Name

自适应智能网格交易策略Adaptive-Intelligent-Grid-Trading-Strategy

Author

ChaoZhang

Strategy Description

[trans]

该策略是一个基于TradingView平台的自适应智能网格交易策略,使用Pine Script v4编写。它在价格表上覆盖,并在指定的范围内创建一个网格,以生成买入和卖出信号。

-

金字塔形和资金管理:

- 允许同向最多14次追加(金字塔),

- 使用基于现金的策略管理头寸大小,

- 为模拟目的,初始资本设定为100美元,

- 每次交易收取0.1%的佣金。

-

网格范围:

- 用户可以选择使用自动计算的范围或手动设置网格的上下限,

- 自动范围可以从最近的价格高点和低点或从简单移动平均线(SMA)导出,

- 用户可以定义用于计算范围的回看周期,并调整偏差以扩大或缩小范围。

-

网格线:

- 该策略允许在范围内的可自定义数量的网格线,建议范围在3至15之间,

- 网格线在上限和下限之间均匀间隔。

-

持仓进入:

- 当价格跌破网格线且该网格线没有相关的未平仓订单时,脚本会下买单,

- 每个买单数量根据初始资金除以网格线数量计算,并根据当前价格调整。

-

持仓退出:

- 当价格上涨超过更高的网格线,且存在与下一个更低网格线相关的未平仓订单时,会触发卖出信号。

-

自适应网格:

- 如果使用自动范围,则网格会通过重新计算上下限并相应调整,来适应变化的市场条件。

该策略集成了网格交易的系统性和高效执行的优势。允许追加且使用资金管理,可以有效控制风险;网格自动自适应市场,适用于不同行情;参数可调整,适应不同交易风格。

价格突破网格上下限可能造成较大损失。应适当调整参数,或结合止损来控制风险。此外,过于频繁交易会增加交易费用。

可以考虑结合趋势指标过滤信号或优化网格参数,也可以通过止损来防范极端行情的风险。

本策略系统地生成买卖点并管理头寸,通过参数调整可适应不同偏好。它将网格交易的规则性与趋势交易的灵活性有机结合,既降低了操作难度,又具备一定的容错性。

||

This strategy is an adaptive intelligent grid trading strategy based on the TradingView platform, written in Pine Script v4. It overlays on the price chart and creates a grid within specified bounds to generate buy and sell signals.

-

Pyramiding and Money Management:

- Allows up to 14 additions in the same direction (pyramiding),

- Uses a cash-based strategy to manage position sizes,

- Initial capital is set at 100 USD for simulation purposes,

- A small commission of 0.1% is charged for each trade.

-

Grid Bounds:

- Users can opt to use auto-calculated bounds or manually set the upper and lower boundaries of the grid,

- Auto bounds can be derived from either the recent High & Low of the price or from a Simple Moving Average (SMA),

- Users can define the lookback period for the bounds calculation and adjust the deviation to widen or narrow the bounds.

-

Grid Lines:

- The strategy allows for a customizable number of grid lines within the bounds, with a recommended range between 3 and 15,

- The grid lines are evenly spaced between the upper and lower bounds.

-

Entry:

- The script places buy orders when the price falls below a grid line and no existing order is associated with that grid line.

- Each buy order quantity is calculated based on the initial capital divided by the number of grid lines, adjusted for the current price.

-

Exit:

- Sell orders are triggered when the price rises above a grid line, provided there is an open order corresponding to the next lower grid line.

-

Adaptive Grid:

- If set to auto bounds, the grid adapts to changing market conditions by recalculating the upper and lower bounds and adjusting the grid accordingly.

The strategy integrates the systematic nature and efficient execution of grid trading. Allowing pyramiding and using money management can effectively control risks. The auto-adapting grid fits different market conditions. The adjustable parameters cater to different trading styles.

A price breakout beyond the grid bounds may cause severe losses. Parameters should be adjusted properly or combined with a stop loss to control risks. Also, excessive trading increases transaction costs.

Consider combining with a trend filter or optimizing grid parameters. A stop loss may also help prevent risks from extreme market moves.

This strategy systematically generates entries and exits while managing positions. Through parameter tuning it adapts to different preferences. It combines the rules-based nature of grid trading with the flexibility of trend trading, easing operation complexity while retaining robustness.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | (?Grid Bounds)Use Auto Bounds? |

| v_input_2 | 0 | (Auto) Bound Source: Hi & Low |

| v_input_3 | 250 | (Auto) Bound Lookback |

| v_input_4 | 0.1 | (Auto) Bound Deviation |

| v_input_5 | 0.285 | (Manual) Upper Boundry |

| v_input_6 | 0.225 | (Manual) Lower Boundry |

| v_input_7 | 8 | (?Grid Lines)Grid Line Quantity |

Source (PineScript)

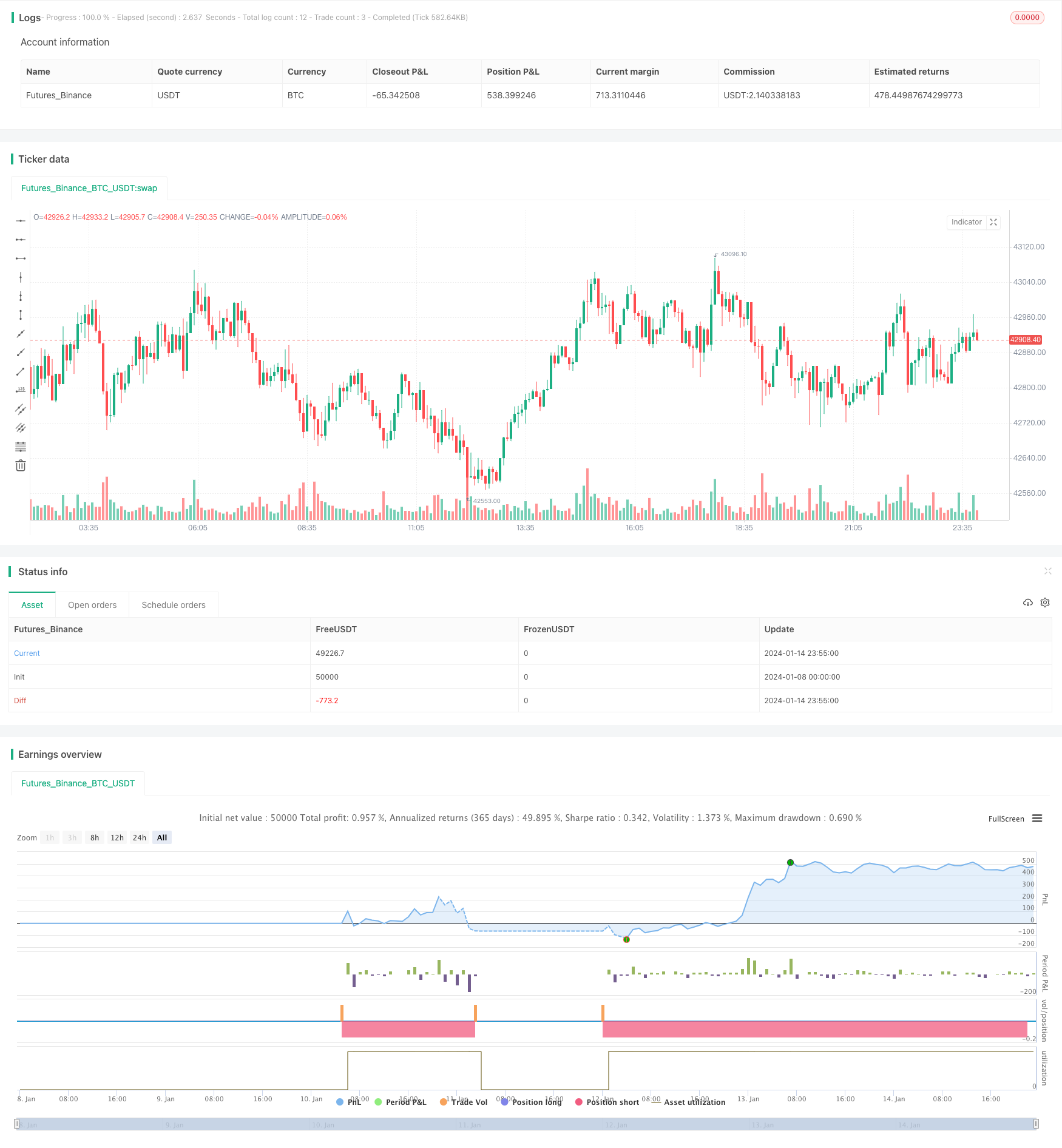

/*backtest

start: 2024-01-08 00:00:00

end: 2024-01-15 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("(IK) Grid Script", overlay=true, pyramiding=14, close_entries_rule="ANY", default_qty_type=strategy.cash, initial_capital=100.0, currency="USD", commission_type=strategy.commission.percent, commission_value=0.1)

i_autoBounds = input(group="Grid Bounds", title="Use Auto Bounds?", defval=true, type=input.bool) // calculate upper and lower bound of the grid automatically? This will theorhetically be less profitable, but will certainly require less attention

i_boundSrc = input(group="Grid Bounds", title="(Auto) Bound Source", defval="Hi & Low", options=["Hi & Low", "Average"]) // should bounds of the auto grid be calculated from recent High & Low, or from a Simple Moving Average

i_boundLookback = input(group="Grid Bounds", title="(Auto) Bound Lookback", defval=250, type=input.integer, maxval=500, minval=0) // when calculating auto grid bounds, how far back should we look for a High & Low, or what should the length be of our sma

i_boundDev = input(group="Grid Bounds", title="(Auto) Bound Deviation", defval=0.10, type=input.float, maxval=1, minval=-1) // if sourcing auto bounds from High & Low, this percentage will (positive) widen or (negative) narrow the bound limits. If sourcing from Average, this is the deviation (up and down) from the sma, and CANNOT be negative.

i_upperBound = input(group="Grid Bounds", title="(Manual) Upper Boundry", defval=0.285, type=input.float) // for manual grid bounds only. The upperbound price of your grid

i_lowerBound = input(group="Grid Bounds", title="(Manual) Lower Boundry", defval=0.225, type=input.float) // for manual grid bounds only. The lowerbound price of your grid.

i_gridQty = input(group="Grid Lines", title="Grid Line Quantity", defval=8, maxval=15, minval=3, type=input.integer) // how many grid lines are in your grid

f_getGridBounds(_bs, _bl, _bd, _up) =>

if _bs == "Hi & Low"

_up ? highest(close, _bl) * (1 + _bd) : lowest(close, _bl) * (1 - _bd)

else

avg = sma(close, _bl)

_up ? avg * (1 + _bd) : avg * (1 - _bd)

f_buildGrid(_lb, _gw, _gq) =>

gridArr = array.new_float(0)

for i=0 to _gq-1

array.push(gridArr, _lb+(_gw*i))

gridArr

f_getNearGridLines(_gridArr, _price) =>

arr = array.new_int(3)

for i = 0 to array.size(_gridArr)-1

if array.get(_gridArr, i) > _price

array.set(arr, 0, i == array.size(_gridArr)-1 ? i : i+1)

array.set(arr, 1, i == 0 ? i : i-1)

break

arr

var upperBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true) : i_upperBound // upperbound of our grid

var lowerBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false) : i_lowerBound // lowerbound of our grid

var gridWidth = (upperBound - lowerBound)/(i_gridQty-1) // space between lines in our grid

var gridLineArr = f_buildGrid(lowerBound, gridWidth, i_gridQty) // an array of prices that correspond to our grid lines

var orderArr = array.new_bool(i_gridQty, false) // a boolean array that indicates if there is an open order corresponding to each grid line

var closeLineArr = f_getNearGridLines(gridLineArr, close) // for plotting purposes - an array of 2 indices that correspond to grid lines near price

var nearTopGridLine = array.get(closeLineArr, 0) // for plotting purposes - the index (in our grid line array) of the closest grid line above current price

var nearBotGridLine = array.get(closeLineArr, 1) // for plotting purposes - the index (in our grid line array) of the closest grid line below current price

strategy.initial_capital = 50000

for i = 0 to (array.size(gridLineArr) - 1)

if close < array.get(gridLineArr, i) and not array.get(orderArr, i) and i < (array.size(gridLineArr) - 1)

buyId = i

array.set(orderArr, buyId, true)

strategy.entry(id=tostring(buyId), long=true, qty=(strategy.initial_capital/(i_gridQty-1))/close, comment="#"+tostring(buyId))

if close > array.get(gridLineArr, i) and i != 0

if array.get(orderArr, i-1)

sellId = i-1

array.set(orderArr, sellId, false)

strategy.close(id=tostring(sellId), comment="#"+tostring(sellId))

if i_autoBounds

upperBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true)

lowerBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false)

gridWidth := (upperBound - lowerBound)/(i_gridQty-1)

gridLineArr := f_buildGrid(lowerBound, gridWidth, i_gridQty)

closeLineArr := f_getNearGridLines(gridLineArr, close)

nearTopGridLine := array.get(closeLineArr, 0)

nearBotGridLine := array.get(closeLineArr, 1)

Detail

https://www.fmz.com/strategy/438937

Last Modified

2024-01-16 14:51:48