Name

RSI多空分歧指标The-RSI-Divergence-Indicator-Strategy

Author

ChaoZhang

Strategy Description

RSI多空分歧指标是一种基于相对强弱指标(RSI)的量化交易策略。它通过分析RSI指标与价格之间的分歧,发现价格趋势反转的机会,实现低买高卖的目的。

该策略的核心指标是RSI。它分析RSI指标与价格之间的“分歧”。所谓“分歧”,就是RSI指标和价格之间出现反向信号。

具体来说,当RSI形成较低的低点,而价格形成较高的低点时,就是RSI与价格之间的多头分歧。这预示着价格可能反转上涨。策略会在这个时点建立多头仓位。

相反,当RSI形成较高的高点,而价格形成较低的高点时,就是RSI与价格之间的空头分歧。这预示着价格可能反转下跌。策略会在这个时点建立空头仓位。

通过捕捉RSI与价格之间的这些分歧点,策略能及时发现价格反转机会,实现低买高卖。

RSI多空分歧策略具有以下优势:

-

捕捉价格反转点精准。RSI与价格分歧往往预示着即将发生的趋势反转,是非常有效的预测信号。

-

实现低买高卖。通过分歧点建仓,能够在相对低点买入,在相对高点卖出,符合量化交易的最佳实践。

-

突破常规RSI策略局限性。常规RSI策略只关注超买超卖区域。而该策略则利用RSI指标本身的反转属性,以更精准的方式捕捉转折点。大大提高了策略的效率。

-

简单的参数设定。主要参数只有RSI周期和回看区间两个,非常简单,容易优化。

RSI多空分歧策略也存在一定的风险:

-

分歧信号可能是假信号。RSI与价格之间的分歧不一定会导致真实的价格反转。有时也会形成假反转。这会导致交易亏损。可以适当设定止损来控制风险。

-

在趋势市场中表现不佳。当股价出现方向明确的趋势行情时,该策略的获利空间会比较小。这种情况下,最好暂时停用该策略,等待新的震荡行情。

-

复利风险。策略设置了复利参数,如果遇到多次亏损交易,可能会加速账户损失。这需要控制仓位规模和止损点来降低风险。

该策略还可以从以下几个方面进行优化:

-

结合其他指标过滤信号。可以加入MACD,KDJ等其他指标,对RSI分歧点进行验证,过滤掉一些假信号,提高策略胜率。

-

优化RSI参数。可以测试不同的RSI周期参数,找到更匹配品种特点的RSI周期设置。一般在6-15之间效果较好。

-

优化回看区间。回看区间直接影响到策略的交易频率。可以测试不同的参数,找到最佳的频率。一般在5-15之间效果较好。

-

增加止损策略。可以根据ATR,移动止损等方式,设定合理的止损逻辑。在出现亏损时快速止损,可以有效控制策略风险。

RSI多空分歧策略通过分析RSI指标本身的反转属性,精准捕捉价格变化的转折点。实现了低买高卖的交易策略。相比于传统意义的RSI超买超卖策略,它使用了更精细和原始的RSI特征,大大提高了策略的效率。配合参数优化和风险控制,它非常适合用来捕捉震荡行情中的短线交易机会。

||

The RSI Divergence Indicator strategy is a quantitative trading strategy based on the Relative Strength Index (RSI) indicator. It detects opportunities for trend reversals by analyzing the divergence between the RSI indicator and price, aiming to buy low and sell high.

The core indicator of this strategy is RSI. It analyzes the "divergence" between the RSI indicator and price. The so-called "divergence" refers to the opposite signals between RSI and price.

Specifically, when the RSI forms a relatively lower low while the price forms a relatively higher low, it is a bullish divergence between the RSI and price. This implies that the price may reverse upwards. The strategy will establish a long position at this point.

Conversely, when the RSI forms a relatively higher high while the price forms a relatively lower high, it is a bearish divergence between the RSI and price. This implies that the price may reverse downwards. The strategy will establish a short position at this point.

By capturing these divergences between RSI and price, the strategy can timely detect opportunities for price reversals and achieve buying low and selling high.

The RSI Divergence strategy has the following advantages:

-

Accurate in capturing price reversal points. Divergences between RSI and price often imply an upcoming trend reversal, which is a very effective predictive signal.

-

Achieve buying low and selling high. By establishing positions at divergence points, it is able to buy at relatively low prices and sell at relatively high prices, aligning with the best practices of quantitative trading.

-

Breakthrough the limitations of conventional RSI strategies. Conventional RSI strategies only focus on overbought and oversold areas. This strategy utilizes the intrinsic reversal properties of the RSI itself to capture turning points more precisely, greatly improving the efficiency of the strategy.

-

Simple parameter settings. The main parameters are just the RSI period and lookback period, which is very simple and easy to optimize.

The RSI Divergence strategy also has some risks:

-

Divergence signals could be false signals. The divergences between RSI and price do not necessarily lead to real price reversals. Sometimes they also form false reversals, leading to trading losses. Reasonable stop loss should be set to control risks.

-

Poor performance in trending markets. When the price shows a clear directional trend, the profit space of this strategy would be relatively small. It is better to temporarily disable the strategy in this case and wait for new ranging markets.

-

Risk of pyramiding. The strategy has set pyramiding parameters. In case of consecutive losing trades, it may accelerate the account drawdown. Position sizing and stop loss should be controlled to mitigate the risk.

The strategy can also be optimized in the following aspects:

-

Combine other indicators for signal filtering. MACD, KDJ and other indicators can be added to verify the RSI divergence points, filtering out some false signals and improving the win rate of the strategy.

-

Optimize RSI parameters. Different RSI periods can be tested to find the one that best matches the characteristics of the product. Generally between 6-15 works well.

-

Optimize lookback period. The lookback period directly affects the trading frequency of the strategy. Different values can be tested to find the optimal frequency, usually between 5-15 is a good range.

-

Add stop loss logic. Reasonable stop loss methods like ATR trailing stop loss can be implemented to quickly cut losses when incurred. This can effectively control the risk of the strategy.

The RSI Divergence strategy accurately captures price turning points by analyzing the intrinsic reversal properties of the RSI indicator itself. It achieves a low-buy-high-sell trading approach. Compared to the traditional overbought-oversold RSI strategies, it utilizes more refined and intrinsic characteristics of RSI, greatly improving efficiency. With parameter optimization and risk control, it is very suitable for capturing short-term trading opportunities within ranging markets.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 9 | RSI Period |

| v_input_2_close | 0 | RSI Source: close |

| v_input_3 | 3 | Pivot Lookback Right |

| v_input_4 | true | Pivot Lookback Left |

| v_input_5 | 80 | Take Profit at RSI Level |

| v_input_6 | 60 | Max of Lookback Range |

| v_input_7 | 5 | Min of Lookback Range |

| v_input_8 | true | Plot Bullish |

| v_input_9 | true | Plot Hidden Bullish |

| v_input_10 | true | Plot Bearish |

| v_input_11 | false | Plot Hidden Bearish |

| v_input_12 | 0 | Trailing StopLoss Type: NONE |

| v_input_13 | 5 | Stop Loss% |

| v_input_14 | 14 | ATR Length (for Trailing stop loss) |

| v_input_15 | 3.5 | ATR Multiplier (for Trailing stop loss) |

| v_input_16 | timestamp(2019-01-01T00:00:00) | startDate |

| v_input_17 | timestamp(2021-01-01T00:00:00) | finishDate |

Source (PineScript)

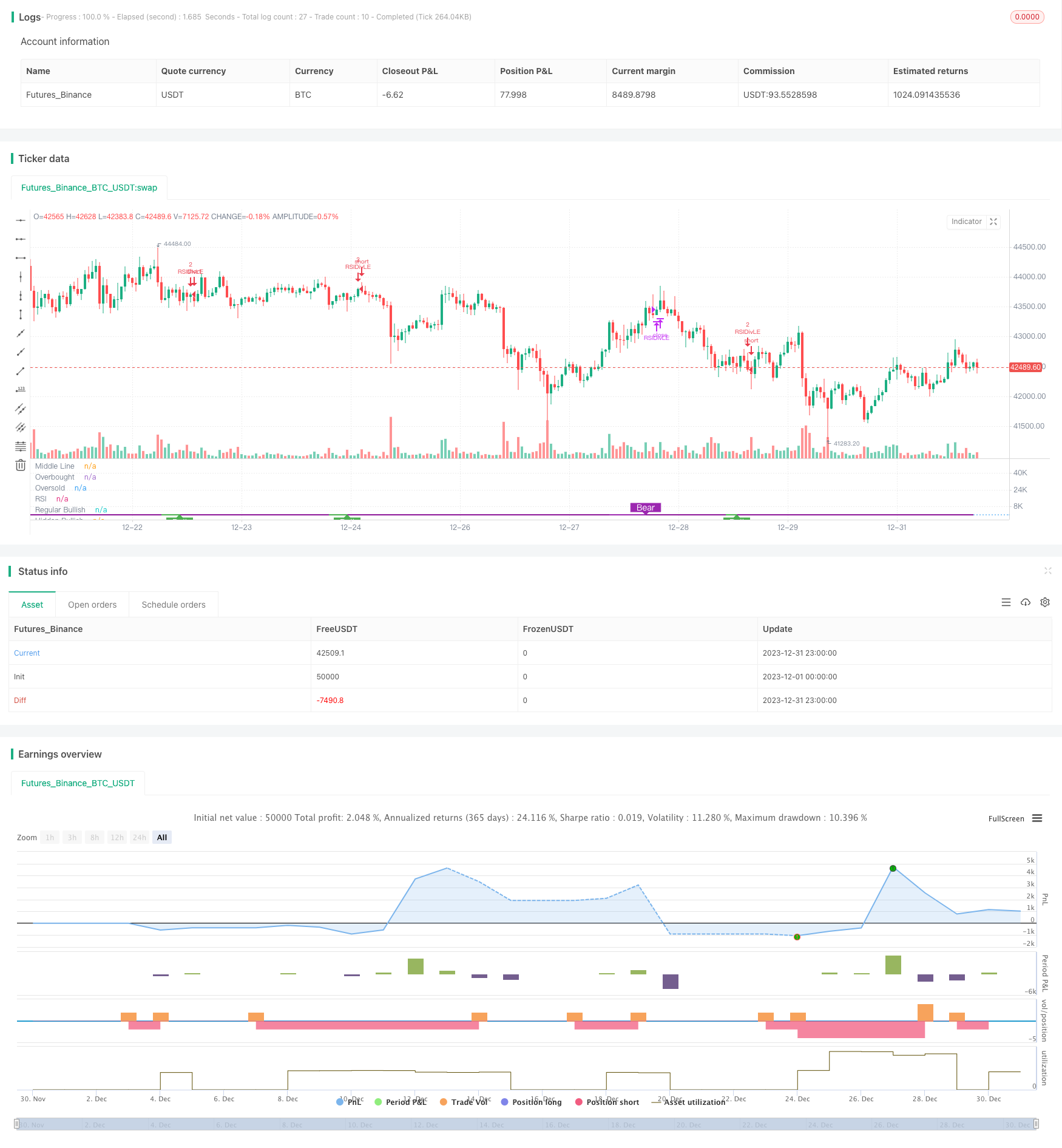

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//study(title="Divergence Indicator", format=format.price)

//GOOGL setting 5 , close, 3 , 1 profitLevel at 75 shows win rate 87.21 % profit factor 7.059

//GOOGL setting 8 , close, 3 , 1 profitLevel at 80 shows win rate 86.57 % profit factor 18.96

//SPY setting 5, close , 3, 3 profitLevel at 70 , shows win rate 80.34% profit factor 2.348

strategy(title="RSI Divergence Indicator", overlay=false,pyramiding=2, default_qty_value=2, default_qty_type=strategy.fixed, initial_capital=10000, currency=currency.USD)

len = input(title="RSI Period", minval=1, defval=9)

src = input(title="RSI Source", defval=close)

lbR = input(title="Pivot Lookback Right", defval=3)

lbL = input(title="Pivot Lookback Left", defval=1)

takeProfitRSILevel = input(title="Take Profit at RSI Level", minval=70, defval=80)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=false)

//useTrailStopLoss = input(false, title="Use Trailing Stop Loss")

sl_type = input("NONE", title="Trailing StopLoss Type", options=['ATR','PERC', 'NONE'])

stopLoss = input(title="Stop Loss%", defval=5, minval=1)

atrLength=input(14, title="ATR Length (for Trailing stop loss)")

atrMultiplier=input(3.5, title="ATR Multiplier (for Trailing stop loss)")

bearColor = color.purple

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

osc = rsi(src, len)

plot(osc, title="RSI", linewidth=2, color=#8D1699)

hline(50, title="Middle Line", linestyle=hline.style_dotted)

obLevel = hline(70, title="Overbought", linestyle=hline.style_dotted)

osLevel = hline(30, title="Oversold", linestyle=hline.style_dotted)

fill(obLevel, osLevel, title="Background", color=#9915FF, transp=90)

plFound = na(pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < valuewhen(plFound, low[lbR], 1)

bullCond = plotBull and priceLL and oscHL and plFound

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor),

transp=0

)

plotshape(

bullCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > valuewhen(plFound, low[lbR], 1)

hiddenBullCond = plotHiddenBull and priceHL and oscLL and plFound

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor),

transp=0

)

plotshape(

hiddenBullCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

longCondition=bullCond or hiddenBullCond

//? osc[lbR] : na

//hiddenBullCond

strategy.entry(id="RSIDivLE", long=true, when=longCondition)

//Trailing StopLoss

////// Calculate trailing SL

/////////////////////////////////////////////////////

sl_val = sl_type == "ATR" ? stopLoss * atr(atrLength) :

sl_type == "PERC" ? close * stopLoss / 100 : 0.00

trailing_sl = 0.0

trailing_sl := strategy.position_size>=1 ? max(low - sl_val, nz(trailing_sl[1])) : na

//draw initil stop loss

//plot(strategy.position_size>=1 ? trailing_sl : na, color = color.blue , style=plot.style_linebr, linewidth = 2, title = "stop loss")

//plot(trailing_sl, title="ATR Trailing Stop Loss", style=plot.style_linebr, linewidth=1, color=color.purple, transp=30)

//Trailing StopLoss

////// Calculate trailing SL

/////////////////////////////////////////////////////

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > valuewhen(phFound, high[lbR], 1)

bearCond = plotBear and priceHH and oscLH and phFound

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor),

transp=0

)

plotshape(

bearCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < valuewhen(phFound, high[lbR], 1)

hiddenBearCond = plotHiddenBear and priceLH and oscHH and phFound

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor),

transp=0

)

plotshape(

hiddenBearCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

longCloseCondition=crossover(osc,takeProfitRSILevel) or bearCond

strategy.close(id="RSIDivLE", comment="Close All="+tostring(close - strategy.position_avg_price, "####.##"), when= abs(strategy.position_size)>=1 and sl_type == "NONE" and longCloseCondition)

//close all on stop loss

strategy.close(id="RSIDivLE", comment="TSL="+tostring(close - strategy.position_avg_price, "####.##"), when=abs(strategy.position_size)>=1 and (sl_type == "PERC" or sl_type == "ATR" ) and crossunder(close, trailing_sl) ) //close<ema55 and rsi5Val<20 //ema34<ema55 //close<ema89

// Calculate start/end date and time condition

startDate = input(timestamp("2019-01-01T00:00:00"), type = input.time)

finishDate = input(timestamp("2021-01-01T00:00:00"), type = input.time)

time_cond = time >= startDate and time <= finishDate

Detail

https://www.fmz.com/strategy/439954

Last Modified

2024-01-25 11:49:36