Name

蜡烛形态策略-Candlestick-Pattern-Strategy

Author

ChaoZhang

Strategy Description

蜡烛形态策略是一种利用蜡烛线形态进行交易决策的策略。该策略可以检测多种常见的蜡烛线形态,包括吞噬形态、间隔形态、早晨之星、三个黑乌鸦等,并在检测到这些形态时产生交易信号。策略同时支持自定义止损、止盈、尾随止损参数,可以有效控制风险。

该策略的核心逻辑是通过Pine Script代码的条件判断,来识别不同类型的蜡烛形态。例如,判断吞噬形态的代码逻辑是:

bullish_engulfing = high[0]>high[1] and low[0]<low[1] and open[0]<open[1] and close[0]>close[1] and close[0]>open[0] and close[1]<close[2] and close[0]>open[1]

以上逻辑判断了当前K线及之前两根K线的高点、低点、开盘价、收盘价的大小关系,如果满足吞噬形态的定义,则返回true。其他蜡烛形态判断也是类似的逻辑。

当识别到符合条件的蜡烛形态时,则相应的多头或空头交易信号变量会被置为true。然后策略会在交易时间段内,判断交易信号是否触发,如果触发则下单,并设置止损、止盈、尾随止损来控制风险。

- 支持多种常见蜡烛形态,覆盖面广

- 可自定义控制风险的参数,灵活性强

- 包含多种绘图工具,可以清楚识别形态

- 结合K线真实趋势,避免被套

-

蜡烛形态并不总是可靠的信号

解决方法:结合趋势指标,避免在震荡市场使用

-

单一形态可能出现假信号

解决方法:可以适当过滤时间段太短的形态信号

-

参数设置不当可能扩大损失

解决方法:严格按照风险承受能力设置止损、止盈参数

- 增加对趋势的判断,避免不配合趋势的形态

- 结合其他指标过滤信号

- 优化形态参数,降低假信号率

- 结合机器学习算法,建立更可靠的形态识别

蜡烛形态策略利用图形技术分析判断短期转折点,是一种较为常见的短线策略。该策略支持多种形态并可自定义风险控制,使用灵活。但形态信号的可靠性并不高,无法单独使用,需要与趋势及其他因素配合,方可发挥价值。

|| Candlestick Pattern Strategy

The candlestick pattern strategy is a strategy that makes trading decisions based on candlestick patterns. This strategy can detect various common candlestick patterns, including engulfing patterns, harami patterns, morning stars, three black crows, etc., and generates trading signals when these patterns are detected. The strategy also supports custom stop loss, take profit, and trailing stop parameters to effectively control risks.

The core logic of this strategy is to identify different types of candlestick patterns through conditional judgments in Pine Script code. For example, the code logic to judge the engulfing pattern is:

bullish_engulfing = high[0]>high[1] and low[0]<low[1] and open[0]<open[1] and close[0]>close[1] and close[0]>open[0] and close[1]<close[2] and close[0]>open[1]

The above logic judges the relationship between the high, low, open, close prices of the current K-line and previous two K-lines. If it meets the definition of engulfing pattern, it returns true. The judgments of other candlestick patterns are similar.

When a qualified candlestick pattern is identified, the corresponding long or short trading signal variable will be set to true. Then during the trading session, the strategy will check if the trading signal is triggered. If triggered, it will place order and set stop loss, take profit and trailing stop to control risks.

- Support many common candlestick patterns, wide coverage

- Customizable risk control parameters, high flexibility

- Contains multiple plotting tools to clearly identify patterns

- Combine with true trend of K-lines to avoid being trapped

-

Candlestick patterns are not always reliable signals

Solution: Combine with trend indicators, avoid using during range-bound markets

-

A single pattern may have false signals

Solution: Appropriately filter out signals from very short-term patterns

-

Improper parameter settings may amplify losses

Solution: Strictly set stop loss and take profit parameters based on risk tolerance

- Add trend judgment to avoid patterns against the trend

- Filter signals with other indicators

- Optimize pattern parameters to reduce false signals

- Combine machine learning algorithms to build more reliable pattern recognition

The candlestick pattern strategy identifies short-term turning points using technical analysis graphics, which is a common short-term strategy. This strategy supports multiple patterns and customizable risk control, very flexible to use. But the reliability of pattern signals is not high. It cannot be used alone and needs to work with trend and other factors to maximize its value.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Engulfing |

| v_input_2 | true | Harami |

| v_input_3 | true | Piercing Line / Dark Cloud Cover |

| v_input_4 | true | Morning Star / Evening Star |

| v_input_5 | true | Belt Hold |

| v_input_6 | true | Three White Soldiers / Three Black Crows |

| v_input_7 | true | Three Stars in the South |

| v_input_8 | true | Stick Sandwich |

| v_input_9 | true | Meeting Line |

| v_input_10 | true | Kicking |

| v_input_11 | true | Ladder Bottom |

| v_input_12 | 100 | Stop Loss |

| v_input_13 | 1000 | Take Profit |

| v_input_14 | 40 | Trailing Stop |

| v_input_15 | 0000-0000 | Trading session |

Source (PineScript)

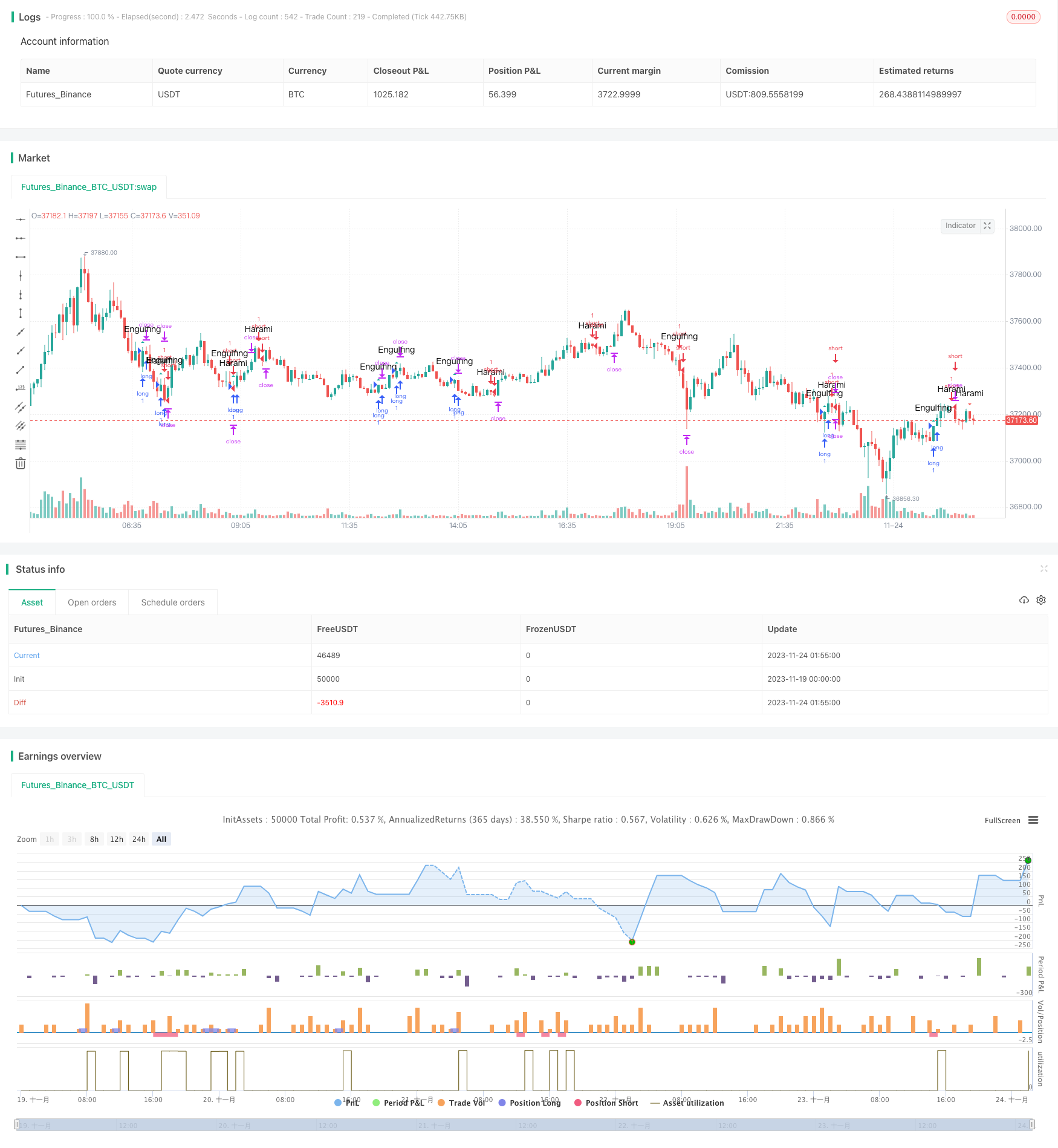

/*backtest

start: 2023-11-19 00:00:00

end: 2023-11-24 02:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//DanyChe

//The script allows you to test popular candlestick patterns on various instruments and timeframes. In addition, you can configure risk management (if the value is zero, it means the function is disabled), and you can also specify the time of the trading session (for example, so that the positions are not transferred to the next day).

//The author is grateful to JayRogers and Phi35, their code examples helped a lot in writing the strategy.

strategy("Candle Patterns Strategy", shorttitle="CPS", overlay=true)

//--- Patterns Input ---

OnEngulfing = input(defval=true, title="Engulfing")

OnHarami = input(defval=true, title="Harami")

OnPiercingLine = input(defval=true, title="Piercing Line / Dark Cloud Cover")

OnMorningStar = input(defval=true, title="Morning Star / Evening Star ")

OnBeltHold = input(defval=true, title="Belt Hold")

OnThreeWhiteSoldiers = input(defval=true, title="Three White Soldiers / Three Black Crows")

OnThreeStarsInTheSouth = input(defval=true, title="Three Stars in the South")

OnStickSandwich = input(defval=true, title="Stick Sandwich")

OnMeetingLine = input(defval=true, title="Meeting Line")

OnKicking = input(defval=true, title="Kicking")

OnLadderBottom = input(defval=true, title="Ladder Bottom")

//--- Risk Management Input ---

inpsl = input(defval = 100, title="Stop Loss", minval = 0)

inptp = input(defval = 1000, title="Take Profit", minval = 0)

inptrail = input(defval = 40, title="Trailing Stop", minval = 0)

// If the zero value is set for stop loss, take profit or trailing stop, then the function is disabled

sl = inpsl >= 1 ? inpsl : na

tp = inptp >= 1 ? inptp : na

trail = inptrail >= 1 ? inptrail : na

//--- Session Input ---

sess = input(defval = "0000-0000", title="Trading session")

t = time('60', sess)

session_open = na(t) ? false : true

// --- Candlestick Patterns ---

//Engulfing

bullish_engulfing = high[0]>high[1] and low[0]<low[1] and open[0]<open[1] and close[0]>close[1] and close[0]>open[0] and close[1]<close[2] and close[0]>open[1] ? OnEngulfing : na

bearish_engulfing = high[0]>high[1] and low[0]<low[1] and open[0]>open[1] and close[0]<close[1] and close[0]<open[0] and close[1]>close[2] and close[0]<open[1] ? OnEngulfing : na

//Harami

bullish_harami = open[1]>close[1] and close[1]<close[2] and open[0]>close[1] and open[0]<open[1] and close[0]>close[1] and close[0]<open[1] and high[0]<high[1] and low[0]>low[1] and close[0]>=open[0] ? OnHarami : na

bearish_harami = open[1]<close[1] and close[1]>close[2] and open[0]<close[1] and open[0]>open[1] and close[0]<close[1] and close[0]>open[1] and high[0]<high[1] and low[0]>low[1] and close[0]<=open[0] ? OnHarami : na

//Piercing Line/Dark Cloud Cover

piercing_line = close[2]>close[1] and open[0]<low[1] and close[0]>avg(open[1],close[1]) and close[0]<open[1] ? OnPiercingLine : na

dark_cloud_cover = close[2]<close[1] and open[0]>high[1] and close[0]<avg(open[1],close[1]) and close[0]>open[1] ? OnPiercingLine : na

//Morning Star/Evening Star

morning_star = close[3]>close[2] and close[2]<open[2] and open[1]<close[2] and close[1]<close[2] and open[0]>open[1] and open[0]>close[1] and close[0]>close[2] and open[2]-close[2]>close[0]-open[0] ? OnMorningStar : na

evening_star = close[3]<close[2] and close[2]>open[2] and open[1]>close[2] and close[1]>close[2] and open[0]<open[1] and open[0]<close[1] and close[0]<close[2] and close[2]-open[2]>open[0]-close[0] ? OnMorningStar : na

//Belt Hold

bullish_belt_hold = close[1]<open[1] and low[1]>open[0] and close[1]>open[0] and open[0]==low[0] and close[0]>avg(close[0],open[0]) ? OnBeltHold :na

bearish_belt_hold = close[1]>open[1] and high[1]<open[0] and close[1]<open[0] and open[0]==high[0] and close[0]<avg(close[0],open[0]) ? OnBeltHold :na

//Three White Soldiers/Three Black Crows

three_white_soldiers = close[3]<open[3] and open[2]<close[3] and close[2]>avg(close[2],open[2]) and open[1]>open[2] and open[1]<close[2] and close[1]>avg(close[1],open[1]) and open[0]>open[1] and open[0]<close[1] and close[0]>avg(close[0],open[0]) and high[1]>high[2] and high[0]>high[1] ? OnThreeWhiteSoldiers : na

three_black_crows = close[3]>open[3] and open[2]>close[3] and close[2]<avg(close[2],open[2]) and open[1]<open[2] and open[1]>close[2] and close[1]<avg(close[1],open[1]) and open[0]<open[1] and open[0]>close[1] and close[0]<avg(close[0],open[0]) and low[1]<low[2] and low[0]<low[1] ? OnThreeWhiteSoldiers : na

//Three Stars in the South

three_stars_in_the_south = open[3]>close[3] and open[2]>close[2] and open[2]==high[2] and open[1]>close[1] and open[1]<open[2] and open[1]>close[2] and low[1]>low[2] and open[1]==high[1] and open[0]>close[0] and open[0]<open[1] and open[0]>close[1] and open[0]==high[0] and close[0]==low[0] and close[0]>=low[1] ? OnThreeStarsInTheSouth : na

//Stick Sandwich

stick_sandwich = open[2]>close[2] and open[1]>close[2] and open[1]<close[1] and open[0]>close[1] and open[0]>close[0] and close[0]==close[2] ? OnStickSandwich : na

//Meeting Line

bullish_ml = open[2]>close[2] and open[1]>close[1] and close[1]==close[0] and open[0]<close[0] and open[1]>=high[0] ? OnMeetingLine : na

bearish_ml = open[2]<close[2] and open[1]<close[1] and close[1]==close[0] and open[0]>close[0] and open[1]<=low[0] ? OnMeetingLine : na

//Kicking

bullish_kicking = open[1]>close[1] and open[1]==high[1] and close[1]==low[1] and open[0]>open[1] and open[0]==low[0] and close[0]==high[0] and close[0]-open[0]>open[1]-close[1] ? OnKicking : na

bearish_kicking = open[1]<close[1] and open[1]==low[1] and close[1]==high[1] and open[0]<open[1] and open[0]==high[0] and close[0]==low[0] and open[0]-close[0]>close[1]-open[1] ? OnKicking : na

//Ladder Bottom

ladder_bottom = open[4]>close[4] and open[3]>close[3] and open[3]<open[4] and open[2]>close[2] and open[2]<open[3] and open[1]>close[1] and open[1]<open[2] and open[0]<close[0] and open[0]>open[1] and low[4]>low[3] and low[3]>low[2] and low[2]>low[1] ? OnLadderBottom : na

// ---Plotting ---

plotshape(bullish_engulfing, text='Engulfing', style=shape.triangleup, color=#1FADA2, editable=true, title="Bullish Engulfing Text")

plotshape(bearish_engulfing,text='Engulfing', style=shape.triangledown, color=#F35A54, editable=true, title="Bearish Engulfing Text")

plotshape(bullish_harami,text='Harami', style=shape.triangleup, color=#1FADA2, editable=true, title="Bullish Harami Text")

plotshape(bearish_harami,text='Harami', style=shape.triangledown, color=#F35A54, editable=true, title="BEarish Harami Text")

plotshape(piercing_line,text='Piercing Line', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(dark_cloud_cover,text='Dark Cloud Cover', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(morning_star,text='Morning Star', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(evening_star,text='Evening Star', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(bullish_belt_hold,text='Belt Hold', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bearish_belt_hold,text='Belt Hold', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(three_white_soldiers,text='Three White Soldiers', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(three_black_crows,text='Three Black Crows', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(three_stars_in_the_south,text='3 Stars South', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(stick_sandwich,text='Stick Sandwich', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bullish_ml,text='Meeting Line', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bearish_ml,text='Meeting Line', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(bullish_kicking,text='Kicking', style=shape.triangleup, color=#1FADA2, editable=false)

plotshape(bearish_kicking,text='Kicking', style=shape.triangledown, color=#F35A54, editable=false)

plotshape(ladder_bottom,text='Ladder Bottom', style=shape.triangleup, color=#1FADA2, editable=false)

// --- STRATEGY ---

SignalUp = bullish_engulfing or bullish_harami or piercing_line or morning_star or bullish_belt_hold or three_white_soldiers or three_stars_in_the_south or stick_sandwich or bullish_ml or bullish_kicking or ladder_bottom

SignalDown = bearish_engulfing or bearish_harami or dark_cloud_cover or evening_star or bearish_belt_hold or three_black_crows or bearish_ml or bearish_kicking

strategy.entry("long", true, when = SignalUp and session_open)

strategy.entry("short", false, when = SignalDown and session_open)

strategy.close("long", when = not session_open)

strategy.close("short", when = not session_open)

strategy.exit("Risk Exit long", from_entry = "long", profit = tp, trail_points = trail, loss = sl)

strategy.exit("Risk Exit short", from_entry = "short", profit = tp, trail_points = trail, loss = sl )

Detail

https://www.fmz.com/strategy/433452

Last Modified

2023-11-27 18:26:52