Name

结合RSI指标与价格突破的短线策略A-Short-term-Strategy-Combining-RSI-Indicator-and-Price-Breakthrough

Author

ChaoZhang

Strategy Description

本策略将RSI指标与价格突破结合,在一定趋势下形成的盘整范围内寻找轮动机会,进而进行短线交易,追求高效率的短线获利。

- RSI指标判断:当RSI指标小于超卖线30时产生买入信号,作为潜在的反转买点;当RSI指标大于超买线60时产生卖出信号,锁定利润;

- 窗口限制:只在指定的回测时间窗口内生效,从而限制策略效力,防止全局套利;

- 突破判断:结合价格走势,寻找突破的机会,增强策略的实际效果,防止不必要的空转。

所以,该策略综合多个维度的判断逻辑,在一定的趋势和突破机会下,利用RSI指标产生的买卖信号进行短线获利的轮动操作。可以有效抓住市场短期的超跌反弹和超买回落的机会。

- 结合多重逻辑判断,相较于简单的RSI策略,更加严谨,可以有效避免双向空转带来的不必要损失;

- 利用RSI指标判断局部极值区域,寻找反转机会,从而获利;

- 设置回测时间窗口,可针对特定市场行情进行验证和优化,提高策略实际可用性;

- 追求短线获利,不需要预测趋势转向,更加容易把握,降低风险。

- 无法直接判断整体趋势方向,需要人工分析大局;

- RSI指标滞后反应价格变化,可能错过最佳买卖点;

- 需要充分了解策略适用的大行情环境;

- 可引入更多技术指标判断大趋势,优化策略参数,提高策略灵活性。

- 增加对大趋势的判断,避免长期滞留亏损的单子;

- 调整RSI参数,优化超买超卖线,提高效果;

- 增加止损逻辑;

- 优化回测窗口范围,让策略更契合实际行情。

本策略利用RSI指标判断超买超卖的短期反转机会,同时结合价格突破进行短线获利的轮动操作。特点是追求短期效率,操作简单,风险有限,非常适合短线交易者在特定行情下使用。需要注意判断整体大趋势,并优化参数等,从而获得更好的效果。

||

This strategy combines the RSI indicator with price breakthroughs to find rotation opportunities within a certain trend and range-bound market, so as to make short-term trades and pursue highly efficient short-term profits.

- RSI Indicator Rule: Generate a buy signal when RSI falls below 30 as a potential reversal buy point. Generate a sell signal when RSI rises above 60 to lock in profits.

- Window Limit: Only take effect within the specified backtest time window, which limits the strategy's effectiveness and prevents overall arbitrage.

- Breakthrough Judgment: Identify breakthrough opportunities combined with price trends to enhance the actual effect of the strategy and avoid unnecessary idling.

Therefore, this strategy integrates multiple dimensions of judgment logic to conduct short-term profitable rotation operations utilizing the buy and sell signals generated by RSI indicator, under certain trends and breakthrough chances. It can effectively seize the reversal bounce opportunity when the market is extremely oversold, as well as the retracement chance when extremely overbought in the short term.

- Integrating multiple logical judgments, which is more rigorous compared to simple RSI strategies, and can effectively avoid unnecessary losses caused by two-way idling.

- Identify local extremes with RSI indicator to spot reversal opportunities and make profits.

- The backtest time window setting enables verification and optimization targeting specific market conditions, improving the practical applicability of the strategy.

- Pursuing short-term profits without predicting trend reversals is easier to grasp and reduces risks.

- Unable to directly determine the overall trend direction, manual analysis of the big picture needed.

- RSI indicator lags in responding to price changes, potentially missing out the best buy/sell timing.

- Requiring adequate understanding of the macro market environment where the strategy is applicable.

- Can incorporate more technical indicators for major trend judgment and optimize strategy parameters to improve flexibility.

- Add judgment of major trends to avoid holding losing trades in prolonged drawdowns.

- Adjust RSI parameters and optimize overbought/oversold lines to improve efficiency.

- Add stop-loss logic.

- Optimize the scope of the backtest window for better fitting actual market conditions.

This strategy leverages RSI indicator to identify short-term reversal opportunities from extremely overbought/oversold scenarios, and conducts short-term profitable rotation operations combined with price breakthroughs. Its characteristics are pursuing short-term efficiency, easy operation, limited risks, and hence extremely suitable for short-term traders to use under certain market conditions. Attention should be paid to judging the overall major trend, parameter optimization etc., in order to obtain better performance.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | From Month |

| v_input_2 | true | From Day |

| v_input_3 | 2020 | From Year |

| v_input_4 | true | Thru Month |

| v_input_5 | true | Thru Day |

| v_input_6 | 2112 | Thru Year |

| v_input_7 | true | Show Date Range |

| v_input_8 | 30 | oversold |

| v_input_9 | 60 | overbought |

Source (PineScript)

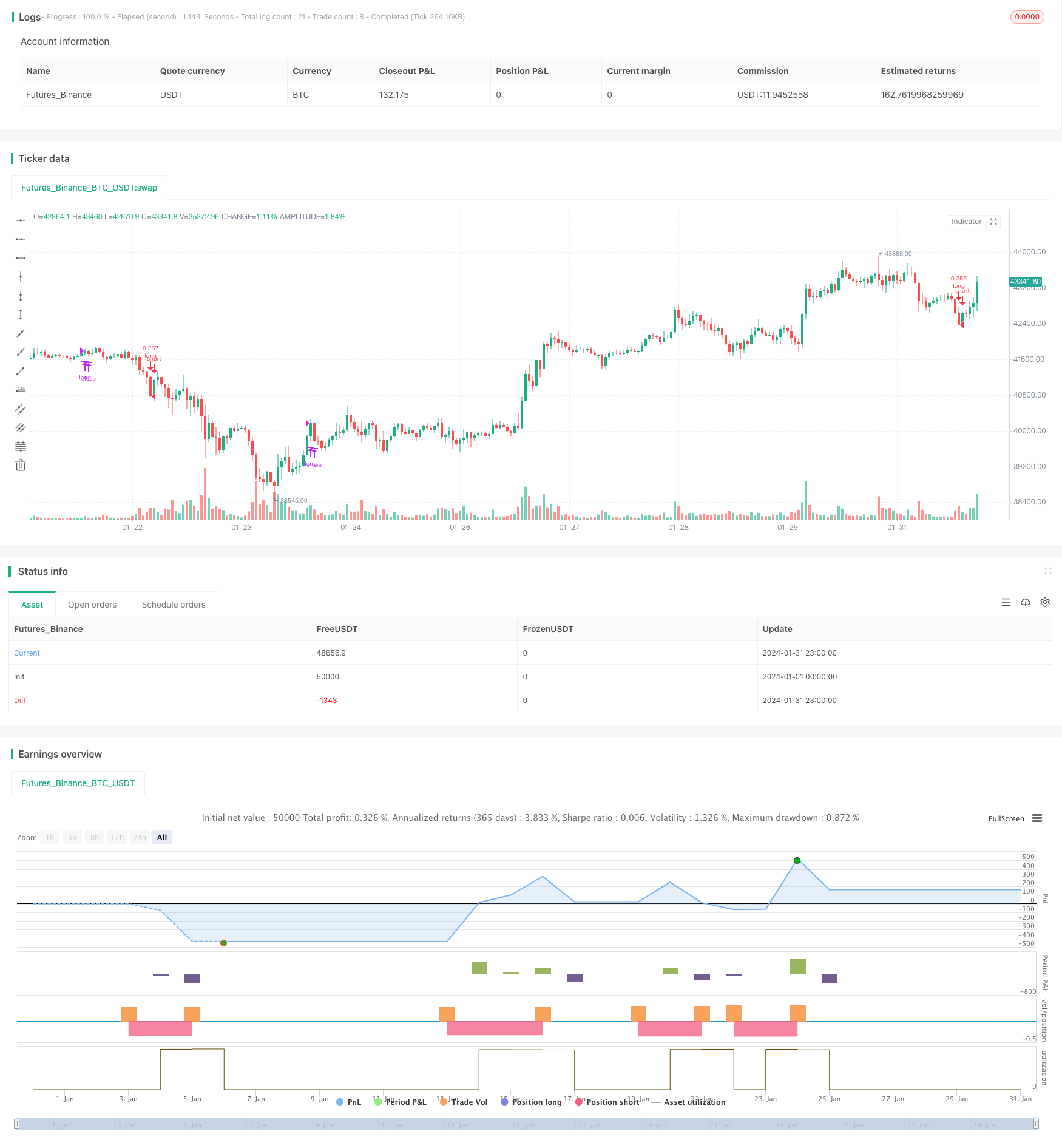

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © relevantLeader16058

//@version=4

strategy(shorttitle='RSI Classic Strategy',title='RSI Classic Strategy (by Coinrule)', overlay=true, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 30, commission_type=strategy.commission.percent, commission_value=0.1)

//Backtest dates

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2020, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

// RSI inputs and calculations

lengthRSI = 14

RSI = rsi(close, lengthRSI)

oversold= input(30)

overbought= input(60)

//Entry

strategy.entry(id="long", long = true, when = RSI< oversold and window())

//Exit

//RSI

strategy.close("long", when = RSI > overbought and window())

Detail

https://www.fmz.com/strategy/441161

Last Modified

2024-02-06 12:01:14