Name

超趋势跟踪止损策略Super-Trend-Tracking-Stop-Loss-Strategy

Author

ChaoZhang

Strategy Description

[trans]

该策略基于超趋势指标和跟踪止损来开仓和平仓。它使用4个报警来打开和平仓,并且采用超趋势策略。该策略专门针对机器人设计,具有跟踪止损功能。

该策略使用ATR指标计算上轨和下轨。当收盘价突破上轨时产生买入信号,突破下轨时产生卖出信号。策略还采用超趋势线来判断趋势方向。当超趋势线上穿时,表示牛市开始;当超趋势线下穿时,表示熊市开始。策略在产生信号时开仓,同时设置初始止损价格。之后会根据价格变动来跟踪调整止损价格,从而锁定盈利,实现跟踪止损的效果。

该策略结合了超趋势指标判断趋势方向和ATR指标设定止损的优点,可以有效过滤假突破。跟踪止损可以很好地锁定盈利,降低回撤。另外,策略专门针对机器人设计,可以自动化交易。

超趋势指标容易产生较多误信号。止损价格调整幅度较大时,会提高止损被击穿的概率。此外,机器人交易也面临服务器宕机、网络中断等技术风险。

为降低误信号概率,可以适当调整ATR参数或添加其他指标进行过滤。调整止损跟踪幅度时需要平衡盈利和风险。同时准备好备用服务器和网络来防范技术故障风险。

该策略可以在以下几个方面进行优化:

-

增加指标或条件来过滤入场信号,避免误信号。例如可 추加MACD指标。

-

可以测试不同的ATR参数组合,找到最佳参数。

-

可以优化止损跟踪幅度,找到最佳平衡点。

-

可以添加更多止损价格,实现分批止损。

-

可以建立主备双服务器架构,在主服务器故障时快速切换。

本策略整合超趋势指标和跟踪止损的优势,可以自动化开仓和止损。实盘中结合优化方向的改进措施,可以成为一款非常实用的量化交易策略。

||

This strategy opens and closes positions based on the Super Trend indicator and trailing stop loss. It uses 4 alerts to open and close long and short positions, and adopts a super trend strategy. The strategy is designed specifically for robots with trailing stop loss functionality.

The strategy uses the ATR indicator to calculate the upper and lower bands. A buy signal is generated when the closing price breaks through the upper band, and a sell signal is generated when it breaks through the lower band. The strategy also uses a super trend line to determine the trend direction. When the super trend line goes up, it indicates the start of a bull market. When it goes down, it indicates the start of a bear market. The strategy opens positions when a signal is generated, and sets the initial stop loss price. It then adjusts the stop loss price based on price changes to lock in profits and achieve a trailing stop loss effect.

The strategy combines the advantages of the Super Trend indicator for determining trend direction and the ATR indicator for setting stops. It can effectively filter out false breakouts. Trailing stops can lock in profits very well and reduce drawdowns. In addition, the strategy is designed specifically for robots, enabling automated trading.

The Super Trend indicator can easily generate more false signals. When the stop loss adjustment range is large, the probability of stop loss being hit increases. In addition, robot trading also faces technical risks such as server crashes and network interruptions.

To reduce the probability of false signals, the ATR parameters can be adjusted appropriately or other indicators can be added for filtration. When adjusting the trailing stop range, profit and risk need to be balanced. At the same time, prepare backup servers and networks to hedge against technical failure risks.

The following are some directions in which this strategy can be optimized:

-

Add indicators or conditions to filter entry signals and avoid false signals. For example, the MACD indicator can be added.

-

Test different ATR parameter combinations to find the optimal parameters.

-

Optimize the trailing stop loss range to find the best balance point.

-

Add more stop loss prices to achieve batch stopping of losses.

-

Build a dual-server architecture with primary and standby servers that can quickly switch when the main server fails.

This strategy integrates the advantages of the Super Trend indicator and trailing stop loss for automated opening and stopping of losses. Combined with the improvement measures in the optimization directions during live trading, it can become a very practical quantitative trading strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_5 | true | From Month |

| v_input_int_6 | true | From Day |

| v_input_int_7 | 2019 | From Year |

| v_input_int_8 | true | To Month |

| v_input_int_9 | true | To Day |

| v_input_int_10 | 9999 | To Year |

| v_input_float_1 | 4.5 | (?ATR)ATR Factor |

| v_input_int_1 | 59 | ATR Period |

| v_input_1 | true | (?stop loss)trailing stop ? |

| v_input_float_2 | 15 | trailing stop % |

| v_input_2 | true | (?take profit)Take profit1 On/Off ? |

| v_input_float_3 | 5 | TP1 % |

| v_input_int_2 | 10 | TP1 Amount % |

| v_input_3 | true | Take profit2 On/Off ? |

| v_input_float_4 | 10 | TP2 % |

| v_input_int_3 | 15 | TP2 Amount % |

| v_input_4 | true | Take profit3 On/Off ? |

| v_input_float_5 | 15 | TP3 % |

| v_input_int_4 | 20 | TP3 Amount % |

| v_input_5 | long | (?Alert Messages)Long Alert Message |

| v_input_6 | long | Long close Alert Message |

| v_input_7 | short | Short Alert Message |

| v_input_8 | short | Short close Alert Message |

Source (PineScript)

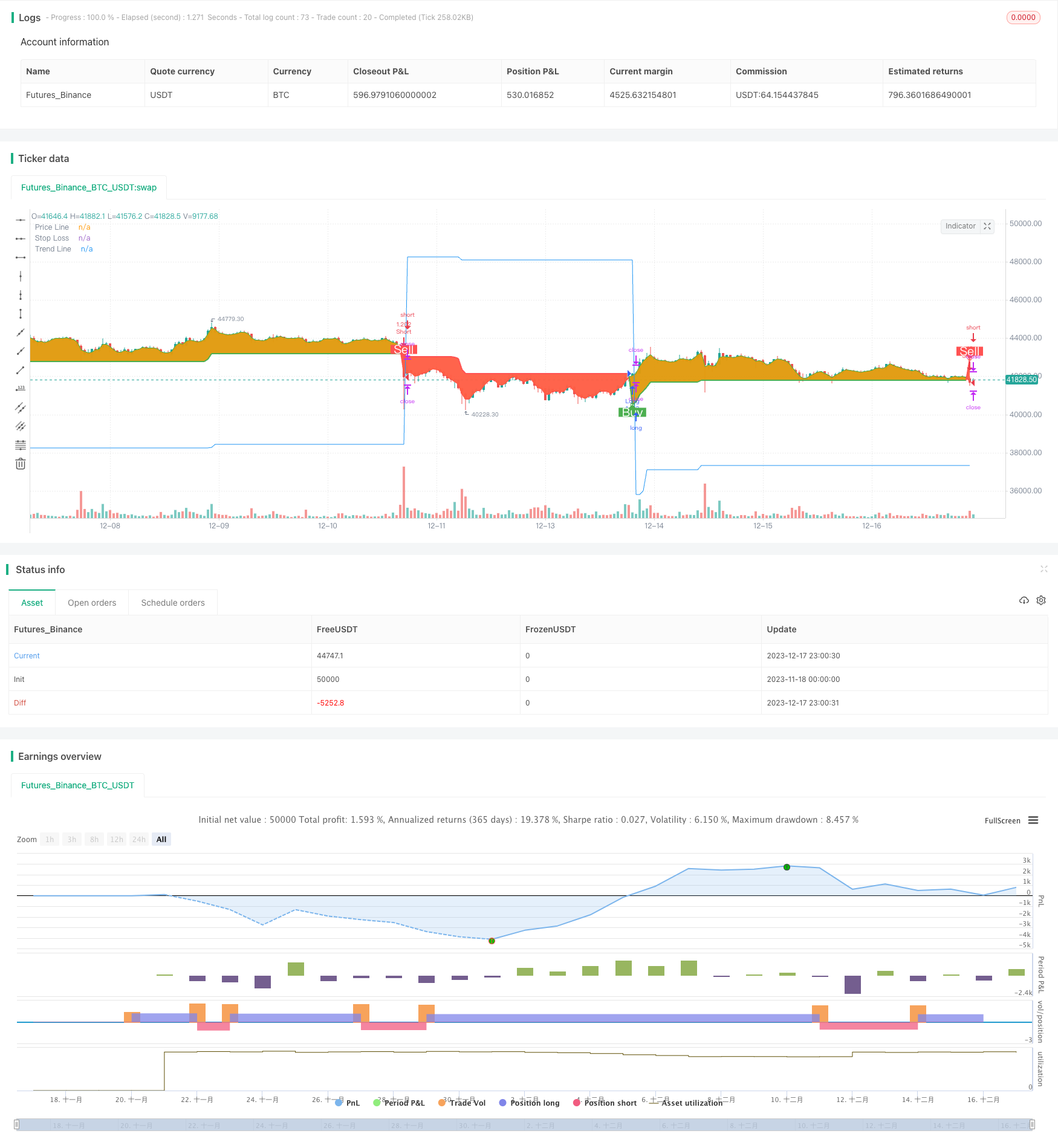

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © arminomid1375

//@version=5

strategy('Mizar_BOT_super trend', overlay=true, default_qty_value=100, currency=currency.USD, default_qty_type=strategy.percent_of_equity, initial_capital=100, max_bars_back=4000)

//===== INPUTS ==========================================================================//

factor = input.float(4.5, title='ATR Factor', step=0.1,group = 'ATR')

period = input.int(59, minval=1, maxval=100, title='ATR Period',group = 'ATR')

up = (high + low) / 2 - factor * ta.atr(period)

down = (high + low) / 2 + factor * ta.atr(period)

trend_up = 0.0

trend_up := close[1] > trend_up[1] ? math.max(up, trend_up[1]) : up

trend_down = 0.0

trend_down := close[1] < trend_down[1] ? math.min(down, trend_down[1]) : down

trend = 0.0

trend := close > trend_down[1] ? 1 : close < trend_up[1] ? -1 : nz(trend[1], 1)

tsl = trend == 1 ? trend_up : trend_down

line_color = trend == 1 ? 'green' : 'red'

long_signal = trend == 1 and trend[1] == -1

short_signal = trend == -1 and trend[1] == 1

background = true

//ss = input.float(defval=15.0, minval=0.0, title=' stop loss %',group = 'stop loss')

use_sl = input(title='trailing stop ?', defval=true,group = 'stop loss')

initial_sl_pct = input.float(defval=15.0, minval=0.0, title='trailing stop %',group = 'stop loss')

Tpactive1 = input(title='Take profit1 On/Off ?', defval=true, group='take profit')

tp1percent = input.float(5.0, title='TP1 %', group='take profit') *100

tp1amt = input.int(10, title='TP1 Amount %', group='take profit')

Tpactive2 = input(title='Take profit2 On/Off ?', defval=true, group='take profit')

tp2percent = input.float(10, title='TP2 %', group='take profit') *100

tp2amt = input.int(15, title='TP2 Amount %', group='take profit')

Tpactive3 = input(title='Take profit3 On/Off ?', defval=true, group='take profit')

tp3percent = input.float(15, title='TP3 %', group='take profit')*100

tp3amt = input.int(20, title='TP3 Amount %', group='take profit')

//===== TIMEFRAME ==========================================================================//

from_month = input.int(defval=1, title='From Month', minval=1, maxval=12)

from_day = input.int(defval=1, title='From Day', minval=1, maxval=31)

from_year = input.int(defval=2019, title='From Year', minval=2017)

to_month = input.int(defval=1, title='To Month', minval=1, maxval=12)

to_day = input.int(defval=1, title='To Day', minval=1, maxval=31)

to_year = input.int(defval=9999, title='To Year', minval=2017)

start = timestamp(from_year, from_month, from_day, 00, 00)

finish = timestamp(to_year, to_month, to_day, 23, 59)

window() =>

time >= start and time <= finish ? true : false

//===== PLOTS ==========================================================================//

// Line

line_plot = plot(tsl, color=trend == 1 ? color.green : color.red, linewidth=2, title='Trend Line')

// Labels

plotshape(long_signal and window() ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.normal, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

plotshape(short_signal and window() ? down : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.normal, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

// Circles

plotshape(long_signal and window() ? up : na, title='Uptrend starts', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

plotshape(short_signal and window() ? down : na, title='Downtrend starts', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

// Background

long_fill = background ? trend == 1 ? color.green : na : na

short_fill = background ? trend == -1 ? color.red : na : na

candle_plot = plot(ohlc4, title='Price Line', color=trend == 1 ? long_fill : short_fill, linewidth=2, transp=90)

fill(candle_plot, line_plot, title='Long Background', color=long_fill, transp=90)

fill(candle_plot, line_plot, title='Short Background', color=short_fill, transp=90)

//===== GLOBAL ==========================================================================//

var entry_price = 0.0

var updated_entry_price = 0.0

var sl_price = 0.0

longString = "Input your custom alert message here.\nAnd put {{strategy.order.alert_message}} in the message box."

longclose = "Input your custom alert message here.\nAnd put {{strategy.order.alert_message}} in the message box."

shortString = "Input your custom alert message here.\nAnd put {{strategy.order.alert_message}} in the message box."

shortclose = "Input your custom alert message here.\nAnd put {{strategy.order.alert_message}} in the message box."

longAlertMessage = input(title="Long Alert Message", defval="long", group="Alert Messages", tooltip=longString)

longcloseAlertMessage = input(title="Long close Alert Message", defval="long", group="Alert Messages", tooltip=longclose)

shortAlertMessage = input(title="Short Alert Message", defval="short", group="Alert Messages", tooltip=shortString)

shortcloseAlertMessage = input(title="Short close Alert Message", defval="short", group="Alert Messages", tooltip=shortclose)

has_open_trade() =>

strategy.position_size != 0

has_no_open_trade() =>

strategy.position_size == 0

is_long() =>

strategy.position_size > 0 ? true : false

is_short() =>

strategy.position_size < 0 ? true : false

plot(use_sl ? has_no_open_trade() ? close : sl_price : na, color=has_no_open_trade() ? na : color.blue, title='Stop Loss')

strategy_close() =>

if is_long()

strategy.close('Long')

alert(longcloseAlertMessage)

if is_short()

strategy.close('Short')

alert(shortcloseAlertMessage)

strategy_long() =>

strategy.entry('Long', strategy.long)

strategy_short() =>

strategy.entry('Short', strategy.short)

sl_pct = initial_sl_pct

if long_signal or is_long() and not(short_signal or is_short())

sl_pct := initial_sl_pct * -1

sl_pct

//===== STRATEGY ==========================================================================//

crossed_sl = false

if is_long() and use_sl

crossed_sl := close <= sl_price

crossed_sl

if is_short() and use_sl

crossed_sl := close >= sl_price

crossed_sl

terminate_operation = window() and has_open_trade() and crossed_sl

if terminate_operation and not(long_signal or short_signal) // Do not close position if trend is flipping anyways.

entry_price := 0.0

updated_entry_price := entry_price

sl_price := 0.0

strategy_close()

start_operation = window() and (long_signal or short_signal)

if start_operation

entry_price := close

updated_entry_price := entry_price

sl_price := entry_price + entry_price * sl_pct / 100

if long_signal

strategy_long()

if Tpactive1==true

strategy.exit('TPL1','Long', qty_percent=tp1amt,profit =tp1percent)

alert(shortcloseAlertMessage)

alert(longAlertMessage)

if short_signal

strategy_short()

if Tpactive1==true

strategy.exit('TPL1','Short', qty_percent=tp1amt,profit =tp1percent)

alert(longcloseAlertMessage)

alert(shortAlertMessage)

//===== TRAILING ==========================================================================//

if is_long() and use_sl

strategy_pct = (close - updated_entry_price) / updated_entry_price * 100.00

if strategy_pct > 1

sl_pct += strategy_pct - 1.0

new_sl_price = updated_entry_price + updated_entry_price * sl_pct / 100

sl_price := math.max(sl_price, new_sl_price)

updated_entry_price := sl_price

updated_entry_price

if is_short() and use_sl

strategy_pct = (close - updated_entry_price) / updated_entry_price * 100.00

if strategy_pct < -1

sl_pct += strategy_pct + 1.0

new_sl_price = updated_entry_price + updated_entry_price * sl_pct / 100

sl_price := math.min(sl_price, new_sl_price)

updated_entry_price := sl_price

updated_entry_price

Detail

https://www.fmz.com/strategy/435839

Last Modified

2023-12-19 11:20:15