Name

Relative-Strength-Index-Divergences-Libertus

Author

ChaoZhang

Strategy Description

Hello all,

To ease everyone's trading experience I made this script which colors RSI overbought and oversold conditions and as a bonus displays bullish or bearish divergences in last 50 candles (by default, you can change it). Script is open source, part of code is from Trading View examples. If you have suggestions or you already made some improvements, please report in comment.

Happy trading and good luck!

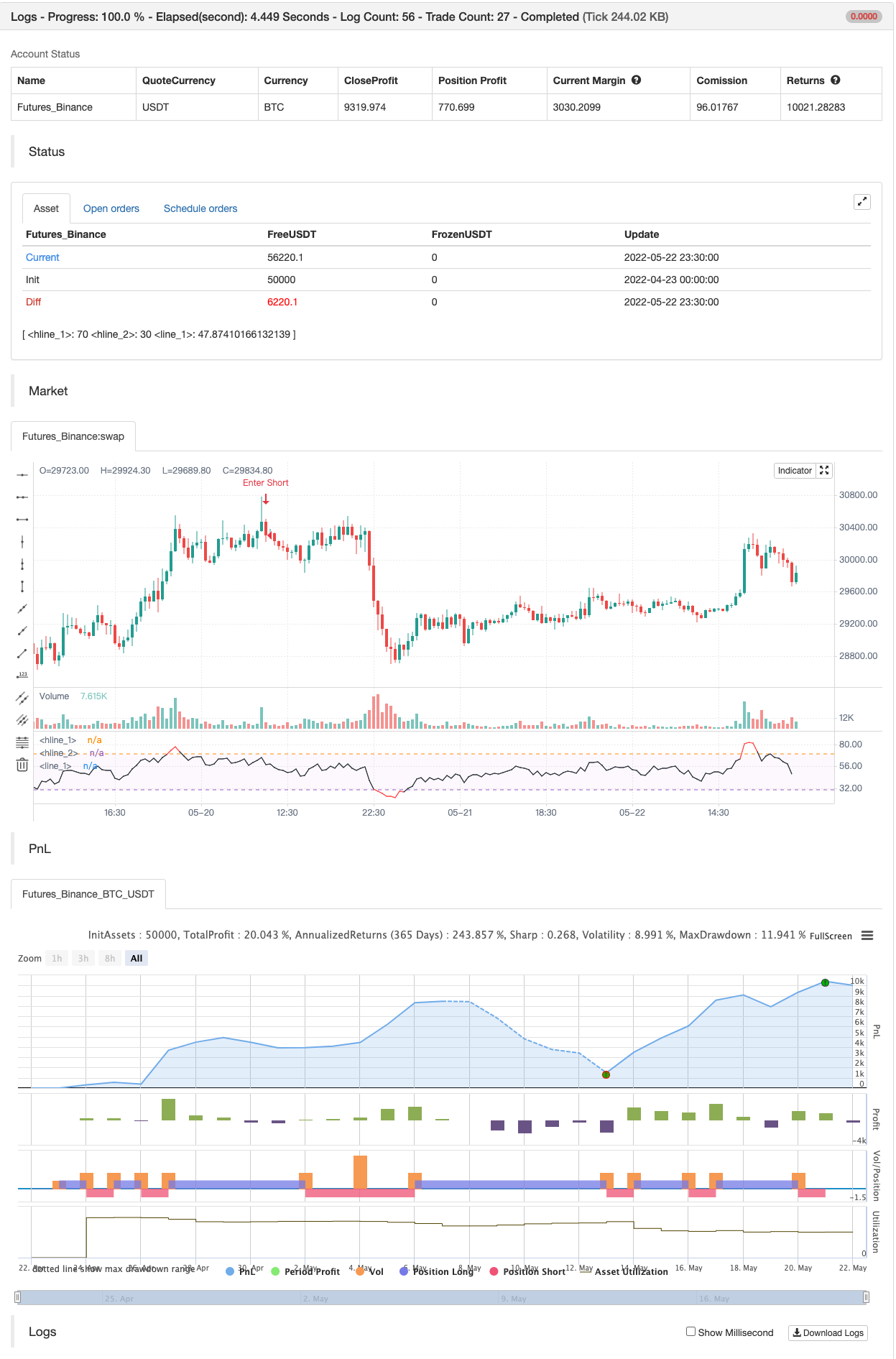

backtest

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | RSI Length |

| v_input_2 | 70 | Overbought |

| v_input_3 | 30 | Oversold |

| v_input_4 | false | Hide pivots? |

| v_input_5 | false | Shorter labels? |

| v_input_6 | false | Hide labels and color background |

| v_input_7 | 90 | Div lookback period (bars)? |

Source (PineScript)

//@version=4

// Copyright by Libertus - 2021

// RSI Divergences v3.2

// Free for private use

study(title="Relative Strength Index - Divergences - Libertus", shorttitle="RSI Div - Lib")

len = input(14, minval=1, title="RSI Length")

ob = input(defval=70, title="Overbought", type=input.integer, minval=0, maxval=100)

os = input(defval=30, title="Oversold", type=input.integer, minval=0, maxval=100)

// RSI code

rsi = rsi(close, len)

band1 = hline(ob)

band0 = hline(os)

plot(rsi, color=(rsi > ob or rsi < os ? color.new(color.red, 0) : color.new(color.black, 0)))

fill(band1, band0, color=color.new(color.purple, 97))

// DIVS code

piv = input(false,"Hide pivots?")

shrt = input(false,"Shorter labels?")

hidel = input(false, "Hide labels and color background")

xbars = input(defval=90, title="Div lookback period (bars)?", type=input.integer, minval=1)

hb = abs(highestbars(rsi, xbars)) // Finds bar with highest value in last X bars

lb = abs(lowestbars(rsi, xbars)) // Finds bar with lowest value in last X bars

// Defining variable values, mandatory in Pine 3

max = float(na)

max_rsi = float(na)

min = float(na)

min_rsi = float(na)

pivoth = bool(na)

pivotl = bool(na)

divbear = bool(na)

divbull = bool(na)

// If bar with lowest / highest is current bar, use it's value

max := hb == 0 ? close : na(max[1]) ? close : max[1]

max_rsi := hb == 0 ? rsi : na(max_rsi[1]) ? rsi : max_rsi[1]

min := lb == 0 ? close : na(min[1]) ? close : min[1]

min_rsi := lb == 0 ? rsi : na(min_rsi[1]) ? rsi : min_rsi[1]

// Compare high of current bar being examined with previous bar's high

// If curr bar high is higher than the max bar high in the lookback window range

if close > max // we have a new high

max := close // change variable "max" to use current bar's high value

if rsi > max_rsi // we have a new high

max_rsi := rsi // change variable "max_rsi" to use current bar's RSI value

if close < min // we have a new low

min := close // change variable "min" to use current bar's low value

if rsi < min_rsi // we have a new low

min_rsi := rsi // change variable "min_rsi" to use current bar's RSI value

// Finds pivot point with at least 2 right candles with lower value

pivoth := (max_rsi == max_rsi[2]) and (max_rsi[2] != max_rsi[3]) ? true : na

pivotl := (min_rsi == min_rsi[2]) and (min_rsi[2] != min_rsi[3]) ? true : na

// Detects divergences between price and indicator with 1 candle delay so it filters out repeating divergences

if (max[1] > max[2]) and (rsi[1] < max_rsi) and (rsi <= rsi[1])

divbear := true

if (min[1] < min[2]) and (rsi[1] > min_rsi) and (rsi >= rsi[1])

divbull := true

// Alerts

alertcondition(divbear, title='Bear div', message='Bear div')

alertcondition(divbull, title='Bull div', message='Bull div')

alertcondition(pivoth, title='Pivot high', message='Pivot high')

alertcondition(pivotl, title='Pivot low', message='Pivot low')

if divbull

strategy.entry("Enter Long", strategy.long)

else if divbear

strategy.entry("Enter Short", strategy.short)

// // Plots divergences and pivots with offest

// l = divbear ?

// label.new (bar_index-1, rsi[1]+1, "BEAR", color=color.red, textcolor=color.white, style=label.style_labeldown, yloc=yloc.price, size=size.small) :

// divbull ?

// label.new (bar_index-1, rsi[1]-1, "BULL", color=color.green, textcolor=color.white, style=label.style_labelup, yloc=yloc.price, size=size.small) :

// pivoth ?

// label.new (bar_index-2, max_rsi+1, "PIVOT", color=color.blue, textcolor=color.white, style=label.style_labeldown, yloc=yloc.price, size=size.small) :

// pivotl ?

// label.new (bar_index-2, min_rsi-1, "PIVOT", color=color.blue, textcolor=color.white, style=label.style_labelup, yloc=yloc.price, size=size.small) :

// na

// // Shorter labels

// if shrt

// label.set_text (l, na)

// // Hides pivots or labels

// if (piv and (pivoth or pivotl)) or hidel

// label.delete (l)

// // Colors indicator background

// bgcolor (hidel ? (divbear ? color.new(color.red, 50) : divbull ? color.new(color.green, 50) : na) : na, offset=-1)

// bgcolor (hidel ? (piv ? na : (pivoth or pivotl ? color.new(color.blue, 50) : na)) : na, offset=-2)

// Debug tools

// plot(max, color=blue, linewidth=2)

// plot(max_rsi, color=red, linewidth=2)

// plot(hb, color=orange, linewidth=2)

// plot(lb, color=purple, linewidth=1)

// plot(min_rsi, color=lime, linewidth=1)

// plot(min, color=black, linewidth=1)

Detail

https://www.fmz.com/strategy/365359

Last Modified

2022-05-24 15:25:05