Name

MACD双向优化交易策略MACD-Double-Optimization-Trading-Strategy

Author

ChaoZhang

Strategy Description

该策略运用MACD指标以及均线的交叉原理构建交易信号。其优势在于可以分别为做多和做空方向优化MACD的参数,从而使参数针对不同行情方向进行最优配置。

- 分别计算做多和做空两个方向的MACD指标。做多采用一组参数,做空采用另一组参数,可以自由配置。

- 判断MACD线和Signal线的交叉产生交易信号。做多时看涨交叉,做空时看跌交叉。

- 可以配置Signal线是否也需要交叉才触发信号,从而避免假信号。

- 进入做多或做空仓位后,等待反向交叉时平仓。

- 双向参数优化:可以自由优化做多和做空的参数,使其分别针对行情方向进行最优配置。

- 可配置信号平滑:Signal参数可以控制信号线的平滑程度,过滤假信号。

- 可配置信号过滤:可配置是否需要Signal线交叉才触发,避免假信号误导。

- 可细调仓位控制:可单独开启做多或做空,也可同时做多做空。

- MACD滞后问题:MACD本身有一定滞后,可能错过快速反转。

- 多空切换风险:行情快速变化时,仓位切换可能过于频繁。

- 参数风险:不当的参数配置可能无法捕捉行情特征。

- 止损保护:应设置合理的止损来控制单笔损失。

管理风险的方法:

- 结合其他指标判断大格局,避免追高杀跌。

- 设置信号延迟和平滑参数来减少错误信号。

- 反复测试优化参数,使其匹配不同周期的行情节奏。

- 设定止损止盈机制,控制单笔损失。

可以从以下几个方面来优化这个策略:

-

测试不同的快线和慢线长度参数组合,找出对不同周期行情最佳的参数。

-

测试不同的Signal线参数,Smoother信号线可以过滤掉更多噪音。

-

测试打开和关闭Signal线交叉过滤的差别,寻找最佳平衡。

-

根据回测情况设定最优止损止盈比例。

-

尝试只做多或只做空,看是否可以将策略效果最大化。

该MACD双向优化交易策略通过分别配置做多和做空参数,实现了针对不同行情方向的最优化,可以自由调整参与的方向。同时加入了信号过滤机制来避免错误信号。通过参数优化和风险管理手段,可以进一步提高策略效果

||

This strategy uses the MACD indicator and moving average cross principles to construct trading signals. Its advantage is that it can optimize the parameters of MACD separately for long and short directions, so that the parameters can be optimally configured for different market directions.

-

Calculate the MACD indicator separately for long and short directions. One set of parameters is used for long, and another set of parameters is used for short, which can be freely configured.

-

Judge the trading signals generated by the crossover of the MACD line and the Signal line. Look for bullish crossover for long, and bearish crossover for short.

-

You can configure whether the Signal line also needs to cross to trigger the signal, so as to avoid false signals.

-

After entering long or short position, close the position when a reverse crossover occurs.

-

Two-way parameter optimization: parameters for long and short can be freely optimized to be optimally configured for market directions separately.

-

Configurable signal smoothing: The Signal parameter can control the smoothness of the signal line to filter out false signals.

-

Configurable signal filtering: Can be configured whether the Signal line crossover is required to trigger to avoid false signals.

-

Fine-tuned position control: Long or short alone can be enabled separately, or long and short can be done at the same time.

-

MACD lag: MACD itself has some lag which may miss fast reversals.

-

Risk of switching between long and short: Frequent position switching may occur when the market changes rapidly.

-

Parameter risk: Improper parameter configurations may fail to capture market characteristics.

-

Lack of stop loss protection: Reasonable stop loss should be set to control single loss.

Methods to manage risks:

-

Combine with other indicators to judge the big picture and avoid chasing highs and selling lows.

-

Set signal delay and smoothing parameters to reduce error signals.

-

Repeatedly test and optimize parameters to match the rhythm of the market in different cycles.

-

Set up stop loss and take profit mechanism to control single loss.

Some ways this strategy can be further optimized:

-

Test different combinations of fast line and slow line length parameters to find the optimal parameters for market conditions in different cycles.

-

Test different Signal line parameters. Smoother signal lines can filter out more noise.

-

Test the difference between turning on and off the Signal line crossover filter to find the optimal balance.

-

Set the optimal stop loss and take profit ratio based on backtest results.

-

Try only long or only short to see if the strategy effect can be maximized.

By configuring long and short parameters separately, this MACD Double Optimization Trading Strategy realizes optimization tailored to different market directions, and allows free adjustment of the participation direction. At the same time, signal filtering mechanisms are introduced to avoid erroneous signals. Through parameter optimization and risk management measures, the strategy effect can be further improved.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_bool_1 | true | (?inputs long)Allow Long |

| v_input_int_1 | 13 | Fast Length Long |

| v_input_int_2 | 19 | Slow Length Long |

| v_input_source_1_close | 0 | Source Long: close |

| v_input_int_3 | 9 | Signal Smoothing Long |

| v_input_string_1 | 0 | Oscillator MA Type Long: EMA |

| v_input_string_2 | 0 | Signal Line MA Type Long: EMA |

| v_input_int_4 | false | Cross Point Long |

| v_input_int_5 | false | MacD Cross Delay Long |

| v_input_bool_2 | false | Signal Must Also Cross Long |

| v_input_int_6 | false | Signal Cross Delay Long |

| v_input_bool_3 | true | (?inputs short)Allow Short |

| v_input_int_7 | 11 | Fast Length Short |

| v_input_int_8 | 20 | Slow Length Short |

| v_input_source_2_close | 0 | Source Short: close |

| v_input_int_9 | 9 | Signal Smoothing Short |

| v_input_string_3 | 0 | Oscillator MA Type Short: EMA |

| v_input_string_4 | 0 | Signal Line MA Type Short: EMA |

| v_input_int_10 | false | Cross Point Short |

| v_input_int_11 | true | MacD Cross Delay Short |

| v_input_bool_4 | false | Signal Must Also Cross Short |

| v_input_int_12 | false | Signal Cross Delay Short |

| v_input_bool_5 | false | (?Stop/Profit Long)Use Stop Loss Long |

| v_input_float_1 | true | Stop Loss % Long |

| v_input_bool_6 | false | Use Take Profit Long |

| v_input_float_2 | true | Take Profit % Long |

| v_input_bool_7 | true | (?Stop/Profit Short)Use Stop Loss Short |

| v_input_float_3 | 21 | Stop Loss % Short |

| v_input_bool_8 | true | Use Take Profit Short |

| v_input_float_4 | 20 | Take Profit % Short |

| v_input_color_1 | #2962FF | (?Color Settings)MACD Line Long |

| v_input_color_2 | #FF6D00 | Signal Line Long |

| v_input_color_7 | #B03DFF | MACD Line Short |

| v_input_color_8 | #00FFE8 | Signal Line Short |

| v_input_color_3 | #26A69A | (?Histogram Color Settings)Grow Above Long |

| v_input_color_4 | #B2DFDB | Fall Above Long |

| v_input_color_5 | #FFCDD2 | Grow Below Long |

| v_input_color_6 | #FF5252 | Fall Below Long |

| v_input_color_9 | #D95965 | Grow Above Short |

| v_input_color_10 | #4D2024 | Fall Above Short |

| v_input_color_11 | #00322D | Grow Below Short |

| v_input_color_12 | #00ADAD | Fall Below Short |

Source (PineScript)

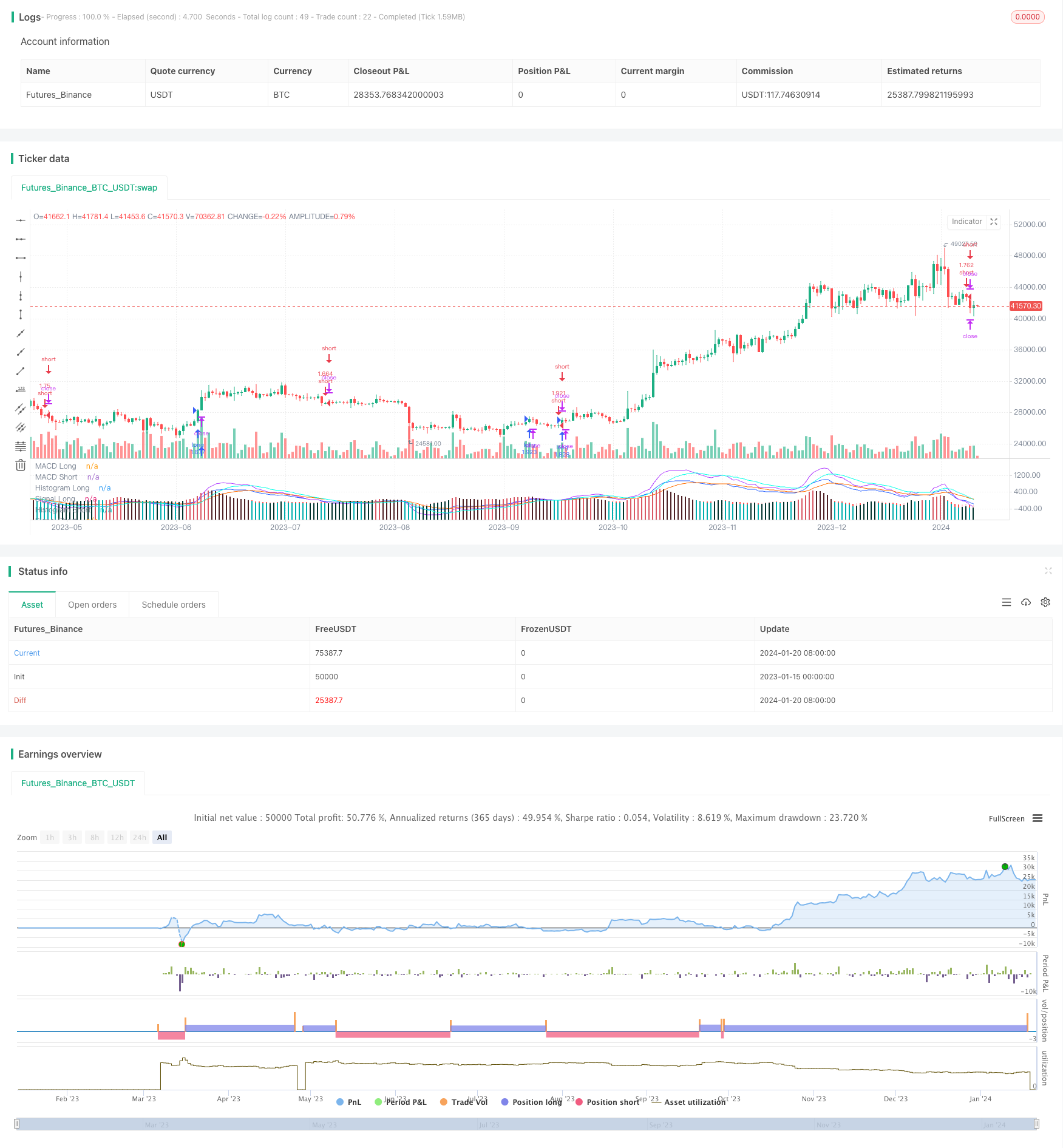

/*backtest

start: 2023-01-15 00:00:00

end: 2024-01-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Gentleman-Goat & TradingTools.Software/Optimizer

strategy(title="MACD Short/Long Strategy for TradingView Input Optimizer", shorttitle="MACD Short/Long TVIO", initial_capital=1000, default_qty_value=100, default_qty_type=strategy.percent_of_equity)

// Get Inputs Long

allow_long = input.bool(title="Allow Long", defval=true, group="inputs long")

fast_length_long = input.int(title="Fast Length Long", defval=13, group="inputs long")

slow_length_long = input.int(title="Slow Length Long", defval=19, group="inputs long")

src_long = input.source(title="Source Long", defval=close, group="inputs long")

signal_length_long = input.int(title="Signal Smoothing Long", minval = 1, maxval = 50, defval = 9, group="inputs long")

sma_source_long = input.string(title="Oscillator MA Type Long", defval="EMA", options=["SMA", "EMA"], group="inputs long")

sma_signal_long = input.string(title="Signal Line MA Type Long", defval="EMA", options=["SMA", "EMA"], group="inputs long")

cross_point_long = input.int(title="Cross Point Long", defval=0, group="inputs long")

cross_delay_macd_long = input.int(title="MacD Cross Delay Long", defval=0, group="inputs long")

signal_must_cross_long = input.bool(title="Signal Must Also Cross Long", defval=false, group="inputs long")

cross_delay_signal_long = input.int(title="Signal Cross Delay Long", defval=0, group="inputs long")

//Get Inputs Short

allow_short = input.bool(title="Allow Short", defval=true, group="inputs short")

fast_length_short = input.int(title="Fast Length Short", defval=11, group="inputs short")

slow_length_short = input.int(title="Slow Length Short", defval=20, group="inputs short")

src_short = input.source(title="Source Short", defval=close, group="inputs short")

signal_length_short = input.int(title="Signal Smoothing Short", minval = 1, maxval = 50, defval = 9, group="inputs short")

sma_source_short = input.string(title="Oscillator MA Type Short", defval="EMA", options=["SMA", "EMA"], group="inputs short")

sma_signal_short = input.string(title="Signal Line MA Type Short", defval="EMA", options=["SMA", "EMA"], group="inputs short")

cross_point_short = input.int(title="Cross Point Short", defval=0, group="inputs short")

cross_delay_macd_short = input.int(title="MacD Cross Delay Short", defval=1, group="inputs short")

signal_must_cross_short = input.bool(title="Signal Must Also Cross Short", defval=false, group="inputs short")

cross_delay_signal_short = input.int(title="Signal Cross Delay Short", defval=0, group="inputs short")

use_stop_loss_long = input.bool(defval=false,title="Use Stop Loss Long", group="Stop/Profit Long")

stop_loss_long_percentage = input.float(defval=1,title="Stop Loss % Long",minval=0.0,step=0.1, group="Stop/Profit Long") * .01

use_take_profit_long = input.bool(defval=false,title="Use Take Profit Long", group="Stop/Profit Long")

take_profit_long_percentage = input.float(defval=1,title="Take Profit % Long",minval=0.0,step=0.1, group="Stop/Profit Long") * .01

use_stop_loss_short = input.bool(defval=true,title="Use Stop Loss Short", group="Stop/Profit Short")

stop_loss_short_percentage = input.float(defval=21,title="Stop Loss % Short",minval=0.0,step=0.1, group="Stop/Profit Short") * .01

use_take_profit_short = input.bool(defval=true,title="Use Take Profit Short", group="Stop/Profit Short")

take_profit_short_percentage= input.float(defval=20,title="Take Profit % Short",minval=0.0,step=0.1, group="Stop/Profit Short") * .01

//------------------------------------------------------------------------------

// Plot colors Long

col_macd_long = input.color(#2962FF, "MACD Line Long", group="Color Settings", inline="MACD")

col_signal_long = input.color(#FF6D00, "Signal Line Long", group="Color Settings", inline="Signal")

col_grow_above_long = input.color(#26A69A, "Grow Above Long", group="Histogram Color Settings", inline="Above Long")

col_fall_above_long = input.color(#B2DFDB, "Fall Above Long", group="Histogram Color Settings", inline="Above Long")

col_grow_below_long = input.color(#FFCDD2, "Grow Below Long", group="Histogram Color Settings", inline="Below Long")

col_fall_below_long = input.color(#FF5252, "Fall Below Long", group="Histogram Color Settings", inline="Below Long")

// Plot colors Short

col_macd_short = input.color(#B03DFF, "MACD Line Short", group="Color Settings", inline="MACD")

col_signal_short = input.color(#00FFE8, "Signal Line Short", group="Color Settings", inline="Signal")

col_grow_above_short = input.color(#D95965, "Grow Above Short", group="Histogram Color Settings", inline="Above Short")

col_fall_above_short = input.color(#4D2024, "Fall Above Short", group="Histogram Color Settings", inline="Above Short")

col_grow_below_short = input.color(#00322D, "Grow Below Short", group="Histogram Color Settings", inline="Below Short")

col_fall_below_short = input.color(#00ADAD, "Fall Below Short", group="Histogram Color Settings", inline="Below Short")

// Calculate Long

fast_ma_long = sma_source_long == "SMA" ? ta.sma(src_long, fast_length_long) : ta.ema(src_long, fast_length_long)

slow_ma_long = sma_source_long == "SMA" ? ta.sma(src_long, slow_length_long) : ta.ema(src_long, slow_length_long)

macd_long = fast_ma_long - slow_ma_long

signal_long = sma_signal_long == "SMA" ? ta.sma(macd_long, signal_length_long) : ta.ema(macd_long, signal_length_long)

hist_long = macd_long - signal_long

// Calculate Short

fast_ma_short = sma_source_short == "SMA" ? ta.sma(src_short, fast_length_short) : ta.ema(src_short, fast_length_short)

slow_ma_short = sma_source_short == "SMA" ? ta.sma(src_short, slow_length_short) : ta.ema(src_short, slow_length_short)

macd_short = fast_ma_short - slow_ma_short

signal_short = sma_signal_short == "SMA" ? ta.sma(macd_short, signal_length_short) : ta.ema(macd_short, signal_length_short)

hist_short = macd_short - signal_short

//Plot Long

plot(hist_long, title="Histogram Long", style=plot.style_columns, color=(hist_long>=0 ? (hist_long[1] < hist_long ? col_grow_above_long : col_fall_above_long) : (hist_long[1] < hist_long ? col_grow_below_long : col_fall_below_long)))

plot(macd_long, title="MACD Long", color=col_macd_long)

plot(signal_long, title="Signal Long", color=col_signal_long)

//Plot Short

plot(hist_short, title="Histogram Short", style=plot.style_columns, color=(hist_short>=0 ? (hist_short[1] < hist_short ? col_grow_above_short : col_fall_above_short) : (hist_short[1] < hist_short ? col_grow_below_short : col_fall_below_short)))

plot(macd_short, title="MACD Short", color=col_macd_short)

plot(signal_short, title="Signal Short", color=col_signal_short)

var detectedLongCrossOver = false

var detectedShortCrossUnder = false

if(ta.crossunder(macd_short,cross_point_short))

detectedShortCrossUnder := true

if(ta.crossover(macd_short,cross_point_short))

detectedShortCrossUnder := false

if(ta.crossover(macd_long,cross_point_long))

detectedLongCrossOver := true

if(ta.crossunder(macd_long,cross_point_long))

detectedLongCrossOver := false

crossover_signal_long = ta.crossover(signal_long,cross_point_long)

crossunder_signal_long = ta.crossunder(signal_long,cross_point_long)

crossunder_signal_short = ta.crossunder(signal_short,cross_point_short)

crossover_signal_short = ta.crossover(signal_short,cross_point_short)

crossover_macd_long = ta.crossover(macd_long,cross_point_long)

crossunder_macd_long = ta.crossunder(macd_long,cross_point_long)

crossunder_macd_short = ta.crossunder(macd_short,cross_point_short)

crossover_macd_short = ta.crossover(macd_short,cross_point_short)

inEntry = false

//Strategy Entries

if (strategy.equity > 0) //This is required for the input optimizer to work since it will fail if the strategy fails to succeed by not having enough equity.

if (strategy.position_size <= 0 and allow_long==true and inEntry==false)

if(signal_must_cross_long==true)

longSignalCondition = detectedLongCrossOver==true and crossover_signal_long[cross_delay_signal_long]

strategy.entry(id="long", direction=strategy.long, when=longSignalCondition)

if(longSignalCondition)

inEntry:=true

else

longMacDCondition = crossover_macd_long[cross_delay_macd_long]

strategy.entry(id="long", direction=strategy.long, when=longMacDCondition)

if(longMacDCondition)

inEntry:=true

if (strategy.position_size >= 0 and allow_short==true and inEntry==false)

if(signal_must_cross_short==true)

shortSignalCondition = detectedShortCrossUnder and crossunder_signal_short[cross_delay_signal_short]

strategy.entry(id="short", direction=strategy.short, when=shortSignalCondition)

if(shortSignalCondition)

inEntry:=true

else

shortMacDCondition = crossunder_macd_short[cross_delay_macd_short]

strategy.entry(id="short", direction=strategy.short, when=shortMacDCondition)

if(shortMacDCondition)

inEntry:=true

if(strategy.position_size > 0 and allow_long==true and allow_short==false)

if(signal_must_cross_long==true)

strategy.close(id="long", when=detectedLongCrossOver==false and crossunder_signal_long)

else

strategy.close(id="long", when=crossunder_macd_long)

if(strategy.position_size < 0 and allow_short==true and allow_long==false)

if(signal_must_cross_short==true)

strategy.close(id="short", when=detectedShortCrossUnder==false and crossover_signal_short)

else

strategy.close(id="short", when=crossover_macd_short)

stop_loss_value_long = strategy.position_avg_price*(1 - stop_loss_long_percentage)

take_profit_value_long = strategy.position_avg_price*(1 + take_profit_long_percentage)

stop_loss_value_short = strategy.position_avg_price*(1 + stop_loss_short_percentage)

take_profit_value_short = strategy.position_avg_price*(1 - take_profit_short_percentage)

if(strategy.position_size>0) //Long positions only

strategy.exit(id="TP/SL Long",from_entry="long", limit=use_take_profit_long ? take_profit_value_long : na, stop=use_stop_loss_long ? stop_loss_value_long : na)

if(strategy.position_size<0) //Short positions only

strategy.exit(id="TP/SL Short",from_entry="short", limit=use_take_profit_short ? take_profit_value_short : na, stop=use_stop_loss_short ? stop_loss_value_short : na)

Detail

https://www.fmz.com/strategy/439613

Last Modified

2024-01-22 11:10:10