for optimization towards different varieties or market environments, improving the accuracy of breakthrough judgments.

-

Independent stop loss line is helpful for risk control. The strategy calculates an independent moving average line as the closing line to stop loss long or short orders, which can greatly reduce trading risks and avoid chasing by losing orders.

-

The code structure is clear and easy to develop secondly. The strategy is written in Pine Script with clear structure and easy to understand and develop secondly. Users can continue to optimize parameters or add other logic based on the existing framework.

Although the overall strategy logic is rigorous and the risk control is in place, there are still some trading risks to be aware of, specifically including:

-

Large-scale trend reversal risk. The core assumption of the strategy is that prices will continue to advance steadily, with some trendiness. However, when large-scale trends reverse, it will have a greater impact on the profitability of the strategy. It is necessary to stop loss in time to control losses.

-

Invalid breakthrough risk. In sideways or shock markets, prices may fall back below the channel line after breaking through, which will cause chasing by losing orders. Parameters need to be optimized to reduce such cases.

-

Expectation management risk. The strategy sets 4 layers of pyramiding orders to pursue greater profits, which results in significant returns during profit periods but also a sharp drop in expectations during loss periods. This requires investors to have professional psychological management skills.

-

Signal optimization risk. The strategy involves adjustments and optimizations across multiple parameters such as channel width and moving average cycle. This requires professional quants to have optimization experience to avoid overfitting.

-

Special market conditions risk. Extreme market conditions like fast gaps or short line limits will greatly damage the strategy logic, so attention needs to be paid to systemic risk metrics for timely stop losses.

In general, the strategy relies mainly on large-scale trend gains for profitability, and only applies to varieties and market environments with long-term persistence characteristics. In addition, multi-parameter optimization and mentality control are also crucial to ensure stable profitability of strategies.

For this moving average envelop channel trend following strategy, the main optimization directions include:

-

Adaptive optimization of channel lines and stop loss lines based on machine learning algorithms. Models like LSTM and trajectory prediction can be used to train channel and stop loss line models to achieve smarter price prediction and risk avoidance.

-

Incorporate auxiliary factors like sentiment indicators, portfolio weighting ratios to optimize pyramid logic. Factors like absolute volatility and market sentiment can be added to control portfolio risks and optimize pyramid order opening logic.

-

Introduce trading cost and slippage models to improve backtesting authenticity. Current backtesting does not consider the impact of trading costs, which is an important factor in real trading that needs to be incorporated into mathematical models.

-

Expand correlation analysis across similar asset classes to build unified risk control frameworks. Expand the current single asset strategy to multiple similar markets like commodities and cryptocurrencies, and unify risk control through correlation analysis to improve strategy stability.

-

Increase strategy explanability to improve user friendless. Use methods like SHAP to analyze the importance of each input variable to strategy results, output importance rankings, and make strategy logic more transparent and interpretable to users.

Introducing algorithms like machine learning and multi-factor models to further optimize strategy stability, authenticity and usability is the main enhancement direction going forwards.

In summary, the moving average envelop channel trend following strategy integrates three key points: trend tracking of moving averages, trend identification of channel indicators and independent stop loss lines for risk control. In strict trending markets, the strategy can provide stable returns with reasonable amount of trend following profit. But users need to pay attention to macro market environments, optimize parameters properly and manage risks, so that the strategy can adapt to complex and ever-changing trading markets. Overall, the strategy provides users with a relatively complete and rigorous trend tracking solution, and is a very suitable quantitative strategy framework for proprietary development and secondary development.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Calculate lot size with avgPrice shifts (HatiKO calculate) |

| v_input_2 | 100 | Lot short, % |

| v_input_3 | 100 | Lot long, % |

| v_input_4 | 0 | Timeframe Short: Current. |

| v_input_5 | 0 | MA Type Short: 1. SMA |

| v_input_6 | 0 | Data Short: 7.OHLC4 |

| v_input_7 | 3 | MA Length Short |

| v_input_8 | false | MA offset Short |

| v_input_9 | 0 | Timeframe Long: Current. |

| v_input_10 | 0 | MA Type Long: 1. SMA |

| v_input_11 | 0 | Data Long: 7.OHLC4 |

| v_input_12 | 3 | MA Length Long |

| v_input_13 | false | MA offset Long |

| v_input_14 | false | Mode close MA Short |

| v_input_15 | 0 | Timeframe Short Close: Current. |

| v_input_16 | 0 | MA Type Close Short: 1. SMA |

| v_input_17 | 0 | Data Short Close: 7.OHLC4 |

| v_input_18 | 3 | MA Length Short Close |

| v_input_19 | false | Short Deviation % |

| v_input_20 | false | MA offset Short Close |

| v_input_21 | false | Mode close MA Long |

| v_input_22 | 0 | Timeframe Long Close: Current. |

| v_input_23 | 0 | MA Type Close Long: 1. SMA |

| v_input_24 | 0 | Data Long Close: 7.OHLC4 |

| v_input_25 | 3 | MA Length Long Close |

| v_input_26 | false | Long Deviation % |

| v_input_27 | false | MA offset Long Close |

| v_input_28 | false | Short Shift 4 |

| v_input_29 | 10 | Short Shift 3 |

| v_input_30 | 7 | Short Shift 2 |

| v_input_31 | 4 | Short Shift 1 |

| v_input_32 | -4 | Long Shift 1 |

| v_input_33 | -7 | Long Shift 2 |

| v_input_34 | -10 | Long Shift 3 |

| v_input_35 | false | Long Shift 4 |

| v_input_36 | false | Shift3 Long LotSize*2 |

| v_input_37 | false | Shift3 Short LotSize*2 |

| v_input_38 | 19 | From Year 20XX |

| v_input_39 | 99 | To Year 20XX |

| v_input_40 | true | From Month |

| v_input_41 | 12 | To Month |

| v_input_42 | true | From day |

| v_input_43 | 31 | To day |

Source (PineScript)

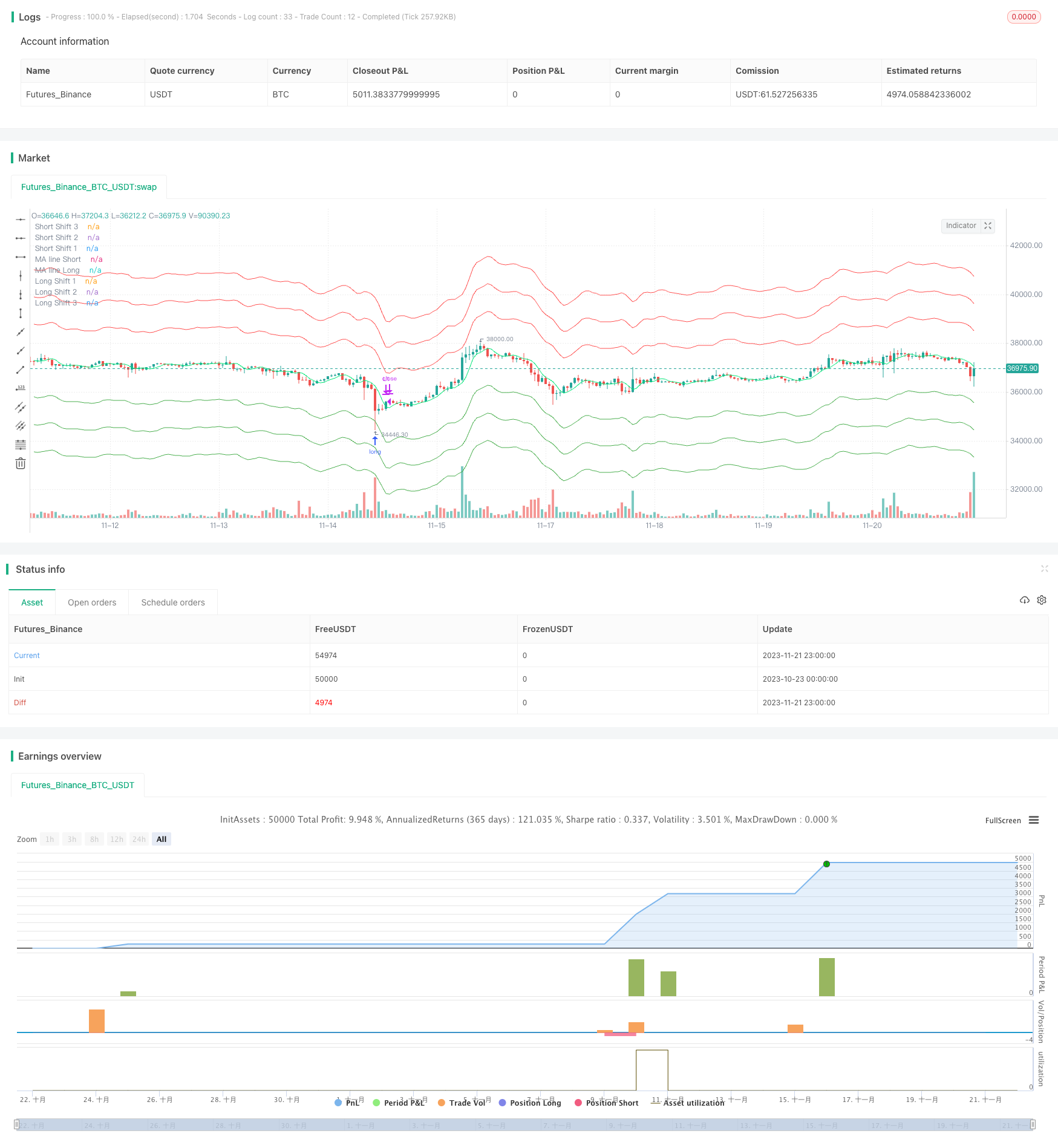

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the GNU Affero General Public License v3.0 at https://www.gnu.org/licenses/agpl-3.0.html

//@version=4

strategy(title = "HatiKO Envelopes", shorttitle = "HatiKO Envelopes", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 4, initial_capital=10, calc_on_order_fills=false)

//Settings

isLotSizeAvgShifts=input(true, title ="Calculate lot size with avgPrice shifts (HatiKO calculate)")

lotsize_Short = input(100, defval = 100, minval = 0, maxval = 10000, title = "Lot short, %")

lotsize_Long = input(100, defval = 100, minval = 0, maxval = 10000, title = "Lot long, %")

//Shorts Open Config

timeFrame_Short = input(defval = "Current.", options = ["Current.", "1m", "3m", "5m", "10m", "15m", "20m", "30m", "45m", "1H","2H","3H","4H","1D"], title = "Timeframe Short")

ma_type_Short = input(defval = "1. SMA", options = ["1. SMA", "2. PCMA", "3. EMA", "4. WMA", "5. DEMA", "6. ZLEMA"], title = "MA Type Short")

Short_Data_input = input(defval = "7.OHLC4", options = ["1.Open", "2.High", "3.Low", "4.Close", "5.HL2", "6.HLC3", "7.OHLC4", "8.OC2"], title = "Data Short")

len_Short = input(3, minval = 1, title = "MA Length Short")

offset_Short = input(0, minval = 0, title = "MA offset Short")

//Longs Open Config

timeFrame_Long = input(defval = "Current.", options = ["Current.", "1m", "3m", "5m", "10m", "15m", "20m", "30m", "45m", "1H","2H","3H","4H","1D"], title = "Timeframe Long")

ma_type_Long = input(defval = "1. SMA", options = ["1. SMA", "2. PCMA", "3. EMA", "4. WMA", "5. DEMA", "6. ZLEMA"], title = "MA Type Long")

Long_Data_input = input(defval = "7.OHLC4", options = ["1.Open", "2.High", "3.Low", "4.Close", "5.HL2", "6.HLC3", "7.OHLC4", "8.OC2"], title = "Data Long")

len_Long = input(3, minval = 1, title = "MA Length Long")

offset_Long = input(0, minval = 0, title = "MA offset Long")

//Shorts Close Config

isEnableShortCustomClose=input(false, title ="Mode close MA Short")

timeFrame_close_Short = input(defval = "Current.", options = ["Current.", "1m", "3m", "5m", "10m", "15m", "20m", "30m", "45m", "1H","2H","3H","4H","1D"], title = "Timeframe Short Close")

ma_type_close_Short = input(defval = "1. SMA", options = ["1. SMA", "2. PCMA", "3. EMA", "4. WMA", "5. DEMA", "6. ZLEMA"], title = "MA Type Close Short")

Short_Data_input_close = input(defval = "7.OHLC4", options = ["1.Open", "2.High", "3.Low", "4.Close", "5.HL2", "6.HLC3", "7.OHLC4", "8.OC2"], title = "Data Short Close")

len_Short_close = input(3, minval = 1, title = "MA Length Short Close")

shortDeviation = input( 0.0, title = "Short Deviation %",step=0.1)

offset_Short_close = input(0, minval = 0, title = "MA offset Short Close")

//Longs Close Config

isEnableLongCustomClose=input(false, title ="Mode close MA Long")

timeFrame_close_Long = input(defval = "Current.", options = ["Current.", "1m", "3m", "5m", "10m", "15m", "20m", "30m", "45m", "1H","2H","3H","4H","1D"], title = "Timeframe Long Close")

ma_type_close_Long = input(defval = "1. SMA", options = ["1. SMA", "2. PCMA", "3. EMA", "4. WMA", "5. DEMA", "6. ZLEMA"], title = "MA Type Close Long")

Long_Data_input_close = input(defval = "7.OHLC4", options = ["1.Open", "2.High", "3.Low", "4.Close", "5.HL2", "6.HLC3", "7.OHLC4", "8.OC2"], title = "Data Long Close")

len_Long_close = input(3, minval = 1, title = "MA Length Long Close")

longDeviation = input( -0.0, title = "Long Deviation %",step=0.1)

offset_Long_close = input(0, minval = 0, title = "MA offset Long Close")

shift_Short4_percent = input(0.0, title = "Short Shift 4")

shift_Short3_percent = input(10.0, title = "Short Shift 3")

shift_Short2_percent = input(7.0, title = "Short Shift 2")

shift_Short1_percent = input(4.0, title = "Short Shift 1")

shift_Long1_percent = input(-4.0, title = "Long Shift 1")

shift_Long2_percent = input(-7.0, title = "Long Shift 2")

shift_Long3_percent = input(-10.0, title = "Long Shift 3")

shift_Long4_percent = input( -0.0, title = "Long Shift 4")

isEnableDoubleLotShift3_Long=input(false, title ="Shift3 Long LotSize*2")

isEnableDoubleLotShift3_Short=input(false, title ="Shift3 Short LotSize*2")

year_Start = input(19, defval = 19, minval = 10, maxval = 99, title = "From Year 20XX")

year_End = input(99, defval = 99, minval = 10, maxval = 99, title = "To Year 20XX")

month_Start = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

month_End = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

day_Start = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

day_End = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

short4_isActive = shift_Short4_percent != 0 and lotsize_Short > 0

short3_isActive = shift_Short3_percent != 0 and lotsize_Short > 0

short2_isActive = shift_Short2_percent != 0 and lotsize_Short > 0

short1_isActive = shift_Short1_percent != 0 and lotsize_Short > 0

long1_isActive = shift_Long1_percent != 0 and lotsize_Long > 0

long2_isActive = shift_Long2_percent != 0 and lotsize_Long > 0

long3_isActive = shift_Long3_percent != 0 and lotsize_Long > 0

long4_isActive = shift_Long4_percent != 0 and lotsize_Long > 0

mult = 1 / syminfo.mintick

is_time_true = time > timestamp(2000+year_Start, month_Start, day_Start, 00, 00) and time < timestamp(2000+ year_End, month_End, day_End, 23, 59)

//MA

TFsecurity_Short = timeFrame_Short == "4H"?60*4:timeFrame_Short=="3H"?60*3:timeFrame_Short=="2H"?60*2:timeFrame_Short=="1H"?60:timeFrame_Short=="45m"?45:timeFrame_Short=="30m"?30:timeFrame_Short=="20m"?20:timeFrame_Short=="15m"?15:timeFrame_Short=="10m"?10:timeFrame_Short=="5m"?5:timeFrame_Short=="3m"?3:1

TFsecurity_Long = timeFrame_Long == "4H"?60*4:timeFrame_Long=="3H"?60*3:timeFrame_Long=="2H"?60*2:timeFrame_Long=="1H"?60:timeFrame_Long=="45m"?45:timeFrame_Long=="30m"?30:timeFrame_Long=="20m"?20:timeFrame_Long=="15m"?15:timeFrame_Long=="10m"?10:timeFrame_Long=="5m"?5:timeFrame_Long=="3m"?3:1

oc2 = (open + close) / 2

lag_Short = (len_Short - 1) / 2//floor((len_Short - 1) / 2)

lag_Long = (len_Long - 1) / 2 //floor((len_Long - 1) / 2)

source_Short = Short_Data_input == "1.Open" ? open : Short_Data_input == "2.High" ? high : Short_Data_input == "3.Low" ? low : Short_Data_input == "4.Close" ? close : Short_Data_input == "5.HL2" ? hl2 : Short_Data_input == "6.HLC3" ? hlc3 : Short_Data_input == "7.OHLC4" ? ohlc4 : Short_Data_input == "8.OC2" ? oc2: close

source_Long = Long_Data_input == "1.Open" ? open : Long_Data_input == "2.High" ? high : Long_Data_input == "3.Low" ? low : Long_Data_input == "4.Close" ? close : Long_Data_input == "5.HL2" ? hl2 : Long_Data_input == "6.HLC3" ? hlc3 : Long_Data_input == "7.OHLC4" ? ohlc4 : Long_Data_input == "8.OC2" ? oc2: close

preS_MA_Short = ma_type_Short == "1. SMA" ? sma(source_Short, len_Short) : ma_type_Short == "2. PCMA"? (highest(high, len_Short) + lowest(low, len_Short)) / 2 : ma_type_Short == "3. EMA" ? ema(source_Short, len_Short) : ma_type_Short == "4. WMA" ? wma(source_Short, len_Short) : ma_type_Short == "5. DEMA" ? (2 * ema(source_Short,len_Short) - ema(ema(source_Short,len_Short), len_Short)) : ma_type_Short == "6. ZLEMA" ? ema(source_Short + (source_Short - source_Short[lag_Short]), len_Short) : na

preS_MA_Long = ma_type_Long == "1. SMA" ? sma(source_Long, len_Long) :ma_type_Long == "2. PCMA"? (highest(high, len_Long) + lowest(low, len_Long)) / 2 : ma_type_Long == "3. EMA" ? ema(source_Long, len_Long) : ma_type_Long == "4. WMA" ? wma(source_Long, len_Long) : ma_type_Long == "5. DEMA" ? (2 * ema(source_Long,len_Long) - ema(ema(source_Long,len_Long), len_Long)) : ma_type_Long == "6. ZLEMA" ? ema(source_Long + (source_Long - source_Long[lag_Long]), len_Long) : na

pre_MA_Short = timeFrame_Short == "Current." ? preS_MA_Short : security(syminfo.tickerid, tostring(TFsecurity_Short), preS_MA_Short)

pre_MA_Long = timeFrame_Long == "Current." ? preS_MA_Long : security(syminfo.tickerid, tostring(TFsecurity_Long), preS_MA_Long)

MA_Short = (round(pre_MA_Short * mult) / mult)[offset_Short]

MA_Long = (round(pre_MA_Long * mult) / mult)[offset_Long]

Level_Long1 = long1_isActive ? round((MA_Long + MA_Long* shift_Long1_percent / 100) * mult) / mult : na

Level_Long2 = long2_isActive ? round((MA_Long + MA_Long* shift_Long2_percent / 100) * mult) / mult : na

Level_Long3 = long3_isActive ? round((MA_Long + MA_Long* shift_Long3_percent / 100) * mult) / mult : na

Level_Long4 = long4_isActive ? round((MA_Long + MA_Long* shift_Long4_percent / 100) * mult) / mult : na

Level_Short1 = short1_isActive ? round((MA_Short + MA_Short*shift_Short1_percent/ 100) * mult) / mult : na

Level_Short2 = short2_isActive ? round((MA_Short + MA_Short*shift_Short2_percent/ 100) * mult) / mult : na

Level_Short3 = short3_isActive ? round((MA_Short + MA_Short*shift_Short3_percent/ 100) * mult) / mult : na

Level_Short4 = short4_isActive ? round((MA_Short + MA_Short*shift_Short4_percent/ 100) * mult) / mult : na

//MA_Close

lag_Short_close = (len_Short_close - 1) / 2 //floor((len_Short_close - 1) / 2)

lag_Long_close = (len_Long_close - 1) / 2 //floor((len_Long_close - 1) / 2)

pre_PCMA_Short_close = (highest(high, len_Short_close) + lowest(low, len_Short_close)) / 2

pre_PCMA_Long_close = (highest(high, len_Long_close) + lowest(low, len_Long_close)) / 2

source_Short_close = Short_Data_input_close == "1.Open" ? open : Short_Data_input_close == "2.High" ? high : Short_Data_input_close == "3.Low" ? low : Short_Data_input_close == "4.Close" ? close : Short_Data_input_close == "5.HL2" ? hl2 : Short_Data_input_close == "6.HLC3" ? hlc3 : Short_Data_input_close == "7.OHLC4" ? ohlc4 : Short_Data_input_close == "8.OC2" ? oc2: close

source_Long_close = Long_Data_input_close == "1.Open" ? open : Long_Data_input_close == "2.High" ? high : Long_Data_input_close == "3.Low" ? low : Long_Data_input_close == "4.Close" ? close : Long_Data_input_close == "5.HL2" ? hl2 : Long_Data_input_close == "6.HLC3" ? hlc3 : Long_Data_input_close == "7.OHLC4" ? ohlc4 : Long_Data_input_close == "8.OC2" ? oc2: close

preS_MA_Short_close = ma_type_close_Short == "1. SMA" ? sma(source_Short_close, len_Short_close) : ma_type_close_Short == "2. PCMA"? (highest(high, len_Short_close) + lowest(low, len_Short_close)) / 2 : ma_type_close_Short == "3. EMA" ? ema(source_Short_close, len_Short_close) : ma_type_close_Short == "4. WMA" ? wma(source_Short_close, len_Short_close) : ma_type_close_Short == "5. DEMA" ? (2 * ema(source_Short_close,len_Short_close) - ema(ema(source_Short_close,len_Short_close), len_Short_close)) : ma_type_close_Short == "6. ZLEMA" ? ema(source_Short_close + (source_Short_close - source_Short_close[lag_Short_close]), len_Short_close) : na

preS_MA_Long_close = ma_type_close_Long == "1. SMA" ? sma(source_Long_close, len_Long_close) : ma_type_close_Long == "2. PCMA"? (highest(high, len_Long_close) + lowest(low, len_Long_close)) / 2 : ma_type_close_Long == "3. EMA" ? ema(source_Long_close, len_Long_close) : ma_type_close_Long == "4. WMA" ? wma(source_Long_close, len_Long_close) : ma_type_close_Long == "5. DEMA" ? (2 * ema(source_Long_close,len_Long_close) - ema(ema(source_Long_close,len_Long_close), len_Long_close)) : ma_type_close_Long == "6. ZLEMA" ? ema(source_Long_close + (source_Long_close - source_Long_close[lag_Long_close]), len_Long_close) : na

TFsecurity_close_Short=timeFrame_close_Short=="4H"?60*4:timeFrame_close_Short=="3H"?60*3:timeFrame_close_Short=="2H"?60*2:timeFrame_close_Short=="1H"?60:timeFrame_close_Short=="45m"?45:timeFrame_close_Short=="30m"?30:timeFrame_close_Short=="20m"?20:timeFrame_close_Short=="15m"?15:timeFrame_close_Short=="10m"?10:timeFrame_close_Short=="5m"?5:timeFrame_close_Short=="3m"?3:1

TFsecurity_close_Long=timeFrame_close_Long=="4H"?60*4:timeFrame_close_Long=="3H"?60*3:timeFrame_close_Long=="2H"?60*2:timeFrame_close_Long=="1H"?60:timeFrame_close_Long=="45m"?45:timeFrame_close_Long=="30m"?30:timeFrame_close_Long=="20m"?20:timeFrame_close_Long=="15m"?15:timeFrame_close_Long=="10m"?10:timeFrame_close_Long=="5m"?5:timeFrame_close_Long=="3m"?3:1

pre_MA_close_Short = isEnableShortCustomClose? security(syminfo.tickerid, timeFrame_close_Short=="Current."?timeframe.period:tostring(TFsecurity_close_Short), preS_MA_Short_close) : preS_MA_Short_close

pre_MA_close_Long = isEnableLongCustomClose? security(syminfo.tickerid, timeFrame_close_Long=="Current."?timeframe.period:tostring(TFsecurity_close_Long), preS_MA_Long_close) : preS_MA_Long_close

MA_Short_close = (round(pre_MA_close_Short * mult) / mult)[offset_Short_close]

MA_Long_close = (round(pre_MA_close_Long * mult) / mult)[offset_Long_close]

countShifts_Long = 0

countShifts_Long:=long1_isActive?countShifts_Long+1:countShifts_Long

countShifts_Long:=long2_isActive?countShifts_Long+1:countShifts_Long

countShifts_Long:=long3_isActive?countShifts_Long+1:countShifts_Long

countShifts_Long:=long4_isActive?countShifts_Long+1:countShifts_Long

avgPriceForLotShiftLong_Data_input = MA_Long+ (MA_Long*((shift_Long1_percent+shift_Long2_percent+shift_Long3_percent+shift_Long4_percent)/countShifts_Long/100))

countShifts_Short = 0

countShifts_Short:=short1_isActive?countShifts_Short+1:countShifts_Short

countShifts_Short:=short2_isActive?countShifts_Short+1:countShifts_Short

countShifts_Short:=short3_isActive?countShifts_Short+1:countShifts_Short

countShifts_Short:=short4_isActive?countShifts_Short+1:countShifts_Short

avgPriceForLotShiftShort_Data_input = MA_Short + (MA_Short*((shift_Short1_percent+shift_Short2_percent+shift_Short3_percent+shift_Short4_percent)/countShifts_Short/100))

strategy.initial_capital = 50000

balance=strategy.initial_capital + strategy.netprofit

lotlong = 0.0

lotshort = 0.0

lotlong := (balance / avgPriceForLotShiftLong_Data_input) * (lotsize_Long / 100) //strategy.position_size == 0 ? (strategy.equity / close) * (lotsize_Long / 100) : lotlong[1]

lotshort := (balance / avgPriceForLotShiftShort_Data_input) * (lotsize_Short / 100) //strategy.position_size == 0 ? (strategy.equity / close) * (lotsize_Short / 100) : lotshort[1]

lotlong:= lotlong>1000000000?1000000000:lotlong

lotshort:=lotshort>1000000000?1000000000:lotshort

if isLotSizeAvgShifts==false

lotlong := (strategy.equity / open) * (lotsize_Long / 100)

lotshort := (strategy.equity / open) * (lotsize_Short / 100)

value_deviationLong=0.0

value_deviationShort=0.0

if(isEnableLongCustomClose == false )

MA_Long_close:=MA_Long

else

value_deviationLong := round(MA_Long_close * longDeviation /100 * mult) / mult

if(isEnableShortCustomClose == false )

MA_Short_close:=MA_Short

else

value_deviationShort := round(MA_Short_close * shortDeviation /100 * mult) / mult

if MA_Short > 0 and lotshort > 0// and strategy.position_size<=0

lotShort_Data_input = strategy.position_size < 0 ? round(abs(strategy.position_size) / lotshort) : 0.0

strategy.entry("S1", strategy.short, lotshort, limit = Level_Short1, when = (lotShort_Data_input == 0 and short1_isActive and is_time_true ))

lotShort_Data_input := strategy.position_size < 0 ? round(abs(strategy.position_size) / lotshort) : 0.0

strategy.entry("S2", strategy.short, lotshort, limit = Level_Short2, when = (lotShort_Data_input <= 1 and short2_isActive and is_time_true ))

lotshort3 = isEnableDoubleLotShift3_Short? lotshort*2 :lotshort

lotShort_Data_input := strategy.position_size < 0 ? round(abs(strategy.position_size) / lotshort) : 0.0

maxLotsshift3=isEnableDoubleLotShift3_Short?3:2

strategy.entry("S3", strategy.short, lotshort3, limit = Level_Short3, when = (lotShort_Data_input <= maxLotsshift3 and short3_isActive and is_time_true ))

lotShort_Data_input := strategy.position_size < 0 ? round(abs(strategy.position_size) / lotshort) : 0.0

maxLotsshift4=isEnableDoubleLotShift3_Short?4:3

strategy.entry("S4", strategy.short, lotshort, limit = Level_Short4, when = (lotShort_Data_input <= maxLotsshift4 and short4_isActive and is_time_true))

strategy.exit("TPS", "S1" ,limit = MA_Short_close+value_deviationShort , when = is_time_true)

strategy.exit("TPS", "S2" ,limit = MA_Short_close+value_deviationShort , when = is_time_true)

strategy.exit("TPS", "S3" ,limit = MA_Short_close+value_deviationShort , when = is_time_true)

strategy.exit("TPS", "S4" ,limit = MA_Short_close+value_deviationShort , when = is_time_true)

if MA_Long > 0 and lotlong > 0// and strategy.position_size>=0

lotLong_Data_input = strategy.position_size > 0 ? round(strategy.position_size / lotlong) : 0.0

strategy.entry("L1", strategy.long, lotlong, limit = Level_Long1, when = (lotLong_Data_input ==0 and long1_isActive and is_time_true))

lotLong_Data_input := strategy.position_size > 0 ? round(strategy.position_size / lotlong) : 0.0

strategy.entry("L2", strategy.long, lotlong, limit = Level_Long2, when = ( lotLong_Data_input <= 1 and long2_isActive and is_time_true))

lotlong3 = isEnableDoubleLotShift3_Long? lotlong*2 : lotlong

lotLong_Data_input := strategy.position_size > 0 ? round(strategy.position_size / lotlong) : 0.0

maxLotsshift3=isEnableDoubleLotShift3_Long?3:2

strategy.entry("L3", strategy.long, lotlong3, limit = Level_Long3, when = (lotLong_Data_input <= maxLotsshift3 and long3_isActive and is_time_true))

maxLotsshift4=isEnableDoubleLotShift3_Long?4:3

lotLong_Data_input := strategy.position_size > 0 ? round(strategy.position_size / lotlong) : 0.0

strategy.entry("L4", strategy.long, lotlong, limit = Level_Long4, when = ( lotLong_Data_input<maxLotsshift4 and long4_isActive and is_time_true))

strategy.exit( "TPL", "L1",limit = MA_Long_close+value_deviationLong, when = is_time_true)

strategy.exit( "TPL", "L2", limit = MA_Long_close+value_deviationLong, when = is_time_true)

strategy.exit( "TPL", "L3", limit = MA_Long_close+value_deviationLong, when = is_time_true)

strategy.exit( "TPL", "L4", limit = MA_Long_close+value_deviationLong, when = is_time_true)

if (MA_Long_close < close)

strategy.close("L1")

strategy.close("L2")

strategy.close("L3")

strategy.close("L4")

if (MA_Short_close > close)

strategy.close("S1")

strategy.close("S2")

strategy.close("S3")

strategy.close("S4")

if time > timestamp(2000+year_End, month_End, day_End, 23, 59)

strategy.close_all()

strategy.cancel("L1")

strategy.cancel("L2")

strategy.cancel("L3")

strategy.cancel("S1")

strategy.cancel("S2")

strategy.cancel("S3")

//Lines

colorlong = color.green

colorshort = color.red

value_long1 = long1_isActive ? Level_Long1 : na

value_long2 = long2_isActive ? Level_Long2 : na

value_long3 = long3_isActive ? Level_Long3 : na

value_long4 = long4_isActive ? Level_Long4 : na

value_short1 = short1_isActive ? Level_Short1 : na

value_short2 = short2_isActive ? Level_Short2 : na

value_short3 = short3_isActive ?Level_Short3 : na

value_short4 = short4_isActive? Level_Short4 : na

value_maShort_close= isEnableShortCustomClose ? MA_Short_close : na

value_maLong_close= isEnableLongCustomClose ? MA_Long_close : na

plot(value_maShort_close + value_deviationShort, offset = 1, color = color.orange, title = "MA line Short Close")

plot(value_short4, offset = 1, color = colorshort, title = "Short Shift 4")

plot(value_short3, offset = 1, color = colorshort, title = "Short Shift 3")

plot(value_short2, offset = 1, color = colorshort, title = "Short Shift 2")

plot(value_short1, offset = 1, color = colorshort, title = "Short Shift 1")

plot(countShifts_Short>0 and lotsize_Short>0 ? MA_Short:na, offset = 1, color = color.purple, title = "MA line Short")

plot(countShifts_Long>0 and lotsize_Long>0? MA_Long:na, offset = 1, color = color.lime, title = "MA line Long")

plot(value_long1, offset = 1, color = colorlong, title = "Long Shift 1")

plot(value_long2, offset = 1, color = colorlong, title = "Long Shift 2")

plot(value_long3, offset = 1, color = colorlong, title = "Long Shift 3")

plot(value_long4, offset = 1, color = colorlong, title = "Long Shift 4")

plot(value_maLong_close + value_deviationLong, offset = 1, color = color.blue, title = "MA line Long Close")

Detail

https://www.fmz.com/strategy/433004

Last Modified

2023-11-23 15:06:32