Name

结合MACDRSI和FIB的量化比特币交易策略Quant-Bitcoin-Trading-Strategy-Combining-MACD-RSI-and-FIB

Author

ChaoZhang

Strategy Description

本策略名称为“黄金交叉芬奇策略”,其结合了移动平均线tech术指标MACD、相对强弱指标RSI以及黄金分割线原理中的斐波那契回撤/扩张理论,实现了对比特币等加密货币的量化交易。

- MACD指标判断买卖点

- 设置MACD快线和慢线的EMA周期为15和30

- 判断快线上穿慢线为买点,下穿为卖点

- RSI指标过滤假信号

- 设置RSI的参数为50周期

- RSI指标可用来辅助过滤掉部分MACD给出的假信号

- 斐波那契理论确定SUPPORT/RESISTANCE

- 结合近期(如38根K线)的最高价和最低价

- 计算出黄金分割线的0.5斐波纳契回撤和扩张位

- 可用作支撑位和阻力位判断

- 均线和RSI判断超买超卖

- 50周期均线可判断目前是否处于超买超卖状态

- RSI指标也可判断超买超卖

- 反手开仓机制

- 给用户提供是否反手做单的选项

- 根据用户选择可灵活调整做多做空逻辑

本策略最大优势在于可全天候运行,可大幅降低人工操作成本。另外,由多种指标组合可提高胜率,在牛市效果尤其明显。具体优势如下:

- 可7*24小时全自动量化交易,无需人工干预

- MACD指标判断买卖时机准确

- RSI指标可过滤掉部分假信号

- 斐波那契理论增加了交易决策依据

- 50均线和RSI判断超买超卖状态

- 可通过反手做单机制调整适应市场变化

本策略也存在一些风险,主要来自于巨幅行情的反转,这时止损可能较难起到作用。此外,持仓时间过长也会存在一定风险。主要风险点如下:

- 止损距离过近,巨幅行情难以起到防护作用

- 持仓时间过长带来的系统性风险

对应解决方法如下:

- 适当放宽止损距离,保证止损充分起到作用

- 优化持仓周期,降低持仓时间过长的风险

本策略主要可从以下几个方向进行优化:

- 优化MACD指标的参数,提高买卖信号准确率

- 优化RSI指标的参数,提高指标的实用性

- 测试更多周期的斐波那契理论取值

- 加入更多滤波指标,进一步降低假信号概率

- 结合更多大周期指标判断市场趋势

本策略综合多个量化指标判断买卖时机,可全天候自动化交易加密货币市场。通过优化各指标参数和加入更多辅助指标,可望进一步提升策略盈利水平。该策略可为用户节省大量人工操作时间成本,值得量化交易者深入研究与应用。

||

The strategy is named "Golden Cross Fibonacci Strategy". It combines the technical indicator MACD, relative strength index RSI and fibonacci retracement/extension theory based on golden ratio, realizing quantitative trading for bitcoin and other cryptocurrencies.

- MACD Indicator for Trading Signals

- Set EMA periods of MACD fast line and slow line to 15 and 30

- Crossing up as buying signal and crossing down as selling one

- RSI Filtering False Signals

- Set RSI parameter to 50 period

- RSI helps filter some false signals MACD gives

- Fibonacci Theory for SUPPORT/RESISTANCE

- Combine recent highest/lowest price over 38 candles

- Calculate 0.5 fibonacci retracement/extension level

- Can be used as support and resistance

- MA and RSI Judging Oversold/Overbought

- 50-period MA judges oversold/overbought status

- RSI also helps judging

- Reverse Opening Mechanism

- Provide option for users to open reverse order

- Flexibly adjust long/short logic according to users' choice

The biggest advantage is operating 24x7 without manual intervention. Besides, the combination of multiple indicators increases the winning rate, especially outstanding performance in bull market. Main advantages include:

- Fully automated 24x7 quant trading without manual intervention

- Accurate trading signals from MACD

- RSI filters some false signals

- Fibonacci theory adds more reference

- Judging oversold/overbought status

- Flexibly adjust strategies through reverse opening

There also exist some risks, mainly from huge reverse of price that is hard for stop loss to take effect. Also, overlong holding period induces risk. Main risks contain:

- Stop loss too tight to protect from huge reverse

- Systematic risk from overlong holding period

Solutions accordingly are:

- Set looser stop loss distance

- Optimize holding period against overlong risk

Main aspects for optimization:

- Optimize MACD parameters for higher accuracy

- Optimize RSI parameter for better utility

- Test more periods of Fibonacci theory

- Add more filter indicators to further decrease false signals

- Combine indicators of larger periods for market trend

The strategy combines multiple quant indicators for trade signals and realizes full automatic crypto trading. Further improving profit by optimizing parameters and adding more assistant indicators. It significantly reduces manual operation costs for users. Worth deep research and application for quant traders.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | BINANCE:BTCUSDT | Symbol |

| v_input_2 | 2.5 | Long Stop Loss (%) |

| v_input_3 | 2.5 | Short Stop Loss (%) |

| v_input_4 | 7.6 | Long Take Profit (%) |

| v_input_5 | 7.5 | Short Take Profit (%) |

| v_input_6 | 90 | Capital Percentage to Invest (%) |

| v_input_7 | false | Reverse ? |

Source (PineScript)

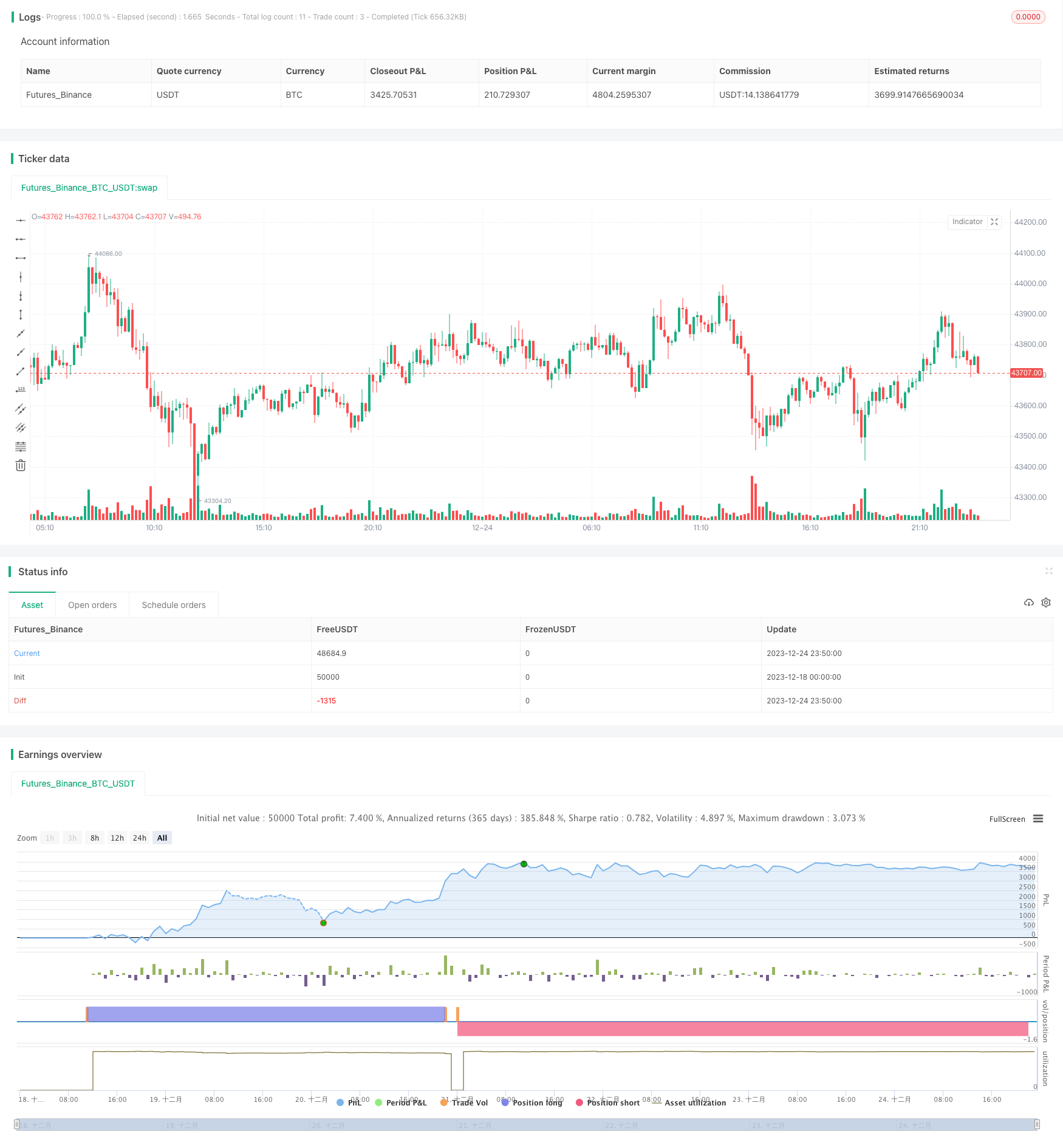

/*backtest

start: 2023-12-18 00:00:00

end: 2023-12-25 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © onurenginogutcu

//@version=4

strategy("STRATEGY R18-F-BTC", overlay=true, margin_long=100, margin_short=100)

///////////default girişler 1 saatlik btc grafiği için geçerli olmak üzere - stop loss'lar %2.5 - long'da %7.6 , short'ta %8.1

sym = input(title="Symbol", type=input.symbol, defval="BINANCE:BTCUSDT") /////////btc'yi indikatör olarak alıyoruz

lsl = input(title="Long Stop Loss (%)",

minval=0.0, step=0.1, defval=2.5) * 0.01

ssl = input(title="Short Stop Loss (%)",

minval=0.0, step=0.1, defval=2.5) * 0.01

longtp = input(title="Long Take Profit (%)",

minval=0.0, step=0.1, defval=7.6) * 0.01

shorttp = input(title="Short Take Profit (%)",

minval=0.0, step=0.1, defval=7.5) * 0.01

capperc = input(title="Capital Percentage to Invest (%)",

minval=0.0, maxval=100, step=0.1, defval=90) * 0.01

choice = input(title="Reverse ?", type=input.bool, defval=false)

symClose = security(sym, "", close)

symHigh = security(sym, "", high)

symLow = security(sym, "", low)

i = ema (symClose , 15) - ema (symClose , 30) ///////// ema close 15 ve 30 inanılmaz iyi sonuç verdi (macd standartı 12 26)

r = ema (i , 9)

sapust = highest (i , 100) * 0.729 //////////0.729 altın oran oldu 09.01.2022

sapalt = lowest (i , 100) * 0.729 //////////0.729 altın oran oldu 09.01.2022

///////////highx = highest (close , 365) * 0.72 fibo belki dahiledilebilir

///////////lowx = lowest (close , 365) * 1.272 fibo belki dahil edilebilir

simRSI = rsi (symClose , 50 ) /////// RSI DAHİL EDİLDİ "50 MUMLUK RSI EN İYİ SONUCU VERİYOR"

//////////////fibonacci seviyesi eklenmesi amacı ile koyuldu fakat en iyi sonuç %50 seviyesinin altı ve üstü (low ve high 38 barlık) en iyi sonuç verdi

fibvar = 38

fibtop = lowest (symLow , fibvar) + ((highest (symHigh , fibvar) - lowest (symLow , fibvar)) * 0.50)

fibbottom = lowest (symLow , fibvar) + ((highest (symHigh , fibvar) - lowest (symLow , fibvar)) * 0.50)

///////////////////////////////////////////////////////////// INDICATOR CONDITIONS

longCondition = crossover(i, r) and i < sapalt and symClose < sma (symClose , 50) and simRSI < sma (simRSI , 50) and symClose < fibbottom

shortCondition = crossunder(i, r) and i > sapust and symClose > sma (symClose , 50) and simRSI > sma (simRSI , 50) and symClose > fibtop

////////////////////////////////////////////////////////////////

///////////////////////////////////////////STRATEGY ENTRIES AND STOP LOSSES /////stratejilerde kalan capital için strategy.equity kullan (bunun üzerinden işlem yap)

if (choice == false and longCondition)

strategy.entry("Long", strategy.long , qty = capperc * strategy.equity / close , when = strategy.position_size == 0)

if (choice == false and shortCondition)

strategy.entry("Short" , strategy.short , qty = capperc * strategy.equity / close , when = strategy.position_size == 0)

if (choice == true and longCondition)

strategy.entry("Short" , strategy.short , qty = capperc * strategy.equity / close , when = strategy.position_size == 0)

if (choice == true and shortCondition)

strategy.entry("Long", strategy.long , qty = capperc * strategy.equity / close , when = strategy.position_size == 0)

if (strategy.position_size > 0)

strategy.exit("Exit Long", "Long", stop=strategy.position_avg_price*(1 - lsl) , limit=strategy.position_avg_price*(1 + longtp))

if (strategy.position_size < 0)

strategy.exit("Exit Short", "Short", stop=strategy.position_avg_price*(1 + ssl) , limit=strategy.position_avg_price*(1 - shorttp))

////////////////////////vertical colouring signals

bgcolor(color=longCondition ? color.new (color.green , 70) : na)

bgcolor(color=shortCondition ? color.new (color.red , 70) : na)

Detail

https://www.fmz.com/strategy/436659

Last Modified

2023-12-26 17:08:03