Name

RSI动量反转策略RSI-Momentum-Reversal-Strategy

Author

ChaoZhang

Strategy Description

[trans]

RSI动量反转策略通过结合RSI指标和K线实体方向,识别超买超卖现象,进行反转交易。该策略同时使用常规RSI和快速RSI,并配合K线实体过滤,可以有效识别反转机会。

该策略主要通过以下几个部分实现:

-

Connors RSI指标

计算常规RSI、RSI胜率指标、RSI巴黎沙尔指标,取三者平均作为Connors RSI。

-

快速RSI指标

使用价格变动计算快速RSI,反映超短线循环。

-

K线实体过滤

需实体阳线做多,阴线做空,防止假突破。

-

多空条件

Connors RSI低于20时,快速RSI低于25时,实体阳线出现,做多。

Connors RSI高于80时,快速RSI高于75时,实体阴线出现,做空。

-

止损退出

实体转向时止损退出。

通过Connors RSI判断长线趋势反转点,快速RSI判断短线反转点,K线实体确保突破效力,这样可以有效发现反转机会,在超买超卖都及时开仓做反向操作。

该策略具有以下优势:

-

结合长短线指标

Connors RSI反映长线循环,快速RSI反映短线循环,二者结合可以更准确判断反转点。

-

实体过滤

仅在实体突破时操作,可以减少假突破带来的亏损。

-

参数可调

RSI参数、交易品种、交易时间段都可以自由调整,适应不同市场。

-

简单直观

RSI和K线实体都是基础指标,策略逻辑简单易懂。

-

容易实施

仅使用内置指标,代码量少,实施难度低。

该策略面临以下主要风险:

-

反转失败风险

反转信号发出后价格继续原趋势运行,导致亏损。

-

震荡行情风险

震荡行情中反复触发信号,造成过多无效交易。

-

突破假突破风险

实体过滤并不能完全避免突破假突破的情况。

-

参数设定风险

RSI参数设定不当,可能错过交易机会或造成多次无效交易。

-

特殊行情风险

特殊行情中RSI指标失效,产生错误信号。

该策略可以从以下几个方面进行优化:

-

增加止损机制

优化止损策略,让止损更为合理,减少单笔损失。

-

集成多个指标

增加MACD、KD等指标过滤,使信号更可靠。

-

增加概率过滤

结合趋势、支撑阻力等判断概率,避免低概率交易。

-

优化参数设置

针对不同交易品种、周期进行参数测试,找到最优参数。

-

规避特殊行情

识别特殊行情,暂停交易,避免巨大亏损。

RSI动量反转策略通过Connors RSI和快速RSI判断长短线反转,配合K线实体过滤增加信号有效性。该策略具有指标组合、参数调节灵活等优势,可以捕捉反转机会,在超买超卖时及时介入交易。但该策略也存在一定的反转失败、突破假突破等风险,需要进一步优化止损、指标组合等方面,以减少风险提高盈利能力。

||

The RSI momentum reversal strategy identifies overbought and oversold conditions by combining RSI indicators and candlestick body directions for reversal trading. This strategy uses both conventional RSI and fast RSI, along with candlestick body filters, to effectively identify reversal opportunities.

The strategy is mainly implemented through the following parts:

-

Connors RSI indicator

Calculates conventional RSI, RSI Win Ratio, and RSI Parisian to get Connors RSI as an average.

-

Fast RSI indicator

Uses price changes to calculate fast RSI, reflecting ultra short-term cycles.

-

Candlestick body filter

Requires bullish body for long and bearish body for short to prevent false breakouts.

-

Long and short conditions

Go long when Connors RSI below 20 and fast RSI below 25 with bullish body.

Go short when Connors RSI above 80 and fast RSI above 75 with bearish body.

-

Stop loss exit

Exits with stop loss when candlestick body turns around.

Connors RSI identifies long-term trend reversal points, fast RSI identifies short-term reversals, and candlestick body ensures the validity of breakouts. This allows effectively detecting reversal opportunities and making counter-trend trades during overbought and oversold conditions.

The advantages of this strategy include:

-

Combining long and short-term indicators

Connors RSI reflects long-term cycles and fast RSI reflects short-term cycles, combining both can accurately identify reversal points.

-

Candlestick body filter

Trading only on body breakouts can reduce losses from false breakouts.

-

Adjustable parameters

RSI parameters, trading products, and trading time frames can be freely adjusted to suit different markets.

-

Simple and intuitive

RSI and candlestick body are basic indicators, easy-to-understand logic.

-

Easy to implement

Uses built-in indicators only, requiring little code and easy to implement.

The main risks of this strategy:

-

Failed reversal risk

Price continues the original trend after reversal signal, leading to losses.

-

Ranging market risk

Frequent ineffective signals triggered in ranging markets.

-

False breakout risk

Candlestick body filter cannot completely avoid false breakouts.

-

Parameter risk

Inappropriate RSI parameters may miss trades or trigger multiple ineffective trades.

-

Special market conditions risk

RSI indicators may fail and generate incorrect signals in special market conditions.

The strategy can be optimized from the following aspects:

-

Add stop loss mechanisms

Optimize stop loss strategies for more reasonable stops, reducing single trade losses.

-

Integrate multiple indicators

Add filters like MACD and KD to make signals more reliable.

-

Add probability filters

Combine trend, support/resistance analysis to avoid low probability trades.

-

Optimize parameter settings

Test parameters on different products and time frames to find optimum values.

-

Avoid special market conditions

Identify and avoid trading in special market conditions to prevent huge losses.

The RSI momentum reversal strategy identifies long and short-term reversals using Connors RSI and fast RSI, with candlestick body filters to increase signal validity. The advantages like indicator combinations and adjustable parameters allow capturing reversals and trading counter-trend when overbought or oversold. But risks like failed reversals and false breakouts remain, requiring further optimizations in stop loss, indicator combinations to reduce risks and improve profitability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Long |

| v_input_2 | true | Short |

| v_input_3 | false | Use Martingale |

| v_input_4 | 100 | Capital, % |

| v_input_5 | true | Use CRSI Strategy |

| v_input_6 | true | Use FRSI Strategy |

| v_input_7 | true | CRSI+FRSI Mode |

| v_input_8 | 25 | RSI limit |

| v_input_9 | true | Use Body-filter |

| v_input_10 | true | Use Color-filter |

| v_input_11 | 1900 | From Year |

| v_input_12 | 2100 | To Year |

| v_input_13 | true | From Month |

| v_input_14 | 12 | To Month |

| v_input_15 | true | From day |

| v_input_16 | 31 | To day |

Source (PineScript)

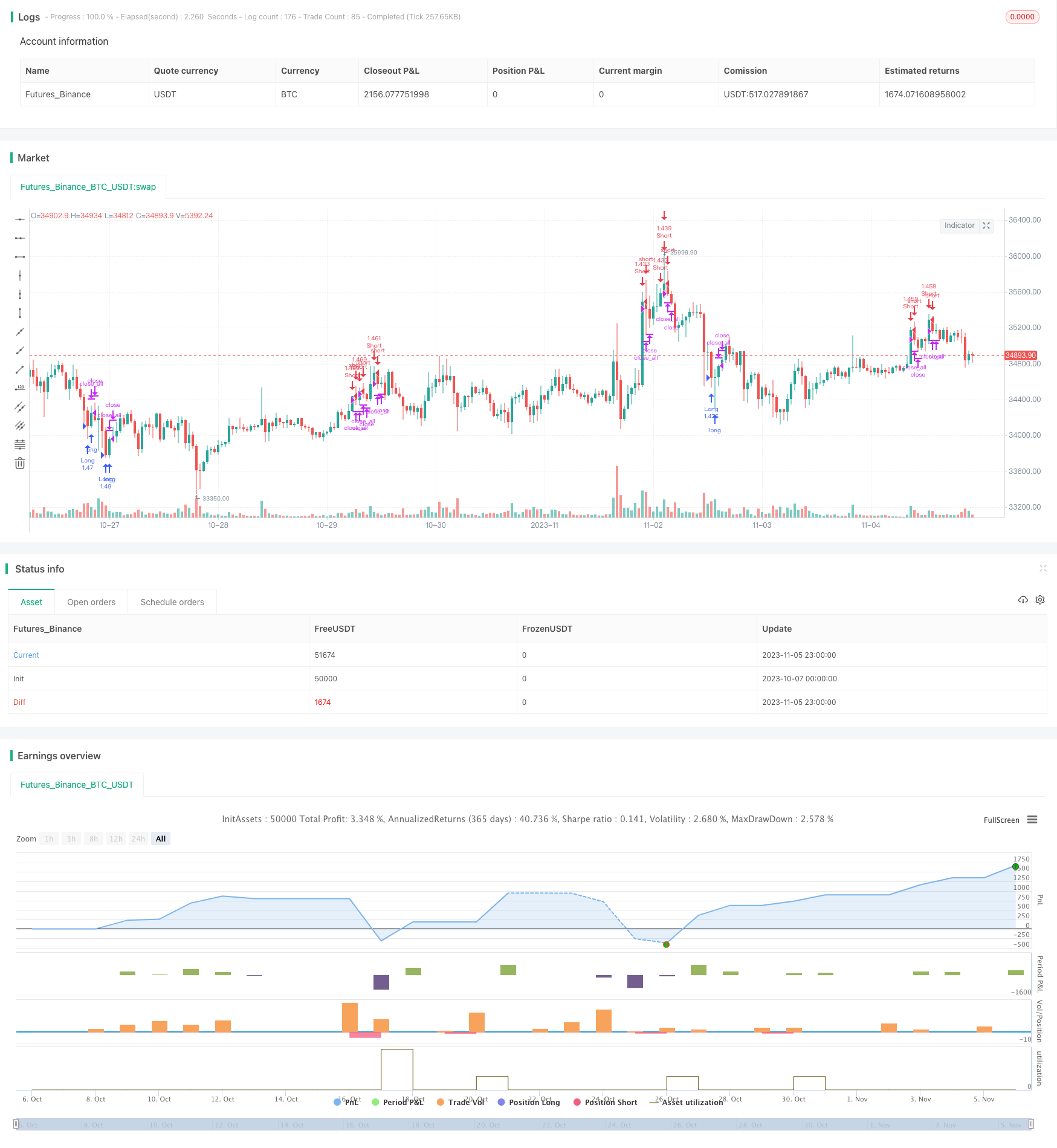

/*backtest

start: 2023-10-07 00:00:00

end: 2023-11-06 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "Noro's Connors RSI Strategy v1.0", shorttitle = "CRSI str 1.0", overlay = false, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 10)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usemar = input(false, defval = false, title = "Use Martingale")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

usecrsi = input(true, defval = true, title = "Use CRSI Strategy")

usefrsi = input(true, defval = true, title = "Use FRSI Strategy")

usemod = input(true, defval = true, title = "CRSI+FRSI Mode")

limit = input(25, defval = 25, minval = 1, maxval = 100, title = "RSI limit")

usebod = input(true, defval = true, title = "Use Body-filter")

usecol = input(true, defval = true, title = "Use Color-filter")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//CRSI

rsilen = 3

streaklen = 2

lookback = 100

rsi = rsi(close,rsilen)

upday = close > close[1] ? 1 : 0

downday = close < close[1] ? -1 : 0

upstreak = upday!=0 ? upstreak[1] + upday : 0

downstreak = downday!=0 ? downstreak[1] + downday : 0

streak = upstreak + downstreak

streakrsi = rsi(streak,streaklen)

roc = close/close[1] - 1

roccount = 0

for i=1 to lookback-1

roccount := roc[i]<roc ? roccount + 1 : roccount

crsi = (rsi + streakrsi + roccount) / 3

//Oscilator

// rsiplot = plot(crsi, title="RSI", style=line, linewidth=1, color=blue)

// band1 = hline(80, title="Upper Line", linestyle=dashed, linewidth=1, color=red)

// band0 = hline(20, title="Lower Line", linestyle=dashed, linewidth=1, color=green)

// fill(band1, band0, color=purple, transp=90)

//Fast RSI

fastup = rma(max(change(close), 0), 7)

fastdown = rma(-min(change(close), 0), 7)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Body Filter

nbody = abs(close - open)

abody = sma(nbody, 10)

body = nbody > abody / 3 or usebod == false

//Color Filter

bar = close > open ? 1 : close < open ? -1 : 0

gbar = bar == 1 or usecol == false

rbar = bar == -1 or usecol == false

//Signals

up1 = rbar and (strategy.position_size == 0 or close < strategy.position_avg_price) and crsi < limit and body and usecrsi

dn1 = gbar and (strategy.position_size == 0 or close > strategy.position_avg_price) and crsi > 100 - limit and body and usecrsi

up2 = rbar and (strategy.position_size == 0 or close < strategy.position_avg_price) and fastrsi < limit and body and usefrsi

dn2 = gbar and (strategy.position_size == 0 or close > strategy.position_avg_price) and fastrsi > 100 - limit and body and usefrsi

exit = ((strategy.position_size > 0 and bar == 1) or (strategy.position_size < 0 and bar == -1)) and body

//Trading

profit = exit ? ((strategy.position_size > 0 and close > strategy.position_avg_price) or (strategy.position_size < 0 and close < strategy.position_avg_price)) ? 1 : -1 : profit[1]

mult = usemar ? exit ? profit == -1 ? mult[1] * 2 : 1 : mult[1] : 1

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 * mult : lot[1]

if ((up1 or up2) and usemod == false) or (up1 and up2 and usemod)

if strategy.position_size < 0

strategy.close_all()

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot)

if ((dn1 or dn2) and usemod == false) or (dn1 and dn2 and usemod)

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot)

if exit

strategy.close_all()

Detail

https://www.fmz.com/strategy/431401

Last Modified

2023-11-07 15:45:15