Name

黄金交叉多头趋势跟踪策略Golden-Cross-Uptrend-Tracking-Strategy

Author

ChaoZhang

Strategy Description

该策略基于移动平均线的黄金交叉原理设计。具体来说,它使用两个不同周期的简单移动平均线,即50周期线和200周期线。当50周期线从下方突破200周期线时,产生买入信号;当50周期线从上方跌破200周期线时,产生卖出信号。

该策略使用 Pine Script 语言编写,主要逻辑如下:

- 计算两个SMA:50周期SMA和200周期SMA

- 判断黄金交叉:当50周期SMA上穿200周期SMA时,做多

- 判断死亡交叉:当50周期SMA下穿200周期SMA时,平仓

这里使用SMA指标的重要性在于,它能有效滤除行情数据的噪音, Capture长期趋势。快速 SMA 线上穿慢速 SMA 线,表示短期上涨势头打败了长期的下跌趋势,买入信号产生。

该策略具有以下几个优势:

- 原理简单易懂,容易实现。

- PARAMETERS设置合理,可自定义两个SMA周期,适应不同市场。

- 采用stable版本Pine语言编写,运行高效。

- 可视化设置信息丰富,易于使用。

该策略也存在一些风险:

-

可能出现假突破,使策略产生错误信号。可适当调整两个SMA参数,降低假突破概率。

-

无法响应短期市场,只适合长线投资者。可适当缩短快速SMA的周期。

-

回撤可能较大。可设置止损点,或适当调整仓位管理。

该策略可从以下几个维度继续优化:

-

增加其他指标过滤,组合多个买入/卖出条件,降低假信号概率。

-

增加止损机制。当价格跌破某一水平时,强制止损。

-

优化仓位管理。例如随着趋势加仓,跟踪止损等。控制回撤并追求更高收益。

-

进行参数优化。评估不同参数对收益风险比的影响。

该策略总的来说是一个典型的趋势跟踪策略。它利用 SMA 的优势,简单高效地 Capture长线趋势。可根据自己的风格和参数调整空间进行定制。同时也需要注意一些已有的不足,进行进一步的优化与改进。

||

This strategy is designed based on the golden cross principle of moving averages. Specifically, it uses two simple moving averages of different periods, namely the 50-period line and the 200-period line. When the 50-period line breaks through the 200-period line from below, a buy signal is generated. When the 50-period line breaks through the 200-period line from above, a sell signal is generated.

The strategy is written in Pine Script language, with main logic as follows:

- Calculate two SMAs: 50-period SMA and 200-period SMA

- Determine golden cross: when 50-period SMA crosses above 200-period SMA, go long

- Determine death cross: when 50-period SMA crosses below 200-period SMA, close position

The importance of using SMA indicator here is that it can effectively filter out market noise and capture long-term trends. When faster SMA line crosses above slower SMA line, it indicates the short-term uptrend momentum defeats the long-term downtrend, generating a buy signal.

The strategy has the following advantages:

- Simple and easy-to-understand principle, easy to implement.

- Reasonable PARAMETERS settings, customizable two SMA periods, adaptable to different markets.

- Written in stable Pine language version, runs efficiently.

- Rich visual settings, easy to use.

The strategy also has some risks:

-

False breakout may occur, generating wrong signals. Can adjust two SMA parameters to reduce false breakout probability.

-

Cannot respond to short-term market, only suitable for long-term investors. Can appropriately shorten fast SMA period.

-

Drawdown may be large. Can set stop loss, or properly adjust position management.

The strategy can be further optimized in following aspects:

-

Add other indicators for filtering, combining multiple buy/sell conditions to reduce false signals.

-

Add stop loss mechanism. Mandatory stop loss when price breaks certain level.

-

Optimize position management. Such as pyramiding along the trend, trailing stop loss etc. To control drawdown and pursue higher return.

-

Parameter optimization. Evaluate the impact of different parameters on return/risk ratio.

In general, this is a typical trend tracking strategy. It utilizes the advantage of SMA to simply and efficiently capture long-term trends. Can customize based on one's style and tuning space. Also need to notice existing deficiencies for further optimization and improvement.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 50 | Fast SMA Period |

| v_input_2 | 200 | Slow SMA Period |

| v_input_3 | 2019 | Backtest Start Year |

| v_input_4 | true | Backtest Start Month |

| v_input_5 | true | Backtest Start Day |

| v_input_6 | 2099 | Backtest Stop Year |

| v_input_7 | 12 | Backtest Stop Month |

| v_input_8 | 31 | Backtest Stop Day |

Source (PineScript)

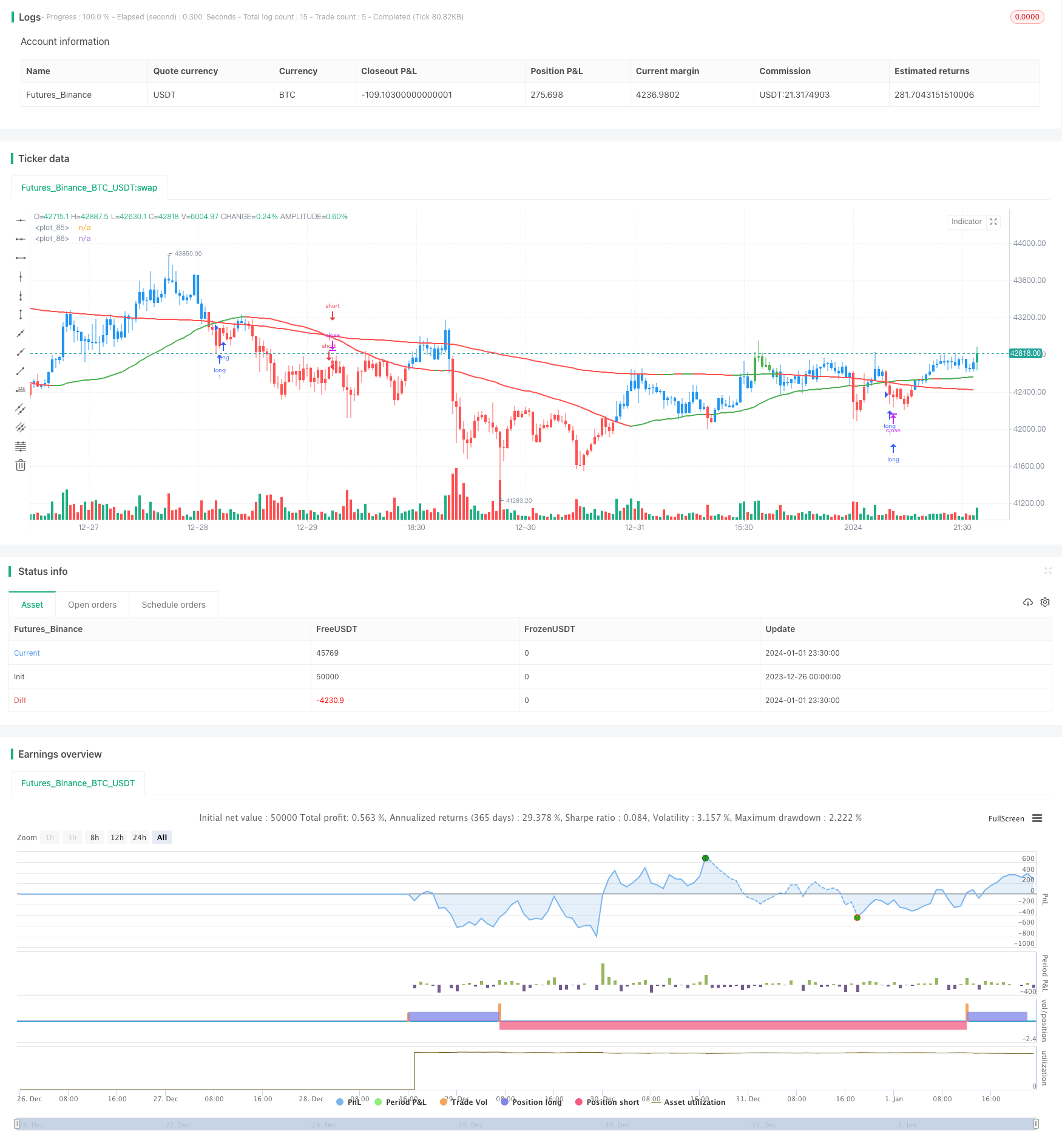

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-02 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

//

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// www.tradingview.com/u/TradeFab/

// www.tradefab.com

// ___ __ __ __ __ __

// | |__) /\ | \ |__ |__ /\ |__)

// | | \ /~~\ |__/ |__ | /~~\ |__)

//

// DISCLAIMER: Futures, stocks and options trading involves substantial risk of loss

// and is not suitable for every investor. You are responsible for all the risks and

// financial resources you use and for the chosen trading system.

// Past performance is not indicative for future results. In making an investment decision,

// traders must rely on their own examination of the entity making the trading decisions!

//

// TradeFab's Golden Cross Strategy.

// The strategy goes long when the faster SMA 50 (the simple moving average of the last 50 bars) crosses

// above the SMA 200. Orders are closed when the SMA 50 crosses below SMA 200. The strategy does not short.

//

VERSION = "1.2"

// 1.2 FB 2020-02-09 converted to Pine version 4

// 1.1 FB 2017-01-15 added short trading

// 1.0 FB 2017-01-13 basic version using SMAs

//

strategy(

title = "TFs Golden Cross " + VERSION,

shorttitle = "TFs Golden Cross " + VERSION,

overlay = true

)

///////////////////////////////////////////////////////////

// === INPUTS ===

///////////////////////////////////////////////////////////

inFastSmaPeriod = input(title="Fast SMA Period", type=input.integer, defval=50, minval=1)

inSlowSmaPeriod = input(title="Slow SMA Period", type=input.integer, defval=200, minval=1)

// backtest period

testStartYear = input(title="Backtest Start Year", type=input.integer, defval=2019, minval=2000)

testStartMonth = input(title="Backtest Start Month", type=input.integer, defval=1, minval=1, maxval=12)

testStartDay = input(title="Backtest Start Day", type=input.integer, defval=1, minval=1, maxval=31)

testStopYear = input(title="Backtest Stop Year", type=input.integer, defval=2099, minval=2000)

testStopMonth = input(title="Backtest Stop Month", type=input.integer, defval=12, minval=1, maxval=12)

testStopDay = input(title="Backtest Stop Day", type=input.integer, defval=31, minval=1, maxval=31)

///////////////////////////////////////////////////////////

// === LOGIC ===

///////////////////////////////////////////////////////////

smaFast = sma(close, inFastSmaPeriod)

smaSlow = sma(close, inSlowSmaPeriod)

bullishCross = crossover (smaFast, smaSlow)

bearishCross = crossunder(smaFast, smaSlow)

// detect valid backtest period

isTestPeriod() => true

///////////////////////////////////////////////////////////

// === POSITION EXECUTION ===

///////////////////////////////////////////////////////////

strategy.entry("long", strategy.long, when=bullishCross)

strategy.entry("short", strategy.short, when=bearishCross)

///////////////////////////////////////////////////////////

// === PLOTTING ===

///////////////////////////////////////////////////////////

// background color

nopColor = color.new(color.gray, 50)

bgcolor(not isTestPeriod() ? nopColor : na)

bartrendcolor =

close > smaFast and

close > smaSlow and

change(smaSlow) > 0

? color.green

: close < smaFast and

close < smaSlow and

change(smaSlow) < 0

? color.red

: color.blue

barcolor(bartrendcolor)

plot(smaFast, color=change(smaFast) > 0 ? color.green : color.red, linewidth=2)

plot(smaSlow, color=change(smaSlow) > 0 ? color.green : color.red, linewidth=2)

// label

posColor = color.new(color.green, 75)

negColor = color.new(color.red, 75)

dftColor = color.new(color.blue, 75)

posProfit= (strategy.position_size != 0) ? (close * 100 / strategy.position_avg_price - 100) : 0.0

posDir = (strategy.position_size > 0) ? "long" : strategy.position_size < 0 ? "short" : "flat"

posCol = (posProfit > 0) ? posColor : (posProfit < 0) ? negColor : dftColor

var label lb = na

label.delete(lb)

lb := label.new(bar_index, max(high, highest(5)[1]),

color=posCol,

text="Pos: "+ posDir +

"\nPnL: "+tostring(posProfit, "#.##")+"%" +

"\nClose: "+tostring(close, "#.##"))

Detail

https://www.fmz.com/strategy/437499

Last Modified

2024-01-03 11:46:44