Name

逆转双均线交叉策略Reversal-Dual-Moving-Average-Crossover-Strategy

Author

ChaoZhang

Strategy Description

原理:策略的核心逻辑是双均线交叉。通过计算两个不同参数的均线,当快速均线上穿慢速均线时产生买入信号;当快速均线下穿慢速均线时产生卖出信号。均线交叉代表了价格的短期与长期趋势的转折。

优势分析:双均线交叉策略优点主要在于简单易操作,通过一个信号即可获知最基本的趋势判断,无须过多参数选择与调整,非常适合新手交易者。且不同类型的均线都有测试,可以选择不同的组合来优化。

风险分析:本策略的主要风险在于常见的均线交叉策略会有大量的虚假信号,从而导致小额获利多次平仓的问题,影响了整体收益。此外,固定快慢均线长度设置也会在某些周期下失效。

优化方向:1)尝试不同周期测试,确定最佳均线交叉周期组合。2)考虑引入第二组均线的参数以及 RSI 指标的辅助判断减少虚假信号。3)引入基于 MA 指标增量变化的条件判定而非简单交叉,得到更加可靠的交叉判断。

总结:本策略采用传统均线交叉策略的框架,进行双均线测试以找寻最佳均线周期组合,同时增加了基于均线 ROC 和价格的止损判定。总的来说是一个简单易用且符合量化交易逻辑的双均线策略。此外丰富的优化思路也为本策略的后继发展提供了空间。

||

Overview: This strategy is based on the classic trading strategy of moving average crossover. It uses dual moving averages, including Simple Moving Average (SMA), Exponential Moving Average (EMA), Variable Weighted Moving Average (VWMA) and Hull Moving Average (HMA).

Principle: The core logic of the strategy is the dual moving average crossover. By calculating two moving averages with different parameters, a buy signal is generated when the fast moving average crosses over the slow one, and a sell signal is generated when the fast moving average crosses below the slow one. The moving average crossover represents the turning point of the short-term and long-term trends of prices.

Advantage Analysis: The main advantages of the dual moving average crossover strategy are simplicity and ease of operation. With only one signal, the most basic trend judgment can be obtained without too many parameter selections and adjustments, which is very suitable for novice traders. In addition, different types of moving averages are tested to optimize different combinations.

Risk Analysis: The main risk of this strategy is that common moving average crossover strategies will have a lot of false signals, resulting in multiple small profits and flat positions, which affects the overall return. In addition, the fixed fast and slow moving average length settings may fail in certain cycles.

Optimization Directions: 1) Test different periods to determine the optimal combination of moving average crosses; 2) Consider introducing a second set of moving average parameters and RSI indicators to assist in judgment to reduce false signals; 3) Introduce condition judgment based on the incremental change of the MA indicator instead of simple crossover to obtain a more reliable crossover judgment.

Summary: This strategy adopts the framework of the traditional moving average crossover strategy to test dual moving averages to find the optimal combination of moving average periods. At the same time, it adds stop-loss judgments based on the ROC and price of the moving average. Overall it is a simple and easy-to-use dual moving average strategy that conforms to quantitative trading logic. In addition, the rich optimization ideas also provide room for the further development of this strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_close | 0 | Source: close |

| v_input_2 | 5 | 1st MA Length |

| v_input_3 | 0 | 1st MA Type: HMA |

| v_input_4 | 7 | 2nd MA Length |

| v_input_5 | 0 | 2nd MA Type: HMA |

| v_input_6 | true | Lookback 1 |

| v_input_7 | 2 | Minimum slope magnitude * 100 |

Source (PineScript)

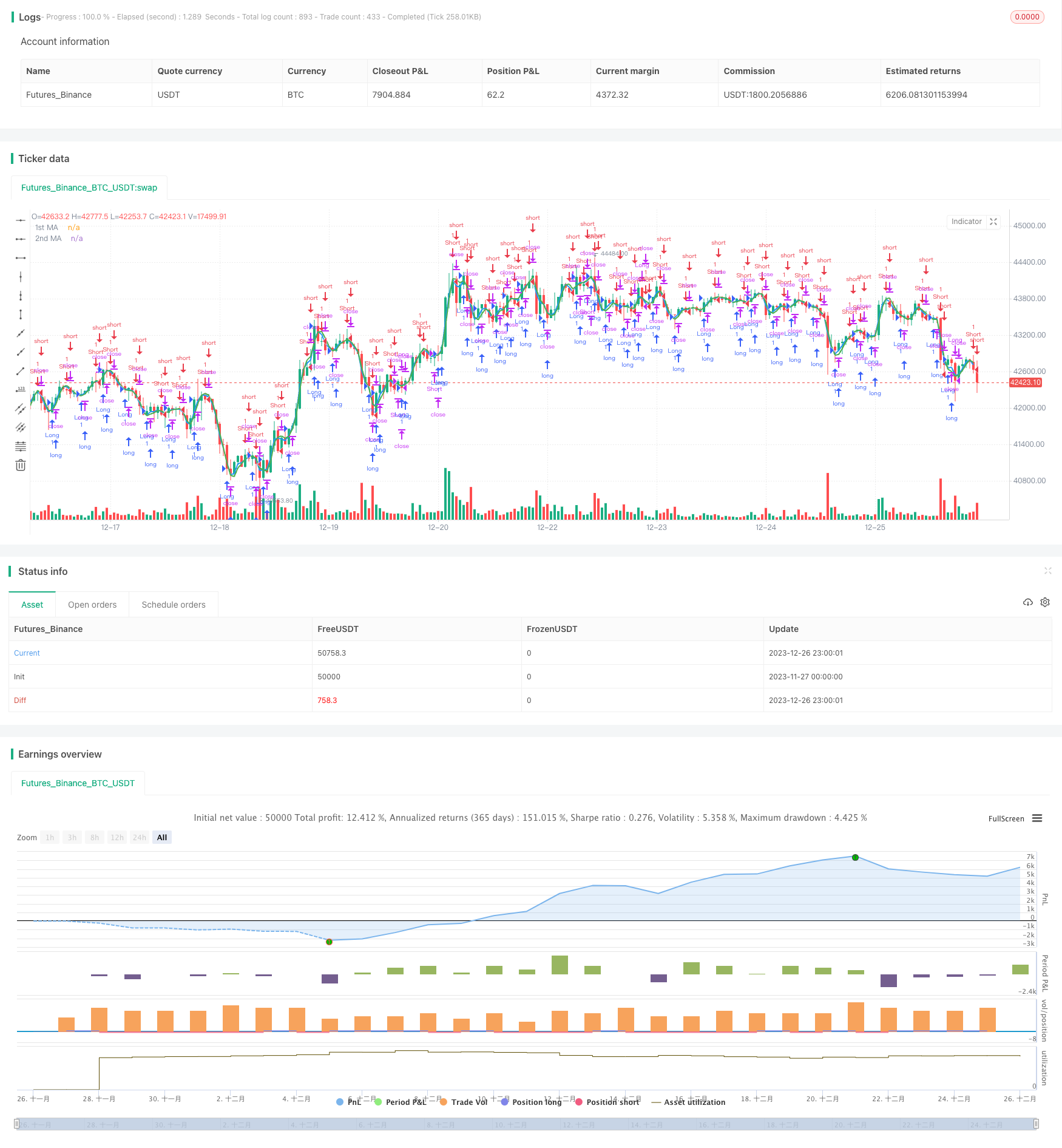

/*backtest

start: 2023-11-27 00:00:00

end: 2023-12-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//study(title="MA Crossover Strategy", overlay = true)

strategy("MA Crossover Strategy with MA Turning Point Exits", overlay=true)

src = input(close, title="Source")

price = request.security(syminfo.tickerid, timeframe.period, src)

ma1 = input(5, title="1st MA Length")

type1 = input("HMA", "1st MA Type", options=["SMA", "EMA", "HMA", "VWMA"])

ma2 = input(7, title="2nd MA Length")

type2 = input("HMA", "2nd MA Type", options=["SMA", "EMA", "HMA", "VWMA"])

f_hma(_src, _length)=>

_return = wma((2*wma(_src, _length/2))-wma(_src, _length), round(sqrt(_length)))

price1 = if (type1 == "SMA")

sma(price, ma1)

else

if (type1 == "EMA")

ema(price, ma1)

else

if (type1 == "VWMA")

vwma(price, ma1)

else

f_hma(price, ma1)

price2 = if (type2 == "SMA")

sma(price, ma2)

else

if (type2 == "EMA")

ema(price, ma2)

else

if (type2 == "VWMA")

vwma(price, ma2)

else

f_hma(price, ma2)

//plot(series=price, style=line, title="Price", color=black, linewidth=1, transp=0)

plot(series=price1, style=line, title="1st MA", color=blue, linewidth=2, transp=0)

plot(series=price2, style=line, title="2nd MA", color=green, linewidth=2, transp=0)

longCondition = crossover(price1, price2)

if (longCondition) // and time>timestamp(2018,6,1,9,30)

strategy.entry("Long", strategy.long)

shortCondition = crossunder(price1, price2)

if (shortCondition) // and time>timestamp(2018,6,1,9,30)

strategy.entry("Short", strategy.short)

lookback1 = input(1, "Lookback 1")

roc1 = roc(price1, lookback1)

ma1up = false

ma1down = false

ma2up = false

ma2down = false

ma1up := nz(ma1up[1])

ma1down := nz(ma1down[1])

ma2up := nz(ma2up[1])

ma2down := nz(ma2down[1])

trendStrength1 = input(2, title="Minimum slope magnitude * 100", type=float) * 0.01

if crossover(roc1, trendStrength1)

ma1up := true

ma1down := false

if crossunder(roc1, -trendStrength1)

ma1up := false

ma1down := true

shortexitCondition = ma1up and ma1down[1]

if (shortexitCondition)

strategy.close("Short")

longexitCondition = ma1down and ma1up[1]

if (longexitCondition)

strategy.close("Long")

Detail

https://www.fmz.com/strategy/436860

Last Modified

2023-12-28 12:00:27