Name

追踪型突破策略Tracking-Breakout-Strategy

Author

ChaoZhang

Strategy Description

[trans]

本策略主要通过“唐奇安通道”指标来实现追踪型突破交易策略。该策略结合趋势和突破两种交易思路,在长线趋势判断的基础上,寻找较短周期的突破点进行 entries,实现在趋势行情中的顺势交易。此外,策略还设置止损和止盈水平,以控制每单交易的风险收益比。总体来说,该策略具有追踪趋势的优势,可以顺势而为,把握长线趋势机会。

-

设置“唐奇安通道”指标的参数,默认周期20;

-

设置EMA平滑移动均线,默认周期200;

-

设置风险收益比,默认1.5;

-

设置突破回踩参数,分别为多头和空头;

-

记录上一突破是否为高点或低点;

-

多头信号:如果上一突破为低点,且价格高于唐奇安上轨且高于EMA均线,生成多头信号;

-

空头信号:如果上一突破为高点,且价格低于唐奇安下轨且低于EMA均线,生成空头信号;

-

进入多头仓位后,设置止损为唐奇安下轨回撤5个点,止盈为风险收益比乘以止损距离;

-

进入空头仓位后,设置止损为唐奇安上轨回撤5个点,止盈为风险收益比乘以止损距离。

通过这种方式,策略结合趋势判断和突破操作,能顺势而为,在长线趋势中捕捉较短周期的机会。同时,止损止盈设置可以控制单笔交易的风险收益情况。

-

追踪长线趋势,顺势而为,避免逆势交易。

-

唐奇安通道作为长线指标,结合EMA均线过滤,可以较好判断趋势方向。

-

止损止盈机制控制每单风险,可以限制可能的损失。

-

风险收益比优化,可以拉大盈亏比,追求超额收益。

-

回测参数设置灵活,可以针对不同市场调整最佳参数组合。

-

唐奇安通道和EMA均线作为过滤指标,可能发出错误信号。

-

突破交易容易被套,需要 identifty 明确趋势背景。

-

止损止盈距离固定,无法根据市场波动程度做调整。

-

Parameters 优化空间有限,实盘效果难以保证。

-

交易系统经不起太多随机性事件的考验,黑天鹅事件可能造成较大亏损。

-

可以考虑加入更多指标进行过滤,例如震荡指标,提高信号质量。

-

可以设置智能止损止盈,根据市场波动程度和ATR指标动态调整盈亏位置。

-

可以采用机器学习等方法对参数进行测试和优化,使之更贴近真实市场。

-

可以优化入场逻辑,设置VOLUME或波动率指标作为辅助条件,避免陷阱。

-

可以考虑与趋势跟踪策略或机器学习结合,形成混合策略,提高稳定性。

本策略作为一种追踪型突破策略,核心思路是在判断到长线趋势的前提下,以突破为信号进行顺势操作,并设定止损止盈控制单笔交易风险。该策略具有一定的优势,但也存在一些可优化空间。总体而言,如能处理好参数设定、入场时机选择等问题,并辅以其他技术进行增强,该策略可以成为一种实用的趋势跟踪策略。但投资者仍需谨记,任何交易系统都无法完全规避市场风险,需要做好风险管理。

||

This strategy mainly uses the “Donchian Channel” indicator to implement a tracking breakout trading strategy. The strategy combines trend following and breakout trading ideas, seeking breakout points in shorter cycles based on identification of the major trend, in order to trade along the trend. In addition, the strategy sets stop loss and take profit levels to control the risk/reward of each trade. Overall, the strategy has the advantage of tracking the trend, and trading in the direction of the major trend.

-

Set parameters for “Donchian Channel” indicator, default period is 20;

-

Set EMA moving average, default period is 200;

-

Set risk/reward ratio, default is 1.5;

-

Set pullback parameters after breakout for long and short;

-

Record if previous breakout was a high or low point;

-

Long signal: if previous breakout was a low, price breaks above Donchian upper band and above EMA line;

-

Short signal: if previous breakout was a high, price breaks below Donchian lower band and below EMA line;

-

After long entry, set stop loss at Donchian lower band minus 5 points, take profit at risk/reward ratio times stop loss distance;

-

After short entry, set stop loss at Donchian upper band plus 5 points, take profit at risk/reward ratio times stop loss distance.

In this way, the strategy combines trend following and breakout trading, to trade along with major trend. Meanwhile, stop loss and take profit controls the risk/reward of each trade.

-

Follow major trend, avoid trading against the trend.

-

Donchian Channel as long term indicator, combining with EMA filter, can effectively identify the trend.

-

Stop loss and take profit controls risk per trade, limits potential losses.

-

Optimizing risk/reward ratio can increase profit factor, pursuing excess returns.

-

Flexible backtest parameters, can optimize parameters for different markets.

-

Donchian Channel and EMA may give wrong signals sometimes.

-

Breakout trading can easily be trapped, need to identify trend background clearly.

-

Fixed stop loss and take profit cannot adjust based on market volatility.

-

Limited optimization space for parameters, live performance not guaranteed.

-

Trading systems vulnerable to black swan events, may lead to severe losses.

-

Consider adding more filters like oscillators to improve signal quality.

-

Set adaptive stop loss and take profit based on market volatility and ATR.

-

Use machine learning to test and optimize parameters to fit real markets.

-

Optimize entry logic with volume or volatility as condition to avoid traps.

-

Combine with trend following systems or machine learning to create hybrid models for robustness.

This strategy is a tracking breakout strategy, with the logic of trading along the major trend identified, and taking breakout as entry signal, while setting stop loss and take profit to control risk per trade. The strategy has some advantages, but also room for improvements. Overall, with proper parameter tuning, entry timing, and enhancements with other techniques, it can become a practical trend following strategy. But investors should always keep in mind that no trading system can eliminate market risk entirely, and risk management is essential.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 20 | (?Indicators)length |

| v_input_2 | 200 | EMA Input |

| v_input_3 | 1.5 | (?Risk/Reward)Risk/Reward Ratio |

| v_input_4 | 0.995 | Distance from Long pullback % |

| v_input_5 | 1.005 | Distance from Short pullback % |

| v_input_6 | true | (?Backtest Date Range)From Month |

| v_input_7 | true | From Day |

| v_input_8 | 2000 | From Year |

| v_input_9 | true | Thru Month |

| v_input_10 | true | Thru Day |

| v_input_11 | 2099 | Thru Year |

Source (PineScript)

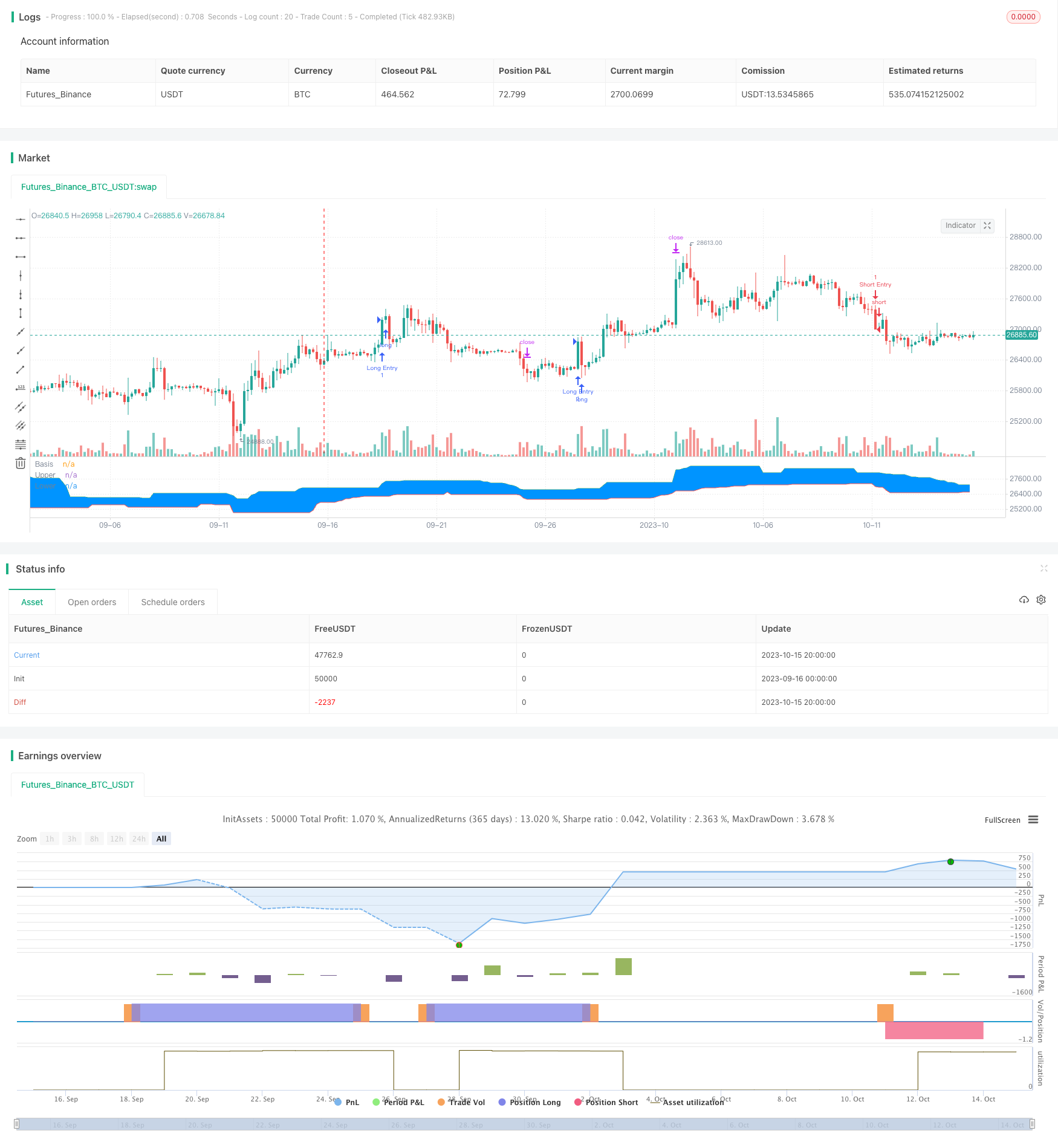

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Welcome to my second script on Tradingview with Pinescript

// First of, I'm sorry for the amount of comments on this script, this script was a challenge for me, fun one for sure, but I wanted to thoroughly go through every step before making the script public

// Glad I did so because I fixed some weird things and I ended up forgetting to add the EMA into the equation so our entry signals were a mess

// This one was a lot tougher to complete compared to my MACD crossover trend strategy but I learned a ton from it, which is always good and fun

// Also I'll explain the strategy and how I got there through some creative coding(I'm saying creative because I had to figure this stuff out by myself as I couldn't find any reference codes)

// First things first. This is a Donchian Channel Breakout strategy which follows the following rules

// If the price hits the upperband of the Donchian Channel + price is above EMA and the price previously hit the lowerband of the Donchian Channel it's a buy signal

// If the price hits the lowerband of the Donchian Channel + price is below EMA and the price prevbiously hit the upper band of the Donchian Channel it's a sell signal

// Stop losses are set at the lower or upper band with a 0.5% deviation because we are acting as if those two bands are the resistance in this case

// Last but not least(yes, this gave BY FAR the most trouble to code), the profit target is set with a 1.5 risk to reward ratio

// If you have any suggestions to make my code more efficient, I'll be happy to hear so from you

// So without further ado, let's walk through the code

// The first line is basically standard because it makes backtesting so much more easy, commission value is based on Binance futures fees when you're using BNB to pay those fees in the futures market

// strategy(title="Donchian Channels", shorttitle="DC", overlay=true, default_qty_type = strategy.cash, default_qty_value = 150, initial_capital = 1000, currency = currency.USD, commission_type = "percent", commission_value = 0.036)

// The built-in Donchian Channels + an added EMA input which I grouped with the historical bars from the Donchian Channels

length = input(20, minval=1, group = "Indicators")

lower = lowest(length)

upper = highest(length)

basis = avg(upper, lower)

emaInput = input(title = "EMA Input", type = input.integer, defval = 200, minval = 10, maxval = 400, step = 1, group = "Indicators")

// I've made three new inputs, for risk/reward ratio and for the standard pullback deviation. My advise is to not use the pullback inputs as I'm not 100% sure if they work as intended or not

riskreward = input(title = "Risk/Reward Ratio", type = input.float, defval = 1.50, minval = 0.01, maxval = 100, step = 0.01, group = "Risk/Reward")

pullbackLong = input(title = "Distance from Long pullback %", type = input.float, defval = 0.995, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

pullbackShort = input(title = "Distance from Short pullback %", type = input.float, defval = 1.005, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

// Input backtest range, you can adjust these in the input options, just standard stuff

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

fromYear = input(defval = 2000, title = "From Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

thruYear = input(defval = 2099, title = "Thru Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

// Date variable also standard stuff

inDataRange = (time >= timestamp(syminfo.timezone, fromYear, fromMonth, fromDay, 0, 0)) and (time < timestamp(syminfo.timezone, thruYear, thruMonth, thruDay, 0, 0))

// I had to makes these variables because the system has to remember whether the previous 'breakout' was a high or a low

// Also, because I based my stoploss on the upper/lower band of the indicator I had to find a way to change this value just once without losing the value, that was added, on the next bar

var previousishigh = false

var previousislow = false

var longprofit = 0.0

var shortprofit = 0.0

var stoplossLong = 0.0

var stoplossShort = 0.0

// These are used as our entry variables

emaCheck = ema(close, emaInput)

longcond = high >= upper and close > emaCheck

shortcond = low <= lower and close < emaCheck

// With these two if statements I'm changing the boolean variable above to true, we need this to decide out entry position

if high >= upper

previousishigh := true

if low <= lower

previousislow := true

// Made a last minute change on this part. To clean up our entry signals we don't want our breakouts, while IN a position, to change. This way we do not instantly open a new position, almost always in the opposite direction, upon exiting one

if strategy.position_size > 0 or strategy.position_size < 0

previousishigh := false

previousislow := false

// Strategy inputs

// Long - previous 'breakout' has to be a low, the current price has to be a new high and above the EMA, we're not allowed to be in a position and ofcourse it has to be within our given data for backtesting purposes

if previousislow == true and longcond and strategy.position_size == 0 and inDataRange

strategy.entry("Long Entry", strategy.long, comment = "Entry Long")

stoplossLong := lower * pullbackLong

longprofit := ((((1 - stoplossLong / close) * riskreward) + 1) * close)

strategy.exit("Long Exit", "Long Entry", limit = longprofit, stop = stoplossLong, comment = "Long Exit")

// Short - Previous 'breakout' has to be a high, current price has to be a new low and lowe than the 200EMA, we're not allowed to trade when we're in a position and it has to be within our given data for backtesting purposes

if previousishigh == true and shortcond and strategy.position_size == 0 and inDataRange

strategy.entry("Short Entry", strategy.short, comment = "Entry Short")

stoplossShort := upper * pullbackShort

shortprofit := (close - ((((1 - close / stoplossShort) * riskreward) * close)))

strategy.exit("Short Exit", "Short Entry", limit = shortprofit, stop = stoplossShort, comment = "Short Exit")

// This plots the Donchian Channels on the chart which is just using the built-in Donchian Channels

plot(basis, "Basis", color=color.blue)

u = plot(upper, "Upper", color=color.green)

l = plot(lower, "Lower", color=color.red)

fill(u, l, color=#0094FF, transp=95, title="Background")

// These plots are to show if the variables are working as intended, it's a mess I know but I didn't have any better ideas, they work well enough for me

// plot(previousislow ? close * 0.95 : na, color=color.red, linewidth=2, style=plot.style_linebr)

// plot(previousishigh ? close * 1.05 : na, color=color.green, style=plot.style_linebr)

// plot(longprofit, color=color.purple)

// plot(shortprofit, color=color.silver)

// plot(stoplossLong)

// plot(stoplossShort)

// plot(strategy.position_size)

Detail

https://www.fmz.com/strategy/429498

Last Modified

2023-10-17 16:36:49