Name

RSI指标结合CCI指标的量化交易策略RSI-amp-CCI-Combination-Quantitative-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略名为RSI指标结合CCI指标的量化交易策略。该策略主要利用RSI指标和CCI指标的组合来判断市场的超买超卖现象,以捕捉反转机会。具体来说,策略通过计算RSI的多空线,结合CCI指标的多空信号,设定多头和空头的开仓规则。当符合开仓规则时,进行相应的做多做空操作。

本策略的核心逻辑是同时利用RSI指标和CCI指标的统计特性,判断市场目前是否处于超买或超卖状态。

首先,RSI部分。RSI指标可以反映市场的超买超卖现象。RSI大于70时为超买区,小于30时为超卖区。本策略设置长线和短线两个RSI指标,长线参数为默认14周期,短线参数为12周期。长线可以判断核心趋势,短线则可以追踪更敏感的转折点。当长线和短线的RSI指标同向(如双超买或双超卖)时,代表市场正处于明确的非均衡状态,这时就是最佳的反转机会。

其次,CCI部分。CCI指标也可以用来判断超买超卖,参数为14周期。CCI高于100为超买,低于-100为超卖。本策略利用CCI指标的这个特性,设定开仓规则:当CCI指标与RSI指标给出的多空信号一致时,即执行RSI指标判定的开仓方向。

具体来说,策略的开仓规则为:

-

多头开仓:当RSI指标显示超卖区(该周期内长短线RSI均小于30),并且CCI指标小于-100时,做多;

-

空头开仓:当RSI指标显示超买区(该周期内长短线RSI均大于70),并且CCI指标高于100时,做空。

通过RSI指标和CCI指标的共同判断,可以有效确认真正的超买超卖区间,从而提高策略的稳定性和盈利概率。

本策略最大的优势在于同时利用RSI和CCI两个指标的统计规律,使得识别超买超卖现象更为准确,从而为捕捉反转提供了理想的切入点。具体优势如下:

- RSI的长短线结合,可以同时判断趋势和敏感反转点,灵活捕捉机会。

- CCI指标的辅助判断,避免受到市场假反转的误导。

- 通过RSI和CCI的组合判断,可以有效过滤假信号,使得入场时间点选择更加准确。

- 利用超买超卖区间进行反转交易,这本身就是一个概率较大的交易策略思路。

- 策略方法简单,容易理解和实现,适合量化初学者学习。

本策略的主要风险在于,RSI和CCI所判断的超买超卖信号不一定能完全反映真实的反转时点。具体风险包括:

- 指标发出的信号可能是假反转。如价格出现震荡调整而不是趋势反转。

- 即使判断正确也会有时间滞后。计算周期内的参数变化不能完全同步反映最新价格变动。

- 反转过程中,止损点可能被突破而导致亏损扩大。

- 策略没有考虑大级别趋势的影响,在具体实施中需要结合趋势分析。

对应风险的解决方法包括:

- 确认反转信号放量突破效果更佳。如价格在指标反转信号出现时有大量放量上涨,则可增加判断的可靠性。

- 适当调整RSI和CCI的参数,降低滞后现象的概率。

- 做好止损和离场思路,控制单笔亏损。

- 在具体实施策略时,要辅以趋势和形态分析,避免逆势操作。

本策略在实际运行中还可进一步优化,主要优化思路包括:

- 测试RSI和CCI的参数设置,找到最优参数组合。如测试RSI的长短周期参数,和CCI周期参数。

- 增加别的指标以丰富多空判断依据,如KD,MACD等。

- 增加止损策略。如设置移动止损,或之字止损。

- 结合高级制胜策略,利用指标分歧来确定胜率更高的入场方向等。

- 利用机器学习算法自动优化参数和信号权重。

- 测试该策略与趋势系统的组合策略。

- 增加对大级别趋势和重要价格位的判断规则。避免逆势操作。

通过测试和优化,可以期望本策略的盈利能力和稳定性得到进一步提高。

本策略属于较为典型的反转捕捉策略。通过RSI和CCI两个常用指标的结合,判断超买超卖区间,并设计相应的开仓规则,形成了一个简单实用的短线交易策略。该策略主要优势是指标组合使用使判断更准确,避免假反转的误导,从而把握反转的最佳时机。当然风险也存在,需要做好指标优化,止损策略,与趋势判断的配合使用。总体来说,本策略为初学者提供了一个简单可靠的量化方法,值得学习和实践。

||

This strategy is named RSI & CCI Combination Quantitative Trading Strategy. It mainly uses the combination of RSI indicator and CCI indicator to judge the overbought/oversold status in the market and capture reversal opportunities. Specifically, the strategy calculates the buy and sell signals of RSI, combined with CCI indicator’s trading signals, to set up the long and short entry rules. When the entry rules are met, corresponding long or short positions will be opened.

The core logic of this strategy is to utilize both the statistical properties of RSI indicator and CCI indicator to determine whether the market is currently in an overbought or oversold state.

Firstly, the RSI part. The RSI indicator can reflect the overbought/oversold phenomena in the market. RSI greater than 70 is typically considered overbought, while less than 30 is oversold. This strategy sets two RSI indicators, a long-term RSI with default 14 periods, and a short-term RSI with 12 periods. The long-term RSI judges overall trend, while the short-term RSI tracks more sensitive turning points. When both RSI lines indicate the same direction (such as double overbought or double oversold), it means the market is in a significant imbalanced state, which provides best reversal opportunities.

Secondly, the CCI part. The CCI indicator can also be used to identify overbought/oversold levels. CCI higher than 100 is considered overbought, while lower than -100 is oversold. This strategy utilizes this characteristic of CCI to set up entry rules: when CCI signal is consistent with the RSI indicator, the entry signal indicated by RSI will be executed.

Specifically, the entry rules are:

-

Long entry: when RSI shows oversold area (both long and short term RSI below 30), and CCI is lower than -100, go long.

-

Short entry: when RSI shows overbought area (both long and short term RSI above 70), and CCI is higher than 100, go short.

By the joint judgment of RSI and CCI, overbought/oversold zones can be effectively confirmed, hence enhancing the stability and profitability of the strategy.

The biggest advantage of this strategy lies in the simultaneous use of both RSI and CCI statistical patterns to identify overbought/oversold signals more precisely, which provides ideal turning points to capture reversals. The concrete advantages include:

- The combination of long and short RSI judges both trend and sensitive inflection points, which helps capture opportunities flexibly.

- CCI’s confirmation avoids misleading by false reversals in the market.

- Through RSI and CCI’s joint signals, false signals can be filtered effectively, making entries more accurate.

- Trading reversal in overbought/oversold zones itself is a strategy idea with relatively big winning odds.

- The strategy is simple to understand and implement, suitable for quant beginners to learn.

The major risk of this strategy is that the overbought/oversold signals indicated by RSI and CCI may not completely reflect the real reversal timing. The concrete risks include:

- Indicator may give false reversal signals. E.g. price fluctuation instead of trend reversal.

- Time lag would exist even if directional correctness. Parameters change within the computing cycle cannot fully synchronize the latest price moves.

- Stop loss may be touched during reversals hence enlarge loss.

- Major trend influence is not considered which should incorporate with trend analysis in actual trading.

Corresponding solutions include:

- Reversals with huge volume tend to perform better in confirming signals.

- Try optimizing parameters of RSI and CCI to lower the probability of time lags.

- Set stop loss properly to control single trade loss.

- In actual trading, combine with trend and technical analysis to avoid trading against major trends.

The strategy can be further optimized in actual trading, mainly:

- Test and find the optimal parameter combinations for RSI and CCI, like the long/short cycle of RSI and CCI's cycle.

- Add other indicators to enrich entry signals, like KD, MACD etc.

- Add stop loss strategies, like mobile stop loss or shark fin stop loss.

- Combine advanced win rate models to determine higher probability entry directions judging from indicator divergences.

- Utilize machine learning algorithms to auto optimize parameters and signal weights.

- Test the combination strategies with trend-following systems.

- Add rules considering higher time frame trends and key price levels, to avoid trading against major trends.

Through tests and optimizations, expectancy of the strategy's profitability and stability could be further improved.

The strategy belongs to a typical reversal capturing strategy. By combining two commonly used indicators, RSI and CCI, it judges overbought/oversold levels and sets up corresponding entry rules, forming a simple practical short term trading strategy. The biggest advantage is that the joint use of the two indicators makes signal judgment more accurate, avoiding fake reversals, and grasps the best timing for reversals. Of course risks exist, requiring optimizations in indicators themselves, stop loss strategies, and collaborating with trend analysis. Overall speaking, it provides beginners a simple reliable quant approach, worth learning and practicing.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | length |

| v_input_2 | 12 | fastLength |

| v_input_3 | 26 | slowLength |

| v_input_4 | 2 | signalLength |

| v_input_5_close | 0 | CCI Source: close |

Source (PineScript)

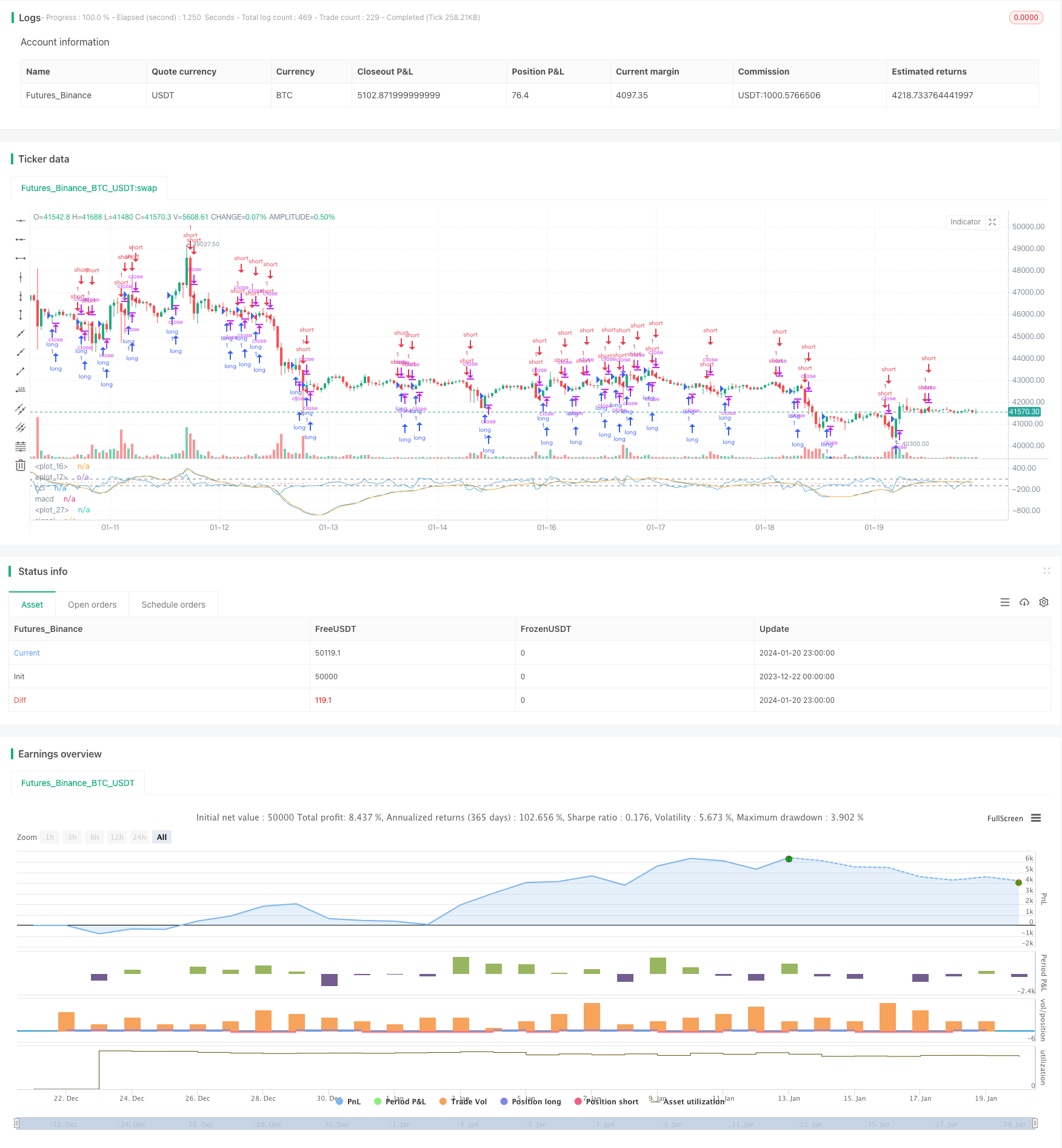

/*backtest

start: 2023-12-22 00:00:00

end: 2024-01-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Author: RvZ14

//Based on Joseph Nemeth MACD+CCI strategy

//Reference reading: https://sites.google.com/site/forexjosephnemeth/home/macd-cci

strategy(title="MACD+CCI Strategy", shorttitle="macd/cci")

length = input(14, minval=1)

fastLength = input(12, minval=1), slowLength=input(26,minval=1)

signalLength=input(2,minval=1)

src = input(close, title="CCI Source")

//cci

ma = sma(src, length)

cci = (src - ma) / (0.015 * dev(src, length))

plot(cci, title = "cci", color=#5DADE2,linewidth = 1,transp = 0)

band1 = hline(100, color=gray, linewidth = 1)

band0 = hline(-100, color=gray, linewidth = 1)

fill(band1, band0, color= #F9E79F)

//macd

source = close

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

signal = ema(macd, signalLength)

hist = macd - signal

plot(hist, color=#EC7063, style=histogram)

plot(macd, title = "macd", color=#5DADE2, linewidth = 1,transp = 0)

plot(signal, title = "signal", color=#F5B041,linewidth = 1,transp = 0)

longCond = cci > 100 and macd > 0 or cci > -100 and macd < 0

shortCond = cci < -100 and macd < 0 or cci < 100 and macd > 0

strategy.entry("long",strategy.long,when = longCond == true)

strategy.entry("short",strategy.short,when=shortCond == true)

Detail

https://www.fmz.com/strategy/439605

Last Modified

2024-01-22 10:33:03