Name

超一目趋势策略Super-Ichi-Strategy

Author

ChaoZhang

Strategy Description

[trans]

超一策略是基于超一指标进行交易决策的趋势交易策略。该策略采用超一指标的转换线、基准线以及云带的关系来判断目前趋势方向,并结合价格的回调来进行入场。

超一策略主要适用于中长线的趋势交易,可以在较大的趋势中获利。该策略同时具有较强的趋势识别能力。

超一策略主要判断以下几个要素来决定交易方向:

-

转换线和基准线的关系: 当转换线在上时看涨,在下时看跌

-

云带的颜色: 当云带为绿色时看涨,为红色时看跌

-

价格回调: 需要价格收回转换线和基准线之外,才可以入场

具体来说,策略的交易信号为:

做多信号:

- 转换线高于基准线

- 价格高于转换线和基准线

- 转换线和基准线高于云带

- 价格收回转换线和基准线以下

做空信号:

- 转换线低于基准线

- 价格低于转换线和基准线

- 转换线和基准线低于云带

- 价格收回转换线和基准线以上

当同时满足做多/空信号时,则根据头寸情况进行开仓操作。

超一策略具有以下优势:

-

使用超一指标组合判断趋势方向,准确率较高

-

转换线和基准线能清晰判断中短期趋势,云带判断长期趋势

-

条件要求价格收回转折线,可避免虚假突破带来的亏损

-

风险控制采用最近期内最高最低价位设定止损,可有效控制单笔损失

-

盈亏比合理,追求稳定收益

-

可在不同周期应用,适合中长线趋势交易

-

策略思路清晰易理解,参数优化空间大

-

可在多种市场环境中效果良好

超一策略也存在以下风险:

-

在震荡市中,止损可能被频繁触发,影响盈利效果

-

当趋势快速变化时,不能及时反转头寸,可能带来亏损

-

设定的盈亏比并不适合所有品种,需要针对不同标的调整参数

-

当突破云带后拉升空间有限时,可能获利有限

-

指标参数需要反复测试优化,不适合参数调整频繁的品种

可通过以下方法降低风险:

-

优化参数,使之更符合不同周期和品种特征

-

结合其他指标过滤入场信号,避免在震荡市假突破

-

动态调整止损位置,降低止损被触发概率

-

测试不同的盈亏比设置

-

采用图表形态等方法确定趋势信号强弱

超一策略可从以下方面进行优化:

-

优化转换线和基准线参数,使之更符合所交易品种的特性

-

优化云带参数,使云带对长期趋势判断更准确

-

优化止损算法,如根据ATR设定止损或带动态止损

-

结合其它指标进行信号过滤,配置更多过滤条件,降低误入场概率

-

优化盈亏比设置,适应策略在不同品种和周期上的特点

-

采用马丁格尔方式管理仓位,适应不同的行情波动频率

-

采用机器学习方法对参数进行优化,实现更高的稳定性

-

设置不同的交易时间段,针对夜盘和盘间的行情特点进行调整

超一策略整体来说是一个非常适合中长线趋势交易的策略。它采用超一指标判断趋势方向的优势明显,同时结合价格回调进行入场可以有效避免误入场。通过优化参数设置,可使策略在更多品种和更多周期上达到稳定盈利。该策略既容易理解,又具有很大的优化空间,适合用作策略研究和学习的基础策略之一。

||

The Super Ichi strategy is a trend trading strategy that makes trading decisions based on the Super Ichi indicator. It uses the relationships between the Tenkan line, Kijun line and the Ichimoku Cloud of the Super Ichi indicator to determine the current trend direction, and enters on price pullbacks.

The Super Ichi strategy is mainly suitable for medium-to-long term trend trading and aims to profit from major trends. It also has strong trend identification capabilities.

The Super Ichi strategy mainly judges the following elements to determine the trading direction:

-

Tenkan and Kijun Relationship: Bullish when Tenkan is on top, bearish when below

-

Cloud Color: Bullish when cloud is green, bearish when red

-

Price Pullback: Requires a pullback from the lines before entry

Specifically, the trading signals are:

Long Signal:

- Tenkan above Kijun

- Price above Tenkan and Kijun

- Tenkan and Kijun above Cloud

- Price pulls back below Tenkan and Kijun

Short Signal:

- Tenkan below Kijun

- Price below Tenkan and Kijun

- Tenkan and Kijun below Cloud

- Price pulls back above Tenkan and Kijun

When the long/short signal is triggered, a position will be opened based on the current position.

The Super Ichi strategy has the following advantages:

-

Uses Ichimoku combination to determine trends accurately

-

Tenkan/Kijun shows short-term, Cloud shows long-term trends

-

Pullback requirement avoids false breakouts

-

Risk management uses recent swing high/low for stop loss to limit losses

-

Reasonable risk-reward ratio for steady gains

-

Applicable to different timeframes for medium-to-long term trend trading

-

Clear logic and large optimization space

-

Performs well across various market conditions

The Super Ichi strategy also has the following risks:

-

Stop loss may be triggered frequently during ranging markets, impacting profitability

-

Failure to quickly reverse positions when trend changes swiftly could lead to losses

-

Default risk-reward ratios may not suit all instruments, fine tuning required

-

Limited upside potential when Cloud breakout has limited follow-through

-

Indicator parameters need extensive testing and optimization for active instruments

Risks can be reduced through:

-

Optimizing parameters for different timeframes and instruments

-

Adding filters to avoid false breakout entries during ranging market

-

Using dynamic stop loss to reduce being stopped out

-

Testing different risk-reward ratio settings

-

Confirming signal strength using chart patterns etc.

The Super Ichi strategy can be optimized in the following aspects:

-

Optimize Tenkan/Kijun parameters to better suit the traded instrument

-

Optimize Cloud parameters for better long-term trend assessment

-

Enhance stop loss algorithm, e.g. ATR-based or trailing stops

-

Add filters using other indicators to reduce false entries

-

Fine-tune risk-reward ratios for different instruments and timeframes

-

Use martingale position sizing to accommodate varying market volatility

-

Utilize machine learning for parameter optimization and robustness

-

Set separate parameters for day vs overnight sessions

The Super Ichi strategy is well-suited for medium-to-long term trend trading overall. It excels at determining trend direction using Ichimoku, while the pullback requirement avoids false entries. With parameter optimization, it can achieve steady profits across more instruments and timeframes. Easy to understand yet highly optimizable, the Super Ichi strategy serves as an excellent basic trend following strategy for research and learning.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 15 | (?Strategy: Risk Management)Swing High/Low Lookback Length |

| v_input_float_1 | 2 | Account percent loss per trade |

| v_input_float_2 | 2 | Profit Factor (R:R Ratio) |

| v_input_bool_1 | true | Use Swing High/Low ATR Override |

| v_input_int_2 | true | Swing High/Low ATR Override Multiplier |

| v_input_int_3 | 14 | Swing High/Low ATR Override Length |

| v_input_int_4 | 5 | (?Strategy: Settings)Pullback Lookback Length |

| v_input_int_5 | 2022 | (?Strategy: Date Range)Start Date |

| v_input_int_6 | 0 | start_month: 1 |

| v_input_int_7 | 0 | start_date: 1 |

| v_input_int_8 | 2023 | End Date |

| v_input_int_9 | 0 | end_month: 1 |

| v_input_int_10 | 0 | end_date: 1 |

| v_input_1 | 9 | (?Indicator: SuperIchi Settings)Tenkan |

| v_input_2 | 2 | tenkan_mult |

| v_input_3 | 26 | Kijun |

| v_input_4 | 4 | kijun_mult |

| v_input_5 | 52 | Senkou Span B |

| v_input_6 | 6 | spanB_mult |

| v_input_7 | 26 | Displacement |

Source (PineScript)

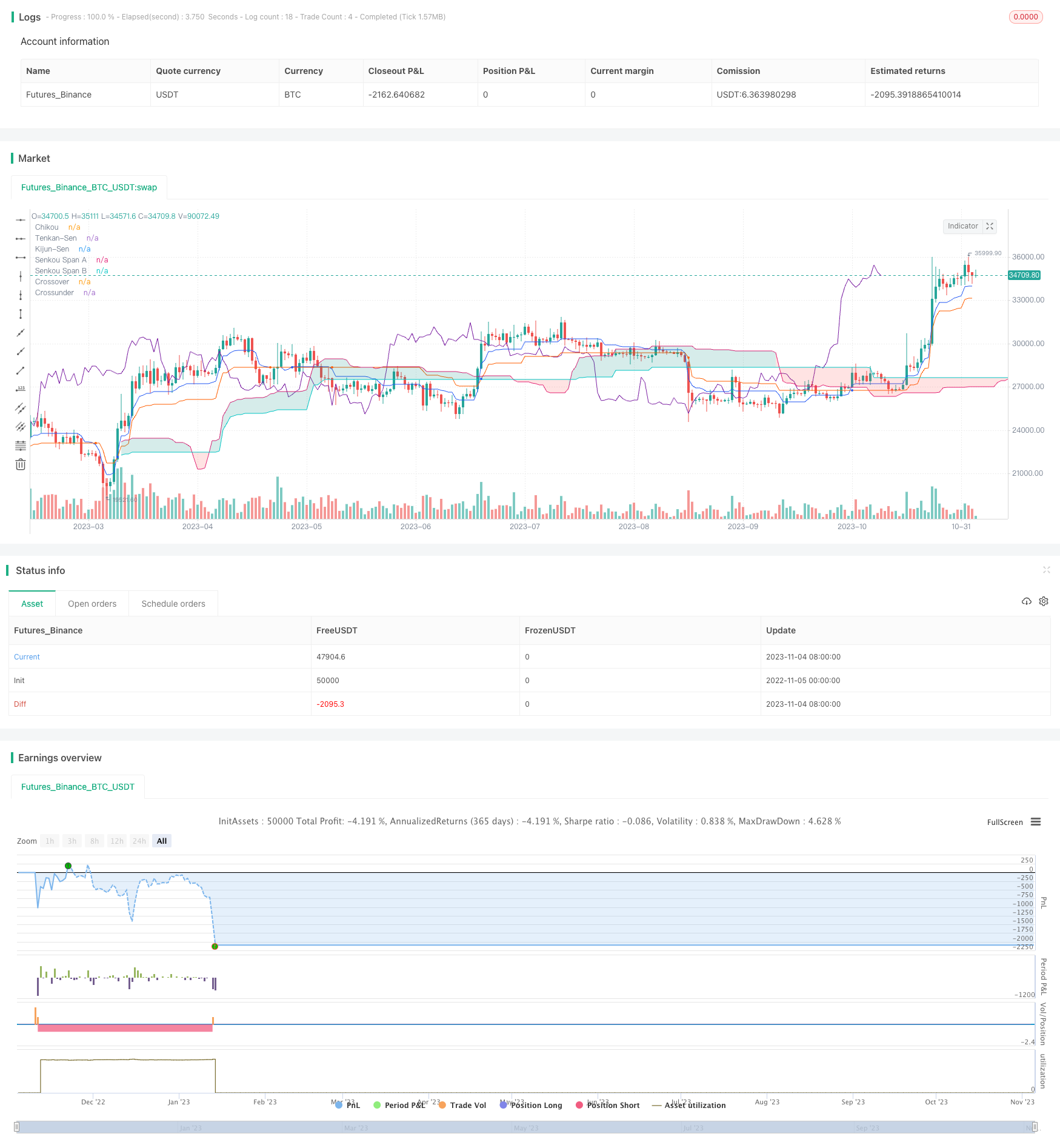

/*backtest

start: 2022-11-05 00:00:00

end: 2023-11-05 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Strategy based on the the SuperIchi indicator.

//

// Strategy was designed for the purpose of back testing.

// See strategy documentation for info on trade entry logic.

//

// Credits:

// - SuperIchi [LUX]: LuxAlgo (https://www.tradingview.com/script/vDGd9X9y-SuperIchi-LUX/)

//@version=5

strategy("SuperIchi Strategy", overlay=true, initial_capital=1000, currency=currency.NONE, max_labels_count=500, default_qty_type=strategy.cash, commission_type=strategy.commission.percent, commission_value=0.01)

// =============================================================================

// STRATEGY INPUT SETTINGS

// =============================================================================

// ---------------

// Risk Management

// ---------------

swingLength = input.int(15, "Swing High/Low Lookback Length", group='Strategy: Risk Management', tooltip='Stop Loss is calculated by the swing high or low over the previous X candles')

accountRiskPercent = input.float(2, "Account percent loss per trade", step=0.1, group='Strategy: Risk Management', tooltip='Each trade will risk X% of the account balance')

profitFactor = input.float(2, "Profit Factor (R:R Ratio)", step = 0.1, group='Strategy: Risk Management')

useAtrOverride = input.bool(true, "Use Swing High/Low ATR Override", group='Strategy: Risk Management', tooltip='In some cases price may not have a large enough (if any) swing withing previous X candles. Turn this on to use an ATR value when swing high/low is lower than the given ATR value')

atrMultiplier = input.int(1, "Swing High/Low ATR Override Multiplier", group='Strategy: Risk Management')

atrLength = input.int(14, "Swing High/Low ATR Override Length", group='Strategy: Risk Management')

// -----------------

// Strategy Settings

// -----------------

pullbackLength = input.int(5, "Pullback Lookback Length", group='Strategy: Settings', tooltip='Number of candles to consider for a pullback into the moving averages (prerequisite for trade entry)')

// ----------

// Date Range

// ----------

start_year = input.int(title='Start Date', defval=2022, minval=2010, maxval=3000, group='Strategy: Date Range', inline='1')

start_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

start_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

end_year = input.int(title='End Date', defval=2023, minval=1800, maxval=3000, group='Strategy: Date Range', inline='2')

end_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

end_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

in_date_range = time >= timestamp(syminfo.timezone, start_year, start_month, start_date, 0, 0) and time < timestamp(syminfo.timezone, end_year, end_month, end_date, 0, 0)

// =============================================================================

// INDICATORS

// =============================================================================

// ---------------

// SuperIchi [LUX]

// ---------------

tenkan_len = input(9,'Tenkan ',inline='SuperIchi', group='Indicator: SuperIchi Settings')

tenkan_mult = input(2.,'',inline='SuperIchi', group='Indicator: SuperIchi Settings')

kijun_len = input(26,'Kijun ',inline='SuperIchi', group='Indicator: SuperIchi Settings')

kijun_mult = input(4.,'',inline='SuperIchi', group='Indicator: SuperIchi Settings')

spanB_len = input(52,'Senkou Span B ',inline='SuperIchi', group='Indicator: SuperIchi Settings')

spanB_mult = input(6.,'',inline='SuperIchi', group='Indicator: SuperIchi Settings')

offset = input(26,'Displacement', inline='SuperIchi', group='Indicator: SuperIchi Settings')

//------------------------------------------------------------------------------

avg(src,length,mult)=>

atr = ta.atr(length)*mult

up = hl2 + atr

dn = hl2 - atr

upper = 0.,lower = 0.

upper := src[1] < upper[1] ? math.min(up,upper[1]) : up

lower := src[1] > lower[1] ? math.max(dn,lower[1]) : dn

os = 0,max = 0.,min = 0.

os := src > upper ? 1 : src < lower ? 0 : os[1]

spt = os == 1 ? lower : upper

max := ta.cross(src,spt) ? math.max(src,max[1]) : os == 1 ? math.max(src,max[1]) : spt

min := ta.cross(src,spt) ? math.min(src,min[1]) : os == 0 ? math.min(src,min[1]) : spt

math.avg(max,min)

//------------------------------------------------------------------------------

tenkan = avg(close,tenkan_len,tenkan_mult)

kijun = avg(close,kijun_len,kijun_mult)

senkouA = math.avg(kijun,tenkan)

senkouB = avg(close,spanB_len,spanB_mult)

//------------------------------------------------------------------------------

tenkan_css = #2157f3 //blue

kijun_css = #ff5d00 //red

cloud_a = color.new(color.teal,80)

cloud_b = color.new(color.red,80)

chikou_css = #7b1fa2

plot(tenkan,'Tenkan-Sen',tenkan_css)

plot(kijun,'Kijun-Sen',kijun_css)

plot(ta.crossover(tenkan,kijun) ? kijun : na,'Crossover',#2157f3,3,plot.style_circles)

plot(ta.crossunder(tenkan,kijun) ? kijun : na,'Crossunder',#ff5d00,3,plot.style_circles)

A = plot(senkouA,'Senkou Span A',na,offset=offset-1)

B = plot(senkouB,'Senkou Span B',na,offset=offset-1)

fill(A,B,senkouA > senkouB ? cloud_a : cloud_b)

plot(close,'Chikou',chikou_css,offset=-offset+1,display=display.none)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

plotchar(kijun, "kijun", "", location = location.top)

plotchar(senkouA[offset-1], "senkouA", "", location = location.top)

plotchar(tenkan > kijun, "line above", "", location = location.top)

plotchar(close > tenkan, "price above", "", location = location.top)

plotchar(kijun > senkouA[offset-1], "above cloud", "", location = location.top)

// blue line above red line + price above both lines + both lines above cloud

longSen = tenkan > kijun and close > tenkan and kijun > senkouA[offset-1]

// red line below blue line + price below both lines + both lines below cloud

shortSen = tenkan < kijun and close < tenkan and kijun < senkouA[offset-1]

plotchar(longSen, "longSen", "", location = location.top)

plotchar(shortSen, "shortSen", "", location = location.top)

// Cloud is green

longSenkou = senkouA[offset-1] > senkouB[offset-1]

// Cloud is red

shortSenkou = senkouA[offset-1] < senkouB[offset-1]

// price must have pulled back below sen lines before entry

barsSinceLongPullback = ta.barssince(close < kijun and close < tenkan)

longPullback = barsSinceLongPullback <= pullbackLength

// price must have pulled back above sen lines before entry

barsSinceShortPullback = ta.barssince(close > kijun and close > tenkan)

shortPullback = barsSinceShortPullback <= pullbackLength

// plotchar(lowestClose, "lowestClose", "", location = location.top)

// plotchar(highestClose, "highestClose", "", location = location.top)

inLong = strategy.position_size > 0

inShort = strategy.position_size < 0

longCondition = longSen and longSenkou and longPullback and in_date_range

shortCondition = shortSen and shortSenkou and shortPullback and in_date_range

swingLow = ta.lowest(source=low, length=swingLength)

swingHigh = ta.highest(source=high, length=swingLength)

atr = useAtrOverride ? ta.atr(atrLength) * atrMultiplier : 0

longSl = math.min(close - atr, swingLow)

shortSl = math.max(close + atr, swingHigh)

longStopPercent = math.abs((1 - (longSl / close)) * 100)

shortStopPercent = math.abs((1 - (shortSl / close)) * 100)

longTpPercent = longStopPercent * profitFactor

shortTpPercent = shortStopPercent * profitFactor

longTp = close + (close * (longTpPercent / 100))

shortTp = close - (close * (shortTpPercent / 100))

// Position sizing (default risk 2% per trade)

riskAmt = strategy.equity * accountRiskPercent / 100

longQty = math.abs(riskAmt / longStopPercent * 100) / close

shortQty = math.abs(riskAmt / shortStopPercent * 100) / close

if (longCondition and not inLong)

strategy.entry("Long", strategy.long, qty=longQty)

strategy.exit("Long SL/TP", from_entry="Long", stop=longSl, limit=longTp, alert_message='Long SL Hit')

buyLabel = label.new(x=bar_index, y=high[1], color=color.green, style=label.style_label_up)

label.set_y(id=buyLabel, y=low)

label.set_tooltip(id=buyLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + "\nQty: " + str.tostring(longQty) + "\nSwing low: " + str.tostring(swingLow) + "\nStop Percent: " + str.tostring(longStopPercent) + "\nTP Percent: " + str.tostring(longTpPercent))

if (shortCondition and not inShort)

strategy.entry("Short", strategy.short, qty=shortQty)

strategy.exit("Short SL/TP", from_entry="Short", stop=shortSl, limit=shortTp, alert_message='Short SL Hit')

sellLabel = label.new(x=bar_index, y=high[1], color=color.red, style=label.style_label_up)

label.set_y(id=sellLabel, y=low)

label.set_tooltip(id=sellLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + "\nQty: " + str.tostring(shortQty) + "\nSwing high: " + str.tostring(swingHigh) + "\nStop Percent: " + str.tostring(shortStopPercent) + "\nTP Percent: " + str.tostring(shortTpPercent))

Detail

https://www.fmz.com/strategy/431278

Last Modified

2023-11-06 16:32:11