Name

突破型上升趋势参考策略Quantitative-Breakthrough-Uptrend-Reference-Strategy

Author

ChaoZhang

Strategy Description

该策略是一个基于简单移动平均线确定趋势方向,配合阻力支撑线形成突破信号的长线持仓策略。通过计算价格Pivot高点和Pivot低点,绘制阻力线和支撑线,当价格突破阻力线时做多,突破支撑线时平仓。该策略适合趋势明显的股票,可以获得较好的风险回报比。

- 计算20日简单移动平均线作为判断趋势的基准线

- 根据用户输入参数计算Pivot高点和Pivot低点

- 根据Pivot高点和Pivot低点绘制阻力线和支撑线

- 当收盘价高于阻力线时,做多入场

- 当支撑线下穿阻力线时,平仓

该策略使用简单移动平均线判断总体趋势方向,再利用关键点突破形成交易信号,属于典型的突破型策略。通过关键点和趋势判断,可以有效过滤假突破。

- 策略机会充足,适合高波动的股票,容易捕捉趋势

- 风险控制 to 做,风险收益比高

- 利用突破信号,避免假突破风险

- 可自定义参数,适应性强

- 依赖参数优化,参数不当会增加假突破概率

- 突破信号延迟,可能错过部分机会

- 震荡行情中容易止损

- 支持线调整不及时可能带来亏损

可以通过实盘优化参数,结合止损止盈策略来降低风险。

- 优化移动平均线周期参数

- 优化支撑阻力线参数

- 增加止损止盈策略

- 增加突破确认机制

- 结合交易量等指标过滤信号

该策略整体是一个典型的突破型策略,依赖参数优化和流动性,适合追踪趋势的交易者。作为一个参考框架,可根据实际需要进行模块扩展,通过止损止盈、信号过滤等机制来降低风险,提高稳定性。

||

This strategy is a long-term holding strategy based on determining the trend direction with simple moving average lines and forming breakthrough signals with resistance and support lines. By calculating the price Pivot High and Pivot Low points, plotting the resistance and support lines, going long when the price breaks through the resistance line, and closing positions when the price breaks through the support line. This strategy is suitable for stocks with obvious trends and can obtain a good risk-reward ratio.

- Calculate the 20-day simple moving average line as the baseline for determining the trend

- Calculate the Pivot High and Pivot Low points based on user input parameters

- Plot the resistance and support lines based on the Pivot High and Pivot Low points

- Go long when the closing price is higher than the resistance line

- Close positions when the support line crosses below the resistance line

This strategy uses simple moving averages to determine the overall trend direction, and then uses key point breakthroughs to generate trading signals, which is a typical breakout strategy. By judging key points and trends, false breakouts can be effectively filtered out.

- The strategy has sufficient opportunities and is suitable for high volatility stocks, making it easy to capture trends

- Good risk control for long positions, high risk-reward ratio

- Use breakthrough signals to avoid the risk of false breakouts

- Customizable parameters, high adaptability

- Rely on parameter optimization, improper parameters will increase the probability of false breakouts

- Delay in breakthrough signals, may miss some opportunities

- Easy to be stopped out in volatile markets

- Failure to adjust the support line in time may lead to losses

Risks can be reduced by optimizing parameters through live trading, and incorporating stop loss/take profit strategies.

- Optimize moving average period parameters

- Optimize resistance and support line parameters

- Add stop loss/take profit strategies

- Increase breakthrough confirmation mechanisms

- Filter signals with trading volume and other indicators

Overall, this strategy is a typical breakout strategy that relies on parameter optimization and liquidity, suitable for trend traders. As a reference framework, it can be extended according to actual needs by adding mechanisms like stop loss/take profit, signal filtering to reduce risk and improve stability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 20 | length |

| v_input_1_close | 0 | Source: close |

| v_input_int_2 | false | Offset |

| v_input_int_3 | 46 | LookbackLeft |

| v_input_int_4 | 32 | LookbackRight |

| v_input_float_1 | 2 | Take Profit |

| v_input_float_2 | 1.75 | Stop Loss |

Source (PineScript)

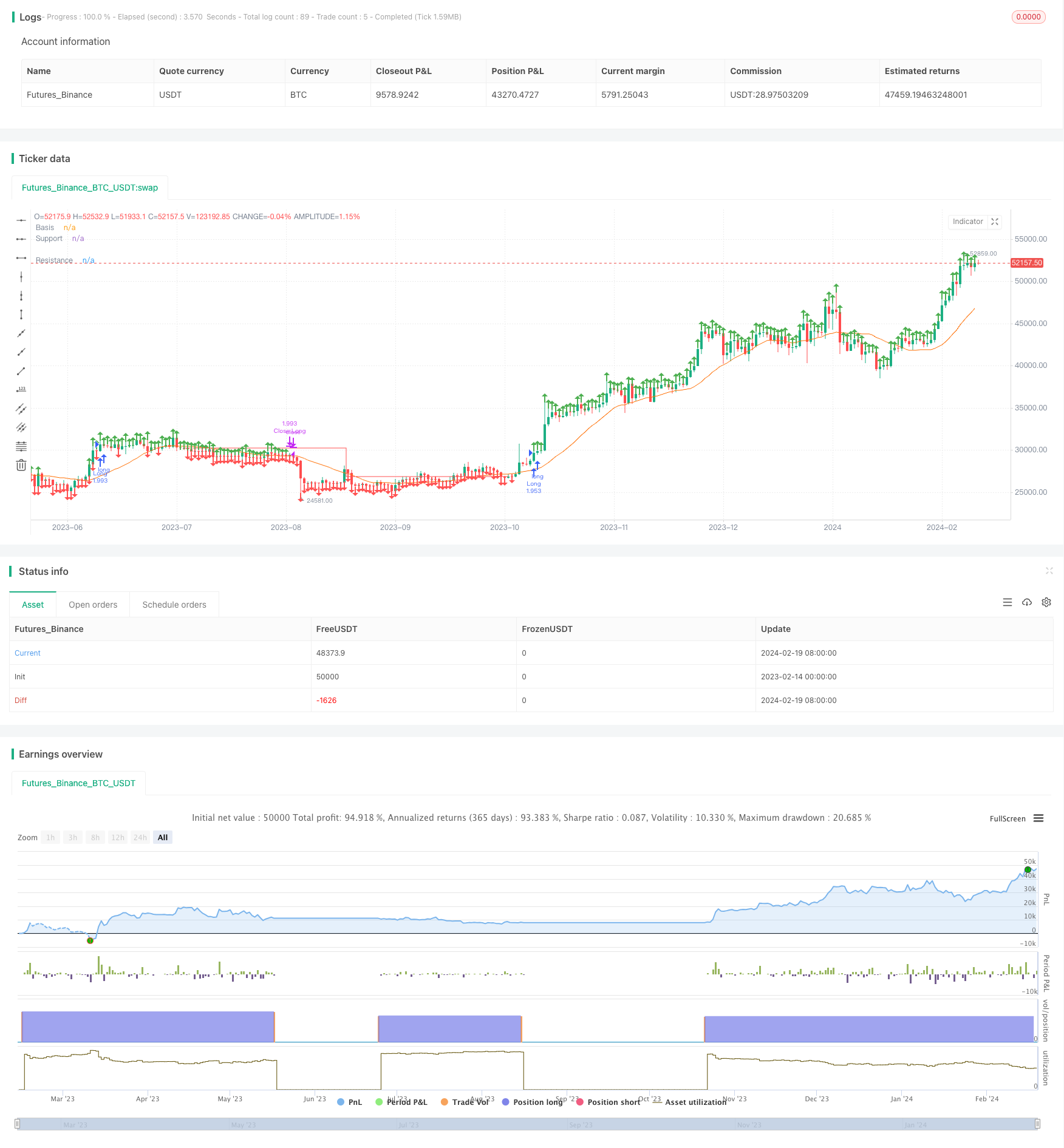

/*backtest

start: 2023-02-14 00:00:00

end: 2024-02-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © CheatCode1

//@version=5

strategy("Quantitative Trend Strategy- Uptrend long", 'Steady Uptrend Strategy', overlay=true, initial_capital = 1500, default_qty_value = 100, commission_type = strategy.commission.percent, commission_value = 0.01, default_qty_type = strategy.percent_of_equity)

length = input.int(20, minval=1)

src = input(close, title="Source")

basis = ta.sma(src, length)

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

inp1 = input.int(46, 'LookbackLeft')

inp2 = input.int(32, 'LookbackRight')

l1 = ta.pivothigh(close, inp1, inp2)

S1 = ta.pivotlow(close, inp1, inp2)

// plot(l1, 'Pivothigh', color.red, 1)

// // plot(S1, 'Pivot Low', color.red)

l1V = ta.valuewhen(l1, close, 0)

S1V = ta.valuewhen(S1, close, 0)

Plotl1 = not na(l1) ? l1V : na

PlotS1 = not na(S1) ? S1V : na

plot(Plotl1, 'Resistance', color.green, 1, plot.style_stepline, true)

plot(PlotS1, 'Support', color.red, 1, plot.style_stepline, true)

Priceforlong = close > l1V ? true : na

Priceforshort = close < S1V ? true : na

plotshape(Priceforlong ? high : na, 'p', shape.arrowup, location.abovebar, color.green, size = size.small)

plotshape(Priceforshort ? low : na, 's', shape.arrowdown, location.belowbar, color.red, size = size.small)

vol = volume

volma = ta.sma(vol, 20)

Plotl1C = ta.valuewhen(na(Plotl1), l1V, 0)

PlotS1C = ta.valuewhen(na(PlotS1), S1V, 0)

//Strategy Execution

volc = volume > volma

Lc1 = Priceforlong

Sc1 = Priceforshort

sL = Plotl1 < PlotS1 ? close : na

sS = PlotS1 > Plotl1 ? close : na

if Lc1

strategy.entry('Long', strategy.long)

// if Sc1 and C2

// strategy.entry('Short', strategy.short)

if Priceforshort

strategy.cancel('Long')

if Priceforlong

strategy.cancel('Short')

// Stp1 = ta.crossover(k, d)

// Ltp1 = ta.crossunder(k, d)

// Ltp = d > 70 ? Ltp1 : na

// Stp = d < 30 ? Stp1 : na

if strategy.openprofit >= 0 and sL

strategy.close('Long')

if strategy.openprofit >= 0 and sS

strategy.close('Short')

takeP = input.float(2, title='Take Profit') / 100

stopL = input.float(1.75, title='Stop Loss') / 100

// // Pre Directionality

Stop_L = strategy.position_avg_price * (1 - stopL)

Stop_S = strategy.position_avg_price * (1 + stopL)

Take_S= strategy.position_avg_price * (1 - takeP)

Take_L = strategy.position_avg_price * (1 + takeP)

// sL = Plotl1 < PlotS1 ? close : na

// sS = PlotS1 < Plotl1 ? close : na

// //Post Excecution

if strategy.position_size > 0 and not (Lc1)

strategy.exit("Close Long", stop = Stop_L, limit = Take_L)

if strategy.position_size < 0 and not (Sc1)

strategy.exit("Close Short", stop = Stop_S, limit = Take_S)

Detail

https://www.fmz.com/strategy/442333

Last Modified

2024-02-21 10:58:01