Name

Triple-Supertrend-with-EMA-and-ADX

Author

ChaoZhang

Strategy Description

Publishing a strategy that includes adx and ema filter as well

Entry: all three Supertrend turns positive. If a filter of ADX and EMA is applied, also check if ADX is above the selected level and close is above EMA Exit: when the first supertrend turns negative

opposite for short entries

A FIlter is given to take or avoid re-enter on the same side. For example, After a long exit, if the entry condition is satisfied again for long before the short single is triggered it takes re-entry if selected.

backtest

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_4 | 200 | EMA Len |

| v_input_int_5 | 14 | ADX Len |

| v_input_int_6 | 14 | Di Len |

| v_input_float_4 | 25 | adx filter |

| v_input_bool_1 | false | Add Adx & EMA filter |

| v_input_bool_2 | true | Allow Reentry |

| v_input_float_1 | true | (?ST 1)ATR Multi |

| v_input_int_1 | 10 | ATR Multi |

| v_input_float_2 | 2 | (?ST 2)ATR Multi |

| v_input_int_2 | 15 | ATR Multi |

| v_input_float_3 | 3 | (?ST 3)ATR Multi |

| v_input_int_3 | 20 | ATR Multi |

Source (PineScript)

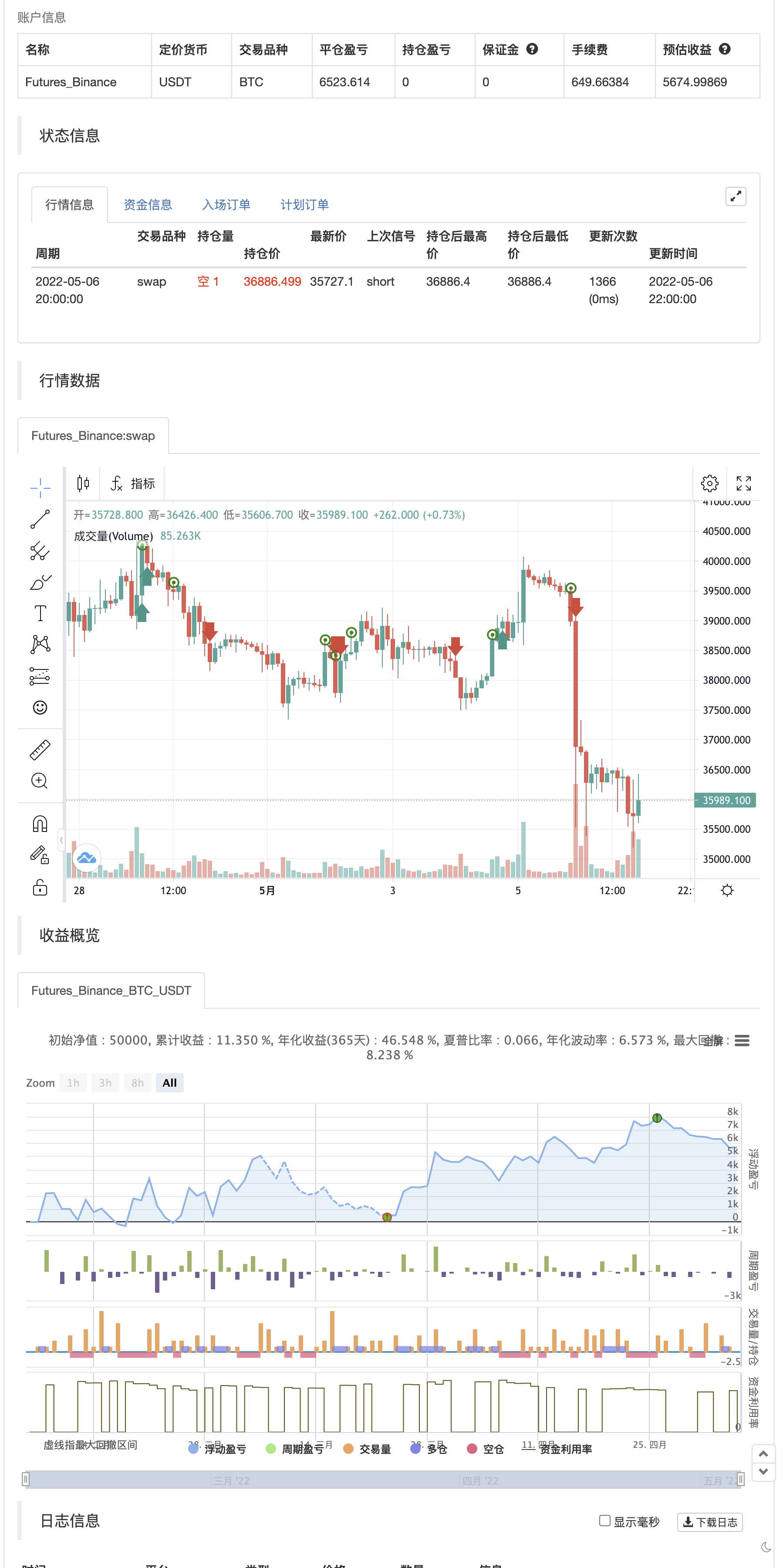

/*backtest

start: 2022-02-07 00:00:00

end: 2022-05-07 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// ©kunjandetroja

//@version=5

strategy('Triple Supertrend with EMA and ADX', overlay=true)

m1 = input.float(1,"ATR Multi",minval = 1,maxval= 6,step=0.5,group='ST 1')

m2 = input.float(2,"ATR Multi",minval = 1,maxval= 6,step=0.5,group='ST 2')

m3 = input.float(3,"ATR Multi",minval = 1,maxval= 6,step=0.5,group='ST 3')

p1 = input.int(10,"ATR Multi",minval = 5,maxval= 25,step=1,group='ST 1')

p2 = input.int(15,"ATR Multi",minval = 5,maxval= 25,step=1,group='ST 2')

p3 = input.int(20,"ATR Multi",minval = 5,maxval= 25,step=1,group='ST 3')

len_EMA = input.int(200,"EMA Len",minval = 5,maxval= 250,step=1)

len_ADX = input.int(14,"ADX Len",minval = 1,maxval= 25,step=1)

len_Di = input.int(14,"Di Len",minval = 1,maxval= 25,step=1)

adx_above = input.float(25,"adx filter",minval = 1,maxval= 50,step=0.5)

var bool long_position = false

adx_filter = input.bool(false, "Add Adx & EMA filter")

renetry = input.bool(true, "Allow Reentry")

f_getColor_Resistance(_dir, _color) =>

_dir == 1 and _dir == _dir[1] ? _color : na

f_getColor_Support(_dir, _color) =>

_dir == -1 and _dir == _dir[1] ? _color : na

[superTrend1, dir1] = ta.supertrend(m1, p1)

[superTrend2, dir2] = ta.supertrend(m2, p2)

[superTrend3, dir3] = ta.supertrend(m3, p3)

EMA = ta.ema(close, len_EMA)

[diplus,diminus,adx] = ta.dmi(len_Di,len_ADX)

// ADX Filter

adxup = adx > adx_above and close > EMA

adxdown = adx > adx_above and close < EMA

sum_dir = dir1 + dir2 + dir3

dir_long = if(adx_filter == false)

sum_dir == -3

else

sum_dir == -3 and adxup

dir_short = if(adx_filter == false)

sum_dir == 3

else

sum_dir == 3 and adxdown

Exit_long = dir1 == 1 and dir1 != dir1[1]

Exit_short = dir1 == -1 and dir1 != dir1[1]

// BuySignal = dir_long and dir_long != dir_long[1]

// SellSignal = dir_short and dir_short != dir_short[1]

// if BuySignal

// label.new(bar_index, low, 'Long', style=label.style_label_up)

// if SellSignal

// label.new(bar_index, high, 'Short', style=label.style_label_down)

longenter = if(renetry == false)

dir_long and long_position == false

else

dir_long

shortenter = if(renetry == false)

dir_short and long_position == true

else

dir_short

if longenter

long_position := true

if shortenter

long_position := false

strategy.entry('BUY', strategy.long, when=longenter)

strategy.entry('SELL', strategy.short, when=shortenter)

strategy.close('BUY', Exit_long)

strategy.close('SELL', Exit_short)

//buy1 = ta.barssince(dir_long)

//sell1 = ta.barssince(dir_short)

//colR1 = f_getColor_Resistance(dir1, color.red)

//colS1 = f_getColor_Support(dir1, color.green)

//colR2 = f_getColor_Resistance(dir2, color.orange)

//colS2 = f_getColor_Support(dir2, color.yellow)

//colR3 = f_getColor_Resistance(dir3, color.blue)

//colS3 = f_getColor_Support(dir3, color.maroon)

//plot(superTrend1, 'R1', colR1, linewidth=2)

//plot(superTrend1, 'S1', colS1, linewidth=2)

//plot(superTrend2, 'R1', colR2, linewidth=2)

//plot(superTrend2, 'S1', colS2, linewidth=2)

//plot(superTrend3, 'R1', colR3, linewidth=2)

//plot(superTrend3, 'S1', colS3, linewidth=2)

// // Intraday only

// var int new_day = na

// var int new_month = na

// var int new_year = na

// var int close_trades_after_time_of_day = na

// if dayofmonth != dayofmonth[1]

// new_day := dayofmonth

// if month != month[1]

// new_month := month

// if year != year[1]

// new_year := year

// close_trades_after_time_of_day := timestamp(new_year,new_month,new_day,15,15)

// strategy.close_all(time > close_trades_after_time_of_day)

Detail

https://www.fmz.com/strategy/361880

Last Modified

2022-05-08 21:16:55