Name

金叉均线突破布林带策略Golden-Cross-with-Bollinger-Bands-Momentum-Strategy

Author

ChaoZhang

Strategy Description

[trans]

本策略结合了移动平均线指标、布林带指标和成交量加权平均价指标,在金叉形成、短均线上穿长均线的条件下判断进入。策略还利用布林带通道,仅在价格触及布林带下轨时才考虑入场,从而避免在行情震荡中频繁进出。

该策略主要通过均线指标判断趋势方向,利用布林带来定位波动区间选择买点。具体来说,策略包含以下几个关键规则:

-

使用50日EMA和200日EMA构建金叉判断系统,当快速移动平均线上穿慢速移动平均线时认为处于多头上升趋势;

-

价格大于VWAP时,认为处于价格上升阶段,有利于建仓做多;

-

价格刚刚触及或突破布林带下轨时,表明股价可能处于反弹点附近,机会较好;

-

进入多头持仓后,价格超过布林带上轨时及时止盈退出。

通过这几个规则的组合,使得本策略在牛市行情中,能够选择合适的买点买入,并设置止损止盈确保收益。

-

利用金叉判断系统确定大趋势方向,避免在震荡行情中小胜小负;

-

VWAP指标可判断价格波动方向,使买点选择更精准;

-

布林带指标判断买点使策略更有韧性,同时设置止损止盈以锁定收益;

-

多种指标相互验证,使策略判断更加准确可靠。

-

金叉判断系统可能发出假信号,应适当缩短均线周期长度,并配合其他指标验证;

-

布林带参数设置不当也会使策略失去效用,应调节布林带周期及标准差参数;

-

停损点设置过于宽松,无法有效控制亏损。应适当收紧止损范围,确保风险可控。

-

优化金叉均线组合,测试不同均线参数,找到最佳参数;

-

测试不同周期布林带参数,找到幅度及离散性最好的参数组合;

-

测试并优化止损范围,使之既能有效控制风险,又不至于过于容易被触发。

本策略综合运用均线系统、布林带以及VWAP指标判断入场时机,在兼顾发现机会与控制风险上做出了平衡。通过后续参数优化及规则修正,有望锁定行业及市场中的持续良机。

||

This strategy combines moving average, Bollinger bands and volume weighted average price (VWAP) indicators. It enters long positions when the golden cross forms and the fast moving average breaks above the slow one. The strategy also utilizes the Bollinger band channel and only considers entering when the price touches the lower band, thus avoiding frequent entries and exits amid market fluctuations.

The core logic relies on moving averages to determine the trend direction, and Bollinger bands to locate the fluctuation range for buying signals. Specifically, it has the following key rules:

-

Construct the golden cross system using 50-day EMA and 200-day EMA. An up trend is identified when the fast EMA crosses above the slow EMA.

-

When the price is above VWAP, it indicates the price is in an upward phase which favors long positions.

-

When the price just touches or breaks the Bollinger lower band, it suggests the price may be near a rebound point thus providing a good opportunity.

-

Exit long positions with profit when the price exceeds the Bollinger upper band.

By combining these rules, the strategy is able to locate appropriate long entries in bull markets and set stop loss/profit taking to secure returns.

-

The golden cross system determines the major trend direction, avoiding small wins and losses amid consolidations.

-

VWAP gauges the price wave direction for more precise buying signals.

-

The Bollinger bands add resilience by locating buys while setting stop loss/profit taking locks in gains.

-

Multiple confirming indicators enhance reliability.

-

The golden cross may give false signals. Fine tune the MA periods and add other confirmations.

-

Improper Bollinger parameters could render the strategy ineffective. Optimize periods and standard deviation.

-

A stop loss threshold too wide fails to effectively limit losses. Tighten the stop loss range to ensure controllable risks.

-

Optimize MA combinations by testing different parameters to find the best.

-

Test Bollinger periods and parameter sets for better bandwidth and volatility.

-

Test and tune stop loss ranges for balancing risk control and avoiding premature triggering.

This strategy strikes a balance between discovering opportunities and controlling risks by integrating MA, Bollinger and VWAP analysis for entries. Continuous fine tuning and optimization will allow it to capitalize on sector and market trends over time.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | From Day |

| v_input_2 | 6 | From Month |

| v_input_3 | 2020 | From Year |

| v_input_4 | true | To Day |

| v_input_5 | 8 | To Month |

| v_input_6 | 2020 | To Year |

| v_input_7 | 50 | fast EMA |

| v_input_8 | 200 | slow EMA |

| v_input_9 | 7 | BB SMA Length |

| v_input_10_close | 0 | BB Source: close |

| v_input_11 | 0 | strategy to use: BB |

| v_input_12 | true | Stop Loss% |

| v_input_13 | 2 | StdDev |

| v_input_14 | false | Offset |

Source (PineScript)

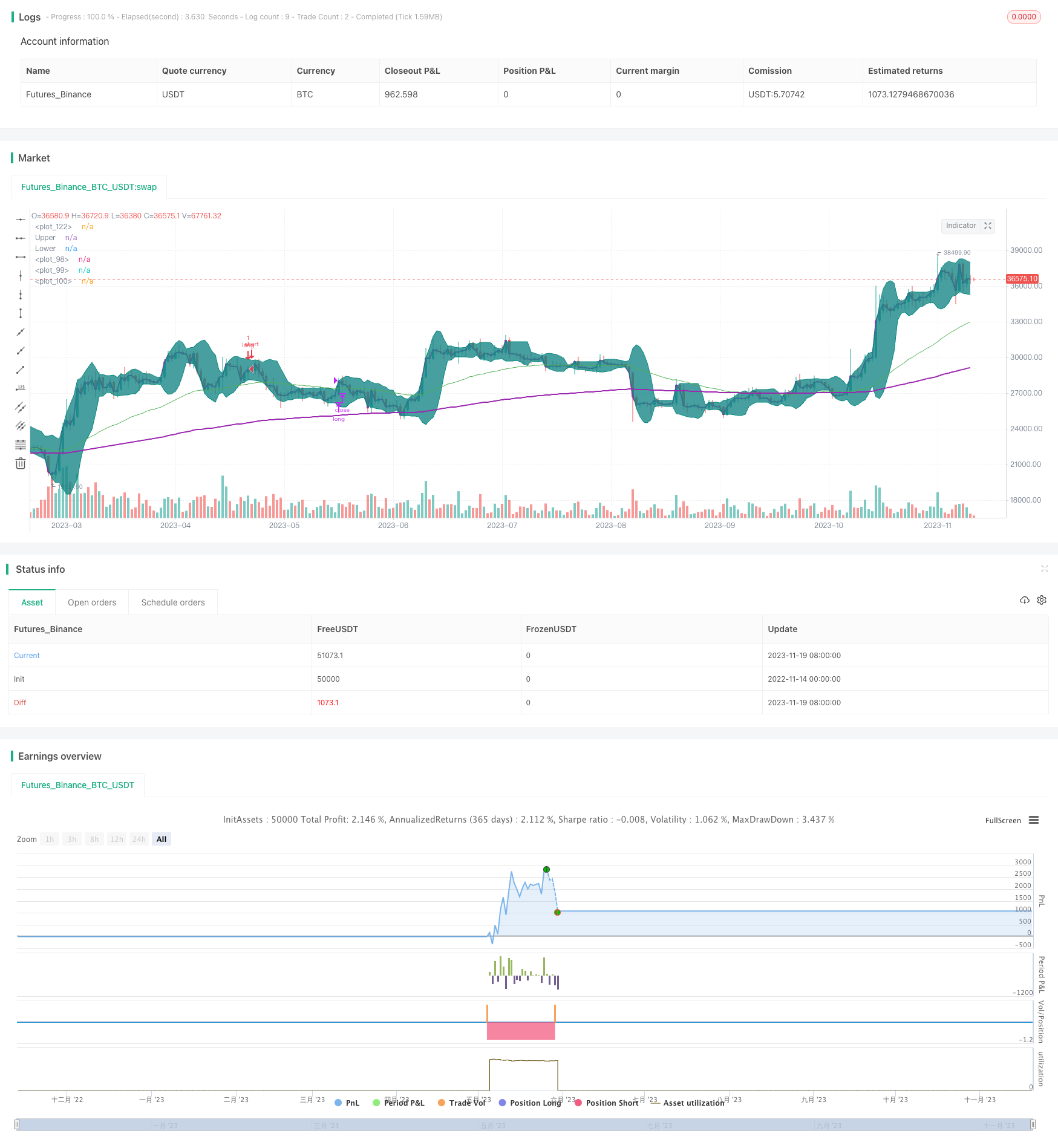

/*backtest

start: 2022-11-14 00:00:00

end: 2023-11-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

strategy(title="VWAP and BB strategy [$$]", overlay=true,pyramiding=2, default_qty_value=1, default_qty_type=strategy.fixed, initial_capital=10000, currency=currency.USD)

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 6, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2020, title = "From Year", minval = 1970)

// To Date Inputs

toDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 8, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2020, title = "To Year", minval = 1970)

// Calculate start/end date and time condition

DST = 1 //day light saving for usa

//--- Europe

London = iff(DST==0,"0000-0900","0100-1000")

//--- America

NewYork = iff(DST==0,"0400-1300","0500-1400")

//--- Pacific

Sydney = iff(DST==0,"1300-2200","1400-2300")

//--- Asia

Tokyo = iff(DST==0,"1500-2400","1600-0100")

//-- Time In Range

timeinrange(res, sess) => time(res, sess) != 0

london = timeinrange(timeframe.period, London)

newyork = timeinrange(timeframe.period, NewYork)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = time >= startDate and time <= finishDate

is_price_dipped_bb(pds,source1) =>

t_bbDipped=false

for i=1 to pds

t_bbDipped:= (t_bbDipped or close[i]<source1) ? true : false

if t_bbDipped==true

break

else

continue

t_bbDipped

is_bb_per_dipped(pds,bbrSrc) =>

t_bbDipped=false

for i=1 to pds

t_bbDipped:= (t_bbDipped or bbrSrc[i]<=0) ? true : false

if t_bbDipped==true

break

else

continue

t_bbDipped

// variables BEGIN

shortEMA = input(50, title="fast EMA", minval=1)

longEMA = input(200, title="slow EMA", minval=1)

//BB

smaLength = input(7, title="BB SMA Length", minval=1)

bbsrc = input(close, title="BB Source")

strategyCalcOption = input(title="strategy to use", type=input.string, options=["BB", "BB_percentageB"], defval="BB")

//addOnDivergence = input(true,title="Add to existing on Divergence")

//exitOption = input(title="exit on RSI or BB", type=input.string, options=["RSI", "BB"], defval="BB")

//bbSource = input(title="BB source", type=input.string, options=["close", "vwap"], defval="close")

//vwap_res = input(title="VWAP Resolution", type=input.resolution, defval="session")

stopLoss = input(title="Stop Loss%", defval=1, minval=1)

//variables END

longEMAval= ema(close, longEMA)

shortEMAval= ema(close, shortEMA)

ema200val = ema(close, 200)

vwapVal=vwap(close)

// Drawings

//plot emas

plot(shortEMAval, color = color.green, linewidth = 1, transp=0)

plot(longEMAval, color = color.orange, linewidth = 1, transp=0)

plot(ema200val, color = color.purple, linewidth = 2, style=plot.style_line ,transp=0)

//bollinger calculation

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = sma(bbsrc, smaLength)

dev = mult * stdev(bbsrc, smaLength)

upperBand = basis + dev

lowerBand = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

bbr = (bbsrc - lowerBand)/(upperBand - lowerBand)

//bollinger calculation

//plot bb

//plot(basis, "Basis", color=#872323, offset = offset)

p1 = plot(upperBand, "Upper", color=color.teal, offset = offset)

p2 = plot(lowerBand, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=#198787, transp=95)

plot(vwapVal, color = color.purple, linewidth = 2, transp=0)

// Colour background

//barcolor(shortEMAval>longEMAval and close<=lowerBand ? color.yellow: na)

//longCondition= shortEMAval > longEMAval and close>open and close>vwapVal

longCondition= ( shortEMAval > longEMAval and close>open and close>vwapVal and close<upperBand ) //and time_cond // and close>=vwapVal

//Entry

strategy.entry(id="long", comment="VB LE" , long=true, when= longCondition and ( strategyCalcOption=="BB"? is_price_dipped_bb(10,lowerBand) : is_bb_per_dipped(10,bbr) ) and strategy.position_size<1 ) //is_price_dipped_bb(10,lowerBand)) //and strategy.position_size<1 is_bb_per_dipped(15,bbr)

//add to the existing position

strategy.entry(id="long", comment="Add" , long=true, when=strategy.position_size>=1 and close<strategy.position_avg_price and close>vwapVal) //and time_cond)

barcolor(strategy.position_size>=1 ? color.blue: na)

strategy.close(id="long", comment="TP Exit", when=crossover(close,upperBand) )

//stoploss

stopLossVal = strategy.position_avg_price * (1-(stopLoss*0.01) )

//strategy.close(id="long", comment="SL Exit", when= close < stopLossVal)

//strategy.risk.max_intraday_loss(stopLoss, strategy.percent_of_equity)

Detail

https://www.fmz.com/strategy/432765

Last Modified

2023-11-21 12:01:25