Name

RSI与平滑RSI策略多头分型RSI-and-smoothed-RSI-bullish-divergence-strategy

Author

ChaoZhang

Strategy Description

该策略通过RSI指标与平滑RSI指标的结合,寻找价格低点买入机会。当RSI指标创新低而价格没有创新低时,认为是多头分型信号。结合平滑RSI指标的趋势判断,可以提高策略的效果。

- 计算RSI指标,参数为14日线。

- 计算平滑RSI指标,通过双重WMA平均实现平滑效果。

- 判断RSI是否低于30,即超卖。

- 判断平滑RSI是否低于35,方向性较强。

- 判断RSI的最低点是否低于25。

- 计算RSI分型,即寻找RSI创新低而价格没有创新低的情况。

- 计算平滑RSI的下降周期,需要达到3日。

- 当上述条件都满足时,产生买入信号。

- 设置止损和止盈条件。

该策略主要依靠RSI指标反转性质,结合平滑RSI判断趋势,在价格承压而RSI超卖时买入。达到止盈或止损后平仓。

- 双RSI指标组合,提高策略效果。

- 利用RSI指标的反转特征,有一定的概率优势。

- 平滑RSI判断趋势有助于避免假反转。

- 完整的止损止盈逻辑,可以限制风险。

- RSI反转失败的概率,无法完全避免。

- 平滑RSI指标滞后,可能错过最佳买入时机。

- 止损点设置过于宽松,亏损扩大的风险。

可以通过调整RSI参数,优化买入时机。适当缩短止损间距,加快止损速度。结合其他指标判断趋势风险,降低假反转概率。

- 可以测试不同参数下RSI指标的效果。

- 优化平滑RSI的计算方法,提高平滑质量。

- 调整止盈止损点,寻找最优风险回报比。

- 增加量能指标等判断力度,避免量能不足情况。

通过参数调整和组合更多指标,可以进一步提升策略交易效果。

该策略整体是一个利用RSI反转特征的策略思路。双RSI指标组合充分发挥RSI反转效果的同时,也增加了指标分歧带来的不确定性。整体是一个典型的指标策略思路。通过不断测试优化可以提高指标参数的适用性,也可以组合更多指标判断来降低误判概率,增强策略健壮性。

||

This strategy combines RSI indicator and smoothed RSI indicator to find buying opportunities at price bottoms. When RSI makes a new low while price does not make a new low, it is considered as a bullish divergence signal. Adding smoothed RSI trend judgment can improve the strategy performance.

- Calculate RSI indicator with 14 periods.

- Calculate smoothed RSI using double WMA to achieve smoothing effect.

- Check if RSI is below 30 level, oversold status.

- Check if smoothed RSI is below 35, with stronger directional trend.

- Check if the RSI lowest point is below 25.

- Calculate RSI bullish divergence, find RSI making new low while price does not.

- Require smoothed RSI downtrend lasts more than 3 periods.

- Trigger buy signal when all conditions above are met.

- Set stop loss and take profit conditions.

The strategy mainly relies on the RSI reversal characteristic, combining with smoothed RSI trend judgment, to buy when price is under pressure while RSI is oversold. Close position when stop loss or take profit is touched.

- Dual RSI indicators combination improves strategy performance.

- Utilize the RSI reversal feature, has a probability edge.

- Smoothed RSI trend judgment helps avoid false reversals.

- Complete stop loss and take profit logic can limit risks.

- Probability of RSI reversal failure cannot be completely avoided.

- Smoothed RSI has lagging effect, may miss best entry timing.

- Stop loss set too loose, risk of expanding losses.

Can optimize entry timing by adjusting RSI parameters. Tighten stop loss distance for faster stopping out. Combine with other indicators to judge trend risk, lower false reversal rate.

- Test effectiveness of RSI under different parameter sets.

- Enhance smoothed RSI calculation for better smoothing quality.

- Adjust stop loss and take profit points, find optimal risk-reward ratio.

- Add momentum indicators etc. to avoid low momentum situations.

Further improve strategy performance by parameter tuning and combining more indicators.

The strategy utilizes the RSI reversal characteristic overall. The dual RSI combination fully leverages the reversal effect while also introduces uncertainty from indicator divergence. It is a typical indicator strategy idea. Can improve indicator adaptiveness through relentless testing and optimizing. Also combine more indicators to reduce misjudging and enhance robustness.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 3 | Take Profit % |

| v_input_2 | 1.75 | Stop Loss % |

| v_input_3 | 14 | RSI Lookback Period |

| v_input_4 | false | Buy Below Lowest Low In RSI Divergence Lookback Target % |

| v_input_5_close | 0 | Source of Buy Below Target Price: close |

| v_input_6 | 10 | Smoothed RSI Lookback Period |

| v_input_7 | 30 | RSI Currently Below |

| v_input_8 | 25 | RSI Divergence Lookback Period |

| v_input_9 | 25 | RSI Lowest In Divergence Lookback Currently Below |

| v_input_10 | 65 | RSI Sell Above |

| v_input_11 | 3 | Minimum SRSI Downtrend Length |

| v_input_12 | 35 | Smoothed RSI Currently Below |

| v_input_13 | false | Plot Target |

Source (PineScript)

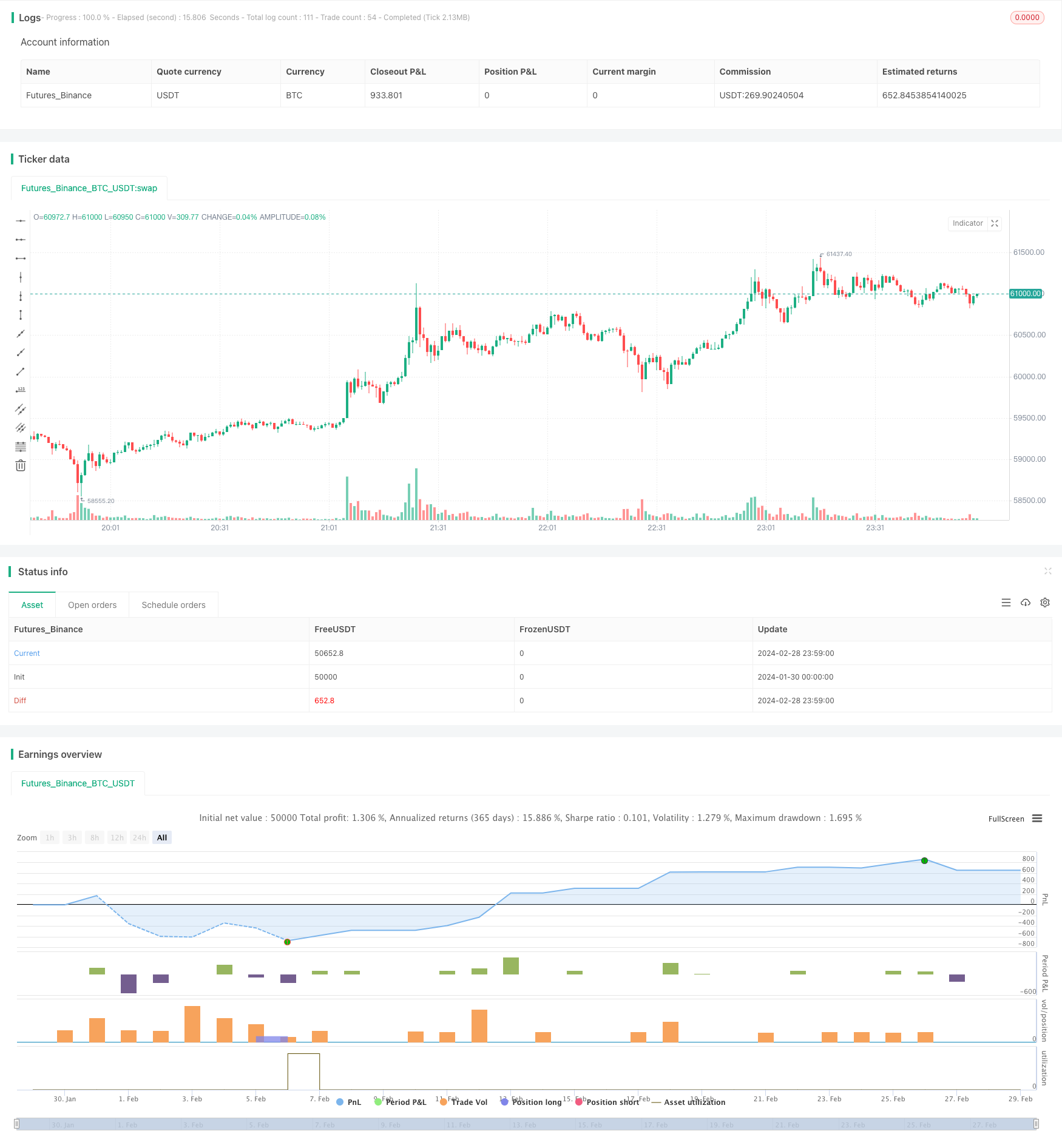

/*backtest

start: 2024-01-30 00:00:00

end: 2024-02-29 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © BigBitsIO

//@version=4

strategy(title="RSI and Smoothed RSI Bull Div Strategy [BigBitsIO]", shorttitle="RSI and Smoothed RSI Bull Div Strategy [BigBitsIO]", overlay=true, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=.1, slippage=0)

TakeProfitPercent = input(3, title="Take Profit %", type=input.float, step=.25)

StopLossPercent = input(1.75, title="Stop Loss %", type=input.float, step=.25)

RSICurve = input(14, title="RSI Lookback Period", type=input.integer, step=1)

BuyBelowTargetPercent = input(0, title="Buy Below Lowest Low In RSI Divergence Lookback Target %", type=input.float, step=.05)

BuyBelowTargetSource = input(close, title="Source of Buy Below Target Price", type=input.source)

SRSICurve = input(10, title="Smoothed RSI Lookback Period", type=input.integer, step=1)

RSICurrentlyBelow = input(30, title="RSI Currently Below", type=input.integer, step=1)

RSIDivergenceLookback = input(25, title="RSI Divergence Lookback Period", type=input.integer, step=1)

RSILowestInDivergenceLookbackCurrentlyBelow = input(25, title="RSI Lowest In Divergence Lookback Currently Below", type=input.integer, step=1)

RSISellAbove = input(65, title="RSI Sell Above", type=input.integer, step=1)

MinimumSRSIDownTrend = input(3, title="Minimum SRSI Downtrend Length", type=input.integer, step=1)

SRSICurrentlyBelow = input(35, title="Smoothed RSI Currently Below", type=input.integer, step=1)

PlotTarget = input(false, title="Plot Target")

RSI = rsi(close, RSICurve)

SRSI = wma(2*wma(RSI, SRSICurve/2)-wma(RSI, SRSICurve), round(sqrt(SRSICurve))) // Hull moving average

SRSITrendDownLength = 0

if (SRSI < SRSI[1])

SRSITrendDownLength := SRSITrendDownLength[1] + 1

// Strategy Specific

ProfitTarget = (close * (TakeProfitPercent / 100)) / syminfo.mintick

LossTarget = (close * (StopLossPercent / 100)) / syminfo.mintick

BuyBelowTarget = BuyBelowTargetSource[(lowestbars(RSI, RSIDivergenceLookback)*-1)] - (BuyBelowTargetSource[(lowestbars(RSI, RSIDivergenceLookback)*-1)] * (BuyBelowTargetPercent / 100))

plot(PlotTarget ? BuyBelowTarget : na)

bool IsABuy = RSI < RSICurrentlyBelow and SRSI < SRSICurrentlyBelow and lowest(SRSI, RSIDivergenceLookback) < RSILowestInDivergenceLookbackCurrentlyBelow and BuyBelowTargetSource < BuyBelowTarget and SRSITrendDownLength >= MinimumSRSIDownTrend and RSI > lowest(RSI, RSIDivergenceLookback)

bool IsASell = RSI > RSISellAbove

if IsABuy

strategy.entry("Positive Trend", true) // buy by market

strategy.exit("Take Profit or Stop Loss", "Positive Trend", profit = ProfitTarget, loss = LossTarget)

if IsASell

strategy.close("Positive Trend")

Detail

https://www.fmz.com/strategy/443241

Last Modified

2024-03-01 12:11:58