Name

Volume-Divergence

Author

ChaoZhang

Strategy Description

It's a simply volume indicator. You should watch for breaks on both volume uptrend and volume downtrend. It uses fibonacci numbers to build smoothed moving average of volume .

Also you can check divergences for trend reversal and momentum loss.

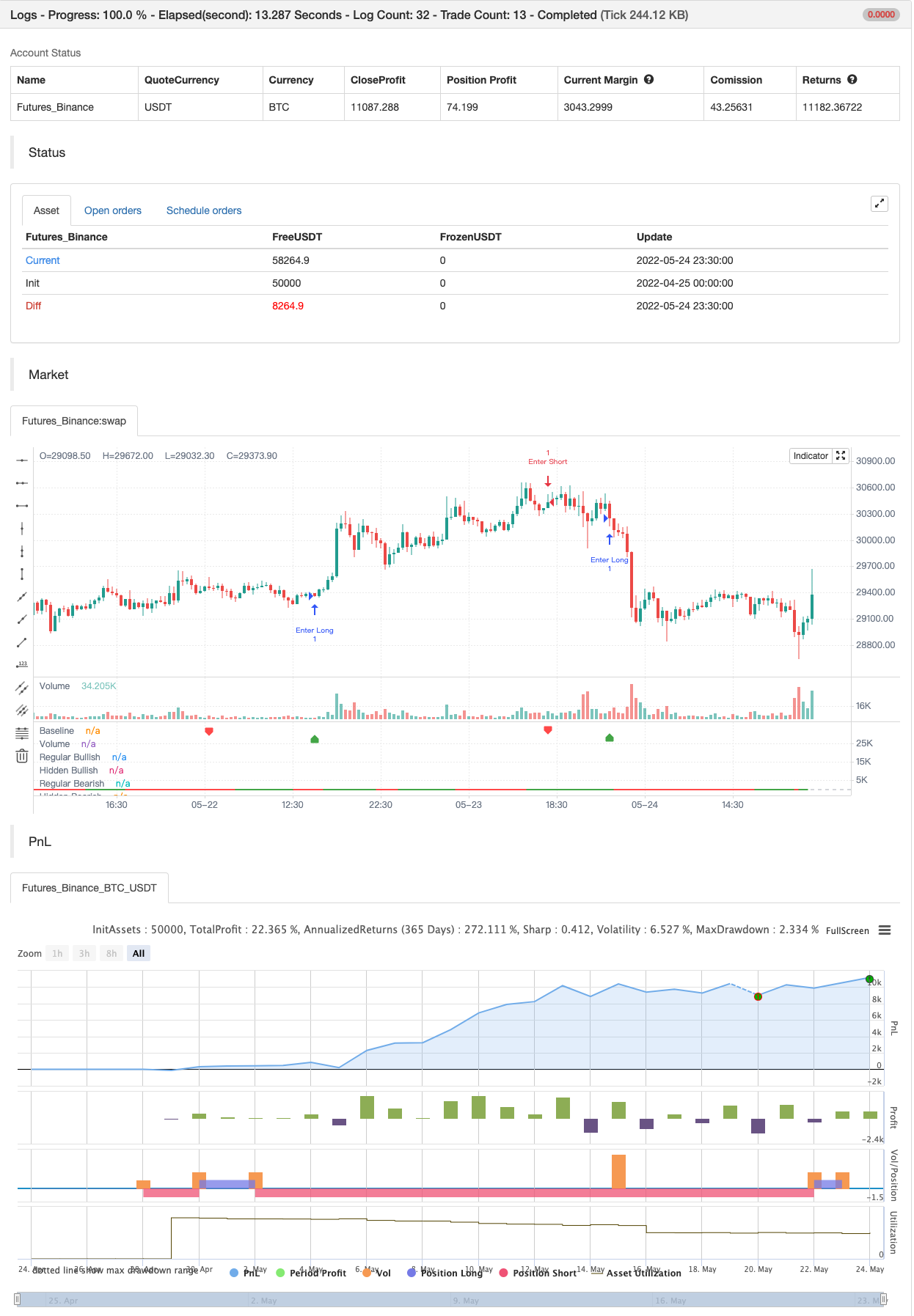

backtest

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 5 | First Moving Average length |

| v_input_2 | 8 | Second Moving Average length |

| v_input_3 | 5 | Pivot Lookback Right |

| v_input_4 | 5 | Pivot Lookback Left |

| v_input_5 | 60 | Max of Lookback Range |

| v_input_6 | 5 | Min of Lookback Range |

| v_input_7 | true | Plot Bullish |

| v_input_8 | false | Plot Hidden Bullish |

| v_input_9 | true | Plot Bearish |

| v_input_10 | false | Plot Hidden Bearish |

Source (PineScript)

/*backtest

start: 2022-04-25 00:00:00

end: 2022-05-24 23:59:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © baymucuk

//@version=4

study(title="Volume Divergence by MM", shorttitle="Volume Divergence", format=format.volume)

pine_wma(x, y) =>

norm = 0.0

sum = 0.0

for i = 0 to y - 1

weight = (y - i) * y

norm := norm + weight

factor = close[i] < open[i] ? -1 : 1

sum := sum + (x[i] * weight * factor)

sum / norm

vl1 = input(defval=5, title="First Moving Average length", type=input.integer)

vl2 = input(defval=8, title="Second Moving Average length", type=input.integer)

vl3 = vl1 + vl2

vl4 = vl2 + vl3

vl5 = vl3 + vl4

v1 = pine_wma(volume, vl1)

v2 = pine_wma(v1, vl2)

v3 = pine_wma(v2, vl3)

v4 = pine_wma(v3, vl4)

vol = pine_wma(v4, vl5)

vol_color = vol > 0 ? color.green : color.red

hline(0, title="Baseline", color=color.silver, linewidth=1)

plot(vol, color=vol_color, linewidth=2, title="Volume")

lbR = input(title="Pivot Lookback Right", defval=5)

lbL = input(title="Pivot Lookback Left", defval=5)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=false)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=false)

bearColor = color.red

bullColor = color.green

hiddenBullColor = color.new(color.green, 25)

hiddenBearColor = color.new(color.red, 25)

textColor = color.white

noneColor = color.new(color.white, 100)

plFound = na(pivotlow(vol, lbL, lbR)) ? false : true

phFound = na(pivothigh(vol, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// vol: Higher Low

volHL = vol[lbR] > valuewhen(plFound, vol[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < valuewhen(plFound, low[lbR], 1)

bullCond = plotBull and priceLL and volHL and plFound

plot(

plFound ? vol[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor),

transp=0

)

plotshape(

bullCond ? vol[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bullish

// vol: Lower Low

volLL = vol[lbR] < valuewhen(plFound, vol[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > valuewhen(plFound, low[lbR], 1)

hiddenBullCond = plotHiddenBull and priceHL and volLL and plFound

plot(

plFound ? vol[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor),

transp=0

)

plotshape(

hiddenBullCond ? vol[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Regular Bearish

// vol: Lower High

volLH = vol[lbR] < valuewhen(phFound, vol[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > valuewhen(phFound, high[lbR], 1)

bearCond = plotBear and priceHH and volLH and phFound

plot(

phFound ? vol[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor),

transp=0

)

plotshape(

bearCond ? vol[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bearish

// vol: Higher High

volHH = vol[lbR] > valuewhen(phFound, vol[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < valuewhen(phFound, high[lbR], 1)

hiddenBearCond = plotHiddenBear and priceLH and volHH and phFound

plot(

phFound ? vol[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor),

transp=0

)

plotshape(

hiddenBearCond ? vol[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

if bullCond

strategy.entry("Enter Long", strategy.long)

else if bearCond

strategy.entry("Enter Short", strategy.short)

Detail

https://www.fmz.com/strategy/365895

Last Modified

2022-05-26 17:04:32