Name

Ichimoku混合Macd和Tsi综合策略Ichimoku-Mixed-Equilibrium-Table-Macd-and-Tsi-Combined-Strategy

Author

ChaoZhang

Strategy Description

本策略综合运用一目均衡表、Macd指标、Chaikin金流指标和Tsi震荡指标等多种技术指标,实现精准判断市场趋势方向,进行短线交易。

策略运用一目均衡表中的天平线、基准线、先行线等指标判断日内价格趋势。同时结合Macd的快慢均线交叉信号,以及金流指标和震荡指标判断资金流入流出。多种指标综合判断后进行买卖决策。

当天平线上穿基准线,先行线在0轴之上,收盘价在一目均衡表的云端之上时为看涨信号。反之当天平线下穿基准线,先行线在0轴之下,收盘价在云端之下时为看跌信号。策略同时检测Macd的直方图是否为正值以及Chaikin金流指标和震荡指标是否同向为正,若指标同向看涨,则进行买入开多;若指标同向看跌,则进行卖出开空。

当指标发出与之前相反信号时,进行反向交易平掉之前头寸。

-

运用多种指标综合判断,提高判断准确性。

-

短线操作,跟踪市场实时波动。

-

无需人工干预,全自动算法交易。

-

多种指标同向看涨看跌的判断容易产生误判风险。可适当放宽部分判定条件,降低误判率。

-

高频短线交易较高手续费率以及难以抓住趋势。可适当延长持仓周期,追求超额收益以弥补成本。

-

无止损设置可能造成较大亏损。可结合ATR来设定合适的止损点或移动止损。

-

优化参数组合。调整均线参数,适配不同周期和品种。

-

增加止损机制。结合ATR指标来动态设定移动止损线。

-

增加仓位管理。动态调整交易量比例。

-

结合机器学习技术对指标和信号进行优化。

本策略综合运用多种技术指标判断趋势实时波动,进行高频短线交易。虽然存在一定风险,但可通过优化来改进。该策略值得进一步深入研究和实盘验证,通过增加止损以及仓位管理来降低交易风险。

||

This strategy comprehensively uses technical indicators such as Ichimoku Kinko Hyo, Macd, Chaikin Money Flow and Tsi Oscillator to accurately judge the direction of market trends for short-term trading.

The strategy uses the Tenkan-sen line, Kijun-sen line, Senkou Span A and Senkou Span B lines in Ichimoku to judge intraday price trends. At the same time, it combines the cross signals of the fast and slow moving average lines of Macd and the money flow indicator and oscillation indicator to determine the inflow and outflow of funds. After the comprehensive judgment of multiple indicators, the buy and sell decisions are made.

When the Tenkan-sen line crosses above the Kijun-sen line, the Chikou Span is above the 0 axis, and the closing price is above the Ichimoku cloud, it is a bullish signal. On the contrary, when the Tenkan-sen line crosses below the Kijun-sen line, the Chikou Span is below the 0 axis, and the closing price is below the cloud, it is a bearish signal. At the same time, the strategy detects whether the MACD histogram is positive and whether the Chaikin Money Flow indicator and the TSI oscillator are positive in the same direction. If the indicators are bullish in the same direction, long position is opened by buying in, and if the indicators are bearish in the same direction, short position is opened by selling out.

When the indicator issues a signal opposite to the previous one, a reverse trade is made to flatten the previous position.

-

Using a combination of multiple indicators improves judgment accuracy.

-

Short-term operations track market fluctuations in real time.

-

No manual intervention, fully automated algorithmic trading.

-

The combined judgment of multiple indicators being bullish or bearish at the same time has the risk of misjudgment. Some judge criteria could be appropriately relaxed to reduce misjudgment rate.

-

High-frequency short-term trading has relatively high commission fees and it’s hard to catch trends. Position holding period could be appropriately extended to seek excess returns to cover costs.

-

No stop loss setting may lead to greater losses. Appropriate stop loss points or moving stop loss can be set based on the ATR.

-

Optimize parameter combinations. Adjust moving average parameters to adapt to different cycles and varieties.

-

Increase stop loss mechanism. Set dynamic stop loss lines combined with the ATR indicator.

-

Increase position management. Dynamically adjust trading volume proportions.

-

Combine machine learning technology to optimize indicators and signals.

This strategy comprehensively uses multiple technical indicators to determine trend fluctuations in real time for high-frequency short-term trading. Although there are some risks, it can be improved through optimization. The strategy is worth further in-depth research and live trading verification. By increasing stop loss and position management, trading risks could be reduced.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 10 | Tenkan-Sen Bars |

| v_input_2 | 30 | Kijun-Sen Bars |

| v_input_3 | 52 | Senkou-Span B Bars |

| v_input_4 | 26 | Chikou-Span Offset |

| v_input_5 | 26 | Senkou-Span Offset |

| v_input_6 | true | Long Entry |

| v_input_7 | true | Short Entry |

| v_input_8 | 17 | Fast Length |

| v_input_9 | 28 | Slow Length |

| v_input_10_close | 0 | Source: close |

| v_input_11 | 5 | Signal Smoothing |

| v_input_12 | true | Simple MA(Oscillator) |

| v_input_13 | true | Simple MA(Signal Line) |

| v_input_14 | 8 | CMF Length |

| v_input_15 | 8 | Long Length |

| v_input_16 | 8 | Short Length |

Source (PineScript)

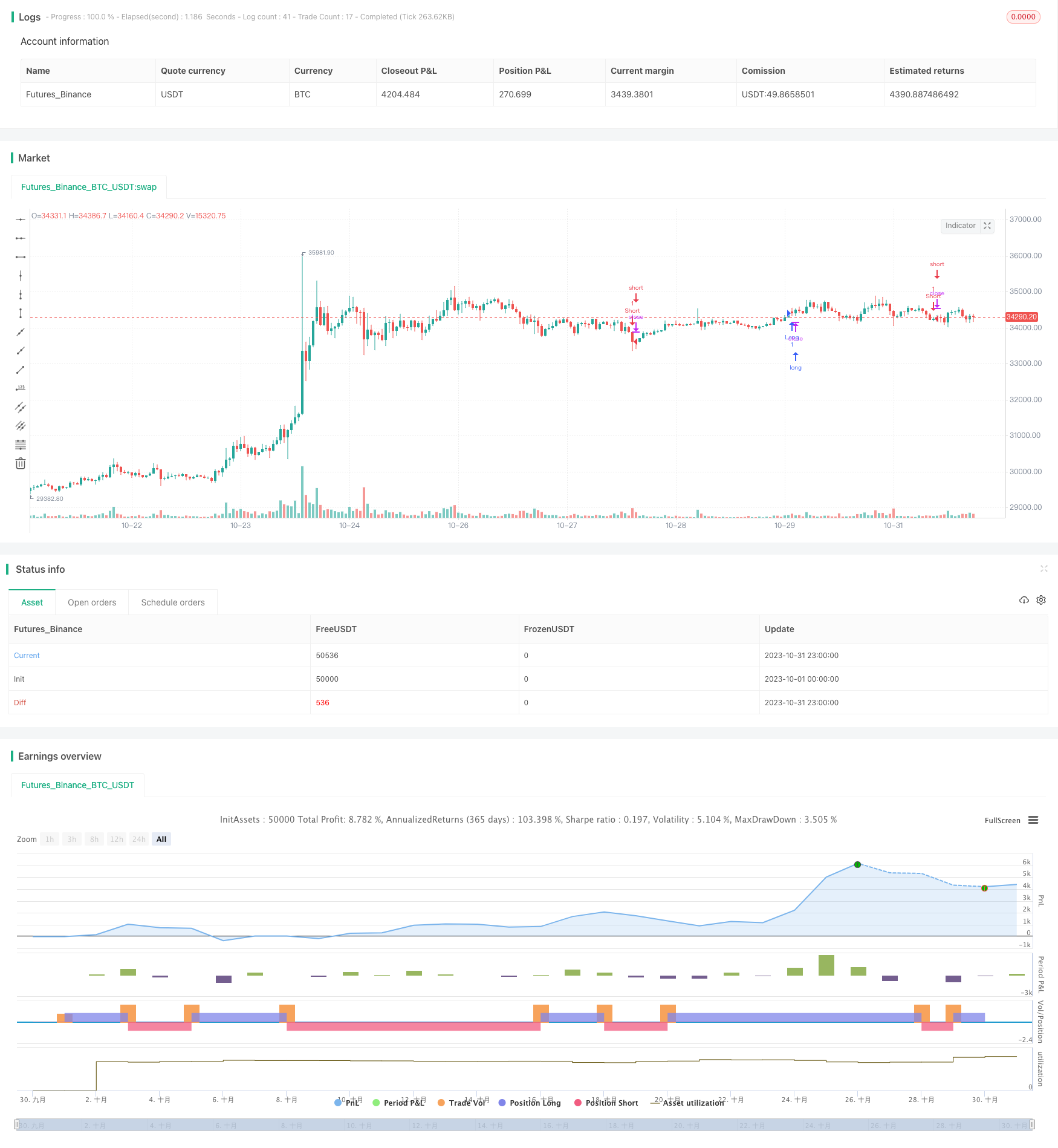

/*backtest

start: 2023-10-01 00:00:00

end: 2023-10-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=4

strategy("Ichimoku with MACD/ CMF/ TSI", overlay=true, margin_long=0, margin_short=0)

//Inputs

ts_bars = input(10, minval=1, title="Tenkan-Sen Bars")

ks_bars = input(30, minval=1, title="Kijun-Sen Bars")

ssb_bars = input(52, minval=1, title="Senkou-Span B Bars")

cs_offset = input(26, minval=1, title="Chikou-Span Offset")

ss_offset = input(26, minval=1, title="Senkou-Span Offset")

long_entry = input(true, title="Long Entry")

short_entry = input(true, title="Short Entry")

middle(len) => avg(lowest(len), highest(len))

// Ichimoku Components

tenkan = middle(ts_bars)

kijun = middle(ks_bars)

senkouA = avg(tenkan, kijun)

senkouB = middle(ssb_bars)

ss_high = max(senkouA[ss_offset-1], senkouB[ss_offset-1])

ss_low = min(senkouA[ss_offset-1], senkouB[ss_offset-1])

// Entry/Exit Signals

fast_length = input(title="Fast Length", type=input.integer, defval=17)

slow_length = input(title="Slow Length", type=input.integer, defval=28)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 5)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=true)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=true)

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

tk_cross_bull = tenkan > kijun

tk_cross_bear = tenkan < kijun

cs_cross_bull = mom(close, cs_offset-1) > 0

cs_cross_bear = mom(close, cs_offset-1) < 0

price_above_kumo = close > ss_high

price_below_kumo = close < ss_low

//CMF

lengthA = input(8, minval=1, title="CMF Length")

ad = close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume

mf = sum(ad, lengthA) / sum(volume, lengthA)

//TSI

long = input(title="Long Length", type=input.integer, defval=8)

short = input(title="Short Length", type=input.integer, defval=8)

price = close

double_smooth(src, long, short) =>

fist_smooth = ema(src, long)

ema(fist_smooth, short)

pc = change(price)

double_smoothed_pc = double_smooth(pc, long, short)

double_smoothed_abs_pc = double_smooth(abs(pc), long, short)

tsi_value = 100 * (double_smoothed_pc / double_smoothed_abs_pc)

bullish = tk_cross_bull and cs_cross_bull and price_above_kumo and hist > 0 and mf > 0.1 and tsi_value > 0

bearish = tk_cross_bear and cs_cross_bear and price_below_kumo and hist < 0 and mf < -0.1 and tsi_value < 0

strategy.entry("Long", strategy.long, when=bullish and long_entry)

strategy.entry("Short", strategy.short, when=bearish and short_entry)

strategy.close("Long", when=bearish and not short_entry)

strategy.close("Short", when=bullish and not long_entry)

Detail

https://www.fmz.com/strategy/433407

Last Modified

2023-11-27 11:50:43